As U.S. regulatory pressures proceed to bear down on the cryptocurrency business, a recent development is starting to take form, altering the dynamics of Bitcoin’s world demand.

The U.S. political setting seeks to tighten the regulatory noose across the neck of the crypto and mining sectors, inflicting merchants inside its borders could also be shedding religion in Bitcoin’s resilience.

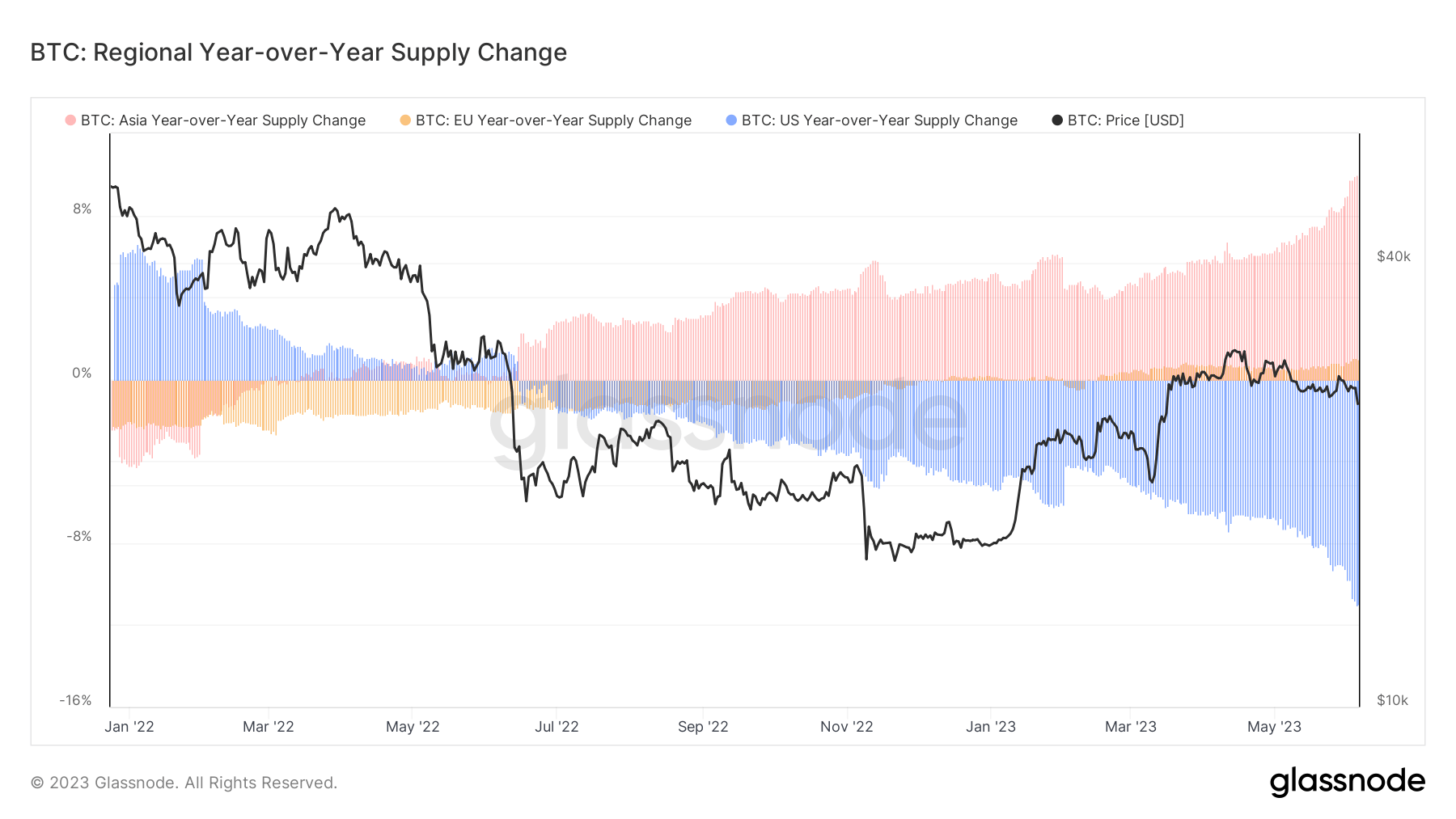

This shift is obvious via Glassnode’s Bitcoin year-over-year (YoY) provide change, which tracks the quantity of Bitcoin held by regional entities.

StarCrypto evaluation discovered that the Bitcoin provide within the U.S. skilled an 11% YoY dip since June 2022.

Contrarily, the Asian crypto market confirmed a surge in Bitcoin provide. In line with knowledge from Glassnode, entities working throughout Asian buying and selling hours have elevated their Bitcoin holdings by 9.9% since June final 12 months, marking an all-time excessive.

Asia’s attraction to Bitcoin sparked questions concerning the potential driving elements behind this shift.

As beforehand reported on StarCrypto, mounting regulatory warmth within the U.S. led merchants to pivot away from Bitcoin and Ethereum, turning as an alternative to the perceived security of stablecoins. This defensive transfer by merchants demonstrates the tangible influence that regulation, or the specter of it, can exert on the habits and choices of cryptocurrency market members. The chance of potential compliance-related penalties and clampdowns can incentivize a safer play, typically at the price of high-yield investments.

Whereas U.S. laws forged a shadow on the crypto market, Asia has been experiencing a extra optimistic wave of regulatory modifications.

As reported by StarCrypto, Hong Kong’s Securities and Futures Fee (SFC) has paved the way in which for a extra crypto-friendly setting, signaling the licensing of over eight crypto firms by year-end and easing regulatory necessities for crypto exchanges.

In response to those accommodating modifications, some crypto entities, reminiscent of CoinEx, have strategically leveraged Hong Kong’s crypto-friendly guidelines.

In the meantime, Bitget has dedicated to investing $100 million to bolster Asia’s Web3 ecosystem. Moreover, mounting hypothesis a couple of Central Asian nation’s potential Bitcoin treasury holding displays a shifting regional sentiment in the direction of Bitcoin.

The submit Asia’s Bitcoin provide soars amid shifting regulatory landscapes appeared first on StarCrypto.