Key Takeaways

- Bitcoin has traditionally carried out robustly within the 12 months following a halvening occasion

- Nonetheless the pattern measurement is small, which means care ought to be taken in assessing previous efficiency

- Halvening cycles have additionally coincided with world liquidity cycles, providing an alternate principle for Bitcoin’s sturdy post-halvening performances

- The subsequent halvening is slated for April 2024

- The query of whether or not halvenings are priced in is an intriguing one to analyse

Maybe nothing sums up Bitcoin’s enigmatic, mysterious and distinctive make-up just like the halvening occasions. As time goes on, these occasions have grow to be the topic of fierce debate as to how they have an effect on Bitcoin’s value. Will the sudden dip in new provide enhance Bitcoin’s value, because it has prior to now? Or are these scheduled occasions, by definition, already priced in?

Earlier than analysing this query, allow us to shortly clarify the halvenings for the uninitiated. These occasions seek advice from the phenomenon by which the block reward for Bitcoin is lower in half each 4 years (or each 210,000 blocks, to be precise). In such a manner, the speed at which new Bitcoins are launched instantly drops 50% each 4 years. Presently, every new block appended to the tip of the blockchain ends in 6.25 Bitcoin being launched, equating to 900 further Bitcoin in circulation. Upon the subsequent halvening, this may fall to three.125 Bitcoin per block, and 1.5625 4 years after that, and so forth.

The primary halvening occurred in 2012, the second in 2016 and the third in 2020. The subsequent halvening ought to happen in April 2024. These halvenings will proceed roughly each 4 years till the sixty fourth and closing halvening will happen within the 12 months 2140, after which miners will dwell off transaction charges alone, and no extra Bitcoin might be launched into circulation.

This halving schedule signifies that, regardless of Bitcoin solely being 14 years outdated, over 92% of the ultimate provide of 21 million Bitcoin is already mined. It additionally creates the seductive laborious provide cap so typically referenced by Bitcoin fans: there’ll solely ever be 21 million Bitcoin, and we all know the schedule at which they’ll hit the market.

That is set and stone and is acquainted to most Bitcoin traders. The place it will get attention-grabbing and issues open up for debate, nevertheless, is how these halvening occasions have an effect on the worth.

Earlier halvenings have preceded aggressive rises within the Bitcoin value. Some level in direction of the easy impact of provide and demand: as the speed of recent provide instantly cuts in half, the worth ought to rise, all else equal. We are going to cope with this after this chart, which demonstrates how the Bitcoin value has certainly moved in accordance with these 4 12 months cycles.

Whereas the above chart seems to be seductive, there are three evident counterpoints to the argument that halvenings might be a constructive affect on value going ahead (afterwards, we are going to assess why there is also an intriguing argument that these cycles will maintain).

- Given the 50% provide lower is understood prematurely, it ought to be priced in already

- Small pattern area

- International liquidity cycles line up with halvenings

Merely put, the environment friendly market speculation dictates that these halvening occasions mustn’t bump up value as a result of they’re recognized prematurely. It is a compelling argument and one that’s laborious to low cost.

One should additionally bear in mind, when assessing the seemingly formidable relationship between these four-year cycles and Bitcoin to this point, that there have solely been three halvenings. That’s a completely tiny pattern measurement and means, fairly merely, that we don’t know. To not point out, Bitcoin’s liquidity was nonetheless so low on the first halvening in 2013 (some may even argue that the second halvening was not precisely liquid both) that it’s laborious to even put a lot weight within the impact of the few halvenings we now have seen.

The actual fact we now have scarcely a decade of Bitcoin value historical past with any type of liquidity to analyse is what makes the asset so befuddling, distinctive and, finally, troublesome to mannequin by way of any type of legacy valuation framework.

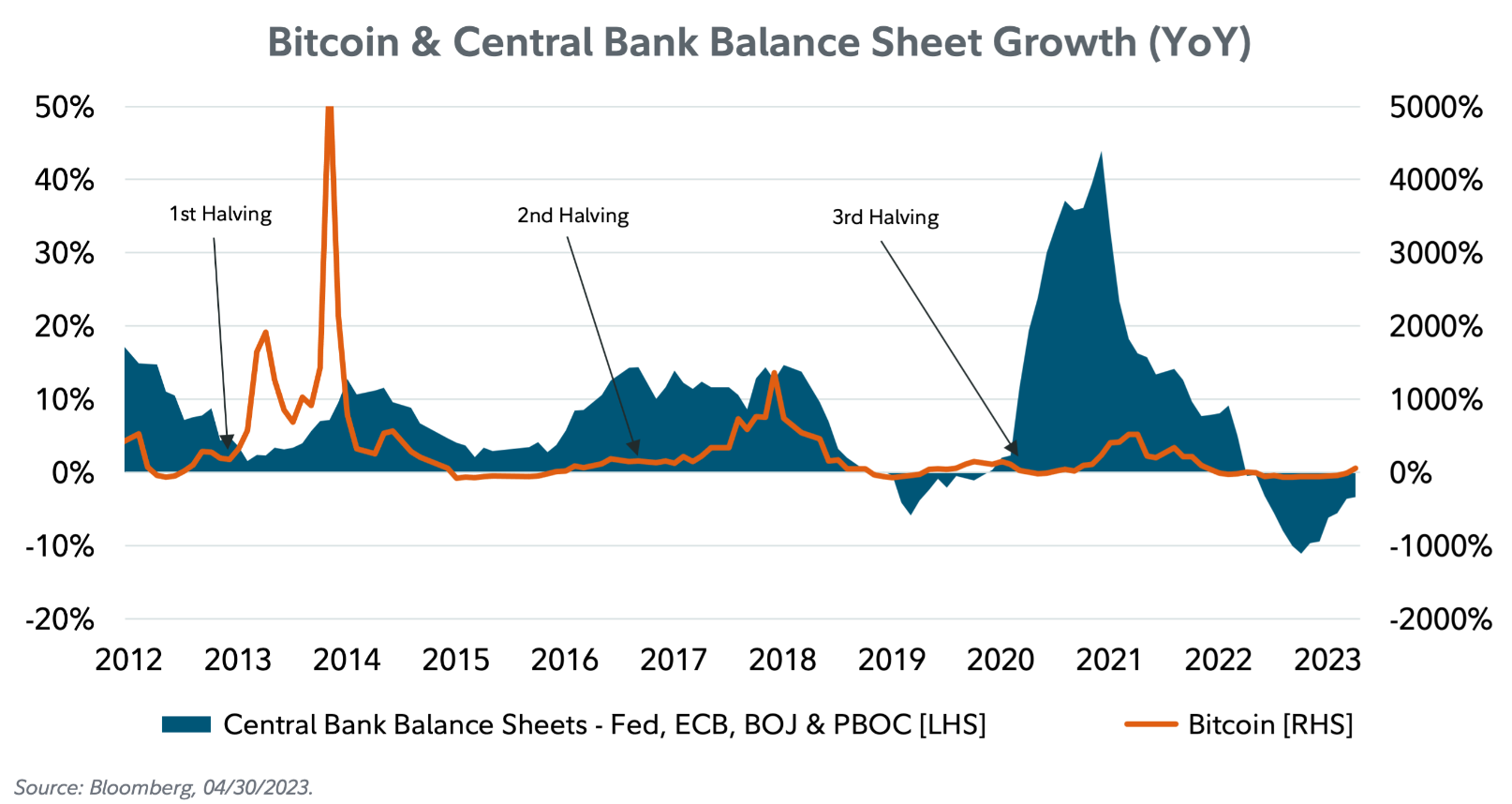

Along with the small pattern measurement, there’s additionally the matter of worldwide liquidity cycles, which have coincidentally lined up extremely nicely with the halvening cycles. The under chart from Constancy Digital Belongings demonstrates this nicely by plotting the expansion of central financial institution stability sheets in opposition to Bitcoin’s progress whereas marking the halvening occasions.

The argument that Halvenings will enhance value

Whereas the above arguments surrounding the small pattern measurement and the matching with world liquidity cycles are compelling, particularly for anybody taking a look at this as a non-crypto native reared on the environment friendly market speculation, there’s one intriguing principle which factors to why halvenings is probably not priced in – and one which could be very particular to the intricacies of the Bitcoin blockchain. Which, once more given its temporary historical past, means it might probably solely be a principle at this time limit.

Specifically, it’s derived out of the problem adjustment which is programmed into the underlying blockchain; as extra miners be part of the community, the problem routinely adjusts in order that blocks are validated on the similar tempo as earlier than (i.e. ten-minute intervals) and therefore the availability of recent Bitcoins holds regular on the pre-determined tempo, no matter how excessive the hash price is on the community. In different phrases, it turns into harder to validate blocks as extra miners be part of the community, which means a better price of vitality is required to mine Bitcoin.

The converse additionally holds true – if miners go away the community, it turns into simpler to mine and therefore decrease vitality/prices are required to mine. Because of this, theoretically, the price of manufacturing for Bitcoin ought to be pushed in direction of its market value. In any other case, in principle a minimum of, an arbitrage alternative would open up if a niche emerged between the price of manufacturing and the market value.

Take a look at it from a miner’s standpoint: if the worth of Bitcoin jumps above the price of manufacturing, the miner will allocate their vitality in direction of mining the Bitcoin on the decrease price of manufacturing, resulting in an upward issue adjustment till the delta closes. Equally, if the price of manufacturing was above the market value, the miner would cease mining as it will be cheaper to acquire Bitcoin in the marketplace, and the price of manufacturing would fall, once more till it reaches a pure equilibrium.

As a result of the market additionally has the power to shift its funds into Bitcoin itself or miners (by way of publicly traded mining firms and different associated funding autos), it’s basically confronted with the identical resolution as our hypothetical miner concerning the place to allocate their capital.

That is an argument in opposition to the thought that the market has priced within the halvening, as a result of if it had, then the worth of Bitcoin can be far above the price of manufacturing and the above equilibrium can be violated. An instance could illustrate this with extra readability:

Allow us to take the present market value and manufacturing price of 1 Bitcoin as $30,000. To make use of an excessive situation, if the worth of Bitcoin then doubles to $60,000, what would you do as a miner? You’d promote your Bitcoin at $60,000 as a way to finance your vitality price to mine Bitcoin at $30,000. Different miners will do the identical, driving each the hash price (issue) of mining up and the spot value available in the market down till convergence is discovered. It doesn’t simply need to be miners – speculators will realise that Bitcoin could also be overpriced relative to its price and launch their very own promote orders, including to the momentum till convergence is discovered.

Whereas the above instance overlooks the truth that the hash price could lag value as a result of it takes time to arrange a mining rig / enhance mining capability versus merely clicking a button on a bitcoin spot order, it sums up the predicament. Paradoxically, this principle argues that environment friendly markets be sure that the halvening can’t be priced in, in any other case there can be an arbitrage alternative. Or course, that is ironic as a result of it signifies that an occasion which is assured and publicly recognized can’t be priced in, which is the very definition of the environment friendly markets speculation.

All in all, the prior principle could also be a bit oversimplified, and it’s troublesome to miss the affect of worldwide liquidity cycles.

On the finish of the day, with solely three halvenings to this point and arguably just one with affordable liquidity, we’re all stabbing at the hours of darkness – Bitcoin nonetheless carries a number of mystique from a valuation perspective and it is extremely difficult to place a proper framework round it. However it exhibits the facility of narratives and the way the traders can create them as they please. Both manner, we are going to discover out within the close to future, as one factor is for sure: we all know that halvening is coming, and its ticking nearer each ten minutes.