The next is a visitor publish from Shane Neagle, Editor In Chief from The Tokenist.

Bitcoin pushed the monetary innovation envelope in lots of instructions. As a distributed digital ledger, it opened up area for transparency and provided a viable various to banking. Counting on its proof-of-work algorithm, Bitcoin established digital shortage. Digital however nonetheless anchored to the bodily world of {hardware} property and vitality necessities.

All this whereas being open-source. And Bitcoin’s open-source nature birthed over 100 onerous forks. These are ledgers ruled underneath completely different rulesets, a lot in order that they’re incompatible with earlier blocks, leading to a brand new blockchain model.

When a brand new onerous fork is created, propelled by completely different visions of P2P cash and incentives, a brand new model of Bitcoin is born. By market cap, the biggest ones are Bitcoin Money (BCH), Bitcoin SV (BSV), Bitcoin XT (BTCXT) and Bitcoin Gold (BTG). Though none of them come even near the large Bitcoin (BTC) market cap of $1.47 trillion, they’ve injected many concepts which might be related to Bitcoin’s future.

What Are Bitcoin Forks All About?

From the very onset of Bitcoin mainnet launch in January 2009, with the primary mined genesis block, it turned obvious that adjustments should happen to make Bitcoin A Peer-to-Peer Digital Money System as Satoshi Nakamoto initially meant.

For that form of imaginative and prescient to work on this planet of near-instant on-line funds, Bitcoin’s community must carry out on par with Visa or Mastercard networks. The issue is, these networks depend on centralized databases (ledgers), corresponding to VisaNet, emphasizing effectivity in transaction processing above all else.

In spite of everything, as a cash middleman between banks, Visa isn’t involved with any form of monetary sovereignty, in distinction to Bitcoin’s imaginative and prescient.

However how would that be potential with a decentralized laptop community? To stay so, every transaction must be verified by different nodes to reach on the proof-of-work consensus. Bitcoin’s present efficiency is round 7 transactions per second, because it takes 10 minutes to verify every block full of transactions (3,347 transactions per block at current).

There are a number of implications of this strategy to ledger administration:

- With the rise in transactions, Bitcoin transaction charges go up. Bitcoin miners inject this friction as a result of they get to set the brand new stage of price precedence within the obtainable Bitcoin mempool area, because the demand for the Bitcoin mining community will increase.

- If the recognition of Bitcoin will increase transaction charges, it makes Bitcoin a poor substitute for “day by day cash” which ideally ought to have minimal friction to be adopted at mass scale.

- If the plain resolution of accelerating transaction block sizes is carried out, the Bitcoin community would get extra centralized as a result of extra computing and storage could be required to course of transactions.

In different phrases, Bitcoin onerous forks have been primarily involved with the balancing act of block sizes. Living proof, when Mike Hearn launched Bitcoin XT as a fork of Bitcoin Core in August 2015, this model of Bitcoin was supposed to extend block measurement from 1 MB to ultimately 8 MB, which may double additional each two years.

If we check out different Bitcoin onerous forks, we see an identical sample of failure.

How Are Laborious Forks Created?

Bitcoin onerous forks are created by the introduction of latest Bitcoin Enchancment Proposals (BIPs). Alongside bug fixes, they’re the staging floor for brand spanking new options. Nonetheless, these new options are carried out provided that an activation threshold is reached, constituting ~95% miner help.

Successfully, the final 2,016 blocks (about two weeks of mining) must sign their help for a brand new BIP to be carried out.

When Mike Hearn and Gavin Anderson launched their BIP 101 proposal to extend most block measurement, from 1 MB to eight MB, it didn’t go the activation threshold. This triggered some controversy as Hearn declared that “Bitcoin has failed”, however solely his BIP 101 failed. The ensuing onerous fork, Bitcoin XT, is the aborted model.

Forks like these result in new cash, in contrast to tokens – the latter of which are sometimes created on pre-existing blockchains. In flip, it was Bitcoin Basic (BXC) that subsequently emerged from Bitcoin XT, because the block measurement was reverted from XT’s 8 MB to 2 MB. As soon as once more, this showcases that Bitcoin onerous forks manifest the balancing act of block sizes.

From these “block wars”, Bitcoin Money (BCH) additionally emerged in August 2017, having ultimately elevated block measurement to 32 MB. Out of all of the onerous fork, BCH stays essentially the most profitable one, presently at a $7.26 billion market cap.

Even such reasonably profitable splits have their very own forks. Australian entrepreneur Craig Wright launched a BCH fork referred to as Bitcoin Satoshi Imaginative and prescient (BSV) a 12 months later, in November 2018. Claiming to be the individual behind the pseudonym Satoshi Nakamoto, he was later revealed as a fraud within the UK Excessive Courtroom, having leveraged intensive forgery and lawfare techniques towards critics.

Cast Within the Crucible of Adversity

Provided that Gavin Anderson was as soon as a key member of Bitcoin Core, the first framework for Bitcoin, it’s honest to say that even failed BIP contributions within the type of onerous forks serve their objective.

Though Block Dimension Wars ended up on the facet of “small blockers”, the contested debate did lead to Segregated Witness (SegWit) implementation as a gentle fork, having been activated at block 477,120 in August 2017.

By BIPs 91, 141, and 148, SegWit made Bitcoin transactions extra environment friendly by segregating witness metadata from the primary transaction. This successfully elevated the block measurement by introducing block weight, which allowed for 4x extra transactions per block.

Most significantly, SegWit paved the highway for Bitcoin’s personal layer 2 scaling resolution, Lightning Community, as a result of it enabled Schnorr signatures. These not solely make it potential to have Atomic Multi-Path Funds (AMP) for LN, which splits giant funds into tiny bits, however they decrease on-chain information footprint with extra environment friendly, smaller signatures.

The AMP characteristic additionally permits customers to optimize fee routing by means of LN channels, because the payer solely has to know the general public key of the recipient. Finally, what began as a collection of Bitcoin onerous forks, with most failing to realize traction, facilitated one other kind of Bitcoin scaling.

The frictionless scaling enabled by LN, mixed with good contracts, could even result in futures contracts not directly, as they’d require such pace and deeper liquidity. Even the Federal Reserve Financial institution of Cleveland acknowledged that Lightning Community will get Bitcoin nearer to “day by day cash” within the paper titled The Lightning Community: Turning Bitcoin into Cash.

“Our findings recommend that the off-chain netting advantages of the Lightning Community may also help Bitcoin to scale and performance higher as a method of fee. Centralization of the Lightning Community doesn’t seem to make it way more environment friendly, although it might improve the proportion of low price transactions.”

Within the funds enviornment, it might be possible that specialised onerous forks may discover their area of interest. There’s all the time a necessity for on-line bill factoring or acquiring commerce credit score for small to medium enterprise (SMBs).

However the truth that Bitcoin remained with a conservative block measurement whereas including LN as a scaling resolution isn’t that stunning in hindsight.

Safety Dangers and Community Vulnerabilities

Within the preliminary phases of Bitcoin’s improvement and adoption, as a significant financial novelty, it was important to take care of a conservative strategy. If the general public is to understand Bitcoin as sound cash, it has to take care of core options, no pun meant.

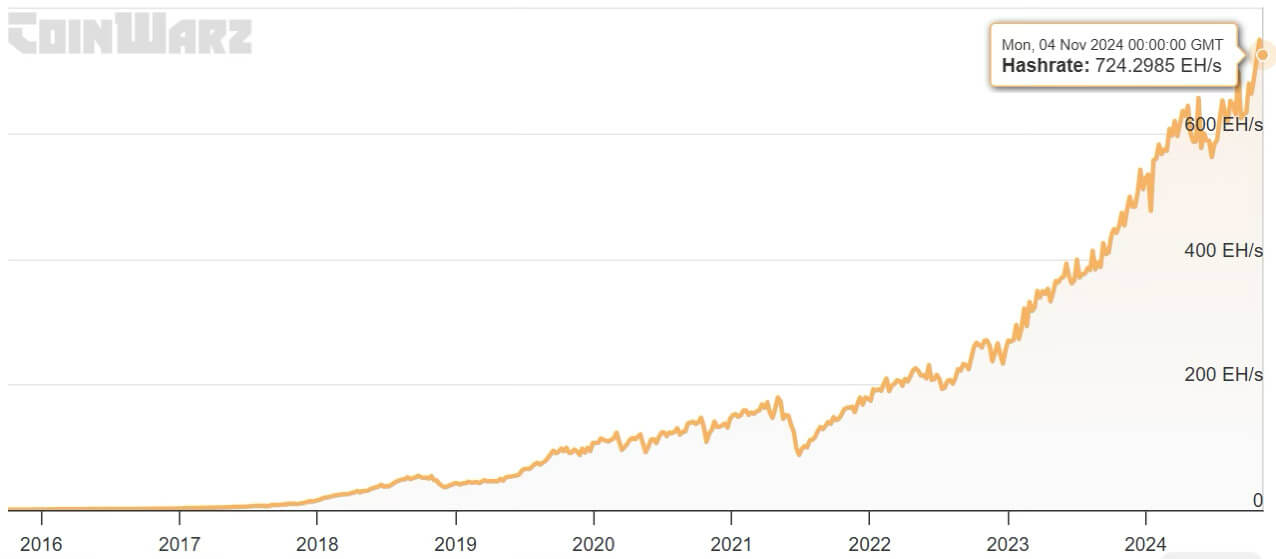

Inherently, by diluting the hash charge energy, onerous forks introduce a safety vulnerability. The underlying worth of Bitcoin comes from the mining community’s hash charge energy. It’s the measure of calculations wanted for mining rigs to resolve cryptographic puzzles and add a legitimate transaction block, in return for BTC as block reward.

Throughout this mining competitors, these with increased hashrate have a larger probability to earn BTC. And as extra computing energy is added to the community, Bitcoin’s community problem auto-adjusts each 2,016 blocks, or round two weeks.

Conversely, a drop in hash charge energy would make it extra possible for a 51% community assault try and succeed. A brand new onerous fork wouldn’t solely siphon away computing energy, however this divergence and dilution would create a heightened state of threat throughout the brand new model rollout.

What this quantities to is that Bitcoin miners are biased towards community safety over innovation.

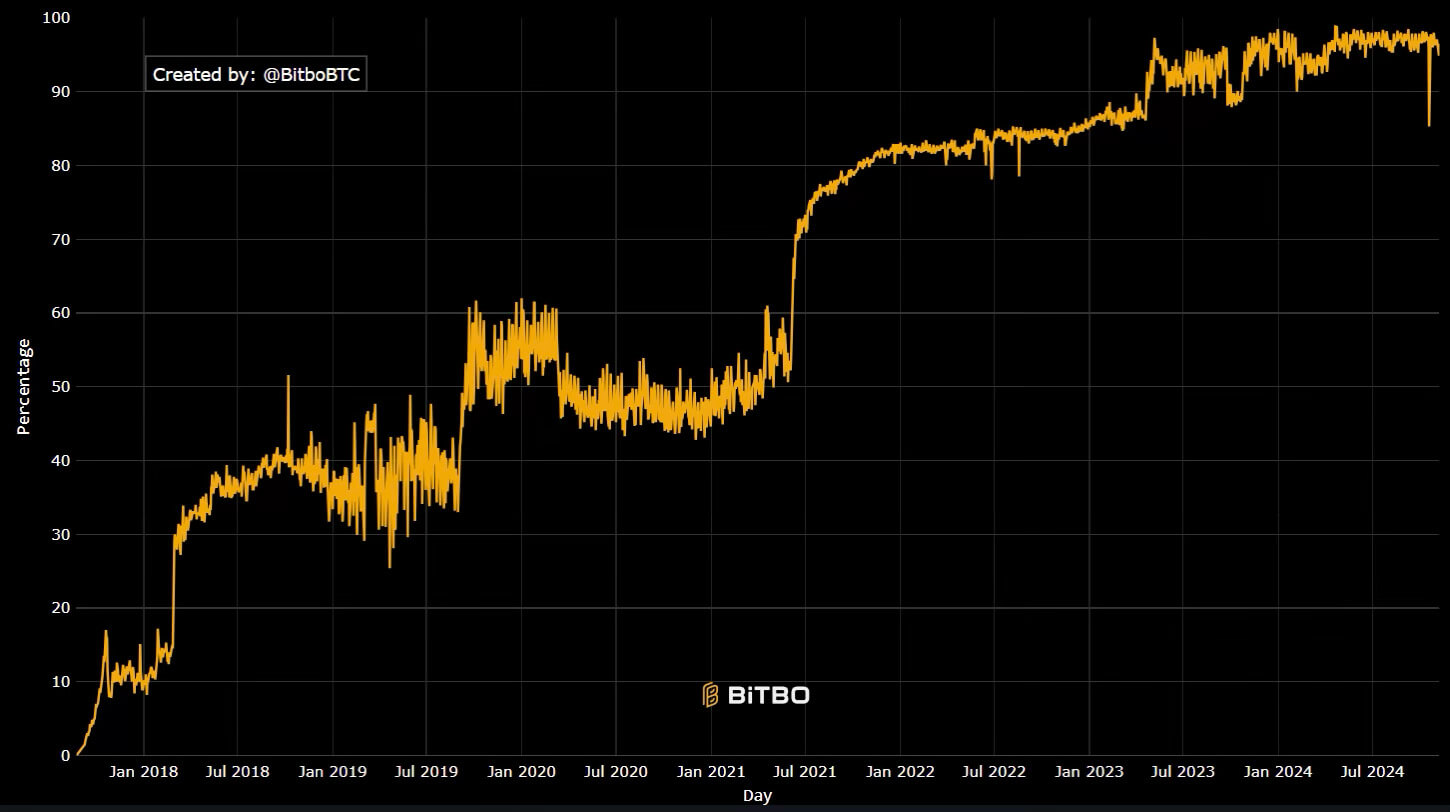

In spite of everything, even when there’s a single publicized occasion of a profitable hack of the Bitcoin community, this could function a value-deflating power in perpetuity. And if that occurs, any innovation would take a again seat. Accordingly, the Bitcoin hashrate has just one trajectory – up.

At this cut-off date, Bitcoin mainnet’s computing energy is so ample that even a extreme BTC worth drop wouldn’t symbolize a vulnerability. In such a situation, it’s potential that some mining operations may exit the community attributable to losses, thus ending up decreasing the mining problem.

However attributable to prior conservative strategy and bias towards safety, the Bitcoin community would climate it.

Market Volatility and Investor Sentiment

Seven years in the past, the aforementioned Bitcoin Money (BCH) had its all-time excessive worth of $4,355, as essentially the most profitable onerous fork launch. Having launched in August 2017, the height occurred on the finish of that 12 months. Following the destiny of many altcoins, alongside Bitcoin SV, the sample is acquainted:

- Preliminary speculative enhance.

- Extra distant, ever lower cost peaks from the earlier ones.

Notably, through the interval of +$6 trillion M2 cash provide enhance by the Federal Reserve in 2020 and 2021, alongside stimulus checks, each onerous forks mirrored that spike. However after the liquidity spigot was turned off with the start of the rate of interest climbing cycle in March 2022, BSV and BCH returned to excessive risk-off territory.

This is sensible contemplating the next elements:

- In whole, there’s solely a lot capital to go round.

- There’s even much less capital within the crypto sphere.

- As digital financial novelty, cryptocurrencies are perceived as riskier than shares.

Consequently, the beneficiary of most capital would go to the unique and most safe cryptocurrency – Bitcoin.

Conclusion

As this valuation sample turns into extra obvious, it’s exceedingly unlikely that future Bitcoin onerous forks, or current ones, would achieve traction over Bitcoin. Within the eyes of buyers, altcoins are juxtaposed towards shares that are primarily based on firms with onerous property and earnings.

The unique Bitcoin is the exception right here, exactly due to its huge computing community that brings onerous property into play. Though onerous forks tried the identical, they pale as compared, which ranges them with generic proof-of-stake altcoins.

Inside that ecosystem, heavyweights like ethereum have develop into the middle of capital gravity. At greatest, Bitcoin onerous forks may obtain a momentary worth enhance, attributable to their decrease market caps in comparison with Bitcoin. This holds speculative potential for revenue, however the identical holds true for the altcoin ecosystem as a complete.