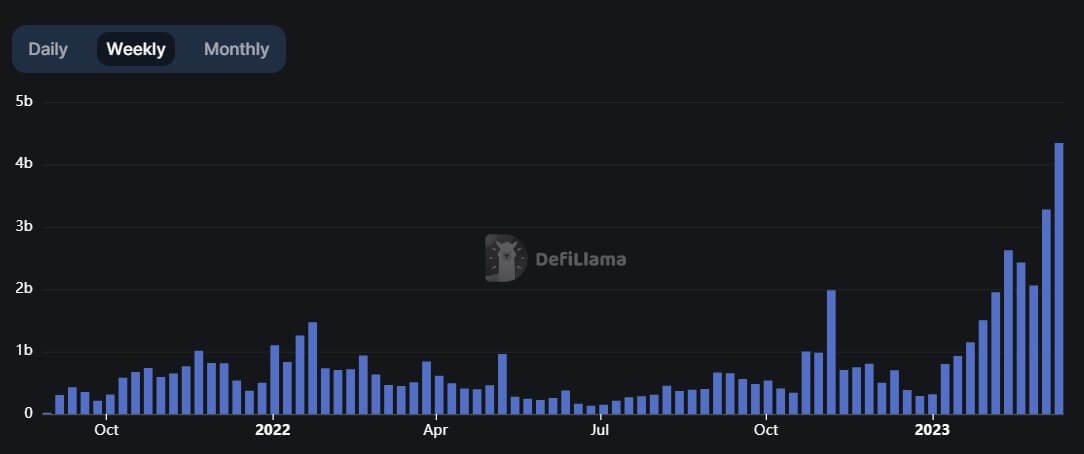

Arbitrum’s decentralized trade (DEX) transactions quantity rose to a brand new all-time excessive (ATH) in every of the final two weeks, in line with DeFillama knowledge.

Over the previous seven days, DEX transactions elevated 32.41% to $4.34 billion. For the week beginning March 5, transaction quantity on Arbitrum had surged to $3.28 billion.

Each day transaction quantity stood at $535 million as of March 20 — second solely to Ethereum (ETH) and nearly twice that of Binance Good Chain (BSC).

The highest 5 DEXs on Arbitrum have been Uniswap, SushiSwap, ZyberSwap, Camelot, and Balancer. Within the final seven days, buying and selling quantity on these platforms grew by a mean of over 40% — Camelot spiked the very best by 95% to $38.45 million, whereas ZyberSwap noticed essentially the most minor development of two.84% to $61,41 million.

In the meantime, Uniswap stays the dominant DEX platform on Arbitrum, accounting for 48% of all trades on the layer2 (L2) community.

Arbitrum’s TVL and stablecoin influx rises

The entire worth of belongings locked on Arbitrum has risen by greater than 20% within the final seven days to $3.85 billion, in line with L2beats. By way of ETH, 2.15 million tokens have been locked on the community.

The rising TVL additionally coincided with high-network exercise on the L2 community. Throughout the interval, Arbitrum’s every day transaction per second rose 80.82% to 10.82.

DeFillama knowledge reveals that Arbitrum’s dominant DeFi protocol is GMX — the venture controls 28.27% of Arbitrum’s whole TVL.

In the meantime, the L2 resolution has continued to witness a rise in its stablecoin influx. For context, Arbitrum’s USD influx climbed 9% to $1.59 billion regardless of the latest points plaguing the dominant stablecoin on its ecosystem, USD Coin (USDC).

Throughout the interval, there was extra influx of Tether’s USDT and algorithmic stablecoin DAI into the community as towards USDC.