- Bullish Arbitrum (ARB) worth prediction ranges from $0.7 to $2.62.

- Evaluation means that the ARB worth may attain above $3 quickly.

- The ARB bearish market worth prediction for 2023 is $0.77.

What’s Arbitrum (ARB)?

Arbitrum is a layer-two (L2) scaling answer constructed on the Ethereum community, which makes use of optimistic rollups to reinforce the velocity, scalability, and cost-efficiency of Ethereum transactions. By shifting many of the computation and storage load off-chain, Arbitrum presents larger throughput and decrease charges in comparison with Ethereum, whereas nonetheless benefiting from Ethereum’s safety and compatibility.

Arbitrum’s native token is known as ARB and is used for governance inside the community. Lately, the builders of Arbitrum, Offchain Labs, introduced a transition to a decentralized autonomous group (DAO) construction generally known as the Arbitrum DAO. ARB holders can now vote on proposals that have an effect on the options, protocol upgrades, funds allocation, and even the election of a Safety Council. This transfer in direction of decentralization permits better group involvement and decision-making within the growth and evolution of the Arbitrum community.

In 2023, Arbitrum has set an bold roadmap for a number of vital developments. Firstly, it plans to launch its personal layer-three answer named Orbit, which can additional enhance the scalability and velocity of transactions on the community. Moreover, the introduction of Stylus will permit builders to deploy packages written in standard programming languages reminiscent of Rust and C++, amongst others, thereby increasing the community’s capabilities.

One other key objective for Arbitrum is to increase its validator set by together with extra unbiased institutional validators, which can improve the community’s safety and decentralization. Moreover, the protocol is about to be moved to layer two with Arbitrum One, which can additional enhance the effectivity and cost-effectiveness of transactions on the community. Total, these developments spotlight Arbitrum’s dedication to advancing the capabilities and adoption of blockchain expertise.

Arbitrum is a distinguished scaling answer for Ethereum that stands out because of its use of optimistic rollups. It presents a number of benefits over different optimistic rollup options, together with compatibility with current Ethereum DApps with none code modifications, excessive scalability with quick finality and low charges, flexibility for builders to deploy packages written in standard programming languages, and a decentralized community of validators who safe the community and earn charges. Moreover, it has a thriving ecosystem of DApps, wallets, instruments, and companions.

Arbitrum depends on the Ethereum community for the safety and finality of transactions. Optimistic rollups are used to execute transactions outdoors of Ethereum and bundle them in batches earlier than submitting them to the mainnet. Off-chain transactions are assumed to be legitimate with out submitting proof of validity. If there’s a dispute, anybody can problem the transaction inside a set time interval by submitting a fraud-proof.

Arbitrum (ARB) Market Overview

| 🪙 Identify | Arbitrum |

| 💱 Image | arb |

| 🏅 Rank | #39 |

| 💲 Value | $1.14 |

| 📊 Value Change (1h) | -0.48582 % |

| 📊 Value Change (24h) | -0.21528 % |

| 📊 Value Change (7d) | -2.36122 % |

| 💵 Market Cap | $1449505609 |

| 📈 All Time Excessive | $8.67 |

| 📉 All Time Low | $0.912886 |

| 💸 Circulating Provide | 1275000000 arb |

| 💰 Complete Provide | 10000000000 arb |

Analysts’ View on Arbitrum (ARB)

A crypto analyst has been telling round that Arbitrum’s worth may drop to $0.77 earlier than the rally.

Lots of crypto analysts are speculating on ARB worth below the Whale coin speak tweet, that the value may attain $3-$5 quickly.

Arbitrum (ARB) Present Market Standing

In response to CoinMarketCap, Arbitrum (ARB) is close to over $1.20 on the time of writing, with a complete of 1,275,000,000 ARB in circulation. ARB has a 24-hour buying and selling quantity of $570,349,415, with a 28.21% lower. And throughout the previous 24 hours, the value of ARB elevated by 3.64%.

The most well-liked crypto exchanges to commerce Arbitrum (ARB) are Binance, KuCoin, Kraken, Bitfinex, Bithumb, Uniswap, and Gate.io. Let’s proceed with our ARB worth analysis for 2023.

Arbitrum (ARB) Value Evaluation 2023

By market capitalization, ARB ranks thirty ninth on CoinMarketCap’s checklist of the largest cryptocurrencies. Will Arbitrum’s most up-to-date enhancements, additions, and modifications assist the ARB worth rise? First, let’s deal with the charts on this article’s ARB worth forecast.

Arbitrum (ARB) Value Evaluation – Keltner Channel

The Keltner channel is a technical indicator launched by American grain dealer, Chester W. Keltner to gauge the volatility of the market. For this goal, it has three bands; the Higher band, Center band (EMA), and decrease band.

The higher band is calculated by including twice the Common True Vary (ATR) to the EMA (center band), whereas the decrease band is calculated by subtracting twice the ATR from the EMA.

The chart above exhibits a purple rectangle that denotes the enlargement of the Keltner channels. When the bands widen it means that there’s going to be extra volatility. Or in different phrases, the costs might drastically drop or enhance.

Moreover, when the value of a cryptocurrency repeatedly touches the higher or decrease band and thereafter touches the other band, (which is, if a cryptocurrency repeatedly touches the higher band and at last touches the decrease band, then we might decide that the bullish pattern has pale. This is applicable vice versa as effectively). This habits could possibly be seen contained in the inexperienced rectangle.

At the moment, ARB is fluctuating testing the decrease band after being rejected by EMA a number of instances. If the Bulls give ARB momentum then we might count on ARB to interrupt the EMA and transfer to the primary half of the Keltner Channel. Moreover, for the reason that Keltner channels are going through downwards, we might count on the costs to lower additional.

Arbitrum (ARB) Value Evaluation – Bollinger Bands

The Bollinger bands are a sort of worth envelope developed by John Bollinger. It provides a variety with an higher and decrease restrict for the value to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time). Furthermore, the higher band as proven within the chart is calculated by including two instances the usual deviation to the Easy Shifting Common whereas the decrease band is calculated by subtracting two instances the usual deviation from the Easy Shifting Common.

The Empirical regulation also referred to as the three-sigma rule or the 68-95-99.7 rule states that the majority noticed information for a traditional distribution will fall inside three commonplace deviations. As such for the traditional distribution information set, 68% of information will fall inside 1 commonplace deviation of the imply, whereas 95% of information for the traditional distribution will fall inside 2 commonplace deviations of the imply and 99.7% of information will fall inside 3 commonplace deviations of the imply.

Therefore, when that is utilized to the value of ARB, we might count on the coin to abide inside the Bollinger bands 95% of the time.

Furthermore, the sections highlighted by purple rectangles present how the bands increase and contract. When the bands widen, we might count on extra volatility, and when the bands contract, it denotes much less volatility. At the moment, the bands are increasing as proven by the gray elliptical, therefore, the ARB could possibly be awaiting a serious fluctuation in costs.

Furthermore, ARB has touched the decrease Bollinger Band as such we are able to say that the coin/token is oversold. It signifies that many are promoting the coin and therefore the costs have decreased. As such the market might right the costs and the costs could enhance drastically. Scalpers and day merchants must be looking out to enter the market within the nick of time to benefit from the chance.

Notably, the Bollinger Band behaves very carefully with the Keltner channel. For example, in the event you have been to make use of each the Bollinger bands and Keltner channel indicators for a cryptocurrency, you’d see that just about more often than not each indicators overlap. Nevertheless, the one distinction between with Bollinger band and the Keltner channel is that the Bollinger bands use Commonplace Deviation whereas the Keltner channel makes use of Common True Vary for calculating its bands that are the highest and backside limits.

Arbitrum (ARB) Value Evaluation – Relative Power Index

The Relative Power Index is an indicator that’s used to search out out whether or not the value of a safety is overvalued or undervalued. As per its title, RSI indicators assist decide how the safety is doing at current, relative to its earlier worth.

Furthermore, it has a sign line which is a Easy Shifting Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, every time the RSI line is above the SMA it’s thought of bullish and if it’s under the SMA then it’s bearish. When contemplating the inexperienced rectangle part on the left of the chart under we are able to see that when the RSI line is under the Sign. As such ARB is bearish or shedding worth however the second inexperienced rectangle exhibits that the RSI is above the sign. Therefore, it’s bullish.

Moreover, the RSI compares the good points of the securities towards the losses it made up to now. This ratio of good points and losses is then deducted from the 100.

If the reply is lower than 30, then we name that the value of the safety is within the oversold area. Which means that many are promoting the safety available in the market, and as such the safety is undervalued. Furthermore, as per the Provide-demand curve idea, the value is meant to drop when there is a rise in provide.

If the reply is greater than 70 then the safety is overbought as many are shopping for. Since many wish to purchase the safety the demand will increase which intuitively will increase the costs.

Moreover, the RSI could possibly be used to find out how robust a pattern is. For example, when a cryptocurrency is bullish or reaching larger highs, then the RSI line additionally must be making larger highs in unison. If not it signifies that though the cryptocurrency is on a bullish pattern it’s shedding worth and therefore a pattern reversal could possibly be lurking across the nook.

Nevertheless, the RSI might additionally give false alarms for breakouts. Though we could count on, the costs to retrace if it goes to the oversold or overbought area, the costs can also keep within the oversold or overbought area for an prolonged interval. As such, merchants must be cautious of it and let the market saturate earlier than making very important selections.

Arbitrum (ARB) Value Evaluation – Shifting Averages

The Exponential Shifting averages are fairly much like the easy shifting averages (SMA). Nevertheless, the SMA smoothens down all values whereas the Exponential Shifting Common provides extra weightage to the present costs. As such, the MA equation has a better reference to the current costs which is required within the unstable trade of crypto.

Every time the value of cryptocurrency is above the 50-day or 200-day MA, or above each we could say that the coin is bullish (inexperienced highlighted part). Contrastingly, if the token is under the 50-day or 200-day, or under each, then we might name it bearish (purple highlighted part).

When wanting on the inexperienced highlighted rectangle within the above chart, we are able to see that ARB rebounded off of the 50-day MA. Nonetheless, it couldn’t maintain on to its gained place because the bears have been too robust. Therefore. AR fell under the 50-day MA and resorted to help from the 200-day MA. Nevertheless, the 200-day MA couldn’t maintain ARB for lengthy.

As such ARB is at present, under each the Shifting Averages and is testing the 200-day MA. Furthermore, because the 50-day MA approached the 200-day from above, there was a demise cross. Subsequently, the market is wanting gloomy, therefore merchants could take into account going quick.

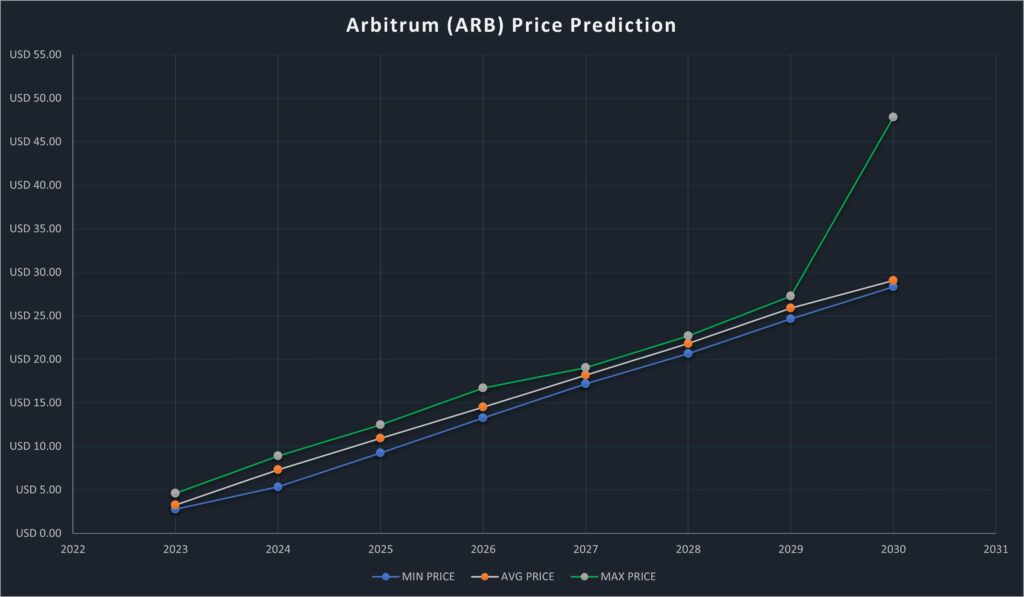

Arbitrum (ARB) Value Prediction 2023-2030 Overview

| YEAR | MINIMUM PRICE | AVERAGE PRICE | MAXIMUM PRICE |

| 2023 | $2.78 | $3.27 | $4.62 |

| 2024 | $5.34 | $7.32 | $8.89 |

| 2025 | $9.24 | $10.94 | $12.48 |

| 2026 | $13.26 | $14.50 | $16.71 |

| 2027 | $17.18 | $18.19 | $19.05 |

| 2028 | $20.67 | $21.81 | $22.68 |

| 2029 | $24.65 | $25.88 | $27.26 |

| 2030 | $28.32 | $29.06 | $47.83 |

| 2040 | $51.32 | $69.00 | $112.50 |

| 2050 | $130.12 | $153 | $169.01 |

Arbitrum (ARB) Value Prediction 2023

Wanting on the each day chart of ARB/USDT, the ARB worth was swinging from $1.80 to $1.10 ever because it first received listed on a serious cryptocurrency change reminiscent of Binance. Bouncing again from the assist degree, ARB is now buying and selling at $1.19 however has extra room to fall.

In the meantime, our long-term ARB worth prediction for 2023 is bullish if it can’t break the assist degree. We will count on ARB to achieve $3.27 this 12 months.

Arbitrum (ARB) Value Prediction 2024

There will probably be Bitcoin halving in 2024, and therefore we should always count on a constructive pattern available in the market because of consumer sentiments and the hunt by traders to build up extra of the coin. For the reason that Bitcoin pattern impacts the path of commerce of different cryptocurrencies, we might count on ARB to commerce at a worth not under $7.135 by the top of 2024.

Arbitrum (ARB) Value Prediction 2025

We should always count on the value of ARB to commerce above its 2024 worth because of the opportunity of most cryptocurrencies breaking extra psychological resistance ranges because of the Bitcoin halving over the earlier 12 months. Therefore, ARB might finish 2025 by buying and selling at round $10.9410.

Arbitrum (ARB) Value Prediction 2026

For the reason that most provide of ARB is approached by 2026, the bearish market that follows a strong bullish run impacts its earlier worth because of the entrance of extra institutional traders to its platform. With this, the price of ARB might break the same old pattern and commerce at $14.5 by the top of 2026.

Arbitrum (ARB) Value Prediction 2027

Traders count on a bullish run subsequent 12 months, 2028, because of Bitcoin halving. Therefore, the value of ARB might consolidate on the earlier good points and even break extra psychological resistance ranges because of traders’ constructive sentiment. Subsequently, ARB might commerce at $18.19 by the top of 2027.

Arbitrum (ARB) Value Prediction 2028

In 2028, there will probably be Bitcoin halving. Therefore, the consolidating market in 2027 could possibly be adopted by a bullish run. That is because of the influence of stories surrounding any 12 months of Bitcoin halving. It’s, due to this fact, attainable that the market might attain larger excessive values. Arbitrum (ARB) might hit $21.81 by the top of 2028.

Arbitrum (ARB) Value Prediction 2029

By 2029, there could possibly be a lot stability within the worth of most cryptocurrencies that had stayed for over a decade. This is because of implementing classes realized to make sure their traders retain the challenge’s confidence. This influence, coupled with the value surge that follows a 12 months after Bitcoin halving, might surge the value of ARB to $25.4423 by the top of 2029.

Arbitrum (ARB) Value Prediction 2030

The cryptocurrency market skilled excessive stability because of the holding actions of early traders in order to not lose future good points within the worth of their belongings. We might count on the value of Arbitrum (ARB) to commerce at round $29.06 by the top of 2030, no matter the beforehand bearish market that adopted a market surge within the earlier years.

Arbitrum (ARB) Value Prediction 2040

In response to our long-term ARB worth estimate, ARB costs might attain a brand new all-time excessive this 12 months. If the present development price continues, we might anticipate a mean worth of $69 by 2040. If the market turns bullish, the value of ARB might go up past what we predicted for 2040.

Arbitrum (ARB) Value Prediction 2050

In response to our ARB forecast, the common worth of ARB in 2050 is likely to be above $153. If extra traders are drawn to ARB between these years, the value of ARB in 2050 could possibly be far larger than our projection.

Conclusion

ARB may attain $3 in 2023 and $29 by 2030 if traders resolve that ARB is an effective funding together with mainstream cryptocurrencies like Bitcoin and Ethereum.

FAQ

Arbitrum is a layer-two (L2) scaling answer constructed on the Ethereum community, which makes use of optimistic rollups to reinforce the velocity, scalability, and cost-efficiency of Ethereum transactions. By shifting many of the computation and storage load off-chain, Arbitrum presents larger throughput and decrease charges in comparison with Ethereum, whereas nonetheless benefiting from Ethereum’s safety and compatibility.

ARB could be traded on many exchanges like different digital belongings within the crypto world. Binance, KuCoin, Kraken, Bitfinex, Bithumb, Uniswap, and Gate.io are at present the preferred cryptocurrency exchanges for buying and selling ARB.

Since ARB offers traders with a number of alternatives to revenue from their crypto holdings, it appears to be a superb funding in 2023. Notably, ARB has a excessive chance of surpassing its present ATH in 2024.

ARB is among the few energetic crypto belongings that proceed to rise in worth. So long as this bullish pattern continues, ARB may break via $5 and attain as excessive as $10. In fact, if the present market favoring crypto continues, it’s going to probably occur.

ARB is anticipated to proceed its upward pattern as one of many fastest-rising cryptocurrencies. We may additionally conclude that ARB is a superb cryptocurrency to take a position on this 12 months, given its current partnerships and collaborations which have improved its adoption.

The bottom ARB worth is $1.1045, attained on March 23, 2023, in keeping with CoinMarketCap.

ARB was launched in August 2021.

Ed Felten, Steven Goldfeder and Harry Kalodner co-founded ARB.

There isn’t any information.

ARB could be saved in a chilly pockets, scorching pockets, or change pockets.

ARB worth is anticipated to achieve $3 by 2023.

ARB worth is anticipated to achieve $7.315 by 2024.

ARB worth is anticipated to achieve $10.9410 by 2025.

ARB worth is anticipated to achieve $14.5 by 2026.

ARB worth is anticipated to achieve $18.19 by 2027.

ARB worth is anticipated to achieve $21.81 by 2028.

ARB worth is anticipated to achieve $25.88 by 2029.

ARB worth is anticipated to achieve $29.06 by 2030.

ARB worth is anticipated to achieve $69 by 2040.

ARB worth is anticipated to achieve $153 by 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this worth prediction, are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be held accountable for any direct or oblique injury or loss.