The next is a visitor publish from Vincent Maliepaard, Advertising and marketing Director at IntoTheBlock.

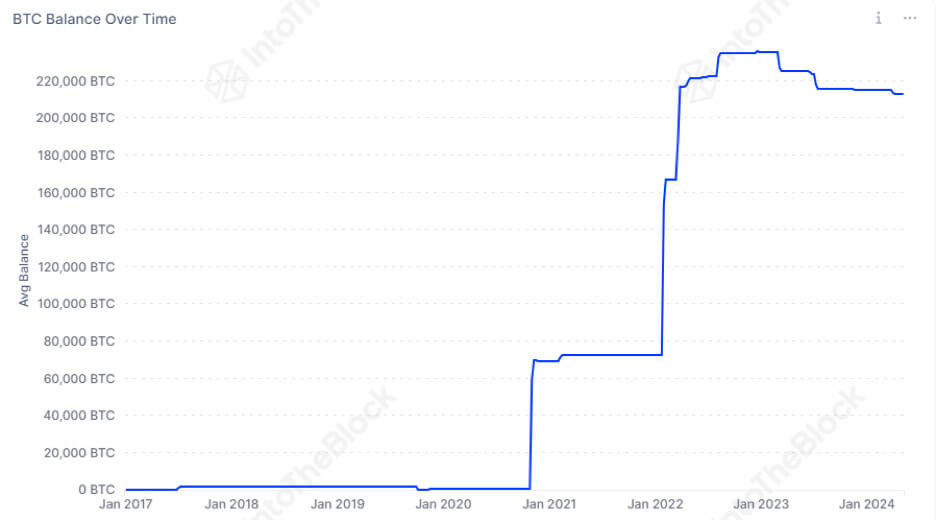

Based on the most recent information from IntoTheBlock, the U.S. authorities holds over 1% of the Bitcoin provide, valued at a powerful $13.16 billion. These holdings have tripled since 2021, demonstrating a constant enhance through the years.

Why the US authorities holds Bitcoin

It’s essential to make clear that the U.S. authorities’s Bitcoin holdings will not be the results of purchases however enforcement actions. These seizures sometimes happen in response to unlawful actions.

Spikes within the quantity of Bitcoin held by the US authorities are related to the most important BTC-related enforcement actions. Notable situations embody the Silk Highway vase and the Bitfinex hack.

Silk Highway (2013):

One of the vital notable circumstances concerned the seizure of roughly 174,000 bitcoins from Silk Highway, a darkish internet market. The FBI shut down Silk Highway and arrested its founder, Ross Ulbricht. In a dramatic twist, the US authorities later seized over $1 billion value of Bitcoin linked to Silk Highway, present in a beforehand undiscovered pockets holding roughly 69,370 bitcoins.

Bitfinex Hack (2016):

In August 2016, hackers breached Bitfinex, a distinguished cryptocurrency alternate, stealing roughly 120,000 BTC, valued at round $72 million.

Years later, in February 2022, the Division of Justice introduced the restoration of a good portion of the stolen Bitcoin, valued at over $3.6 billion. This marked the most important recoveries of stolen crypto in historical past.

Different notable seizures

Whereas Silk Highway and Bitfinex are among the many most distinguished circumstances, a number of different vital seizures have occurred. In 2017, the US seized bitcoins value $4 million (at present valued at over $60 million) from the BTC-e alternate throughout a multi-agency investigation into alleged cash laundering actions. Alexander Vinnik, the alleged operator of BTC-e, was arrested.

One other notable case entails the 2020 seizure of belongings from the founders of the BitMEX alternate for violations of the Financial institution Secrecy Act. Though particular quantities of Bitcoin weren’t disclosed, BitMEX dealt with giant volumes of Bitcoin transactions.

Implications of Authorities Holdings

Monitoring the holdings of enormous Bitcoin stashes, resembling these held by the U.S. authorities, is essential for a number of causes.

Firstly, the selections surrounding whether or not and when the federal government strikes these Bitcoins may considerably affect market dynamics. The strategy of their launch—be it through direct sale, public sale, or one other strategy—can both mitigate or exacerbate market impression.

For instance, auctioning off the cash may appeal to institutional traders who worth the transparency and legitimacy of “government-sanctioned” Bitcoin. This reassurance is especially essential for these involved concerning the origins of their crypto holdings, as buying from respected sources avoids the dangers related to funds tied to unlawful actions.

Equally, the US authorities holds sufficient Bitcoin to have an effect on market costs considerably upon releasing their holdings, which may result in speculative conduct amongst smaller traders making an attempt to anticipate or react to those strikes.

However there’s extra to the story. A good portion of the Bitcoin provide is managed by authorities and ETF entities, posing a possible menace. Based on Juan Pellicer, Senior Researcher at IntoTheBlock:

The present possession ranges of Bitcoin amongst U.S. authorities and ETF entities pose a possible danger to the notion of Bitcoin as an asset past the management of presidency forces or main monetary establishments. The US authorities holds over 1% of the Bitcoin provide, valued at over $13.16 billion, whereas Bitcoin ETF issuers management $50.6 billion, accounting for over 4% of the BTC provide. This excessive focus of holdings challenges the narrative of Bitcoin’s decentralization and will affect market dynamics and investor conduct sooner or later.’

Thus, monitoring these vital holdings is about understanding present market values and foreseeing potential market shifts.

The publish Analyzing the US Authorities’s Bitcoin holdings: What it is advisable know appeared first on StarCrypto.