Monitoring the motion of Bitcoin‘s provide, significantly when categorized by the point since final lively, is pivotal for understanding investor habits and forecasting market traits. This evaluation sheds gentle on the present state of Bitcoin holdings and gives vital insights into its future actions.

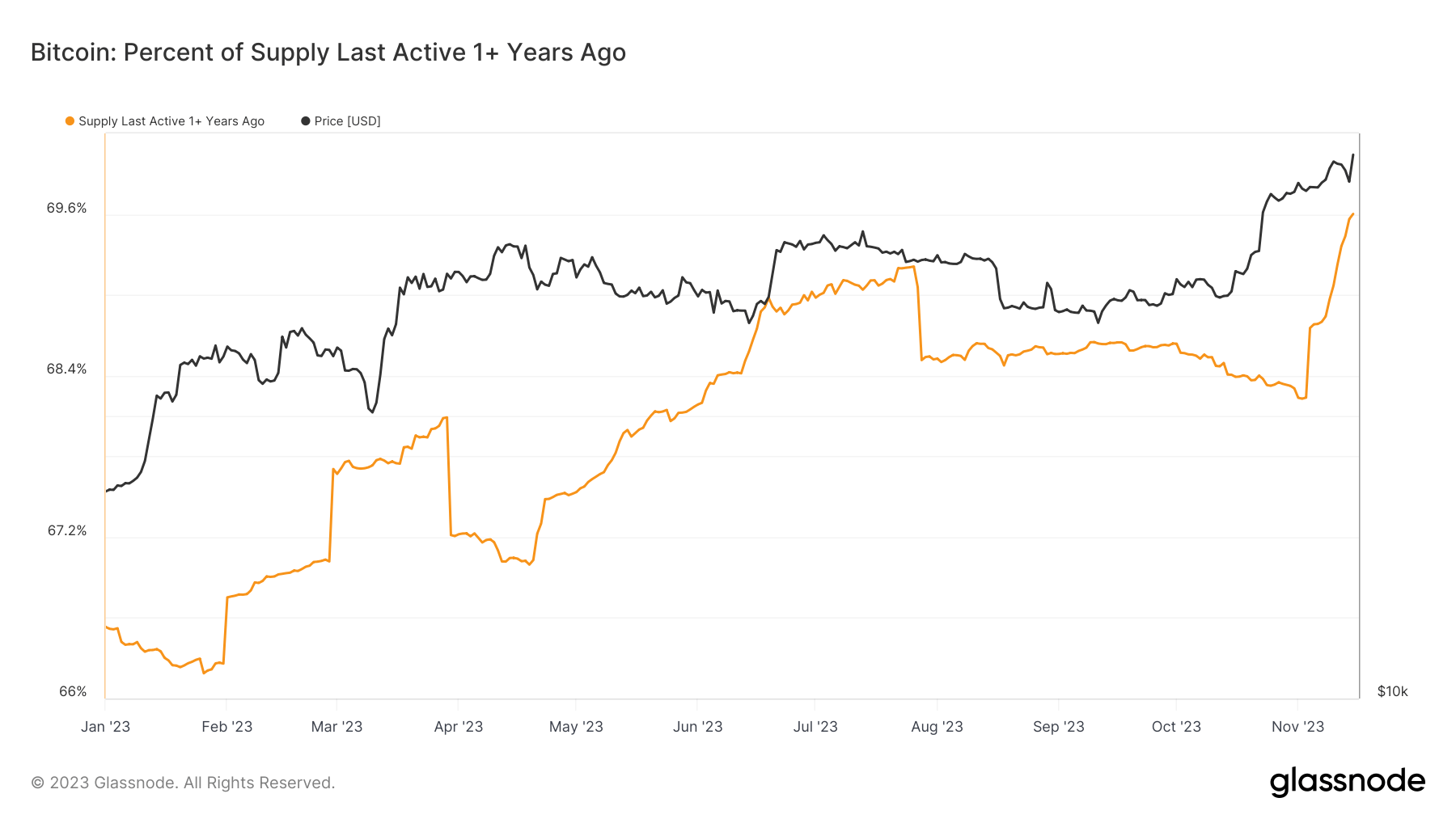

There was a exceptional shift in Bitcoin’s provide dynamics that adopted its latest value rally. In simply over a month, Bitcoin’s value surged from $26,846 to $37,964. Throughout the identical interval, the share of Bitcoin’s provide final moved over a 12 months in the past elevated by round 4%, indicating a heightened tendency amongst traders to carry their property for longer durations.

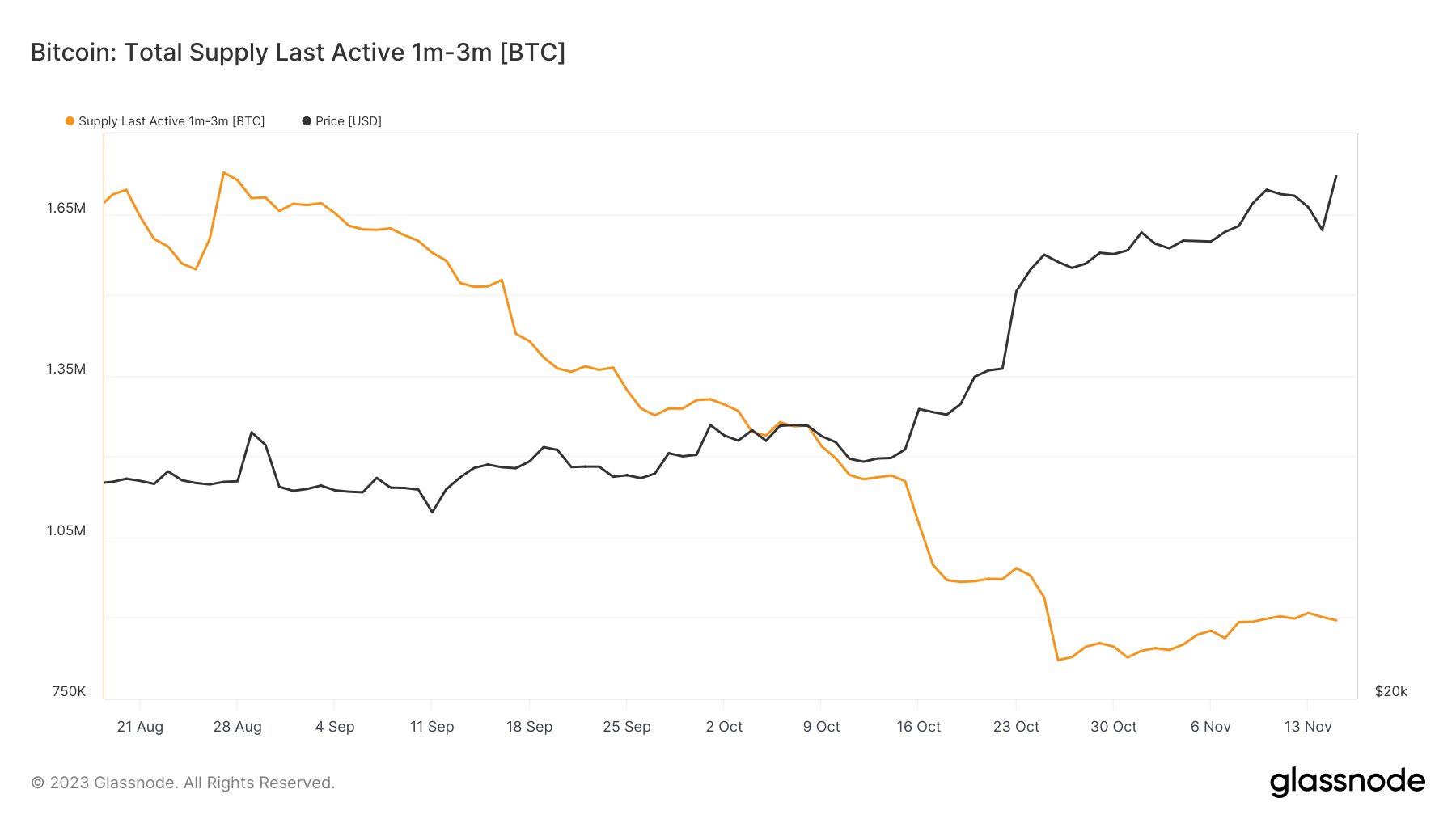

This era additionally noticed modifications in shorter-term provide actions: the provision final lively for 1-3 months decreased from 1.16 million BTC to 895,347 BTC, a considerable drop of roughly 22.7%, reflecting a decline in short-term buying and selling actions.

These traits are indicative of a broader sentiment amongst Bitcoin holders. The rising percentages within the provide final moved classes, particularly over a 12 months, spotlight a powerful inclination in the direction of holding Bitcoin as a long-term funding or a retailer of worth. This habits suggests a maturing market the place traders are much less reactive to short-term value fluctuations and extra assured within the long-term prospects of Bitcoin.

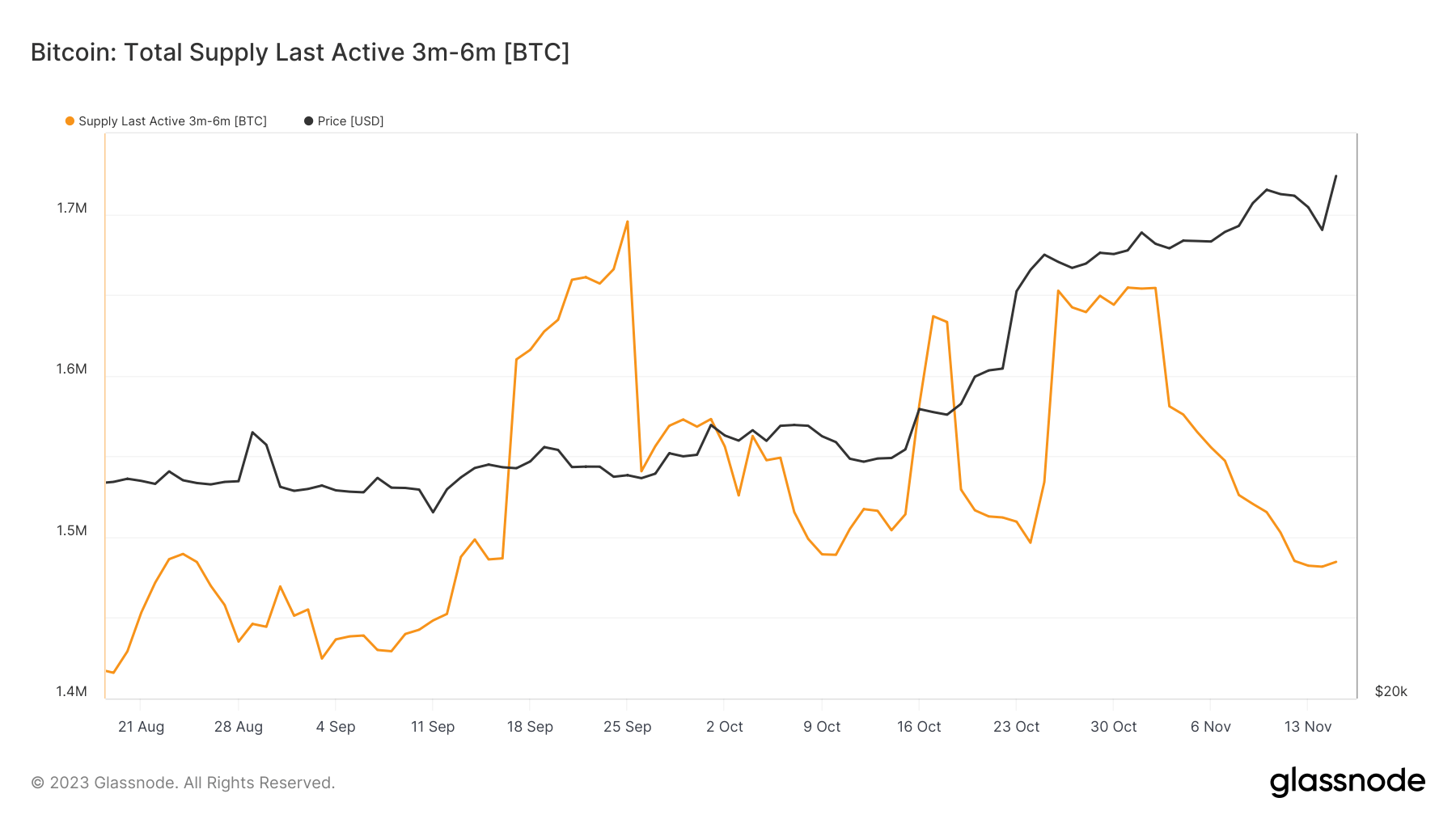

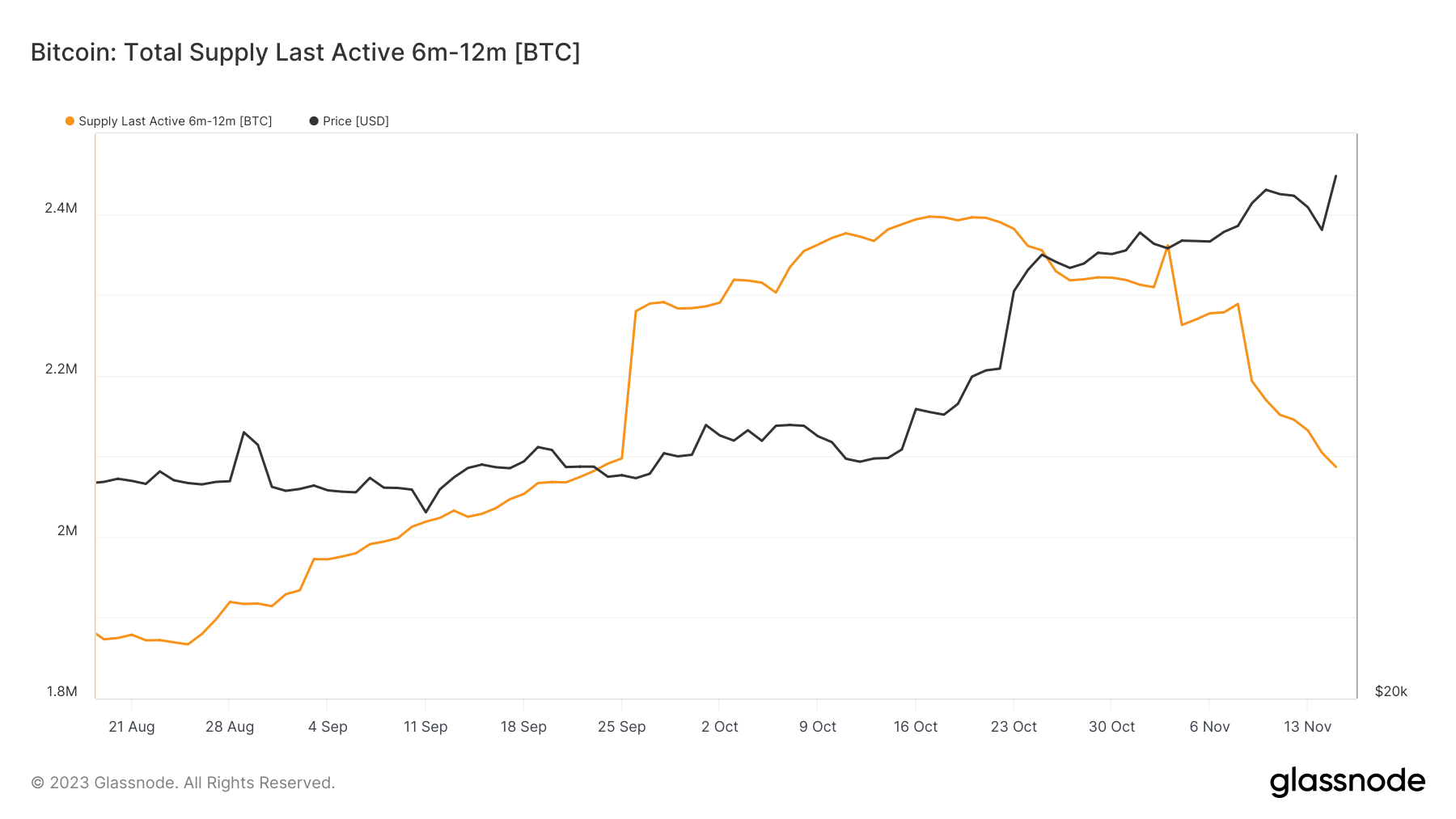

The provision final lively within the 3-6 and 6-12 months classes additionally confirmed intriguing actions. The three-6 months class noticed a rise adopted by a slight lower, whereas the 6-12 months class constantly decreased.

This fluctuation may point out a motion of Bitcoin from a comparatively dormant state (6-12 months) to a extra lively state (3-6 months), doubtlessly in response to market developments or value actions.

These provide dynamics are essential for understanding the liquidity and stability of the Bitcoin market. A good portion of Bitcoin being held for prolonged durations results in a lower within the circulating provide, which might contribute to cost will increase, particularly within the context of Bitcoin’s capped provide. Then again, low liquidity, marked by much less provide obtainable for commerce, can result in elevated value volatility.

The insights drawn from this evaluation should not simply reflective of present market circumstances but additionally predictive of potential future traits. For example, if a substantial portion of Bitcoin that has been held for over three years begins turning into lively, it would sign a possible promoting strain, probably resulting in a value lower. Furthermore, the response of those provide classes to exterior occasions can present helpful insights into how totally different investor segments understand and react to those developments.

The submit Analyzing Bitcoin’s provide traits as surge in long-term Bitcoin holdings factors to investor confidence appeared first on StarCrypto.