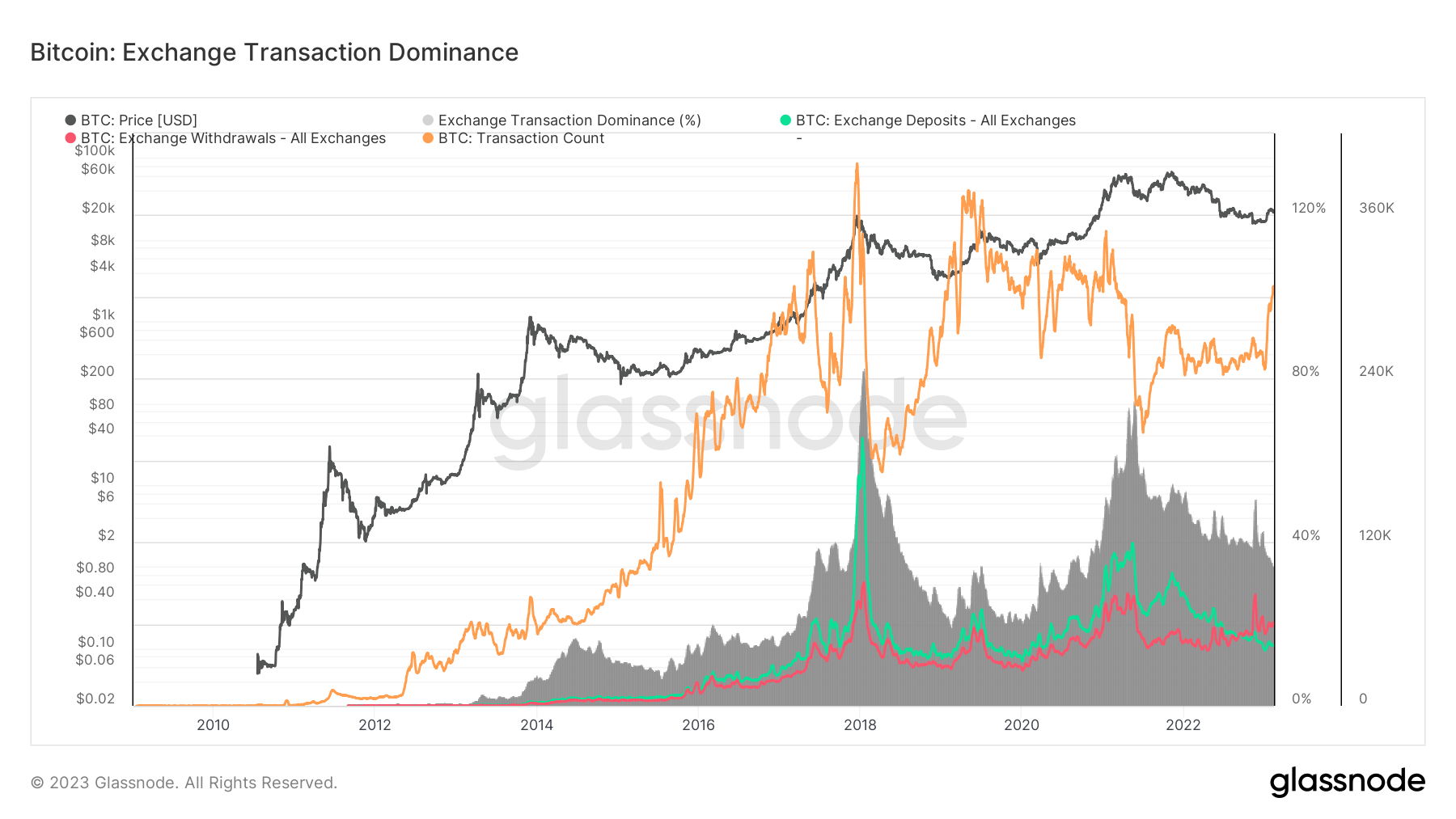

Change-related deposits and withdrawals of Bitcoin are sometimes good indicators of market sentiment.

When the variety of alternate deposits grows, the liquid provide of Bitcoin grows and exhibits the market’s readiness to commerce. Conversely, when the variety of alternate withdrawals will increase, buyers appear much less involved in buying and selling and wish to maintain their BTC off exchanges.

Taking a look at these exchange-related transactions in opposition to the entire variety of Bitcoin transactions can present whether or not the market is gearing up for a bull run.

In February 2023, the entire variety of Bitcoin transactions surpassed 307,000, reaching a two-year excessive, information analyzed by StarCrypto exhibits,

Earlier transaction quantity peaks correlated with Bitcoin’s value rallies. The 400,000 transactions recorded in late 2017 helped gasoline the bull run that pushed Bitcoin to its all-time excessive of $20,000. Round 80% of all Bitcoin transactions on the time have been exchange-related, with the bulk being alternate deposits.

Subsequent jumps in transaction numbers adopted the identical sample — a rising variety of transactions fueled a bull run that entered right into a correction as soon as the transaction numbers peaked. Each alternate deposits and withdrawals noticed notable will increase, with deposits surpassing withdrawals.

The earlier transaction quantity excessive recorded in early 2021 repeated the sample. Nevertheless, Bitcoin’s value started rising even after the variety of transactions peaked, indicating that the bull run skilled all year long was fueled by derivatives.

Since 2014, the dominating pattern was for alternate deposits to outpace withdrawals. This pattern was damaged in September 2022, when withdrawals outpaced deposits – September 2022 noticed 53,000 BTC withdrawn, and 52,000 BTC deposited to exchanges.

This pattern has solely gotten stronger for the reason that collapse of FTX. In November, withdrawals reached 81,000 BTC as buyers raced to take their cash off centralized exchanges. On Feb. 11, 44,000 BTC was deposited onto exchanges, whereas 61,000 BTC left exchanges. The discrepancy between withdrawals and deposits exhibits that buyers are persevering with to take possession of the cash they acquired in the course of the bear run.

The reducing dominance of alternate transactions additional confirms this — lower than 35% of all Bitcoin transactions in February have been exchange-related.

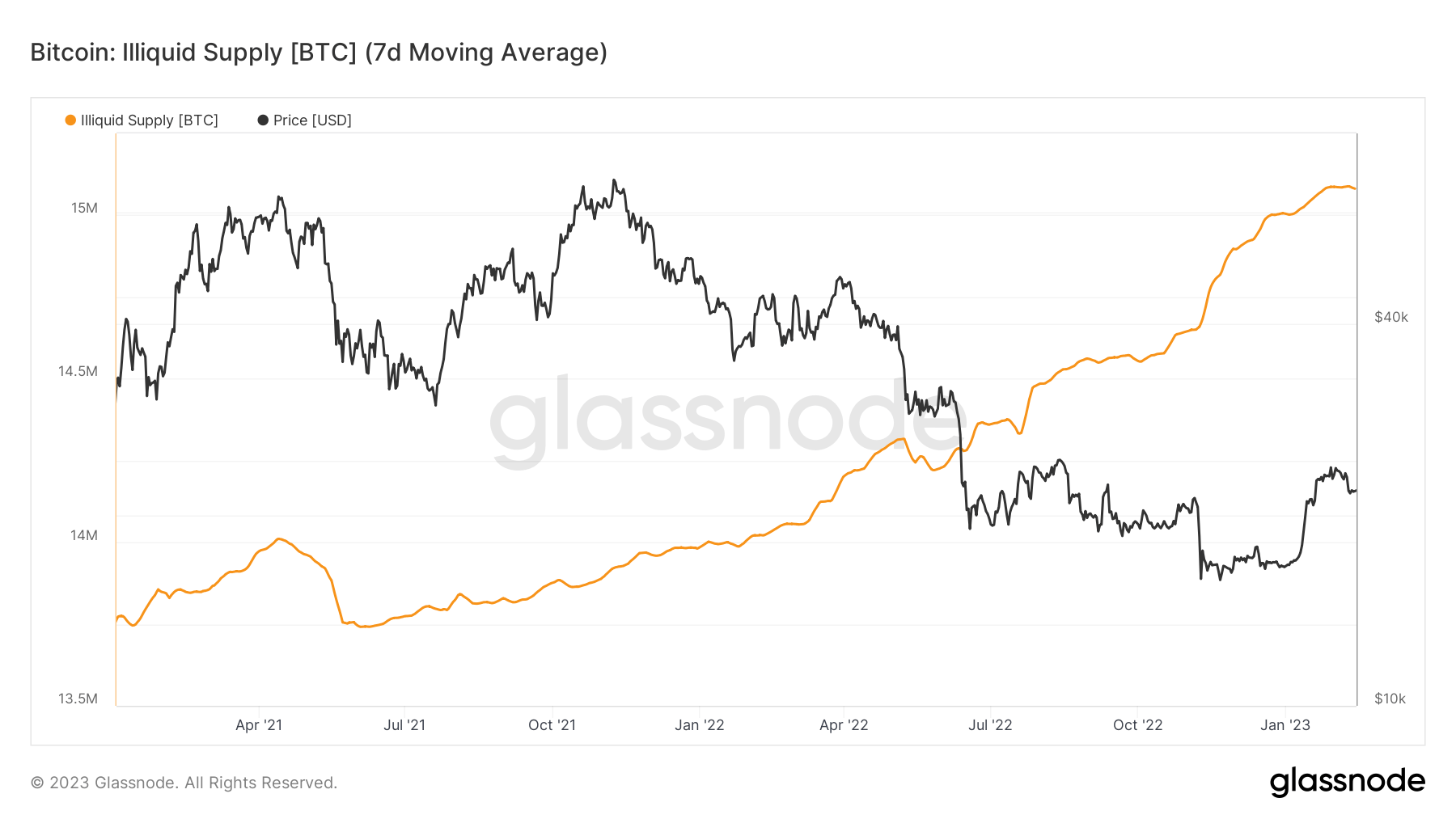

With numerous BTC now being taken off exchanges, Bitcoin’s illiquid provide has seen vital progress. Put merely, the liquidity of Bitcoin’s provide exhibits the variety of cash really out there for getting and promoting. A rising variety of illiquid Bitcoins (i.e., cash in chilly storage and dormant cash) is usually seen as a robust bullish sign because it exhibits robust investor holding sentiment.

Information analyzed by StarCrypto confirmed a sustained improve in Bitcoin’s illiquid provide that started in September 2021.