starcrypto analysts examined the gasoline utilization shares of various transaction classes on the Ethereum (ETH) community and located that the NFTs class accounted for 28% within the first month of the 12 months.

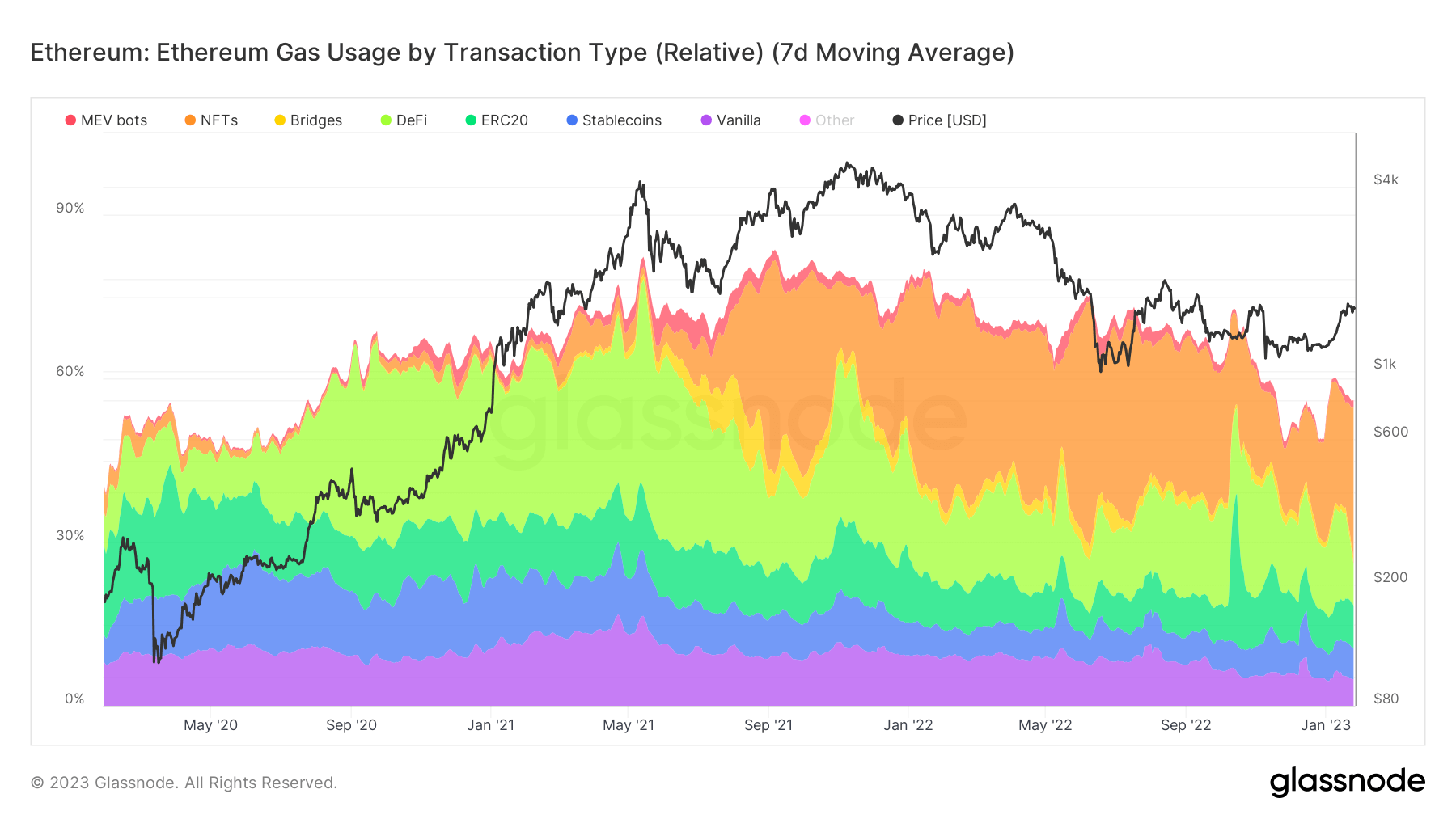

The evaluation divides all transactions on the ETH community into eight classes as Vanilla, ERC20, Stablecoins, DeFi, Bridges, NFTs, MEV Bots, and others.

The second, third, and fourth classes that occupied probably the most important gasoline utilization by share appeared as Defi, ERC20, and stablecoins, with 8% for Defi and ERC20 and 6% for stablecoins.

The classes

The vanilla class contains pure ETH transfers between Externally Owned Accounts (EOAs) issued with out calling any contracts. The ERC20 class counts all transactions that decision ERC20 contracts, excluding stablecoin transactions.

The stablecoins class represents all fungible tokens which have their worth pegged to an off-chain asset both by the issuer or by an algorithm. This class contains over 150 stablecoins, with Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI (DAI) being probably the most distinguished ones.

The Defi class covers all on-chain monetary devices and protocols carried out as good contracts. Decentralized exchanges (DEXs) additionally fall underneath this class. Greater than 90 Defi protocols are represented underneath this part, together with Uniswap (UNI), Etherdelta, 1 inch (1INCH), Sushiswap (SUSHI), and Aave (AAVE).

Bridges characterize all contracts that permit the switch of tokens between completely different blockchains and contains over 50 bridges corresponding to Ronin, Polygon (MATIC), Optimism (OP), and Arbitrum (ARBI).

All transactions interacting with non-fungible tokens fall underneath the NFTs class. This part contains each ERC721 and ERC1155 token contract requirements and NFT marketplaces for buying and selling them.

MEV bots, or Miner Extractable Worth bots, characterize bots that routinely execute transactions for revenue by reordering, inserting, and censoring transactions inside blocks.

All remaining ETH transactions are gathered underneath the Different class.

Gasoline utilization by class

The chart beneath represents the relative quantity of gasoline consumed by every class within the ETH community. The chat begins from January 2020 and represents the gasoline utilization share of every class with a special colour.

At first look, the NFTs, Defi, ERC20, Stablecoins, and Vanilla classes stand out as they’ve probably the most seen shares in whole gasoline charges.

At first look, the NFTs, Defi, ERC20, Stablecoins, and Vanilla classes stand out as they’ve probably the most seen shares in whole gasoline charges.In accordance with the information, the NFTs class at the moment accounts for 28% of the overall gasoline charges on the ETH community, which is represented with the orange zone. This class’s share was solely round 4% in early Could earlier than the pandemic began.

The Defi takes up the second largest share with 8%, represented by the sunshine inexperienced space. Each the NFTs and the Defi class recorded a rise in gasoline price shares for the reason that pandemic began. The ERC20 class accounts for 8% of the overall gasoline share. Represented by the darkish inexperienced space, the class’s share halved from 16% in October 2022.

Within the meantime, stablecoins’ proportion remained flat, round 5-6%, as could be seen from the darkish blue zone as nicely. Lastly, the vanilla class continued to account for round 5% of whole gasoline charges.

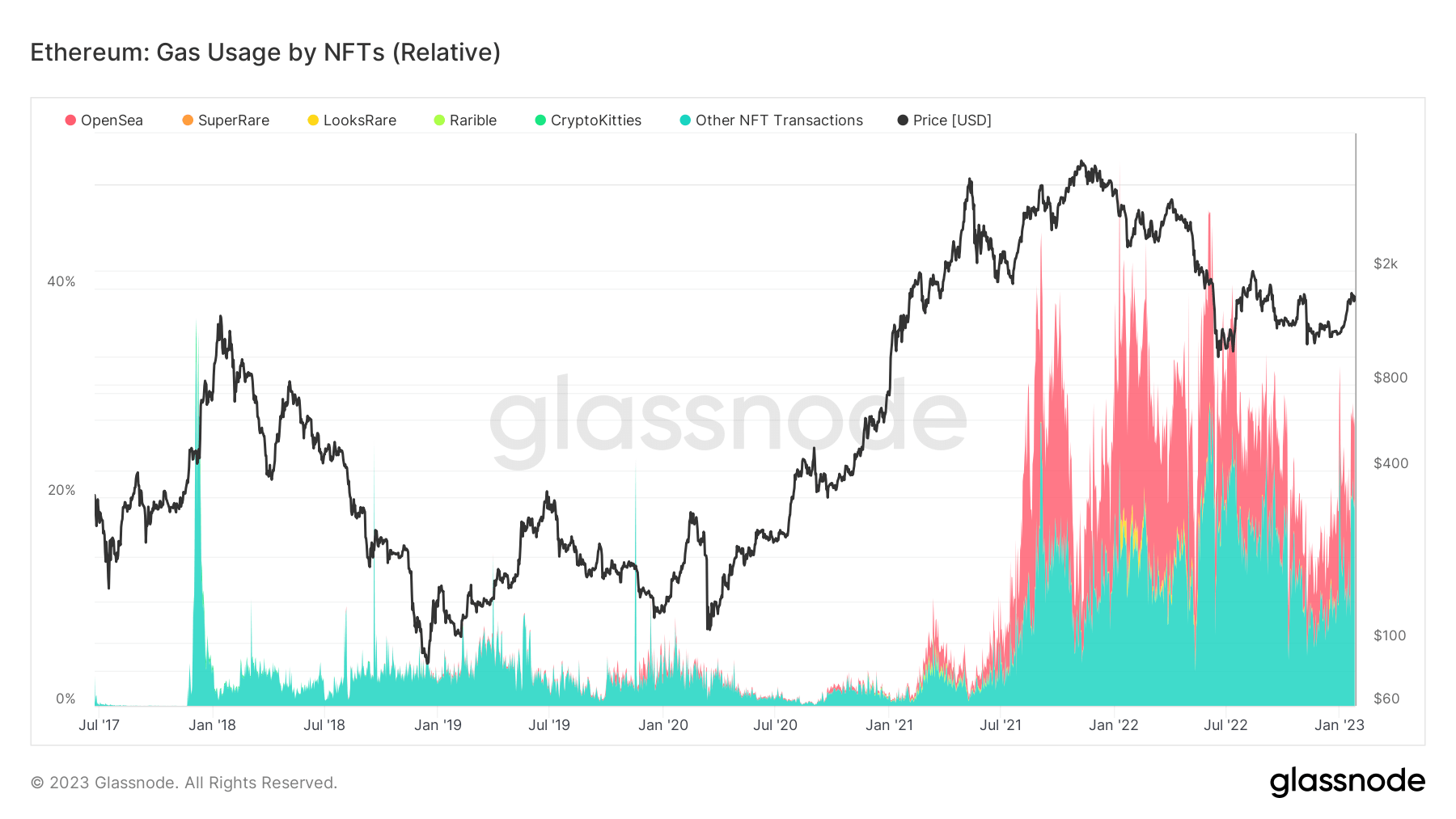

Gasoline utilization by NFTs

Wanting on the gasoline utilization of the NFTs class intimately, OpenSea seems as dominant. The chart beneath represents the NFT marketplaces’ share in gasoline utilization for the reason that starting of 2018.

OpenSea appeared in early 2020 and considerably elevated its share in gasoline utilization after mid-2021. It stays the dominant NFT market that occupies sufficient gasoline utilization to depart a mark on the general chart, apart from a brief interval in January 2022, the place LooksRare accounted for sufficient gasoline utilization to look briefly subsequent to OpenSea.

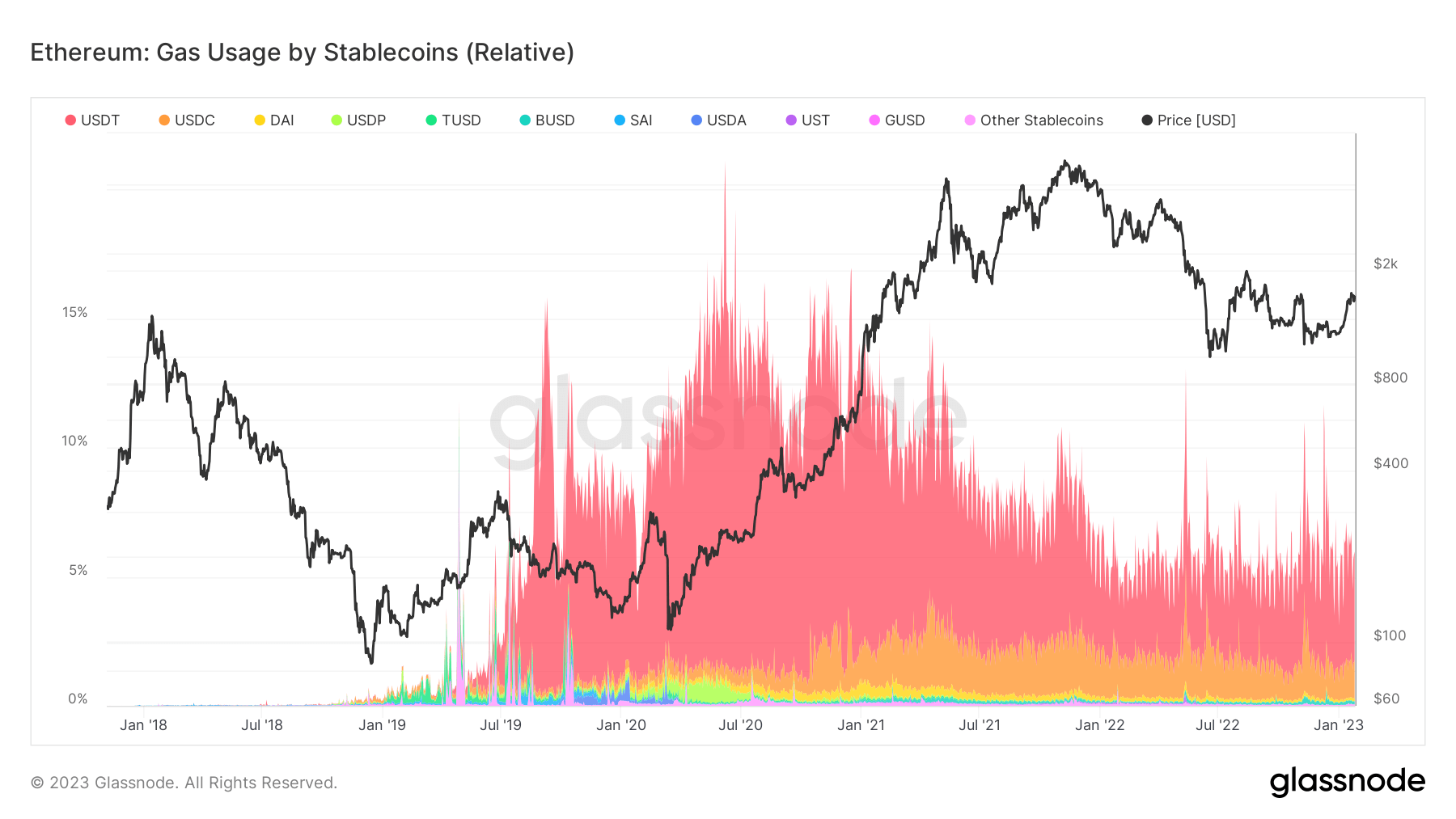

Gasoline utilization by stablecoins

The breakdown of the gasoline utilization share of stablecoins additionally emphasizes USDT’s dominance. The chart beneath represents main stablecoins’ gasoline utilization shares from the start of 2018.

Although USDT stays the dominant stablecoin, its share nonetheless recorded a major lower from 11% to 4%. However, USDC turned seen on the chart in early 2020 and has been rising its share in gasoline utilization slowly however steadily since then.