Shanghai is the subsequent main Ethereum improve, scheduled to go dwell on April 12.

As soon as carried out, ETH staked on the staking contract might be unlocked and withdrawable – thus finalizing the method that started with the Beacon Chain launch in December 2020.

The implication of the Shanghai improve is topic to a lot hypothesis. Some anticipate the spot value to tank as holders liquidate. Others consider shifting into and out of the staking contract simply will appeal to extra stakers, main to cost stability.

Glassnode information analyzed by starcrypto urged Ethereum derivatives merchants are cautious going into the Shanghai improve. Nonetheless, post-Shanghai, sentiment relaxes.

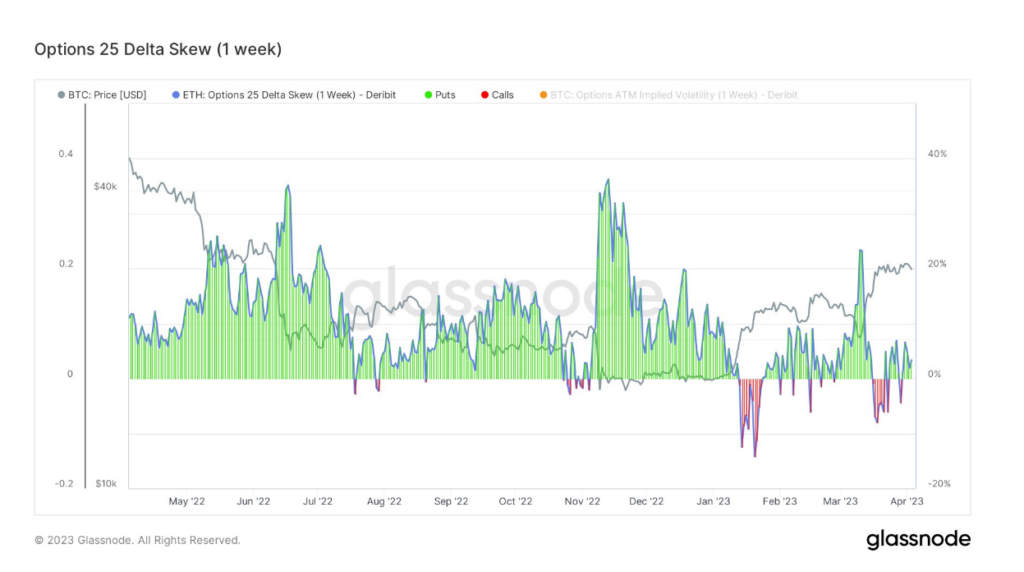

Ethereum – Choices 25 Delta Skew

The Choices 25 Delta Skew metric appears on the ratio of put-to-call choices expressed when it comes to Implied Volatility (IV).

A name possibility provides the holder the precise to purchase an asset, and a put possibility provides the holder the precise to promote an asset.

For choices with a particular expiration date, this metric appears at places with a delta of -25% and calls with a delta of +25%, netted off to reach at a knowledge level – giving a measure of the choice’s value sensitivity considering the change in Ethereum spot value.

Sometimes, this metric might be organized by durations at which the choice contract expires, equivalent to one week, one month, three months, and 6 months.

The chart under pertains to choices expiring in per week (close to time period); it exhibits places at the moment are at a premium, suggesting the market is cautious because the Shanghai rollout nears.

The 1-month 25 Delta Skew is considerably evenly poised between places and calls, pointing to a settling of sentiment post-Shanghai.

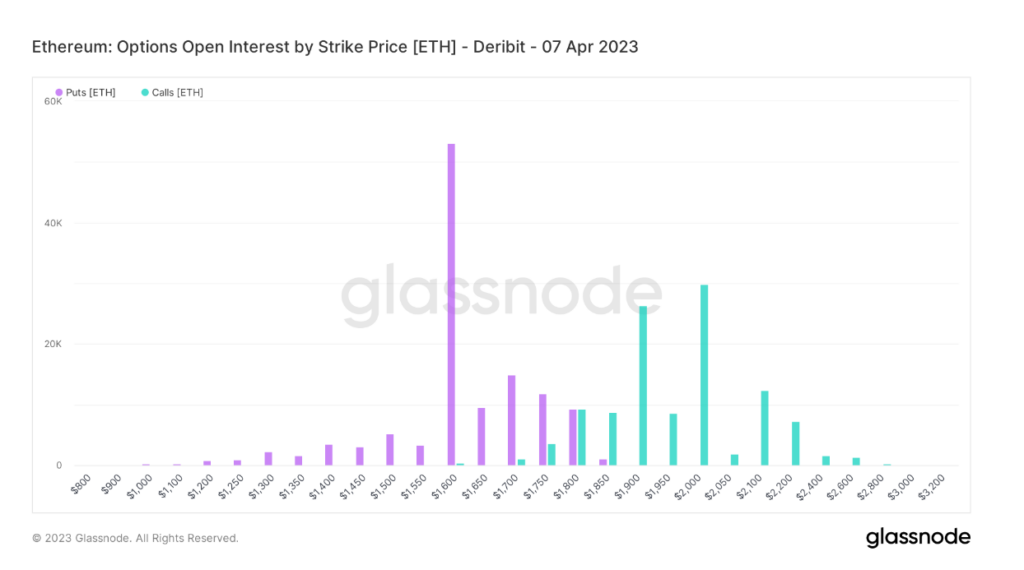

Open Curiosity

Open Curiosity by Strike Value refers back to the complete variety of excellent derivatives contracts but to settle, organized by the exercised put or name value.

This metric is used to gauge the final market sentiment, significantly the energy behind put or name value developments.

The chart under for April 7 exhibits places dominating, with the $1,600 strike value far within the lead at over 50,000 contracts.

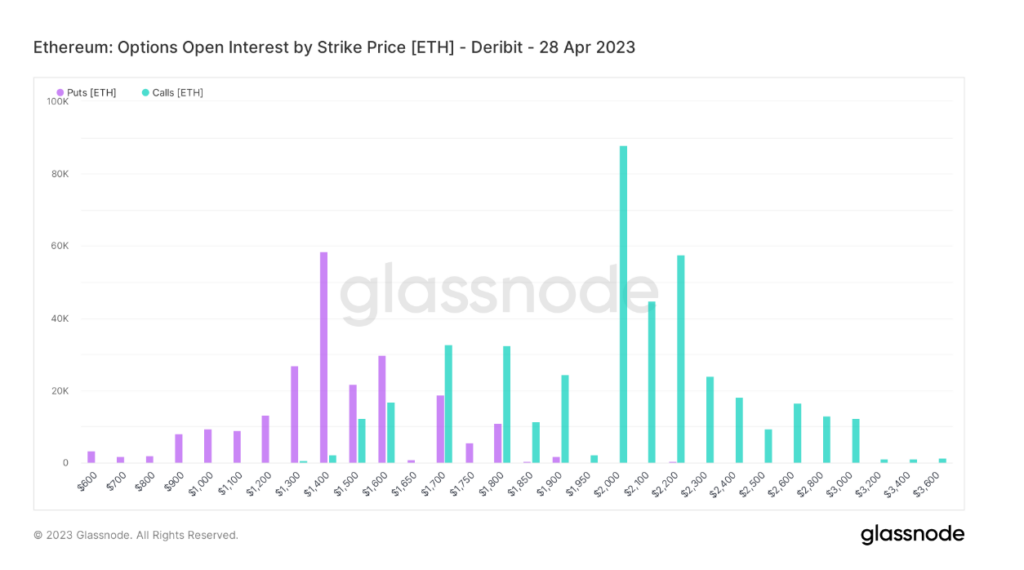

Wanting past Shanghai’s go-live date, in the direction of the tip of April, the frequency of places versus calls has evened up in comparison with April 7. Nonetheless, sentiment swings the opposite manner, with calls at $2,000 being essentially the most frequent alternative at round 90,000 contracts.

As such, shifting into subsequent month, merchants are signaling a extra optimistic outlook.

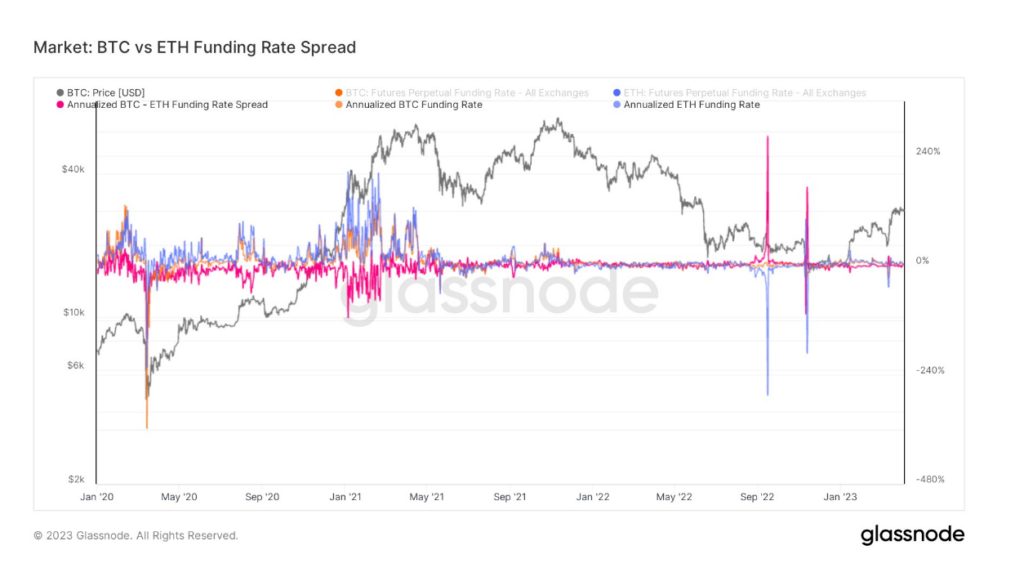

Funding Charge Unfold

The Funding Charge refers to periodic funds made to or by derivatives merchants, each lengthy and brief, based mostly on the distinction between perpetual contract markets and the spot value.

When the funding fee is constructive, the value of the perpetual contract is increased than the marked value. In such instances, lengthy merchants pay for brief positions. Against this, a adverse funding fee exhibits perpetual contracts are priced under the marked value, and brief merchants pay for longs.

This mechanism ensures futures contract costs fall consistent with the underlying spot value.

On this case, the unfold refers back to the distinction within the annualized BTC and ETH Funding Charges.

Throughout the Merge in September 2022, the annualized ETH Funding Charge sunk as little as -282% – indicating brief merchants had been overwhelmingly bearish and keen to pay for longs.

Quick ahead to now, the magnitude of strikes has lessened to a major extent in comparison with final September. Yesterday, ETH merchants posted a barely constructive Funding Charge at 0.14% – suggesting mildly bullish sentiment. In comparison with the BTC Funding Charge of two.8%, this means a considerably extra pessimistic view than Bitcoin merchants.

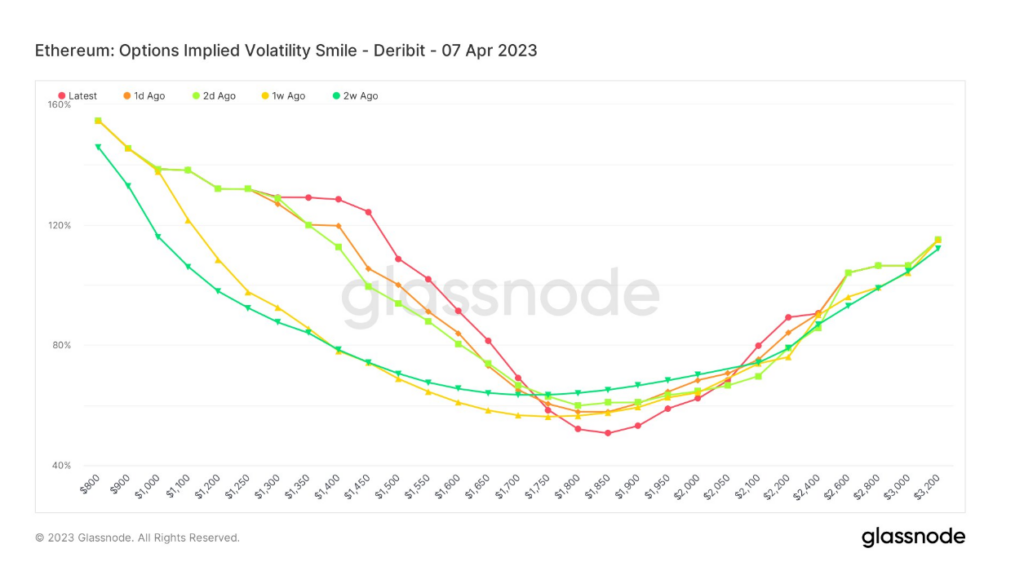

Implied Volatility Smile

The Volatility Smile outcomes from plotting the Strike Value and Implied Volatility (IV) of choices with the identical underlying asset and expiration date.

IV rises when the underlying asset of an possibility is additional out-of-the-money (OTM), or in-the-money (ITM), in comparison with at-the-money (ATM).

Choices additional OTM usually point out increased IVs, giving Volatility Smile charts their distinctive “smile” form. The steepness and form of the smile can be utilized to evaluate the relative expensiveness of choices and gauge what sort of tail dangers the market has priced in.

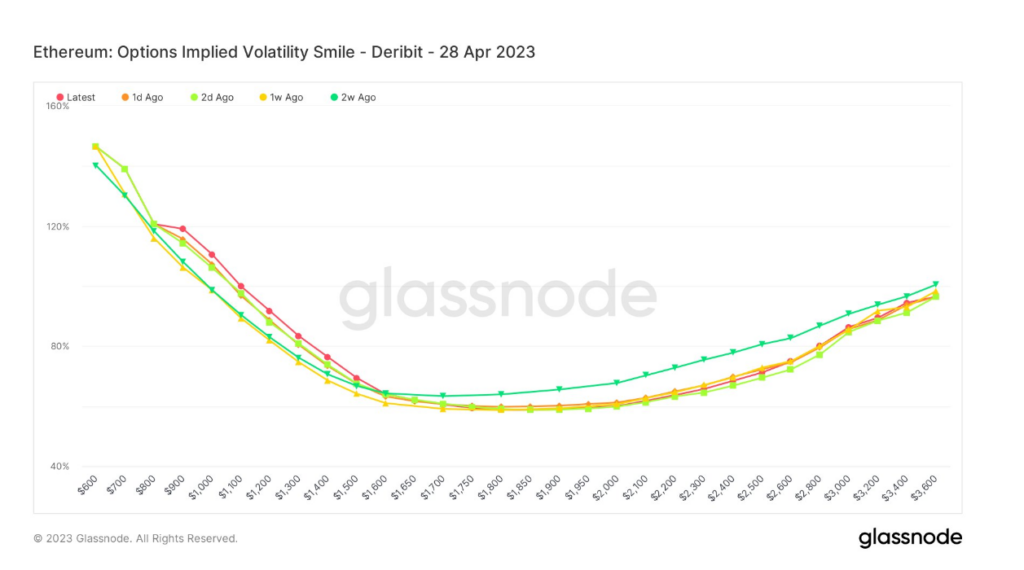

Evaluating the “Newest” smile to historic overlays from at some point, two days, one week, and two weeks in the past, it’s doable to find out the diploma of implied volatility on both facet of ATM.

The chart under exhibits markets are paying a premium for draw back safety earlier than the Shanghai improve. IV is nicely above 100%.

Submit-upgrade, markets proceed paying a premium for draw back safety. However the patterns have smoothed out considerably, exhibiting a slight decline on the precise tail, with a comparatively flat form and sub 100% IV throughout the precise facet curve.

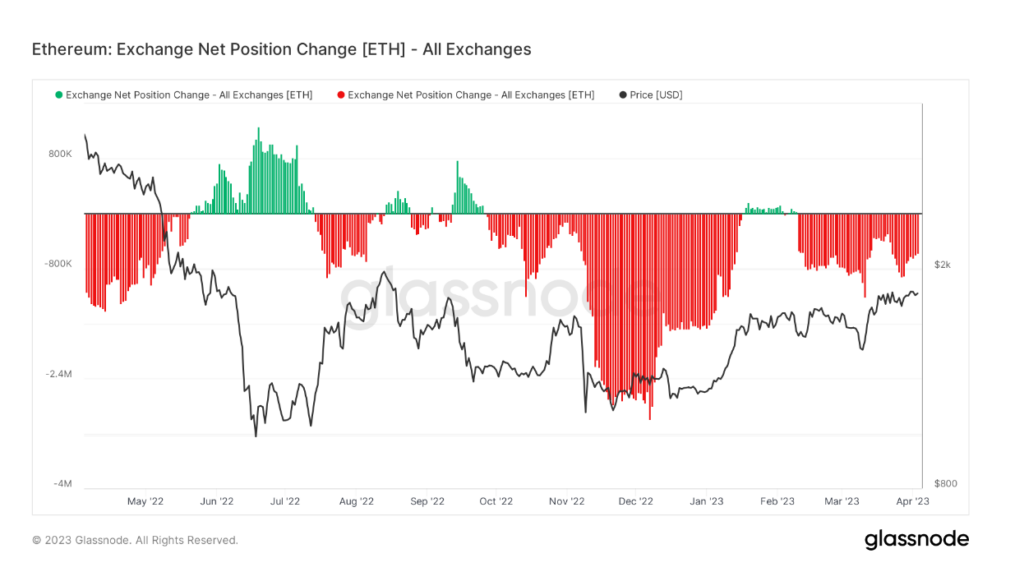

Spot demand

Change Internet Place Change (ENPC) measures the cash deposited or withdrawn from change wallets.

Inflows or constructive change is usually thought of bearish, as the first cause to switch to an change is to promote. Whereas outflows, or adverse change, is often considered bullish, the primary cause to withdraw pertains to pockets storage – thus hodling.

Since mid-February, ETH’s ENPC has flipped adverse, suggesting sturdy spot demand within the run-up to Shanghai.

The submit Analysis: Ethereum derivatives merchants sign warning forward of Shanghai improve appeared first on starcrypto.