Glassnode knowledge analyzed by StarCrypto analysts means that rising Bitcoin (BTC) value additionally will increase miner profitability and income, which have been historic pointers for market bottoms.

StarCrypto regarded into the Problem Regression Mannequin and Miner Income vs. Yearly Common comparability metrics to guage miners’ profitability. Whereas each metrics agree that issues are going swimmingly for BTC miners, the ASIC Rig profitability metric revealed that the hash price reached a brand new all-time excessive.

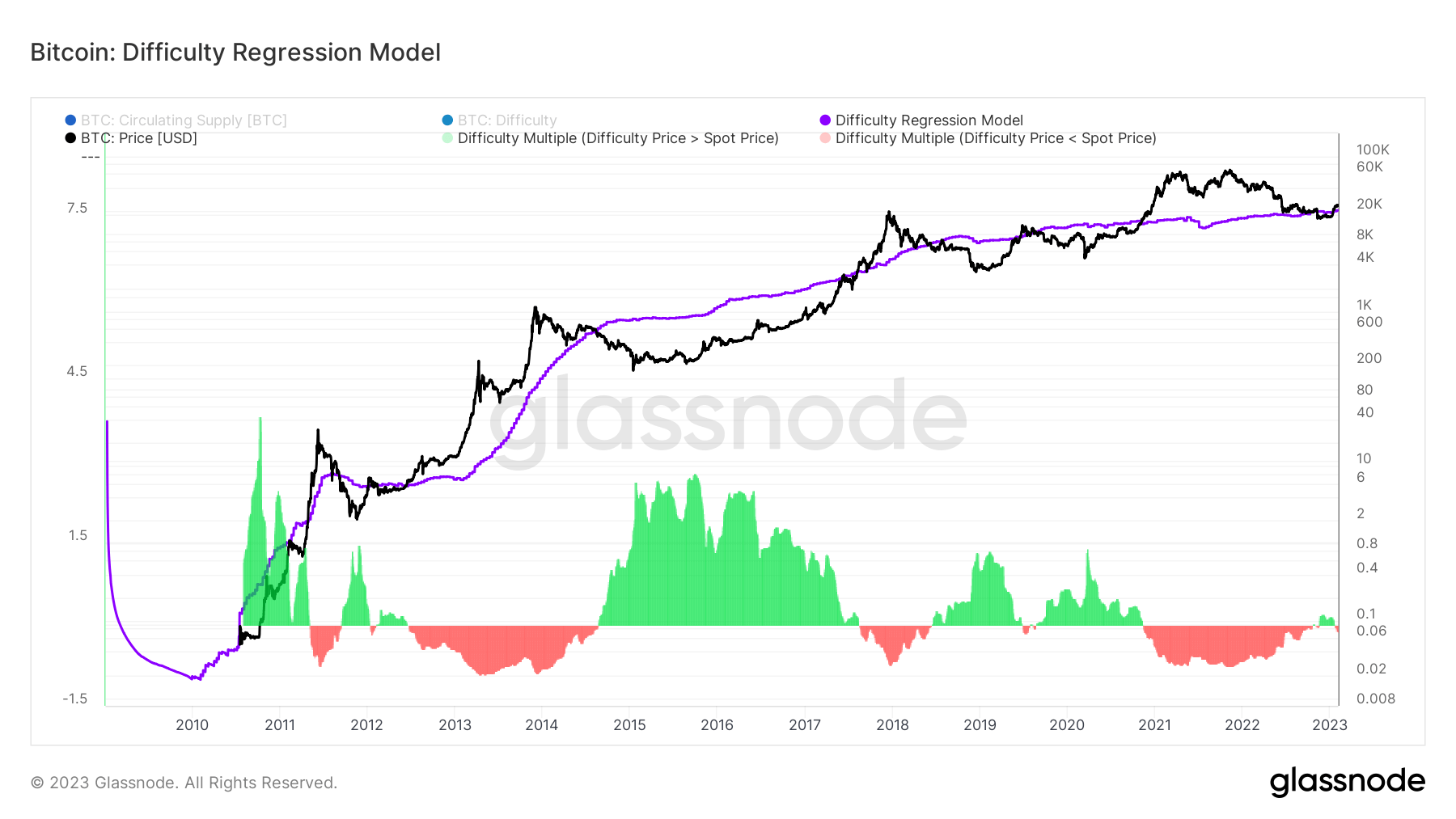

Problem Regression Mannequin

The Problem Regression Mannequin is used to make sense of the all-in-sustaining price of manufacturing one BTC. It takes mining problem as the final word distillation of the price of mining, accounting for all of the mining variables in a single quantity. Due to this fact, the calculated worth displays an estimated common manufacturing price for mining one BTC.

The chart under reveals the Problem Regression Mannequin for BTC since 2010 with the purple line and the value of BTC with the black line. BTC mining turns into worthwhile when the purple line signifies a price decrease than the BTC value, which is illustrated within the purple areas under. Equally, if the purple line exceeds the black one, it signifies that BTC mining will not be worthwhile, which creates the inexperienced zones on the chart.

At present, the information reveals that the all-in-sustaining price of manufacturing one BTC is $20,000. This can be a barely decrease worth than the present BTC value, which lingers round $23,554 on the time of writing.

Along with mining profitability, the chart demonstrates the historic relationship between the all-in-sustaining price of manufacturing one BTC and the market bottoms. Since 2010, the all-in-sustaining price of manufacturing one BTC marked a decrease worth than the BTC value on 5 completely different events in 2011, 2012, 2018, 2019, and 2021, all of which had been adopted by a rise within the BTC’s worth. Traditionally, it may be mentioned that this example may sign a market backside.

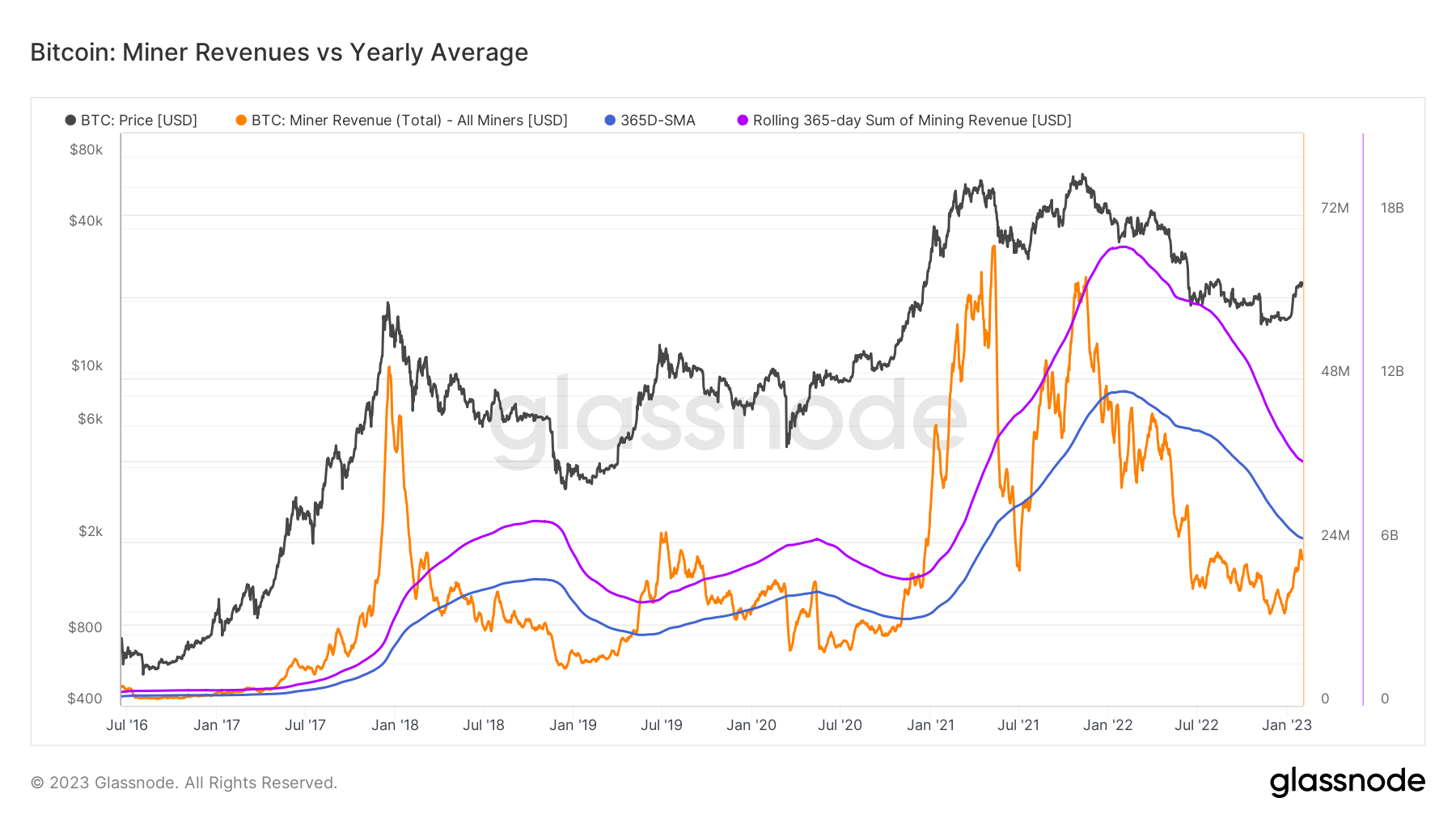

Miner Income vs. Yearly Common

The Miner Income vs. Yearly Common comparability is utilized by analysts who need to measure every day volatility in opposition to a longer-term pattern. This metric takes the full every day income generated by BTC miners in U.S. {dollars} and compares it to the 365-day easy transferring common.

The chart under begins from mid-2016 and represents the full income paid to miners and the 365-day easy transferring common with the orange and blue strains, respectively.

The aggregated income generated by miners has been under the 365-day easy transferring common stage for the reason that starting of 2022. In line with the chart, the full income generated by miners is at present round $22.5 million, whereas the 365-day easy transferring common is roughly $24.6 million.

This relationship additionally signifies market bottoms. A BTC value surge was recorded at any time when the combination income created by miners exceeded the 365-day easy transferring common. The info additionally reveals that the miners’ revenue has been growing for the reason that starting of 2023. If the rise continues, the combination income may break by way of the 365-day easy transferring common resistance, greenlighting a market surge.

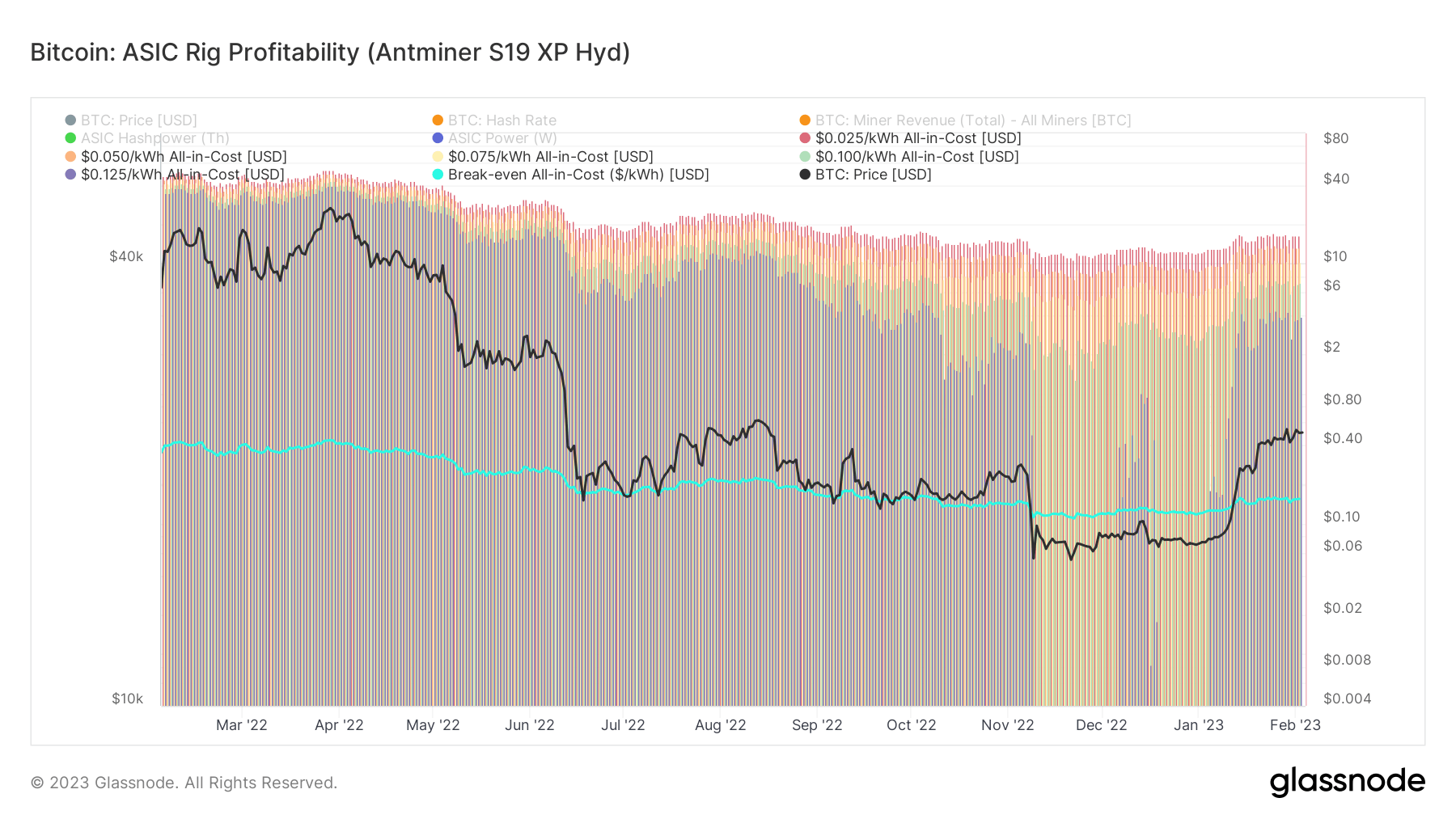

ASIC Rig Profitability

This metric estimates a U.S. Greenback worth for the denominated every day revenue earned by an Antminer S19 XP Hyd ASIC rig below numerous all-in-sustaining-cost AISC assumptions.

The Antminer S19 XP Hyd ASIC rig was launched in October 2022 and might attain 255 Th/h hash price, consuming 5304 watts.

The chart under reveals the ASIC Rig Profitability for BTC for the reason that starting of 2022 with the turquoise line. The road signifies profitability if it marks a degree decrease than the BTC value.

In line with the chart, the Antminer S19s have change into worthwhile initially of 2023. The all-in-sustaining price sits at roughly $0.15. This prompted miners to show again on the Antminer S19s rigs, which elevated the hash price to the purpose of a brand new all-time excessive.

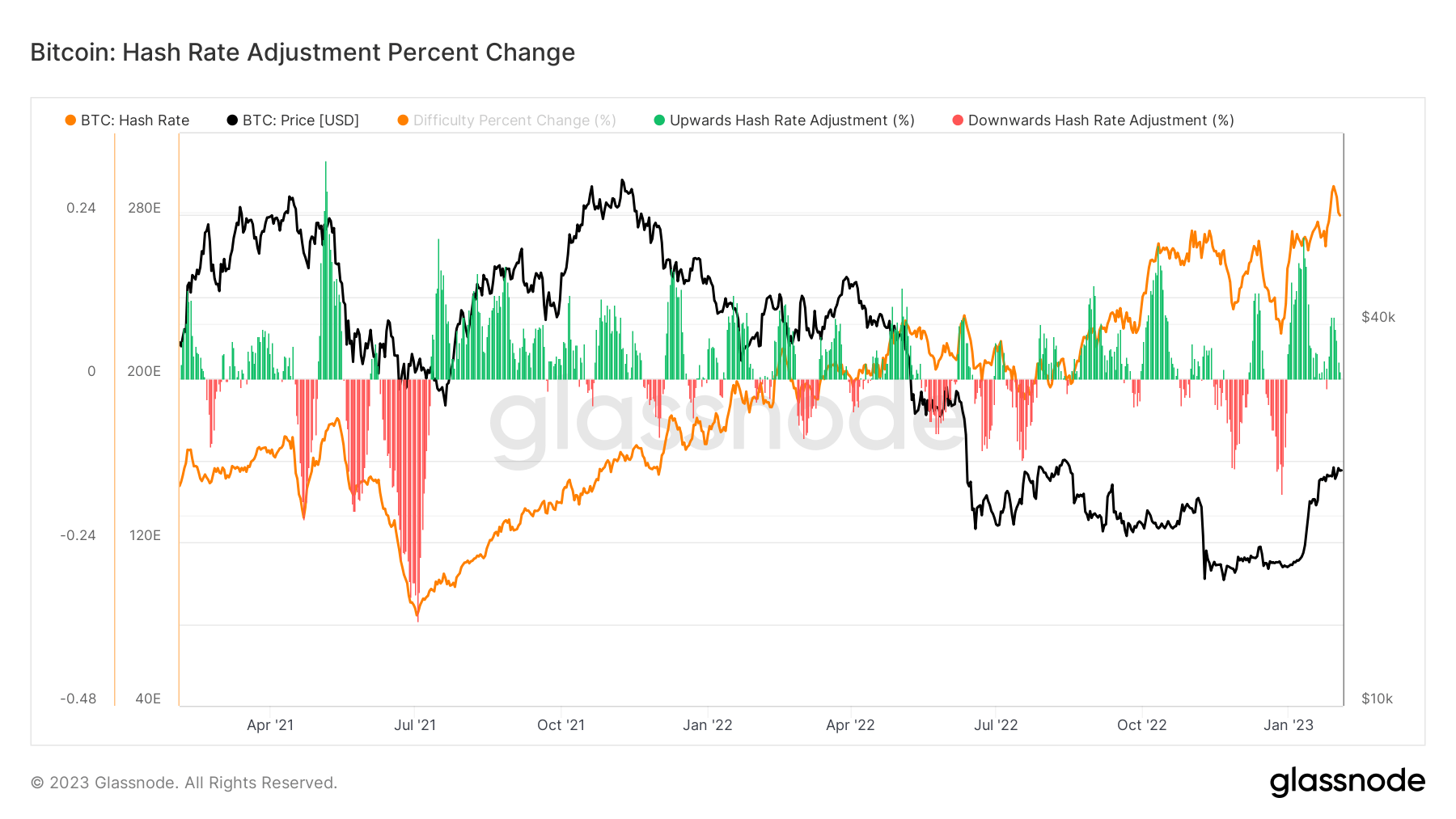

The chart above represents the BTC hash price with the orange line for the reason that starting of 2021. The hash price has been rising exponentially for the reason that starting of 2023, which has additionally been strengthening community safety.