Information analyzed by StarCrypto suggests the robust correlation between Bitcoin and gold might mark the beginning of a value run-up, relying on whether or not the Fed’s mountain climbing schedule is completed by March.

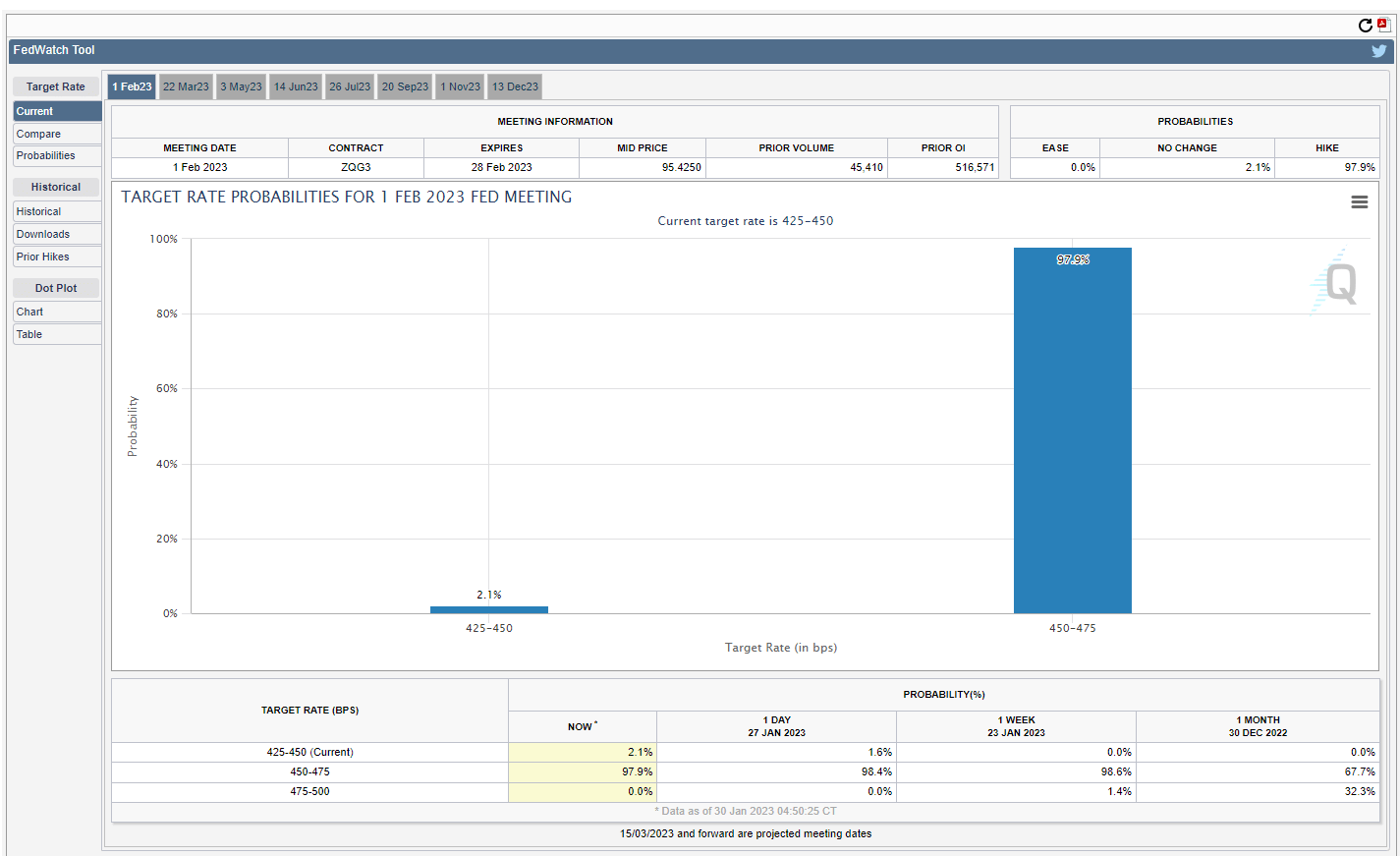

The Federal Open Market Committee (FOMC) assembly is about to conclude on Feb. 1, with the market overwhelmingly anticipating a 25 foundation level hike, which is able to take the federal funds price to 4.5% – 4.75%.

The next FOMC assembly is scheduled to conclude on March 22, with analysts majority betting on one other 25 bps hike. From there, it’s anticipated the Fed will maintain charges marking the highest of the mountain climbing schedule.

Bitcoin and FOMC conferences

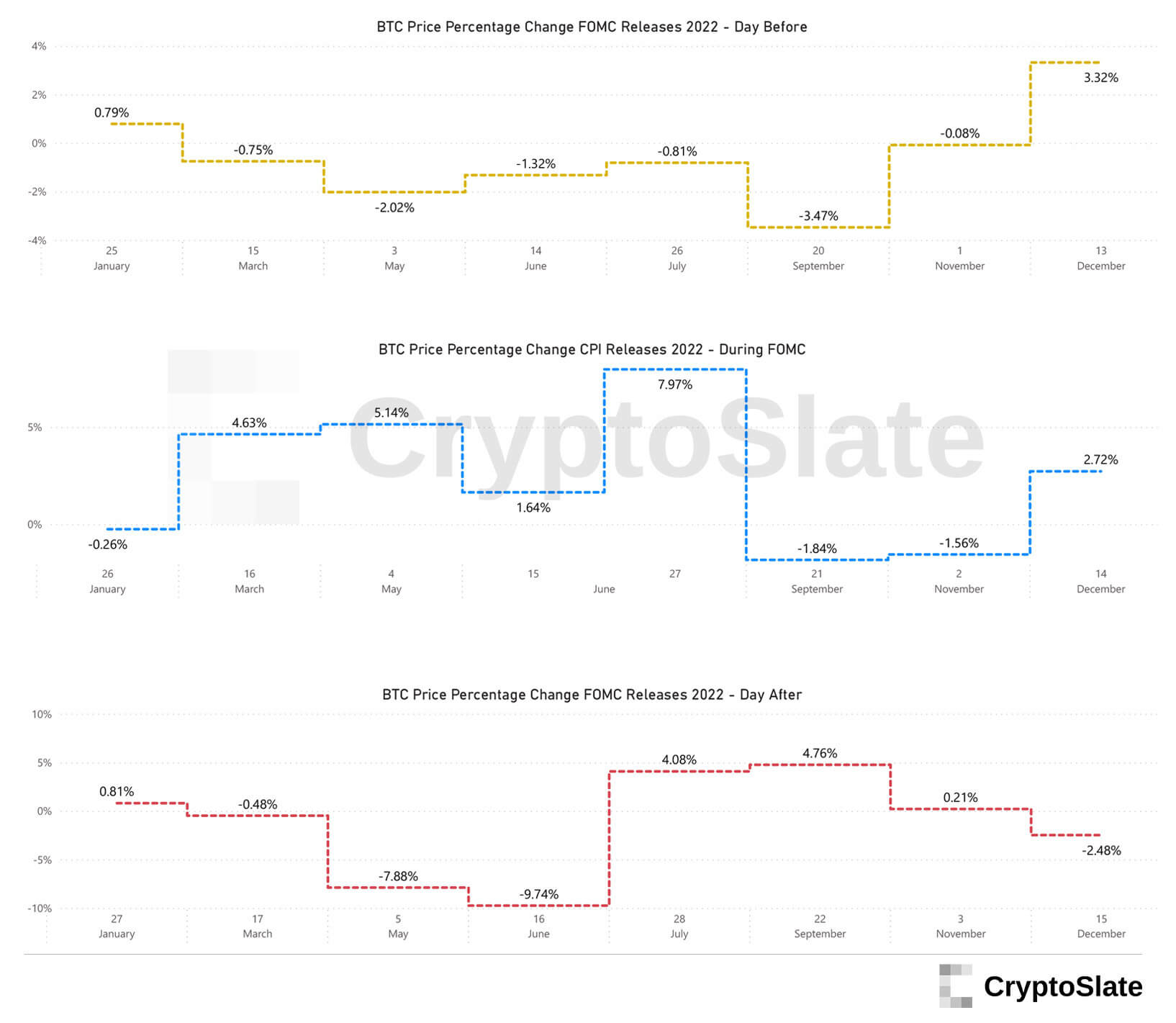

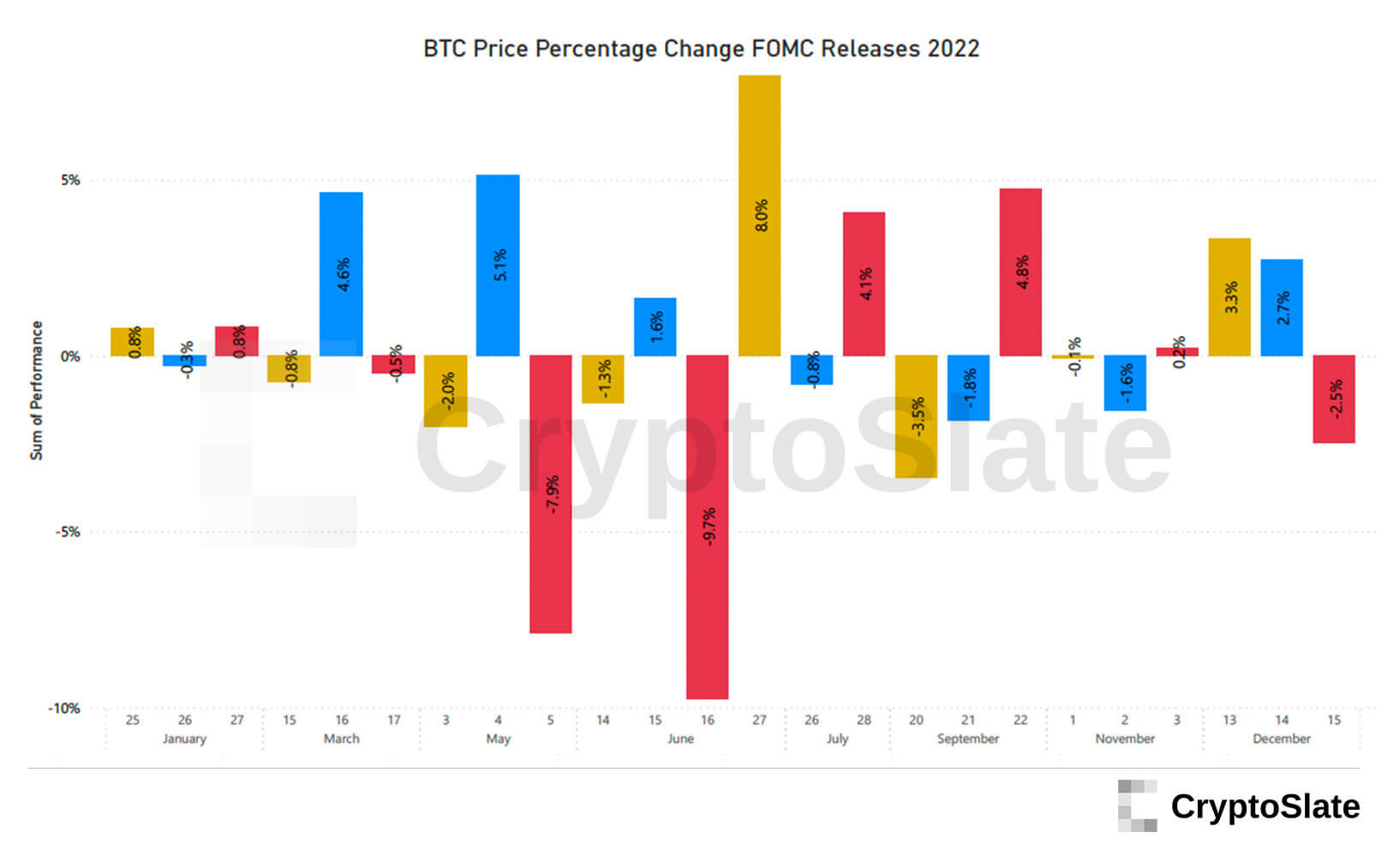

Inspecting the Bitcoin value proportion change for every 2022 FOMC assembly the day earlier than the occasion, throughout, and after, 13 of the 24 situations resulted in a drawdown for the main cryptocurrency.

When the Fed first started elevating charges, a unfavorable Bitcoin efficiency could possibly be defined by promote strain ensuing from fearful markets. Nonetheless, over the yr, because the market accepted the inevitability of upper rates of interest, a much less unfavorable response is anticipated.

Of better significance than every day value actions is the long-term motion in relation to the Fed’s price schedule.

Robust BTC-gold correlation

Plotting the efficiency of the S&P and gold, since 1998, towards the federal funds price, it was famous the highest of the Fed’s mountain climbing schedule coincided with a bottoming within the gold value, as denoted by the black arrows on the chart.

In these circumstances, the worth of gold went on to maneuver considerably greater. For instance, in late 2005 because it went from $400/oz to $1,920/oz over a six and half yr interval.

Equally, pauses within the rate of interest schedule coincided with the S&P bottoming, proven by the purple arrows beneath, resulting in sustained strikes greater for tech shares.

Since February 2022, the worth of Bitcoin and gold has proven an 83% correlation – the very best price in over a yr.

If gold reacts because it did in previous situations of the Fed mountain climbing schedule topping out, and Bitcoin mimics gold, BTC could possibly be in for a big leap in value.

Nonetheless, there isn’t a certainty that March will mark the highest of the Fed’s price schedule. As well as, different macroeconomic and geopolitical elements are in play, as is the growing state of affairs at Genesis following its chapter submitting.