Futures open curiosity (OI) is the full variety of open futures contracts for an asset held by market members. Open curiosity on futures contracts for any given asset varies each day, representing the amount of money flowing into the market.

A rising OI implies that more cash is shifting into futures contracts, whereas a declining pattern reveals positions are being closed and cash is shifting out of the market. Throughout value actions, a rise in OI is usually used to verify the prevalent pattern available in the market — rising OI throughout a bear market reveals the pattern will proceed downwards. In distinction, a rise in OI throughout a bull run signifies upward motion.

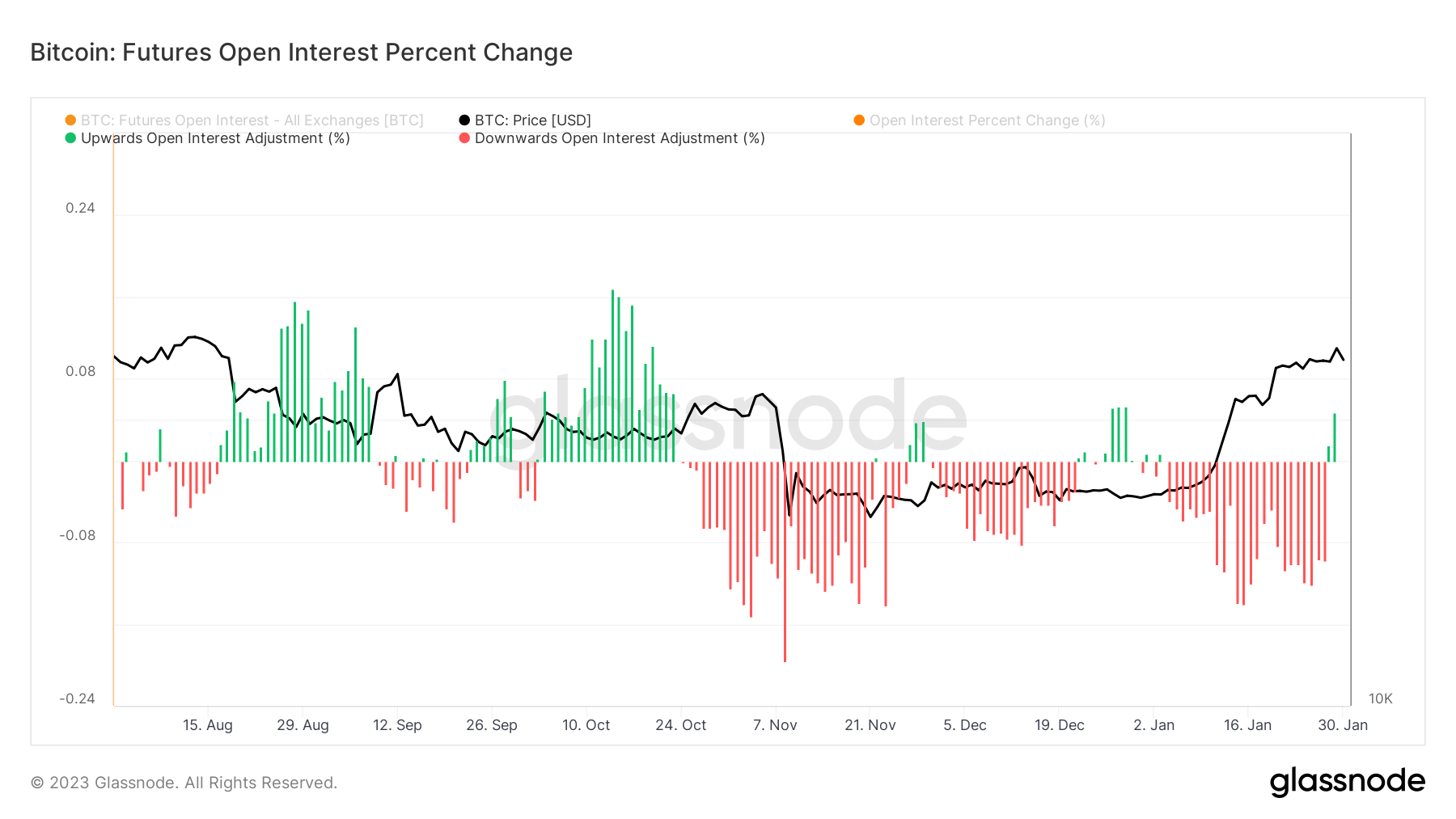

StarCrypto’s evaluation of the open curiosity for Bitcoin futures confirmed a notable improve in OI.

This improve reveals a big rebound within the futures market. The collapse of FTX induced a large lower in OI, wiping out 40% of open futures contracts since mid-November.

There may be at present round 433,000 BTC allotted into futures contracts — a pointy lower from the 666,000 BTC recorded in November. A drop of no less than 95,000 BTC might be attributed to the collapse of FTX.

The rebound in OI started in mid-January. Many of the progress might be attributed to elevated institutional curiosity in Bitcoin futures — StarCrypto evaluation confirmed that 20% of the full Bitcoin futures OI got here from CME. Largely inaccessible to retail buyers, Bitcoin futures on CME are a superb indicator of institutional curiosity within the crypto market.

On Jan. 30, Bitcoin futures OI noticed the largest improve for the reason that starting of the 12 months — rising 6% which factors to buyers gearing up for a big market motion.

This improve in OI is one issue contributing to the current uptick in Bitcoin’s value.

Traditionally, market volatility tends to extend earlier than and through the Federal Market Open Committee (FOMC) conferences. FOMC holds eight conferences yearly the place it assesses and implements adjustments to financial coverage within the U.S.

Rising rates of interest and rampant inflation have made FOMC conferences previously 12 months main market movers as buyers flip to derivatives in a bid to hedge the market.

For Bitcoin, FOMC conferences have been principally bearish occasions. Bitcoin tends to be extremely risky the day earlier than, throughout, and after the conferences. Nevertheless, the momentum tends to swing upwards within the days following the FOMC assembly as extra leverage will get added to the market.

Diving deeper into the futures market reveals that the continued market volatility has the potential to show into optimistic value motion following the FOMC assembly.

Market actions rely upon the distinction between lengthy and brief futures contracts. Market swings are typically optimistic when longs dominate OI, whereas OI dominated by shorts typically results in adverse value actions.

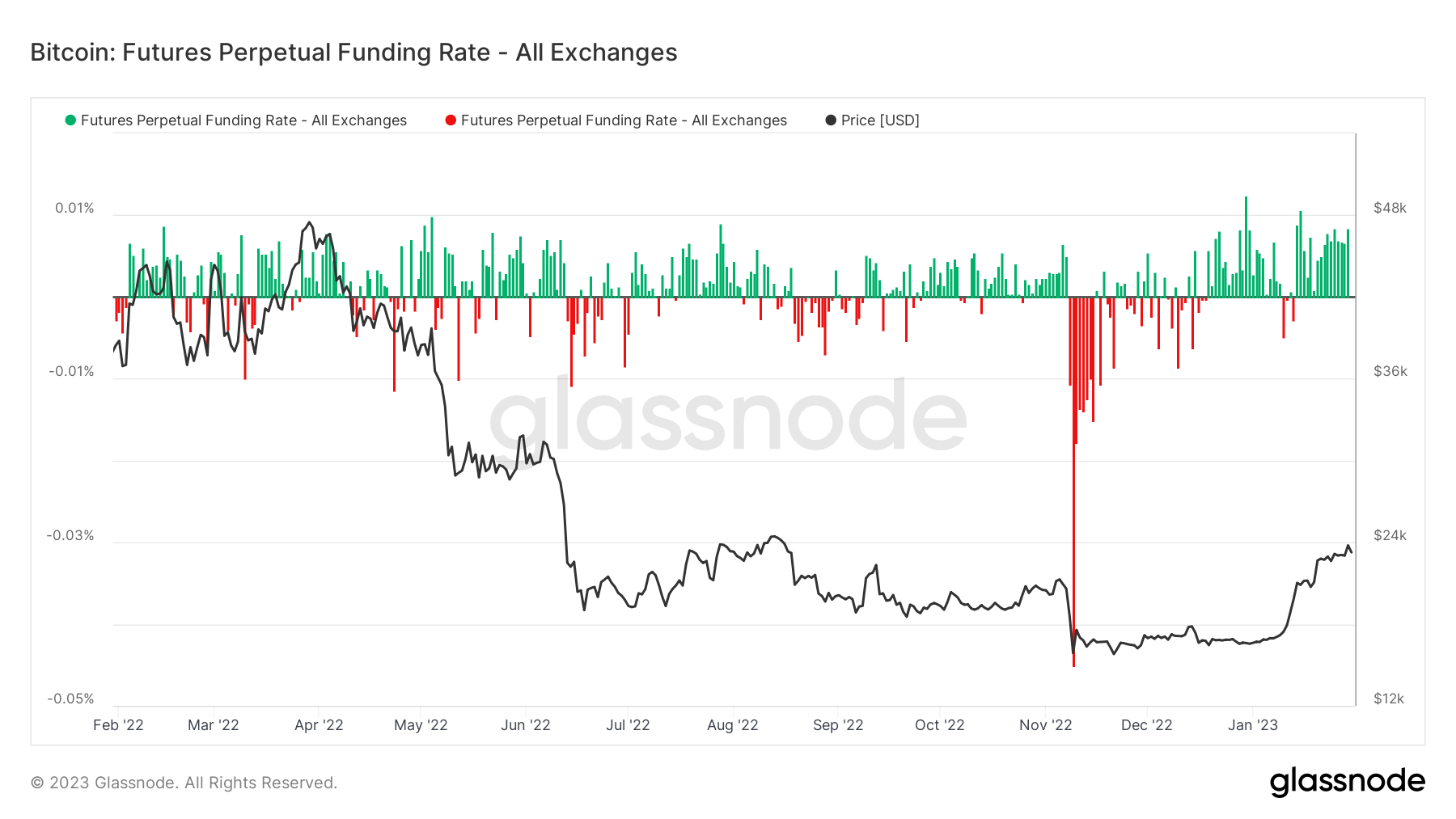

The perpetual funding fee is the typical funding fee set by exchanges for perpetual Bitcoin futures contracts. When the speed is optimistic, lengthy positions pay the funding fee to brief positions. A adverse fee implies that brief positions have to pay the speed to lengthy positions to maintain the worth of the contracts comparatively steady.

Information analyzed by StarCrypto confirmed a optimistic perpetual funding fee, with longs dictating the market. The rising optimistic perpetual funding fee follows a interval of aggressive shorting that peaked through the FTX collapse.

Aggressive shorting is usually a backside sign in a bear market, particularly when adopted by an general improve in OI. If this sample continues into the next weeks, it might imply that Bitcoin bottomed at round $15,500 following the FTX collapse and will proceed its upward trajectory properly into the primary quarter.