Bitcoin (BTC) has been locked in a good buying and selling vary, fluctuating between $30,000 and $31,000. Whereas some on-chain metrics present that this ongoing sideways motion has been noticed earlier than Bitcoin’s earlier bull runs, there may be little to point {that a} important shift might occur quickly.

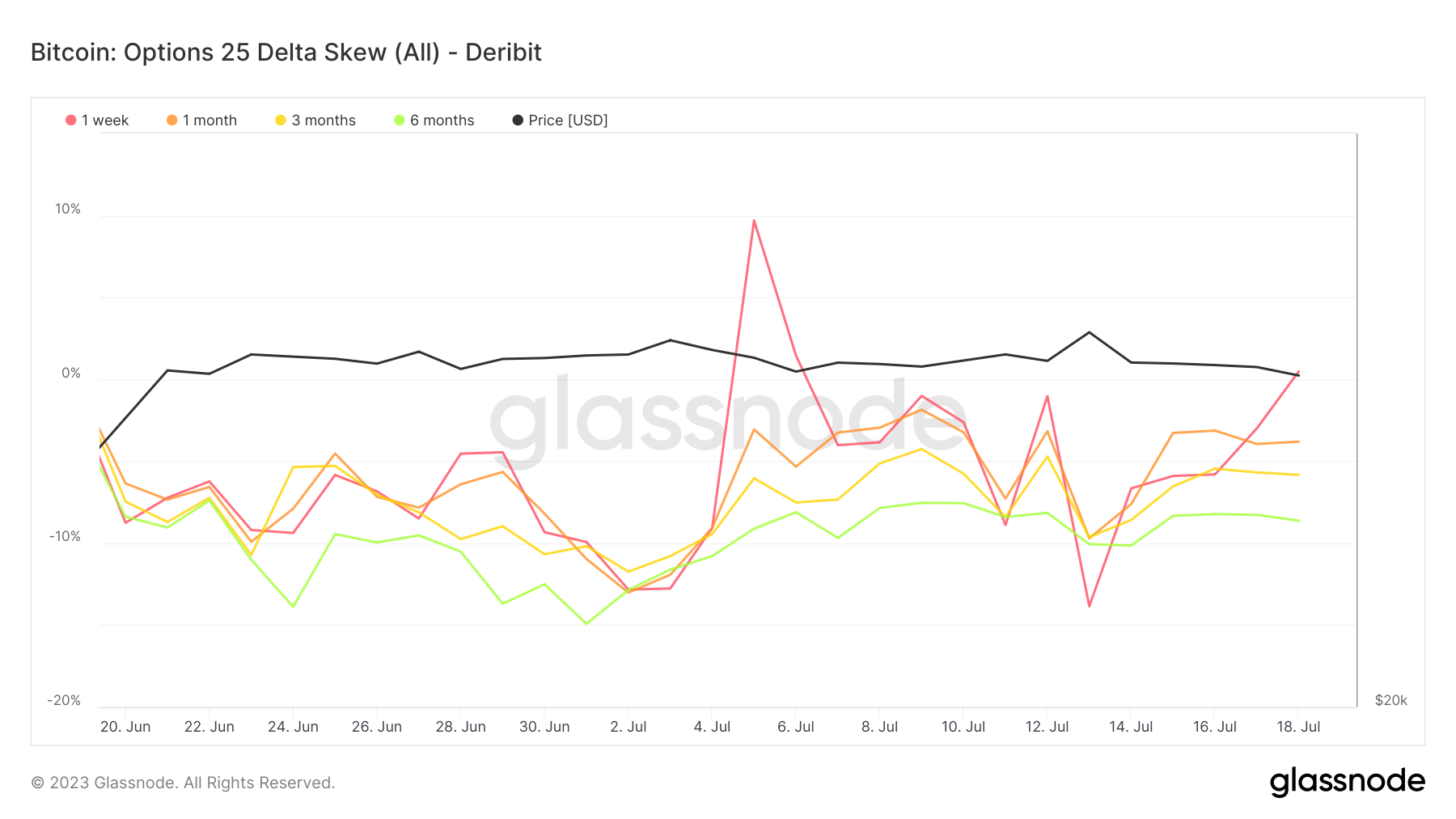

The derivatives market, notably the choices market, reveals a divided sentiment about Bitcoin’s efficiency. This division is obvious when analyzing Bitcoin choices delta skew. The delta skew for choices contracts expiring one week, one month, three months, and 6 months from now could be 0.48%, -3.8%, -5.83%, and -8.62%, respectively.

Delta skew, also referred to as the “skew” or “danger reversal,” is a measure of market sentiment usually used within the choices market. It measures the distinction in implied volatility between out-of-the-money (OTM) places and OTM calls.

If the market is bullish, OTM name choices (choices to purchase above the present worth) can have greater implied volatility than OTM put choices (choices to promote beneath the present worth) as a result of merchants are keen to pay extra for the prospect to purchase the asset at the next worth sooner or later, anticipating the value to rise. This case ends in a constructive delta skew.

Conversely, if the market is bearish, OTM put choices can have the next implied volatility than OTM name choices, leading to a adverse delta skew. On this case, merchants are keen to pay extra for the prospect to promote the asset at the next worth sooner or later, as they count on the value to fall.

The 0.48% delta skew for Bitcoin choices expiring in a single week is barely constructive, indicating considerably bullish to flat sentiment for BTC within the quick time period. Nonetheless, the delta skew for choices expiring in a single month, three months, and 6 months is adverse (-3.8%, -5.83%, and -8.62%, respectively), suggesting that the market sentiment turns into more and more bearish over the long term. Merchants are keen to pay extra for the prospect to promote Bitcoin at the next worth sooner or later, anticipating the value to fall.

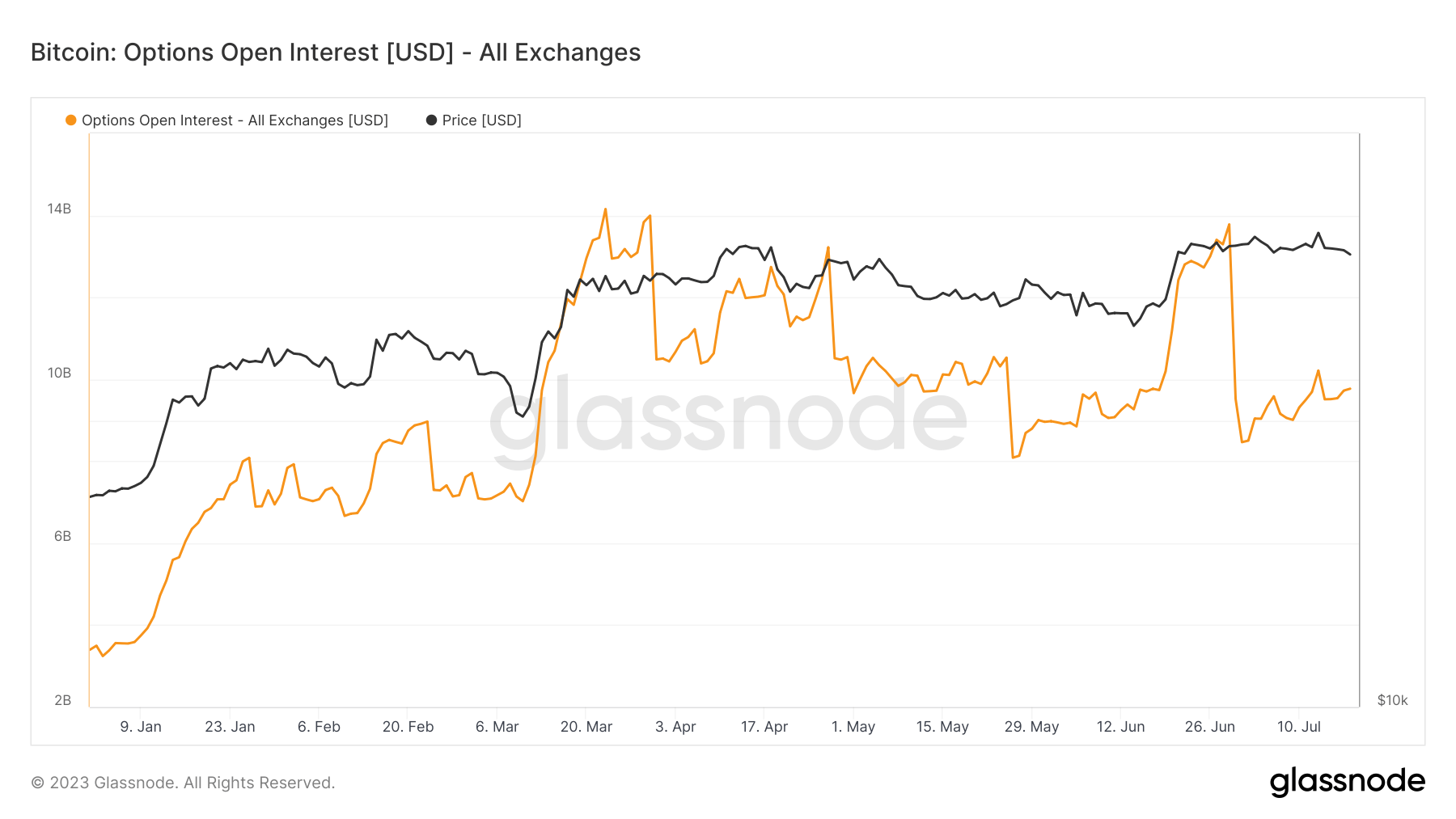

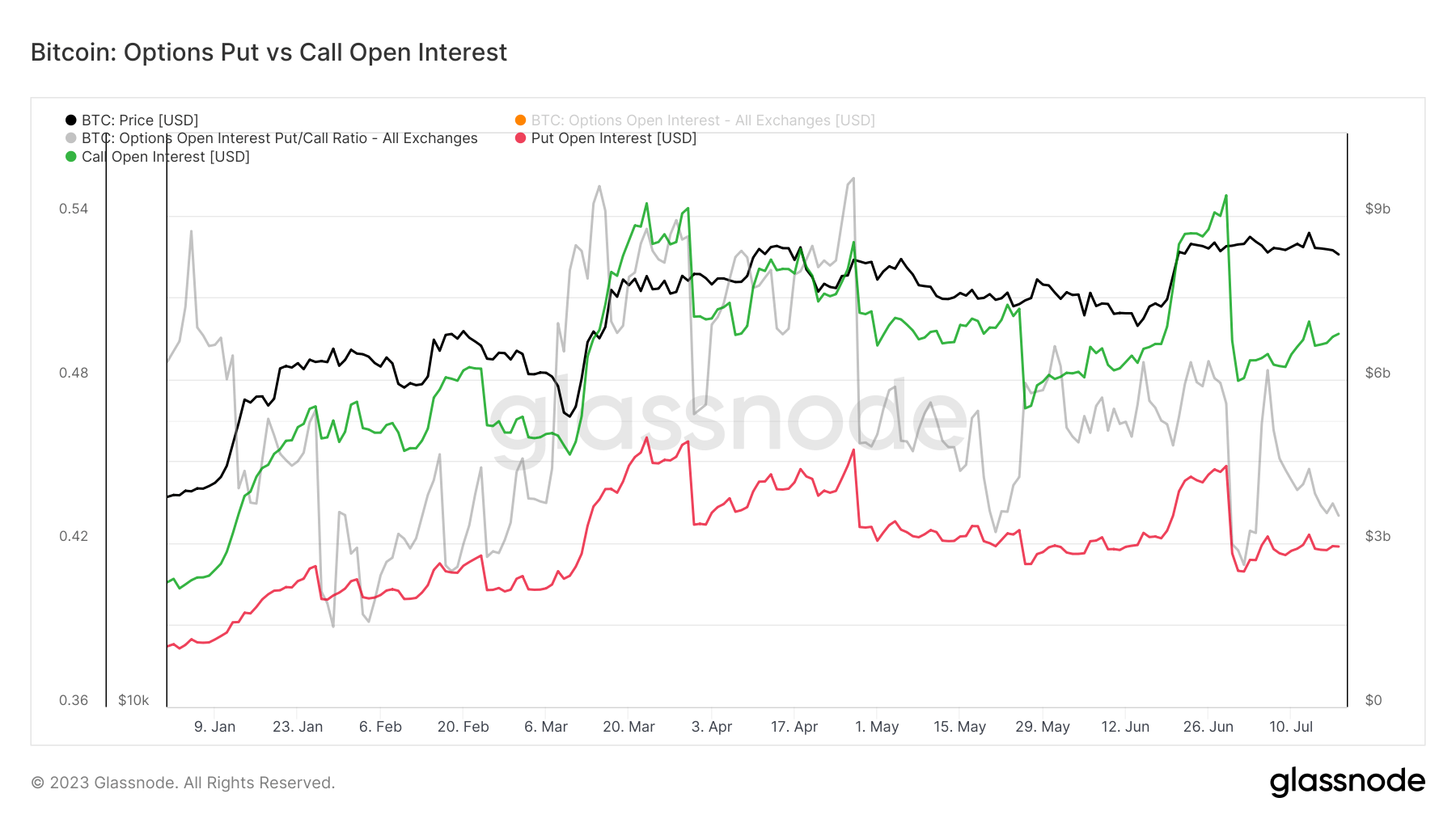

This divided sentiment contrasts with the construction of the entire open curiosity for Bitcoin name choices, which stands at $9.7 billion. Open curiosity refers back to the complete variety of excellent choices contracts that haven’t been settled. It’s a crucial metric that displays cash move into the derivatives market.

The full open curiosity for Bitcoin calls is $6.93 billion, considerably greater than the open curiosity for places, which is $2.83 billion. This discrepancy might recommend that merchants are usually extra bullish on Bitcoin, anticipating the value to extend, therefore the upper variety of name choices.

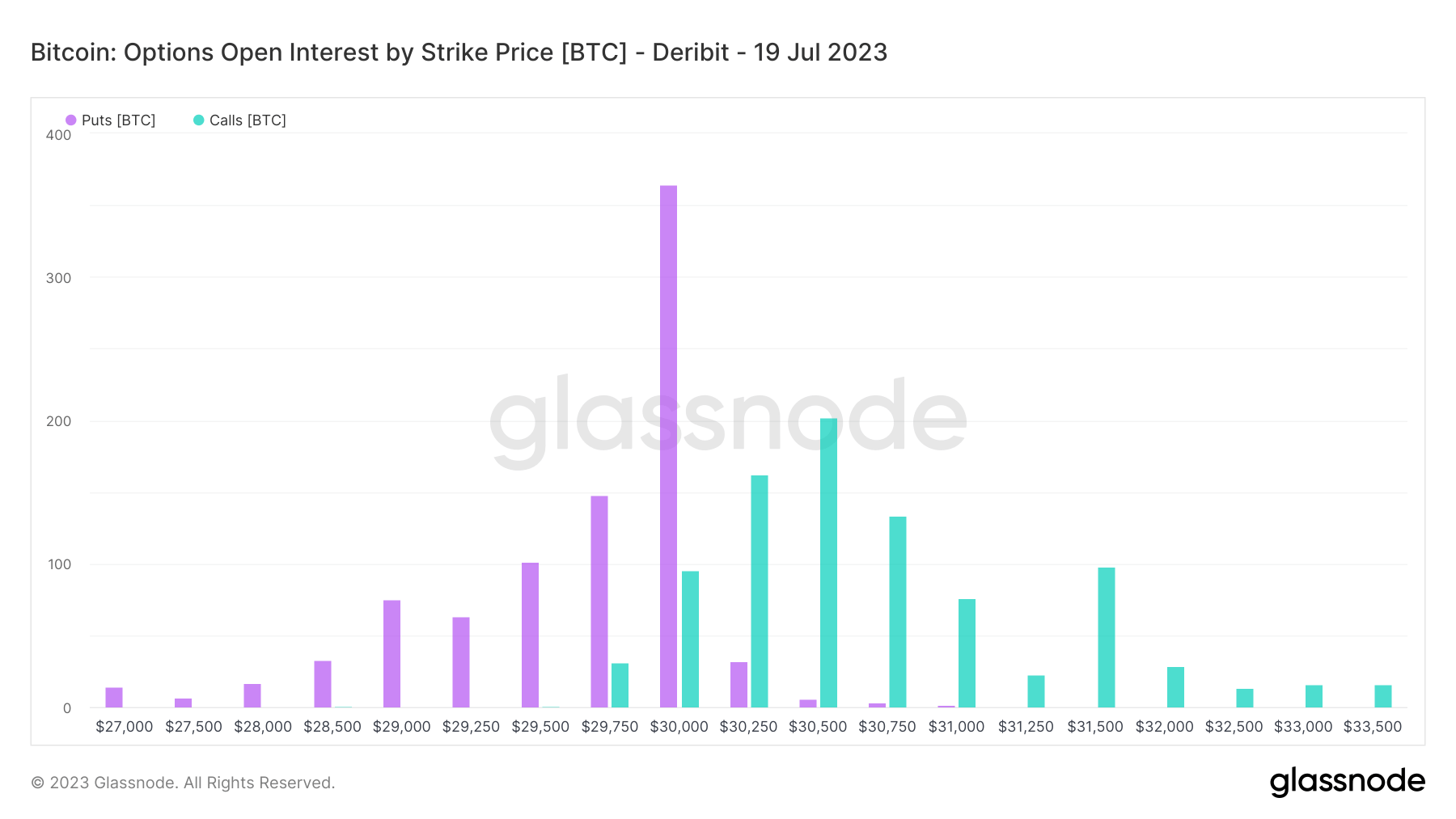

Nonetheless, the open curiosity of name and put choices by strike worth for choices contracts expiring on July 19 reveals a special story. An equal quantity of open curiosity, 365.4 BTC, is betting that BTC will fall beneath $30,000 and rise above $30,250-$30,500. This stability of curiosity signifies a market at a standstill, reflecting Bitcoin’s present worth degree.

In conclusion, the indecisive derivatives market is preserving Bitcoin flat. Whereas some merchants are bullish, anticipating a worth enhance, an equal quantity are bearish, betting on a worth lower. This division helps Bitcoin in a good buying and selling vary, with little indication of a big shift within the coming days.

Opposite to the bearish sentiment mirrored within the choices market, long-term forecasts by some consultants recommend a extra bullish viewpoint, with merchants seemingly able to trip out the present flat market in anticipation of future worth rises.

The put up An indecisive choices market retains Bitcoin flat appeared first on StarCrypto.