The anticipation of an upcoming bull market has fueled curiosity in a number of altcoins, with merchants intently watching SUI, SEI, SOL, APT, and FET. Current value actions present clues to their potential efficiency as they check key assist and resistance ranges. On this risky market, these altcoins exhibit varied traits that might influence their trajectory within the subsequent bull run.

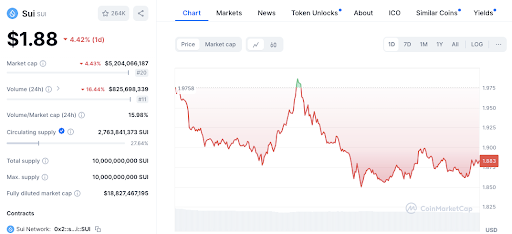

Sui (SUI) – Holding Help at Key Degree

Sui (SUI), at present priced at $1.88, has confronted a 4.97% decline over the past 24 hours. The worth peaked at $1.9758 earlier than experiencing a downward motion. Nevertheless, the $1.878 degree seems to be a vital assist level, the place the value has discovered stability. This assist has been examined repeatedly, indicating robust purchaser curiosity.

The important thing resistance degree is at $1.9758, some extent SUI struggled to beat earlier than the sell-off. If shopping for stress will increase and SUI breaks via this resistance, it might sign a renewed upward pattern. Conversely, failure to carry the $1.878 assist might result in additional declines.

Sei (SEI) – Consolidation Close to Important Help

Sei (SEI) is valued at $0.4131, having dropped by 4.28% over the past day. The worth reached a excessive of $0.4315 earlier than pulling again. At present, it’s consolidating close to $0.41, which has acted as a assist degree a number of occasions.

If SEI stays above this degree, it might try one other break above the $0.4315 resistance. Nevertheless, a drop under this assist might ship the value towards the $0.40 vary, a key psychological and historic assist degree. Quantity exercise suggests patrons are attempting to regain management, however the bearish pattern might persist if resistance ranges stay unbroken.

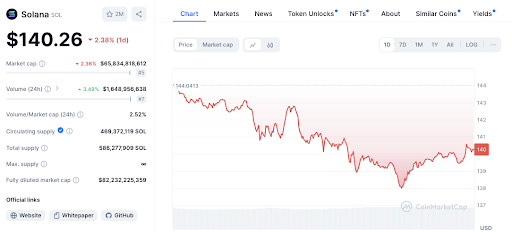

Solana (SOL) – Testing Decrease Help Ranges

Solana (SOL), at present buying and selling at $140.35, has seen a 2.53% decline. The worth peaked at $144.04 through the day earlier than dropping to a low close to $138, the place it discovered some stability. The $138 degree is rising as a major assist zone, as patrons stepped in to stop additional decline.

Nevertheless, stronger assist lies round $135, which may very well be examined if the bearish pattern continues. To realize bullish momentum, SOL wants to interrupt the $144.04 resistance, with additional resistance anticipated within the $146-$148 vary.

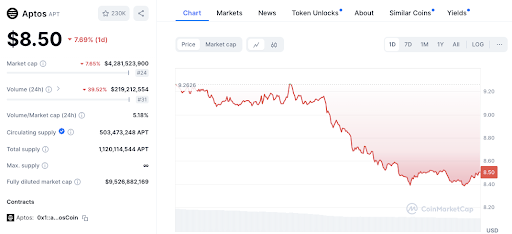

Aptos (APT) – Struggling Amidst Declining Quantity

Aptos (APT) has taken a pointy hit, with its value falling to $8.48, an 8.51% decline over the previous 24 hours. A big quantity drop of practically 40% alerts lowered shopping for curiosity at decrease ranges.

Learn additionally: Aptos and SUI: Outperforming the Crypto Market

The worth is hovering close to $8.40, which acts as a key assist degree. If this assist breaks, the following psychological degree may very well be $8.00. Nevertheless, to regain bullish momentum, APT should overcome resistance between $8.90 and $9.26, a spread it beforehand failed to carry.

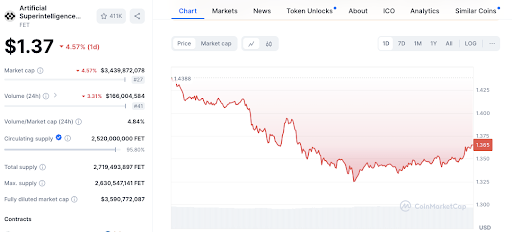

Synthetic Superintelligence Token (FET) – Going through Bearish Stress

Synthetic Superintelligence Token (FET), now priced at $1.36, has seen a 4.94% drop. The worth lately reached $1.44 earlier than pulling again. At present, it’s consolidating close to $1.35, which acts as a right away assist degree.

Nevertheless, if FET fails to carry this assist, it might check the $1.30 degree. On the upside, the value would want to interrupt via $1.40 earlier than difficult the important thing resistance zone round $1.44-$1.45. Declining quantity suggests weakening momentum, which might result in additional draw back except shopping for curiosity revives.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.