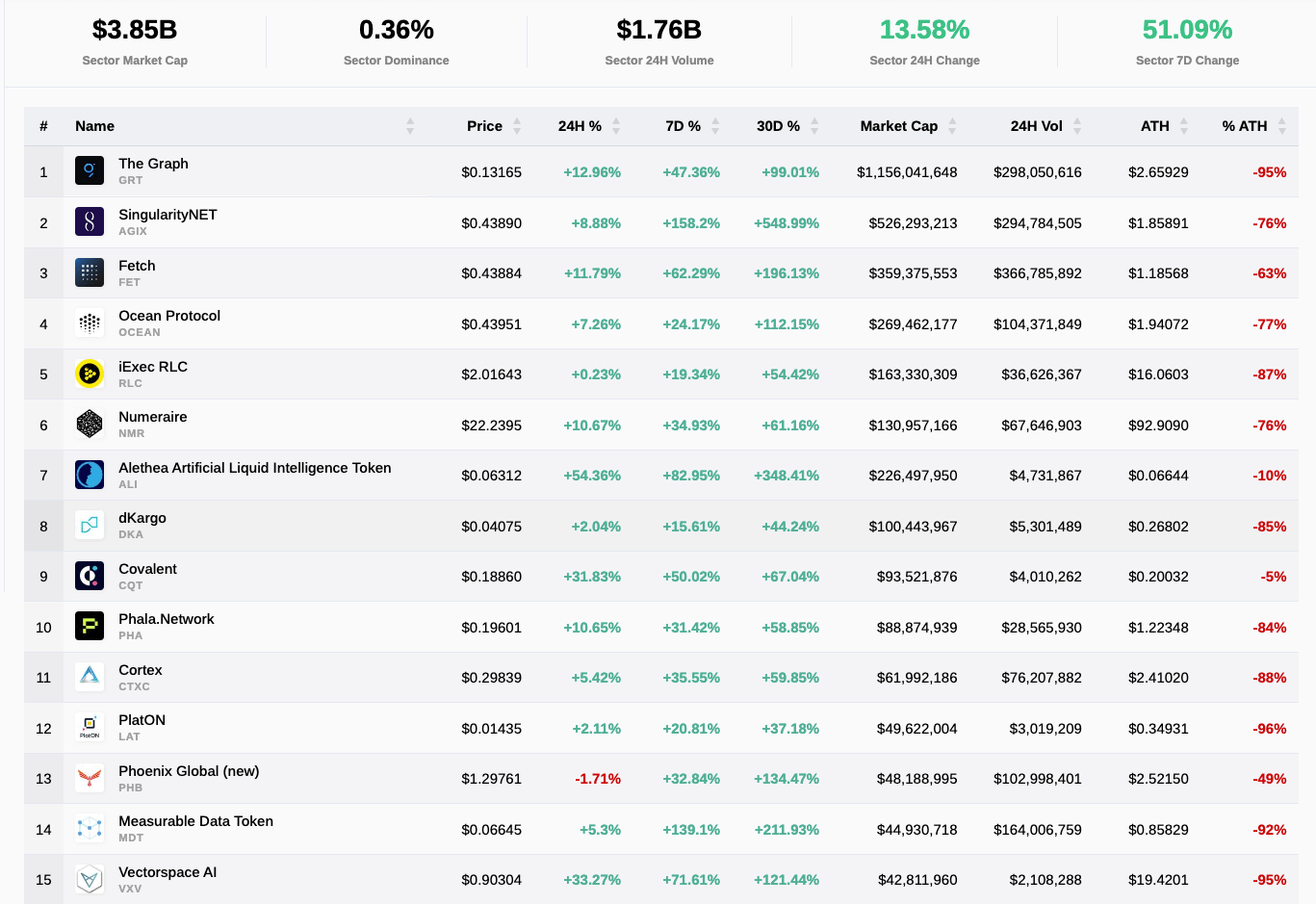

The market sector of AI crypto continues to sizzle, with the highest 30 tokens all within the inexperienced during the last 30 days, a pattern that has left many buyers questioning: how frothy can this high probably get?

The information comes on the heels of the extensively profitable launch of ChatGPT, backed to the tune of $10 billion by Microsoft (a good portion of which comes within the type of cloud computing credit, by way of Microsoft’s Azure cloud platform); in addition to a renewed push by Alphabet Inc. (Google’s guardian firm), who late final week reportedly dedicated to additionally make investments not less than $400 million in a ChatGPT rival, Anthropic.

ChatGPT is already upending many work flows and industries. It was the quickest app to attain a 1 million downloads, a feat it achieved solely 5 days after launch final December. It has additionally been built-in into Microsoft’s Groups, permitting the instrument to behave as a strong digital agent and workplace assistant.

The meteoric rise of the AI crypto sector additionally comes as institutional buyers proceed to look extra deeply into the sector. In Cathie Wooden’s current ARK Make investments report, for instance, she cited the confluence of AI and blockchain as a part of a broader shift within the coming years that can see buyers more and more look towards disruptive improvements in each sectors.

Different analysts, nevertheless, are extra skeptical.

Based on a current JP Morgan report, which drew from a survey of 835 institutional buyers throughout 60 world markets, greater than half of these surveyed stated that they imagine AI and machine studying would be the single most impactful expertise within the coming years. That very same survey, nevertheless, put shade on institutional funding in crypto, with almost three out of 4 respondents saying that they “don’t have any plans to commerce crypto.”

So what explains the current rise in value of AI cryptos? Let’s have a look at a few of the underlying applied sciences behind a few of the sector’s greatest movers and shakers.

The Graph (GRT) market capitalization: $1.1 billion

GRT is the highest ranked AI crypto by market cap at over $1.1 billion, with a dominance of over $500 million to its closest competitor (SingularityNET, whose market cap presently stands at $517 million). GRT is a decentralized platform for indexing and querying information from blockchains, particularly designed for the decentralized net (Web3). It makes use of a novel indexing and querying mechanism that permits quick and environment friendly information retrieval from decentralized sources, making it a key infrastructure element for decentralized purposes (dApps).

What units GRT other than different AI-based cryptocurrencies is its give attention to offering environment friendly and dependable information retrieval for decentralized purposes.

Moreover, GRT is designed to be a decentralized community, the place validators are incentivized to contribute their computing sources to index and question information. This makes it a very decentralized and open platform for information indexing and retrieval, setting it other than different centralized options available in the market.

Value: $.13

24H%: +11.6%

7D%: +47.18%

30D: +93.09%

%ATH: -95%

SingularityNET (AGIX) market capitalization: $529.62 million

AGIX is an AI market that serves as an ecosystem for AI associated apps and tasks. It has gained reputation attributable to its give attention to democratizing AI and permitting builders to entry AI sources simply, permitting builders to create, share, and monetize AI providers throughout their ecosystem. AGIX runs on each Ethereum and Cardano, created by a group of AI and blockchain consultants led by Dr. Ben Goertzel, who can also be recognized for his work on the event of Sophia the Humanoid Robotic.

AGIX was created with the aim of offering a decentralized platform for AI growth, with Sophia serving as an illustration of the potential of the expertise. AGIX is now primarily an AI market that enables totally different actors to utilize its community. It additionally features a staking platform that enables AGIX tokens for use to assist preserve the platform’s AI market.

Present Value: $0.43

24H%: +2.35%

7D%: +152.41%

30D%: +491.69%

%ATH: -76%

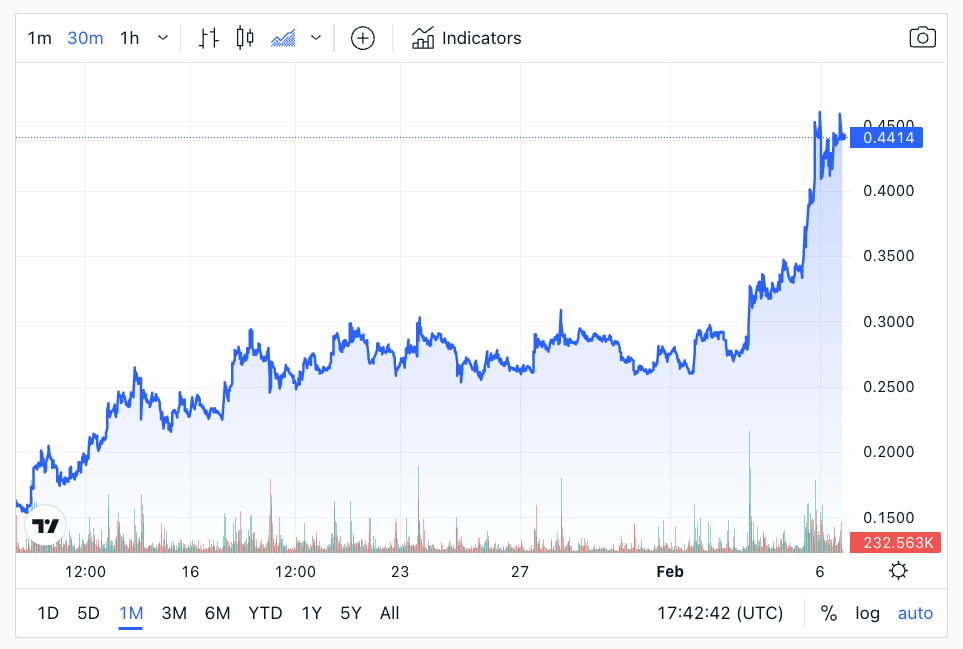

Fetch (FET) market capitalization: $359.54 million

FET is positioned within the Cosmos ecosystem and primarily features as a layer 1 protocol that enables customers to utilize its peer-to-peer automation bot service, utilizing AI. It was created by a group of consultants within the fields of AI, blockchain, and cryptography. The group is based by Humayun Sheikh, Thomas Hain and Toby Simpson, all of whom have intensive expertise within the growth of clever programs and decentralized applied sciences.

What makes FET distinctive is its use of AI and blockchain expertise to create a decentralized community for clever automation. The community allows self-organizing programs and offers a platform for the creation and deployment of different AI-powered decentralized purposes. However not like Singularity, which is actually an AI market, Fetch makes use of brokers to create good contracts, in a position to detect and carry out sure features .

Moreover, FET has a novel consensus mechanism that mixes components of Proof-of-Work (PoW) and Proof-of-Stake (PoS), utilizing this distinctive consensus mechanism to function as a decentralized AI-powered community that permits clever automation and self-organizing programs.

Their focus is on clever automation, with Fetch.ai’s digital tokens serving as a method of accessing the platform’s sources and providers, offering a direct incentive for token holders to actively use and take part within the community.

Value: $0.43

24H%: +15.71%

7D%: +61.83%

30D: +177.88%

%ATH: -63%

Ocean Protocol (OCEAN) market capitalization: $272.29 million

OCEAN is an enormous information challenge created by a group of skilled expertise and enterprise professionals led by Bruce Pon and AI researcher Trent McConaghy.

The 2 mixed to create Ocean in 2017, primarily based on the thought it may operate as a decentralized information storage and privateness service (assume VPN, browsers, and many others). They supply Knowledge NFTs, Knowledge farming and growth of the Ocean DAO and ecosystem. The info NFTs developed by OCEAN present an IP framework that mixes ERC20 and ERC721 and doubtlessly allows a number of income streams in opposition to the bottom IP, with totally different sub-licenses. OCEAN has additionally been featured within the World Financial Discussion board’s record of innovators within the information economic system.

Value: $0.43

24H: +4.71%

7D%: +18.3%

30D%: +102.81%

%ATH: -77%

VAIOT (VAI) market capitalization: $40.34 million

VAI could be very low-cap in relation to crypto AIs, with a market cap of solely $40.34 million, curiosity in it appears to stem from the very fact it offers clever providers powered IBM. It affords a portfolio of blockchain-based AI assistants and on-chain Clever contracts for companies and customers to offer automated providers and transactions.

Just like ChatGPT’s integration with Microsoft’s Groups, VAIOT combines AI and blockchain to create a group of business-focused Clever Digital Assistants that cater to each customers and companies. These digital assistants will function a brand new digital medium for promoting, delivering services and products, and conducting transactions, and importantly have a give attention to permitting cellular integration (one thing plenty of different AI-focused apps are likely to ignore, selecting as a substitute to give attention to desktop purposes).

VAIOT final purpose appears to be on making a digital platform for each business-to-consumer (B2C) and consumer-to-consumer (C2C) transactions between customers, which make the most of VAIOT’s blockchain and VAI tokens.

Value: $0.20

24H: +9.4%

7D: +83.48%

% from ATH: -29.55%