- ADA finds assist at $0.2376, fueling hopes for a bullish breakout.

- Elevated buying and selling quantity suggests robust demand for ADA on the dip.

- Technical indicators predict ADAUSD’s potential reversal as stochastic RSI indicators oversold situations.

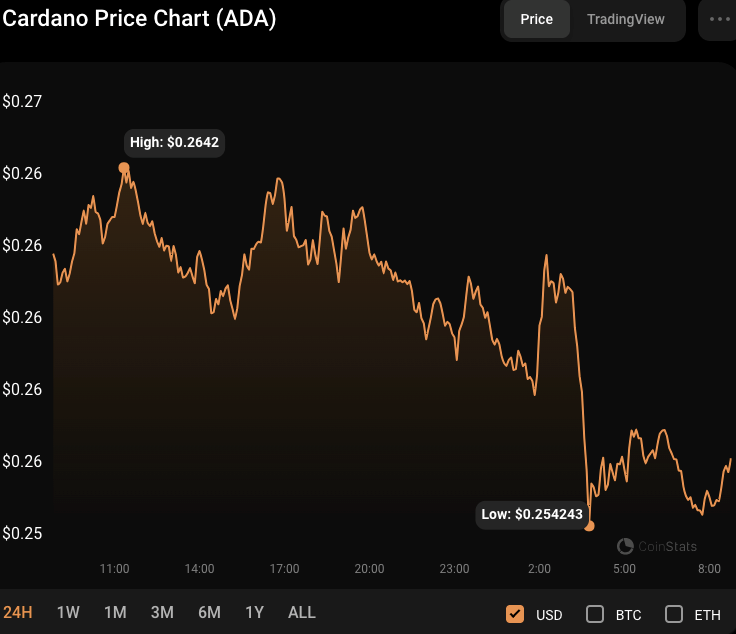

Early within the day, bullish momentum within the Cardano (ADA) market was strong, however the resistance above the intra-day excessive of $0.2642 proved too arduous to beat. Consequently, the value fell, but it surely regained assist above the $0.2546 stage.

This stage signifies that there’s nonetheless a number of shopping for curiosity in ADA, and if the bulls can generate sufficient momentum, they might break via the barrier and propel the value larger. ADA was buying and selling at $0.2559 at press time, a 2.34% decline from its earlier excessive.

If the bearish momentum breaks via the $0.2546 assist stage, the following stage to observe is round $0.25. This stage has supplied strong assist for ADA and would possibly current a shopping for alternative if it holds. Nevertheless, if the promoting stress will increase and the value falls beneath $0.25, ADA might face extra unfavourable potential to the following assist stage, round $0.24.

If the bulls can discover sufficient power to interrupt past $0.2642, the following resistance stage to observe is round $0.27, the place promoting stress might mount.

ADA’s market capitalization and 24-hour buying and selling quantity declined by 2.38% and 20.81%, respectively, to $8,989,613,577 and $168,004,57, indicating a drop in market exercise. This drop in buying and selling quantity reveals that buyers’ curiosity and engagement might wane, influencing ADA’s worth motion. Moreover, the decline in market capitalization suggests a discount in total worth for ADA, which can result in additional promoting stress and important unfavourable considerations.

The stochastic RSI on the ADAUSD 4-hour worth chart crossed its sign line with a price of two.80, indicating that the ADAUSD is oversold. This sample implies a reversal of the current downturn and an impending rebound. If the stochastic RSI shifts and strikes towards the 50 mark, it would reinforce the constructive momentum and provides extra proof for an ADAUSD rally.

With a Cash Movement Index rating of 43.08, ADAUSD reveals a gentle unfavourable sentiment. If the Cash Movement Index begins to rise over 50, it would sign a change in market angle towards shopping for stress and important upside possibilities for the ADAUSD. Moreover, a break above the resistance stage would possibly bolster the case for an ADAUSD advance by signaling a shift in market sentiment and elevated shopping for exercise.

The unfavourable Charge of Change (ROC) development with a rating of -2.29 signifies that the bearish momentum in ADAUSD is powerful. As sellers dominate the market, this would possibly put extra downward stress on costs. If the ROC continues to fall into unfavourable territory, it might indicate a growing bearish development and a probable slide in ADAUSD.

Nevertheless, if the ROC begins to maneuver into the constructive zone and rise in worth, it might point out a change in market temper and a possible motion towards bullish momentum. This development would possibly entice further purchasers into the market, resulting in a spike within the ADAUSD worth.

With the Relative Energy Index at 45.19, beneath its sign line, the bearish development in ADAUSD might persist within the close to time period. Nevertheless, if the RSI rises above its sign line and into the overbought zone, it might counsel a probable reversal of the bearish development and a shift towards optimism.

In conclusion, Cardano’s ADA reveals resilience amidst challenges. Merchants eye assist at $0.2376, with potential for a bullish reversal indicated by key indicators.

Disclaimer: The views, opinions, and knowledge shared on this worth prediction are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be responsible for direct or oblique harm or loss.

Common Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.