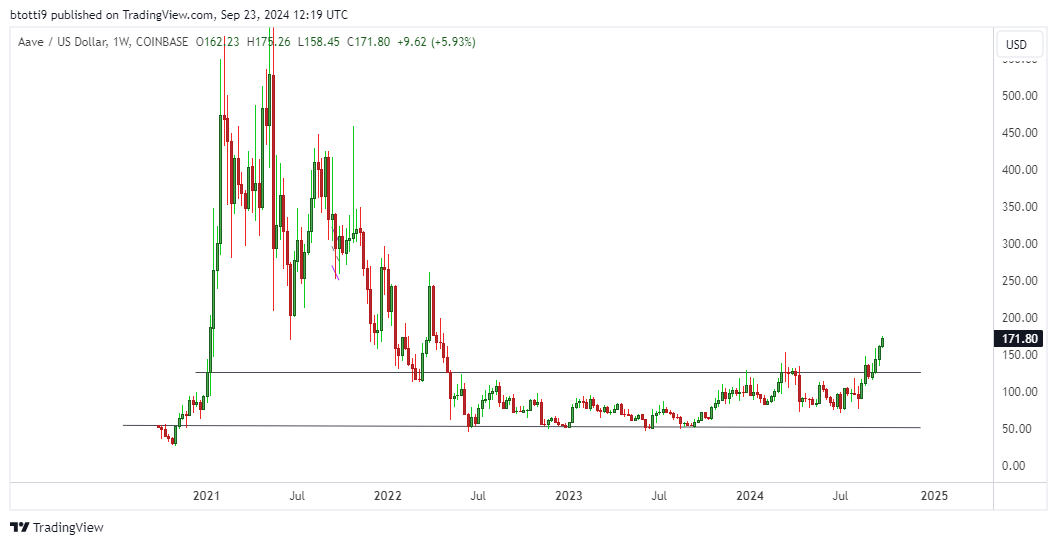

- AAVE value reached highs of $173 on Monday, its highest degree since April 2022.

- TVL has additionally recovered because the decentralised finance protocol witnessed bullish sentiment.

DeFi protocol Aave (AAVE) has seen the worth of its native token surge to highs final seen in April 2022.

The surge to above $173 represents Aave’s highest value degree because the coin traded at round $176 on April 28, 2022.

For AAVE, it was a pointy downturn after bulls reached the all-time excessive above $670 in Might 2021, earlier than an enormous accumulation section for practically two and half years.

Aave now seems to be poised above the horizontal line that has constrained consumers for this lengthy.

A part of this restoration comes because the broader crypto market eyes an upward run, led by Bitcoin’s flip above $60k and the rally that features retesting of bear resolve above $64,800. In keeping with CoinGecko knowledge, AAVE/USD has jumped greater than 172% prior to now 12 months, together with an uptick of over 23% prior to now week.

These good points have come as AAVE’s whole worth locked recovered because the decline to $5.7 billion in January 2023. In a 12 months the place the decentralised finance market has benefited from an total restoration amid larger lending and borrowing, DeFiLlama exhibits Aave’s TVL has touched $22.1 billion.

Many of the worth is on Aave V3, which has seen a whole lot of key integrations throughout the market. Whole TVL for the community stood round $20.5 billion.