- Aave goals for CRV liquidity through rewarding swimming pools, guided by veCRV dominance.

- Aave’s neighborhood handed the “aCRV OTC” proposal, securing CRV by means of USDT utilization.

- Aiming to safe 5 million CRV, the Aave neighborhood break up over the proposal with 58% in favor.

An replace on the Aave governance discussion board means that the neighborhood has handed the “aCRV OTC” proposal, which proposes the strategic buy of CRV tokens by means of the utilization of USDT from the collector contract, Aave DAO treasury.

Furthermore, the governance proposal goals to safe 5 million Curve DAO Tokens (CRV). The neighborhood has displayed evident divergence of opinion concerning this proposal, as over 42.19% of the votes oppose the CRV acquisition association. Conversely, virtually 58% of the neighborhood has solid their vote in favor of advancing with the deal, which is anticipated to be put in force inside the upcoming 24 hours.

Aave DAO’s transfer is an effort to seize a good portion of Curve Finance’s liquidity by prioritizing swimming pools with increased CRV rewards. The distribution of CRV rewards amongst these swimming pools is guided by the dominance of protocols holding substantial veCRV token quantities. On the discussion board, Aave famous:

The treasury steadiness and the anticipated decrease prices for service suppliers for the 2023-2024 funds would permit this strategic acquisition whereas sustaining a conservative stance with DAO treasury holdings.

Curve Finance founder Michael Egorov has utilized greater than 30% of CRV’s general market capitalization as safety to amass loans amounting to roughly $60 million from Aave v2.

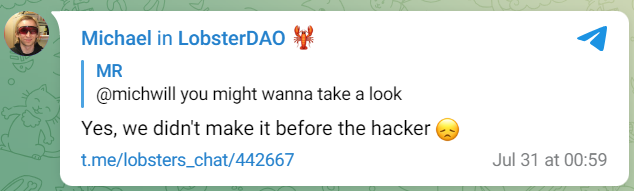

Nevertheless, the current hack on Curve, which transpired on July 30, has had a unfavorable affect on the token’s worth. Consequently, Egorov’s place is now prone to being liquidated as a consequence of this decline in token value.

The current exploit of Curve Finance

As well as, Aave can be aiming to advertise liquidity for its native stablecoin GHO. To realize this, the protocol intends to lock CRV tokens to amass Curve voting affect and set up a devoted gauge for GHO, finally enhancing secondary liquidity for GHO.

In the meantime, the Aave neighborhood presently considers two proposals aimed toward minimizing CRV publicity. The preliminary proposal targets a 6% discount within the liquidation threshold for CRV on Aave Ethereum V2 and is on observe for approval, garnering unanimous assist within the votes. The second proposal goals to droop borrowing of CRV on Ethereum and Polygon V3, encountering no opposition to date and scheduled for implementation after August 13, 2023.