April was a month crammed with important exercise and volatility for Bitcoin miners. A lot of the month was spent anticipating Bitcoin’s halving and the launch of Runes, with many analysts and market consultants warning in regards to the outsized impression they might have on the mining sector.

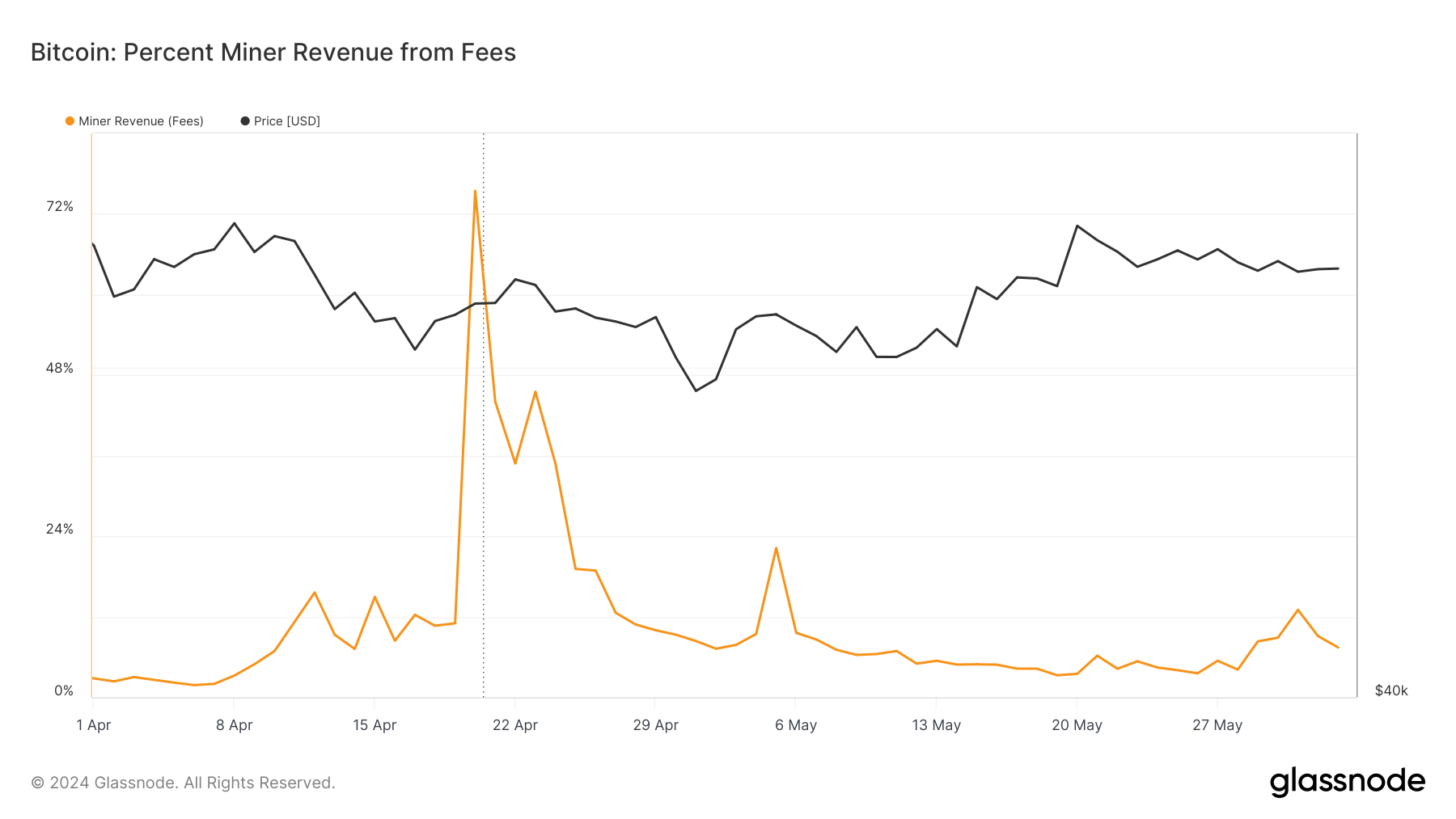

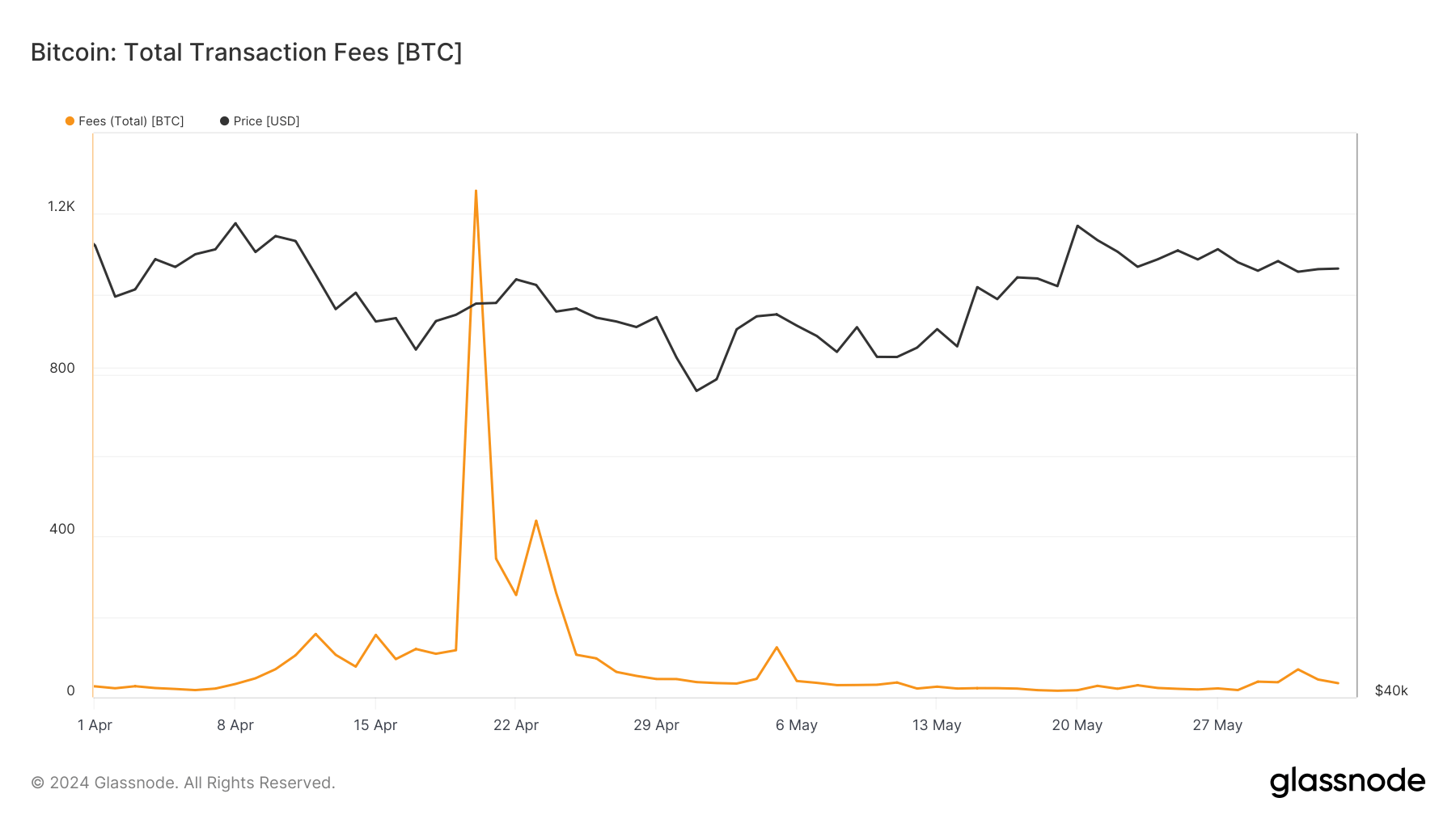

As anticipated, the mix of the halving and Runes propelled transaction charges and miner revenues to unprecedented heights. A complete of 1,257 BTC in charges was paid to miners, bringing their whole income from charges to 75.44%.

Come Might, the mining trade entered a peaceful and uneventful interval. Knowledge from Glassnode confirmed stability throughout a number of miner metrics regardless of the broader market experiencing important volatility.

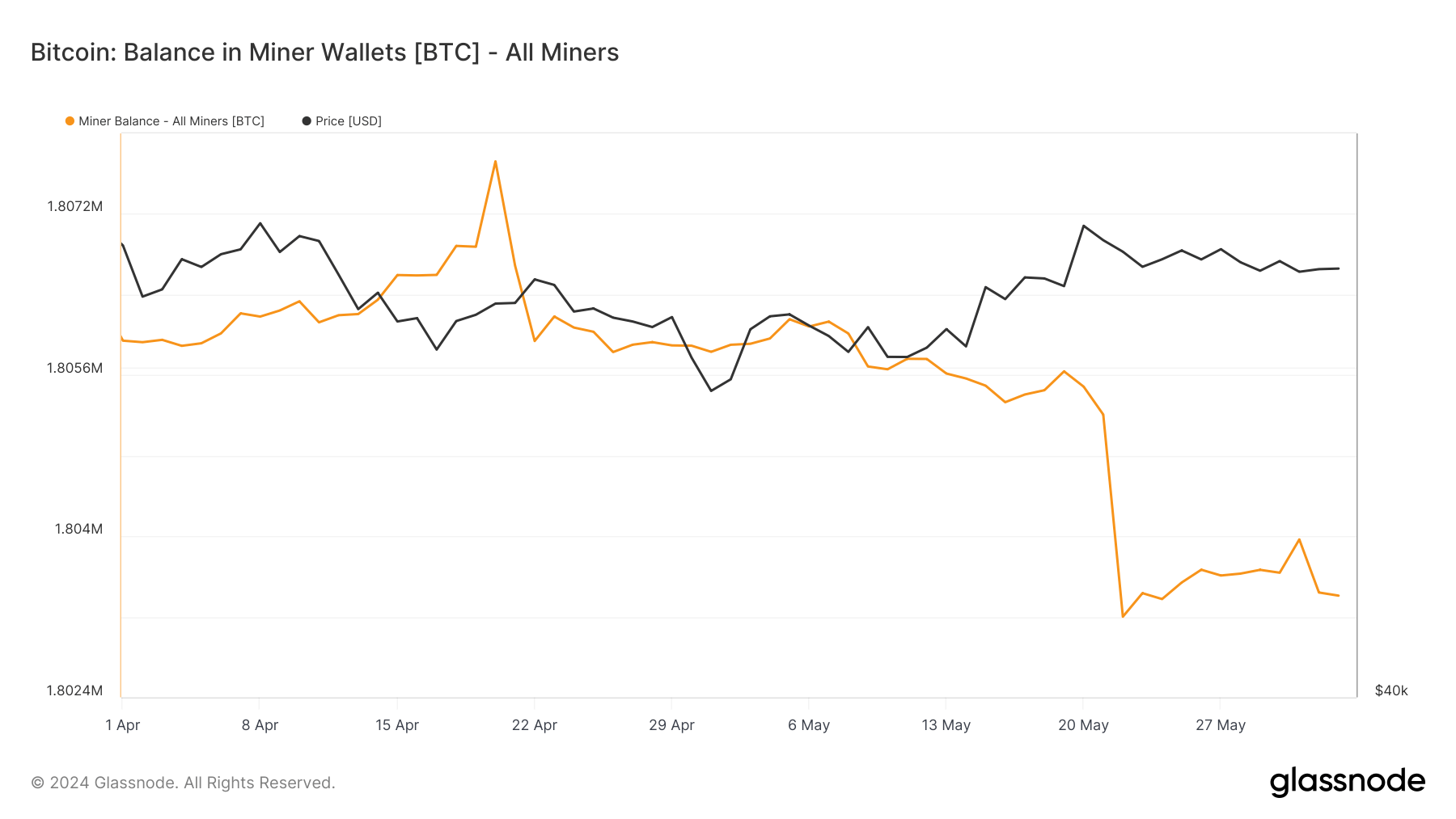

The quantity of BTC held in miner wallets noticed a vertical spike on April 20, passing 1.807 million BTC. Nonetheless, this spike was short-lived as miners offloaded a lot of their newly acquired revenue. Balances reverted to 1.805 million BTC by the tip of April, remaining steady all through Might. We noticed a slight lower to 1.803 million BTC by June 3. This stability stability exhibits a interval of equilibrium and decreased exercise in comparison with April. It signifies that miners had been neither aggressively promoting their holdings nor considerably accumulating new cash, preferring as an alternative to take care of their positions and solely cowl working prices.

Transaction charges, a important indicator of miner income and community exercise, additionally mirrored this shift. The explosive payment enhance to 1,257.71 BTC on April 20 was short-lived, dropping to 253.93 BTC by April 22 and additional declining to a mere 16.35 BTC by the second half of Might. By June 2, charges had risen barely to 35.13 BTC, however this was nonetheless a far cry from the peaks seen in April. This payment discount can largely be attributed to the waning consideration for Runes and an total lower in community congestion and transaction volumes.

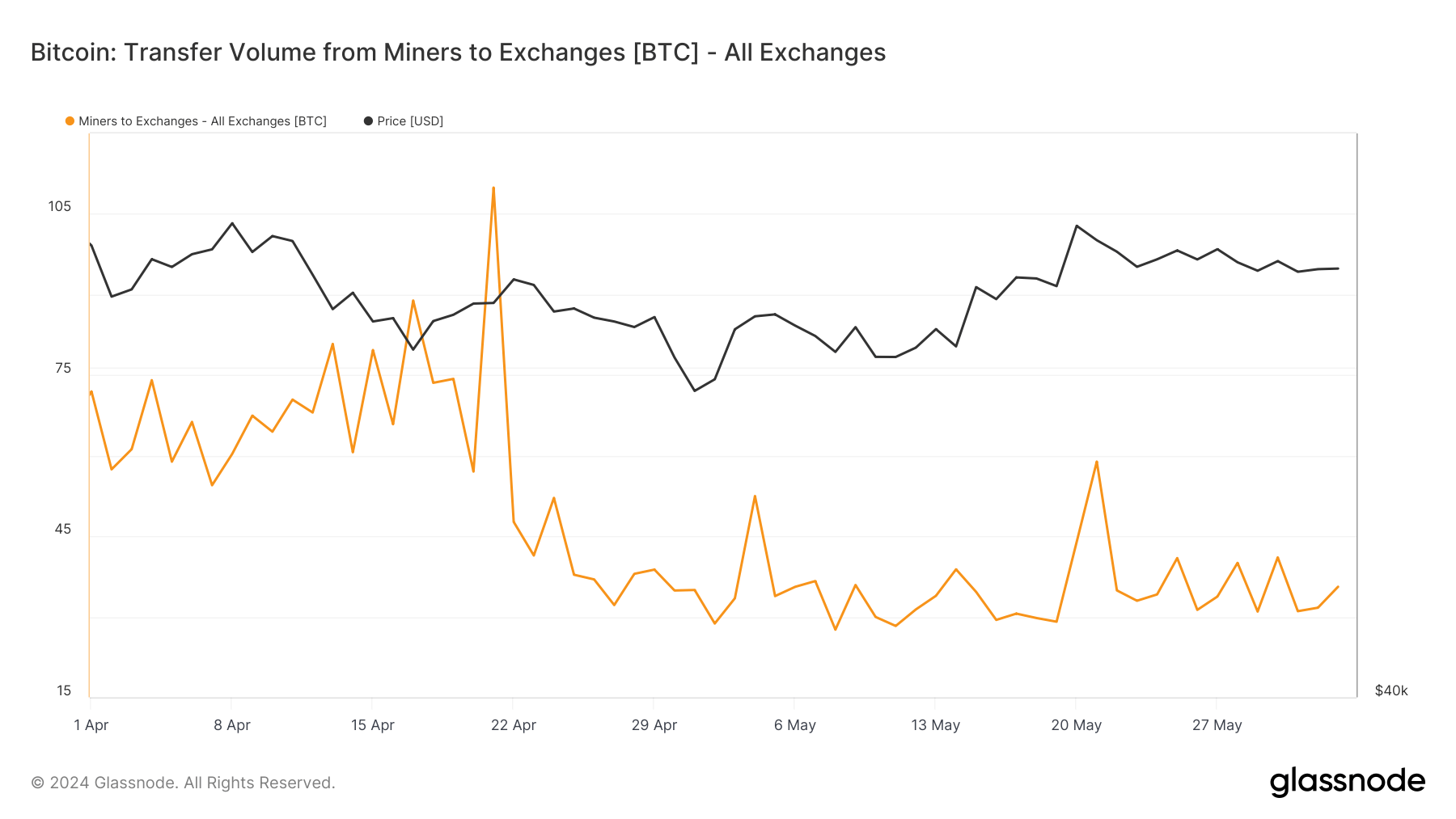

Analyzing miner transfers to exchanges additional exhibits simply how calm Might was. Early April noticed transfers of 71.95 BTC, which decreased to 57.03 BTC by April 20 and continued to say no, reaching 29.08 BTC by Might 19. This metric remained comparatively steady, with 34.90 BTC transferred by Might 22 and 35.59 BTC by June 2. The decreased motion of BTC from miners to exchanges means that miners weren’t pressured to liquidate their holdings.

The online circulate of cash into and out of miner addresses encapsulates the general sentiment and exercise. April’s internet flows had been extremely risky, peaking at 848.35 BTC on April 20 earlier than plummeting to -748.18 BTC by April 22. Might exhibited a extra tempered dynamic, with a internet influx of 187.24 BTC on Might 19, adopted by a major outflow of -2,007.13 BTC on Might 22, and settling at -31.15 BTC by June 2. It suggests sporadic promoting stress however not at a degree that signifies panic or a bearish outlook.

This contrasts with the volatility we noticed in Bitcoin costs final month. Whereas the market reacted to cost fluctuations with typical volatility, miners adopted a extra measured strategy, probably indicating confidence within the longer-term prospects of Bitcoin. This measured strategy by miners could possibly be interpreted as an indication of stability and maturation within the mining sector, the place short-term worth actions are much less impactful on operational methods.

Trying ahead, the relative stability in miner balances and decreased transaction charges counsel that miners are seemingly anticipating a interval of consolidation and are probably gearing up for future worth will increase. The low ranges of BTC transfers to exchanges point out that miners usually are not beneath instant monetary stress, permitting them to carry their property and probably profit from larger costs down the road.

These metrics may additionally counsel that community exercise and transaction volumes may stay subdued except catalyzed by important market occasions or technological developments. This might end in decrease transaction charges and probably decreased miner revenues except offset by a considerable enhance in Bitcoin’s worth.

The put up A flat month for miners after a risky April appeared first on StarCrypto.