- Bitcoin’s open curiosity exceeds $18 billion, a traditionally risky degree.

- Analysts predict a potential shakeout earlier than Bitcoin’s subsequent main value transfer.

- Funding charges present gentle bullish sentiment, however a correction may nonetheless be imminent.

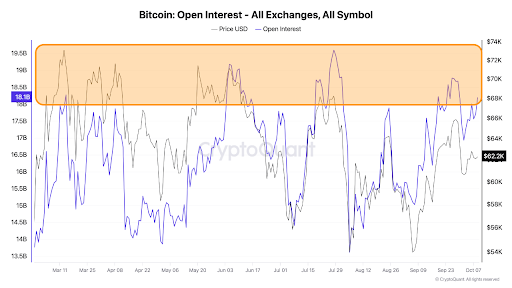

Bitcoin’s open curiosity has exceeded $18 billion, a traditionally vital degree usually previous market corrections. Bitcoin’s value has additionally retreated to a low of $60,314 at present.

The rise in open curiosity, which tracks the variety of excellent spinoff contracts, suggests rising speculative exercise available in the market. Current charts by CryptoQuant present that open curiosity has ranged between $13.5 billion and $19.5 billion in latest months. Earlier peaks in open curiosity have usually coincided with value corrections.

Historic Correlation Between Bitcoin Crashes and Excessive Open Curiosity

In July, when open curiosity was above $19 billion, BTC’s value neared $68,000. Nonetheless, a pointy decline adopted, bringing BTC’s value all the way down to $54,000, with open curiosity equally declining.

An analogous sample emerged in June when open curiosity hovered between $16.5 billion and $17.5 billion, whereas Bitcoin’s value fluctuated between $55,000 and $66,000. This highlights the correlation between Bitcoin’s value and open curiosity.

Funding Charges Stay Secure Regardless of Surge in Open Curiosity

Regardless of the surge in open curiosity, Bitcoin’s funding charges stay comparatively steady. Present charges, at 0.011%, are barely above their 200-day easy transferring common (SMA). This means that lengthy merchants—these betting on Bitcoin’s value to rise—presently dominate the market.

Traditionally, funding charges have turned destructive throughout main market corrections, usually signaling a forthcoming value restoration. Nonetheless, the present impartial degree means that whereas bullish sentiment is current, it’s not overwhelming. This might point out a shallow correction, ought to one happen.

Analyst Anticipates a Last Shakeout Earlier than the Subsequent Huge Transfer

In accordance with CryptoQuant analyst Aytekin Cetinkaya, a remaining shakeout involving lengthy liquidations may scale back open curiosity and stabilize the market forward of Bitcoin’s subsequent value rally. This liquidation occasion would seemingly convey open curiosity all the way down to more healthy ranges, paving the way in which for extra sustainable progress in the direction of a possible all-time excessive.

Cetinkaya remarked, “It wouldn’t be stunning to see some lengthy liquidations that decrease open curiosity and put together the marketplace for its subsequent transfer.”

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.