- SOL faces robust resistance at $146.44, with weak help at $142 and $140.

- Lowering buying and selling quantity alerts warning, elevating dangers of additional downward stress.

- RSI at 46.55 and MACD pattern point out continued bearish sentiment for Solana.

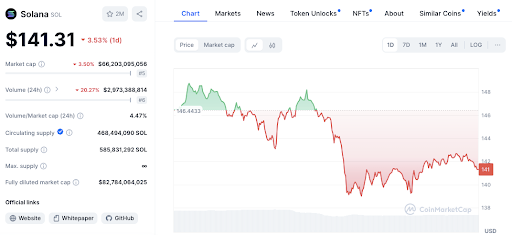

The worth of Solana (SOL) has fallen to $141.74 after a 3.2% drop within the final 24 hours, main traders to query whether or not the cryptocurrency has reached its backside. Technical indicators additionally current combined alerts on SOL’s future value motion.

Merchants are carefully monitoring Solana’s value motion for indicators of a possible reversal or additional decline.

SOL Value Development and Market Exercise

Solana’s value pattern reveals weakening momentum. After reaching a excessive of $146.44, the value began falling, displaying a loss in bullish power. Regardless of some upward motion, SOL has struggled to carry good points, falling again towards the $142 mark.

Learn additionally: Analyst Says SOL Will Hit 20% of ETH’s Market Cap in Subsequent Bull Rally

Considerably, buying and selling quantity has decreased by over 20%, suggesting a slowdown in market exercise. This decline means that merchants have gotten extra cautious, which might trigger additional value dips if the pattern continues.

Key Help and Resistance Ranges to Watch

The near-term help degree for SOL is $142, the place the value is presently hovering. If SOL falls under this level, the subsequent help degree is $140, which could possibly be an necessary space for merchants trying to assess additional draw back dangers.

On the upside, resistance lies at $146.44, the newest peak. Ought to Solana handle to interrupt via this degree, it might sign a resurgence in bullish sentiment. An intermediate resistance at $144, which SOL briefly examined, additionally performs a task in figuring out the cryptocurrency’s short-term value motion.

Over the previous 12 hours, there have been extra quick liquidations than lengthy liquidations for Solana. Early within the interval, lengthy liquidations outpaced quick liquidations throughout upward value actions.

Learn additionally: Will Solana (SOL) Hit a Good Spike Following the Market Rekt?

Nevertheless, as the value started to fluctuate, there was a noticeable enhance briefly liquidations when the value dipped. Afterward, there was a surge in lengthy liquidations as the value recovered, displaying heightened volatility as merchants took positions on each side of the market. This volatility signifies uncertainty, as members react to the speedy value swings.

The 1-day RSI for SOL is presently 46.55, which suggests promoting stress however will not be but in oversold territory. Additionally, the 1-day MACD is buying and selling under the sign line, suggesting a short-term bearish pattern.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.