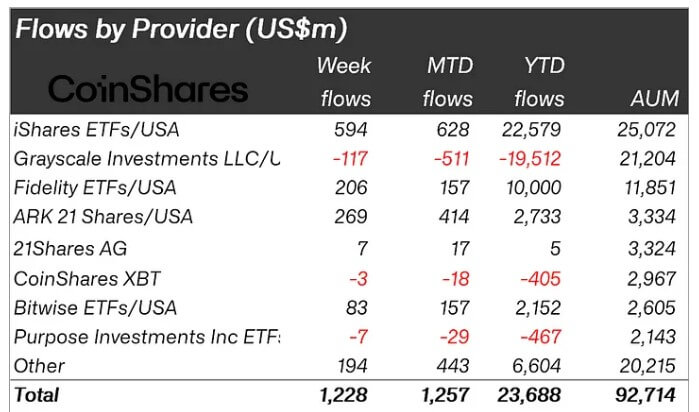

Inflows into crypto-related funding merchandise continued for the third consecutive week, with $1.2 billion flowing into the sector, in line with CoinShares’ newest weekly report.

James Butterfill, CoinShares’ head of analysis, attributed the robust inflows to expectations of a dovish US financial coverage and optimistic market momentum. These components pushed whole property beneath administration up 6.2% to $92.7 billion.

The US Securities and Alternate Fee accepted choices buying and selling for BlackRock’s spot Bitcoin ETF, which additionally lifted market sentiment. Regardless of these inflows, weekly buying and selling quantity within the sector dipped by 3.1%.

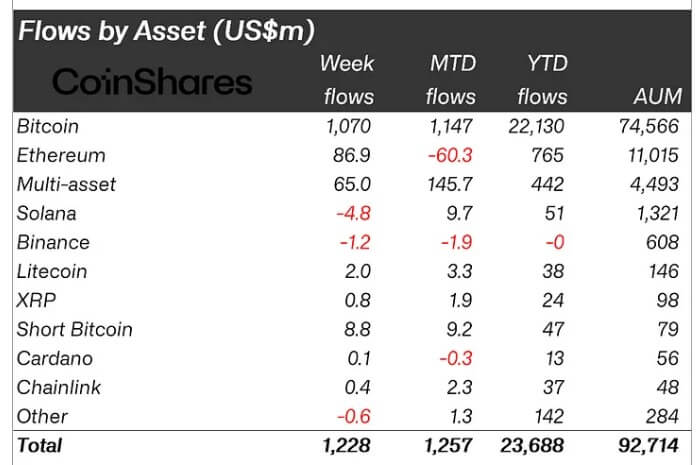

Bitcoin’s dominance continues

The CoinShares report confirmed that Bitcoin continued to dominate the flows, with buyers pouring in $1 billion to BTC-related funding merchandise.

This may be linked to its robust worth efficiency and in addition the improved inflows to identify Bitcoin ETF merchandise final week. Notably, the funds run by Bitwise, BlackRock, Constancy, and Ark 21 Shares all noticed optimistic efficiency through the reporting interval.

Nonetheless, Grayscale’s crypto funds continued their internet outflow development, dropping its whole property to $21.2 billion.

In the meantime, BTC’s latest uptrend to round $65,000 fueled an $8.8 million influx into short-Bitcoin merchandise, as some buyers count on the present rally to fade.

Regionally, sentiment was divided. The US led with $1.2 billion in inflows, whereas Switzerland trailed with $84 million. In distinction, Germany and Brazil skilled outflows of $21 million and $3 million, respectively.

Ethereum breaks a destructive streak.

Ethereum-related merchandise ended a five-week outflow streak, bringing in $87 million—the primary important influx since early August.

Information from SosoValue confirmed that spot Ethereum ETFs noticed the second-highest weekly flows since their launch in July.

Alternatively, large-cap various digital property had combined outcomes. Litecoin and XRP recorded inflows of $2 million and $0.8 million, respectively. In the meantime, Solana and Binance confronted outflows of $4.8 million and $1.2 million.