Digital asset funding merchandise noticed inflows for the second consecutive week this month, with buyers pouring $321 million into the trade, in response to CoinShares‘ newest weekly report.

This inflow boosted the full property below administration (AuM) for crypto exchange-traded merchandise (ETPs) by 9%, bringing the full to $85.8 billion. The general funding product quantity additionally elevated to roughly $9.5 billion.

James Butterfill, head of analysis at CoinShares, linked this constructive pattern to the Federal Reserve’s current choice to chop rates of interest by 50 foundation factors. He defined:

“This surge was probably pushed by the Federal Open Market Committee (FOMC) feedback final Wednesday, which took a extra dovish stance than anticipated, together with a 50 foundation level rate of interest lower.”

Bitcoin, US dominate flows

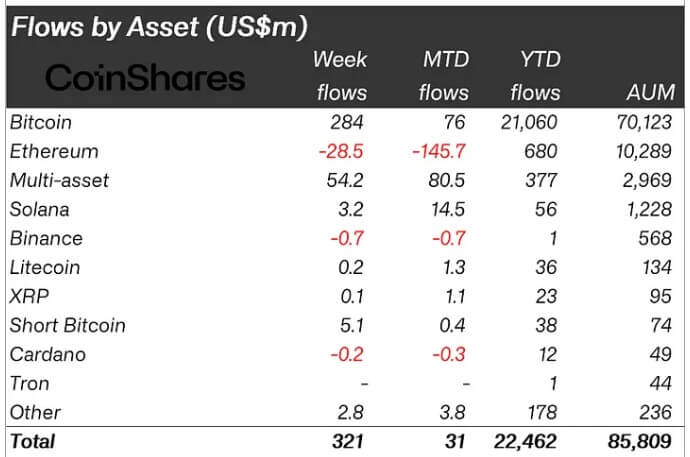

A breakdown of the flows confirmed that Bitcoin-based funding merchandise led the inflows, producing $284 million in web beneficial properties globally final week. Notably, main crypto funds from corporations like BlackRock, Bitwise, Constancy, ProShares, and 21Shares contributed to this rebound, collectively including $321 million in web inflows.

The constructive worth momentum for Bitcoin additionally attracted buyers with bearish sentiment, who allotted $5.1 million to short-Bitcoin funds.

Ethereum confronted its fifth consecutive week of outflows, totaling $29 million. This pattern stems from ongoing withdrawals from Grayscale’s ETHE product and declining curiosity in new choices.

Based on Farside knowledge, ETHE skilled outflows between $13 million and $18 million for 3 straight days final week, overshadowing minor inflows from different merchandise, together with Grayscale’s Mini-Belief.

In the meantime, Solana maintained its present constructive pattern, including $3.2 million in inflows final week. This circulate may also be linked to the bulletins of a number of conventional monetary establishments saying plans to launch monetary providers on the community through the newest Solana Breakpoint occasion in Singapore.

Different large-cap altcoins, together with XRP and Litecoin, noticed mixed inflows of $300,000.

Throughout areas, the US unsurprisingly emerged because the main contributor to final week’s influx, accounting for $277 million, adopted by Switzerland with $63 million.

In distinction, Germany, Sweden, and Canada skilled outflows of $9.5 million, $7.8 million, and $2.3 million, respectively.