- Bitcoin drops to $57,500, pushing the market again into worry mode after briefly hitting impartial.

- Merchants are divided as they await a possible Federal Reserve price minimize choice.

- Analysts warn {that a} bigger price minimize may unsettle traders and dampen market optimism.

The crypto market confronted surprising bearish strain on Monday after a number of days of uptrend that noticed Bitcoin surpass $60,000. Bitcoin dropped to $57,500 yesterday, pushing the crypto market’s worry and greed index again to worry mode only a day after it had reached impartial.

Though the market is at present in worry mode, widespread group determine Sheldon The Sniper has suggested towards panic promoting. He famous that he’s at present extra bullish than ever on altcoins regardless of the temporary downturn.

Sheldon acknowledged that the market stays unstable, largely as a result of being at a important resistance degree, which he known as a interval of relative stability or “the boring half.” He warned that the ensuing value motion may catch many off guard as soon as these resistance ranges are damaged.

All Eyes on the Fed’s Financial Choice

A key issue driving his optimism is the upcoming Federal Open Market Committee (FOMC) assembly, at which a significant financial choice—corresponding to a possible price minimize—will likely be made for the primary time in years.

Traditionally, rate of interest cuts have positively impacted threat belongings, together with cryptocurrencies. Many traders are hoping for the same final result this time. The reasoning is that top rates of interest make money extra interesting, because it generates passive returns. When charges are minimize, nevertheless, traders typically shift focus towards belongings with increased returns, corresponding to Bitcoin.

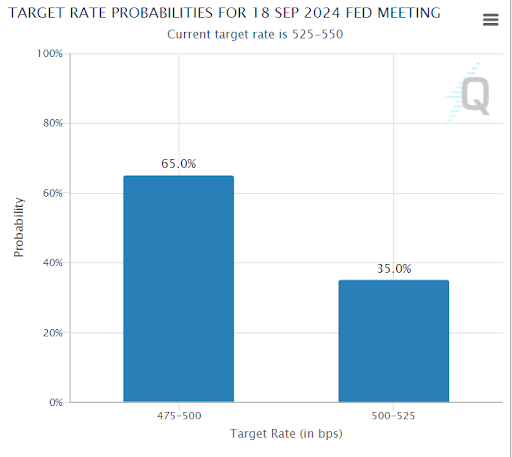

Notably, the scale of the speed minimize will considerably affect the market’s response. Merchants are at present divided between two prospects: a reasonable 25 foundation factors (bps) minimize or a extra aggressive 50 bps minimize.

On the time of reporting, CME Watchtool information exhibits a 35% chance of a 25 bps minimize, bringing rates of interest to the 5%-5.25% vary. It additionally indicated a 65% probability of a 50 bps minimize, decreasing charges to the 4.7%-5% vary.

Nevertheless, analysts from 10x Analysis warning {that a} 50 bps minimize may not have the specified impact. Fairly than boosting the market, a bigger minimize may doubtlessly unsettle traders by signaling issues in regards to the economic system’s well being, resulting in elevated warning towards riskier belongings like Bitcoin.

At press time, Bitcoin and the broader crypto market is already rallying into the anticipated occasion of tomorrow. Bitcoin is again above $59K, in search of to re-enter the psychological $60K vary.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t liable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.