With a large crash in ETH/BTC worth under 0.04, Ethereum holders are below strain. For the primary time within the final three and a half years, the worth has dropped under the 0.04 assist and breaks under a long-coming falling channel. At the moment, the pair stands at 0.03916 with a 24-hour low at 0.03870, resulting in a lower cost rejection, final seen in April 2021.

TradingView

Amid the crashing Ethereum worth, James Fickel, a widely known ETH bull, has offered one other 5,600 ETH, value $13.30 million. With the sell-off coming as a approach to cut back liquidation threat, Fickle continues to carry 153,868 stETH and has borrowed 1,896 WBTC, with a well being issue of two.56.

Historic Repetition Teases Turnaround

With the subsequent assist at 0.033662, the downfall within the ETH/BTC pair is prone to proceed forward, primarily based on charts. Nonetheless, in a current tweet, Benjamin Cowen shares a assist zone between 0.03-0.04. Cowen expects the declining development to bounce again from the vary and development upwards in 2025. As for the anticipated time, Cowen expects the bear run to backside as early as this week or as late as December

Earlier than the reversal expectation, Cowen efficiently predicted the crash within the ETH/BTC pair in a tweet. That is the place he highlighted the earlier crashes of 2016 and 2019, with this time being no completely different. This historic sample might be essential for the ETH value prediction.

FOMC and Crypto Bull Run Possibilities

On a bullish observe, the crypto markets are prone to witness a shift in development momentum, with the FOMC assembly simply two days from now. With the upcoming FOMC assembly, the market anticipates a fee cut-driven bullish rally.

In a current tweet, Quinten Francois shared an perception supporting the uptrend probabilities in Bitcoin. In his perception, Francois highlights Bitcoin reaching $69,000 in 2021, with rates of interest of 0.25%. Following the bear market, the BTC value jumped to $74,000 throughout the quickest fee hike and tightening in historical past earlier this 12 months. Because the central banks put together for a 500 foundation level reduce in rates of interest, Bitcoin prepares for an additional bull run.

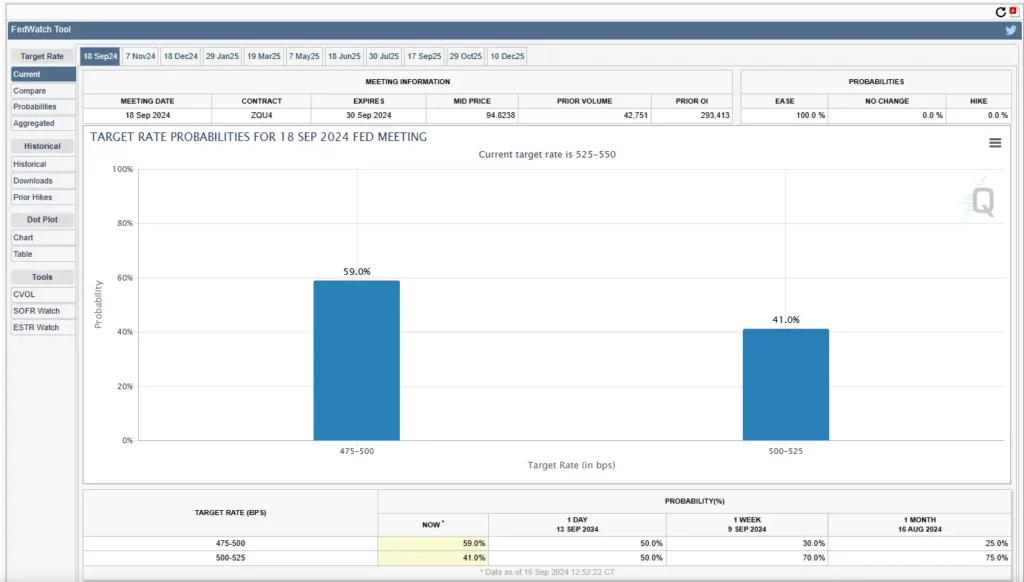

Additional, the FEDWatch software over the CME web page exhibits rising anticipations of a 475-500 foundation level cuts forward. With 59% of traders concentrating on a 475-500 foundation level reduce, the 500-525 vary declines to 41% may have main implications for the Bitcoin prediction.

Closing Factors

Supporting the reversal probabilities, CryptoBullet highlights a 3rd potential breakdown and accumulation section within the month-to-month chart of ETH/BTC. This repeating sample aligns with the 2016 and 2019 predictions of Benjamin Cowen.

With a possible restoration in sight, Crypto Bullet targets 0.08850 as the primary degree and 0.1100 because the second degree in 2025.

In conclusion, regardless of the current dump, the historic development exhibits a possible turnaround forward. Additional, the market sentiments will rise again with a possible fee reduce within the September FOMC assembly.