The funding charge is a key mechanism in Bitcoin perpetual futures designed to maintain the contract worth as shut as potential to BTC‘s spot worth. It’s a periodic cost alternate between lengthy and brief merchants, decided by the distinction between the perpetual futures and spot costs. When the funding charge is optimistic, lengthy positions pay shorts; when it’s unfavourable, shorts pay longs.

Monitoring the funding charge is essential for analyzing the market because it’s the most effective indicators of dealer positioning, notably in leveraged buying and selling environments. A constantly excessive or optimistic funding charge signifies a bullish sentiment, as extra merchants are prepared to pay a premium to carry lengthy positions in a perpetual contract. Conversely, a unfavourable funding charge exhibits a bearish sentiment, with merchants extra inclined to brief the asset and, in flip, pay a premium.

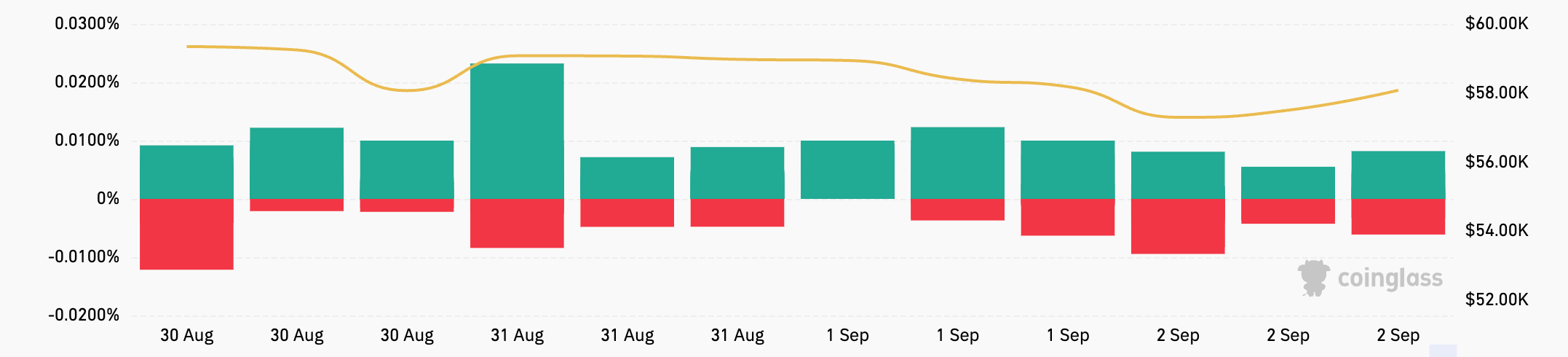

All through the weekend, the funding charges for USDT and USD-margined contracts fluctuated throughout exchanges. On Aug. 31, the charges have been predominantly optimistic, displaying a bullish sentiment, although various in magnitude. Bitmex had the very best funding charge at 0.0089%, whereas OKX had the bottom at 0.0029%. On Sep. 1, there’s been a notable shift, notably on Binance and Bybit, the place the charges turned unfavourable at -0.0004% and -0.0009%, respectively. This confirmed a rise in bearish sentiment on these exchanges.

This pattern continued on Sep. 2 and have become extra pronounced on Bybit and OKX, with each platforms seeing unfavourable funding charges of -0.0040%, indicating rising strain from brief positions. In distinction, Bitmex, which had the very best funding charge on Aug. 31, noticed a big drop to 0.0048% by Sep. 2, although it remained optimistic. HTX‘s funding charge additionally decreased however stayed optimistic at 0.0014%. Funding charges differ a lot throughout exchanges because of the variations in dealer sentiment and positioning on every platform, that are probably influenced by liquidity, buying and selling quantity, and the precise dealer base.

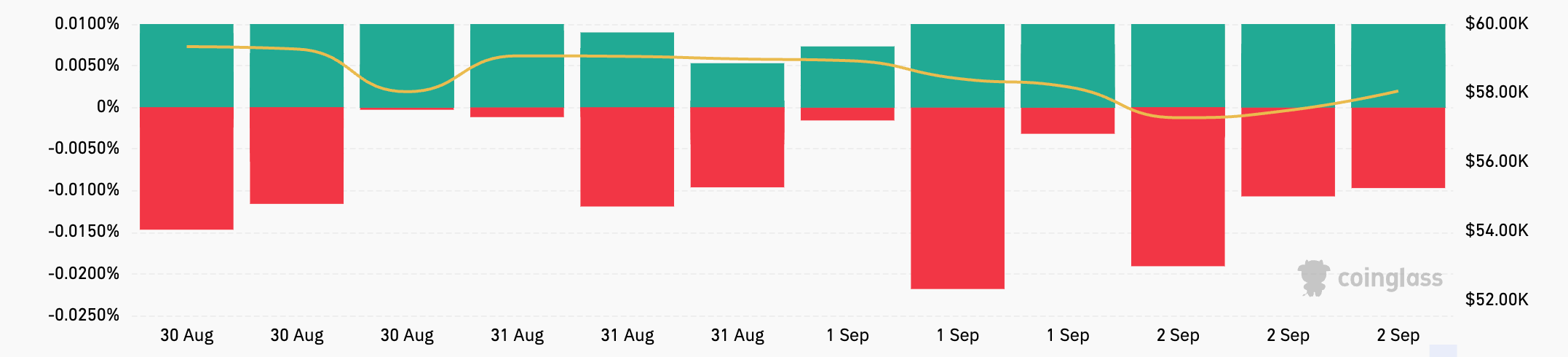

The funding charges for token-margined contracts throughout the identical interval have been a lot totally different. By Sep. 1, most exchanges noticed unfavourable funding charges, with Bybit and OKX dropping to -0.0096% and -0.0044%, respectively. On Sep. 2, the divergence turned extra pronounced, with Bybit’s charge falling to -0.0191%, suggesting intense bearish strain, whereas HTX noticed a big soar to 0.0100%, indicating a pointy reversal in sentiment on that platform.

This disparity in funding charges between USDT/USD-margined and token-margined contracts exhibits how merchants in these markets behave in a different way.

USDT and USD-margined contracts, settled in stablecoins and fiat, are typically most well-liked by merchants who need to keep away from publicity to Bitcoin’s worth volatility when settling income and losses. These contracts are in style amongst retail merchants and those that use leverage to take directional bets on Bitcoin’s worth motion with out affecting their underlying Bitcoin holdings.

Alternatively, token-margined contracts are settled in BTC or different cryptocurrencies, making them extra interesting to merchants with a long-term bullish view of Bitcoin or snug with the inherent danger of further volatility. These contracts are sometimes utilized by extra subtle merchants or these with a long-term holding technique, as they provide the potential for extra vital beneficial properties and better dangers attributable to their publicity to Bitcoin’s worth.

The variations in funding charges between these two varieties of contracts throughout this era present the merchants’ various danger appetites and techniques. The unfavourable funding charges for token-margined contracts point out that merchants in these markets have been extra bearish or risk-averse, presumably anticipating additional Bitcoin worth declines.

In distinction, the commonly extra steady and optimistic funding charges for USDT/USD-margined contracts recommend that merchants in these markets have been both extra bullish or much less involved about short-term worth volatility.

It’s additionally vital to research these modifications in funding charges alongside Bitcoin worth fluctuations. Through the weekend, Bitcoin’s worth declined from $58,970 to $57,570 — a comparatively modest drop within the context of Bitcoin’s historic volatility. Nonetheless, the sharp swings in funding charges, notably the unfavourable shifts on Binance and Bybit for USDT/USD-margined contracts and the acute negativity in token-margined contracts, recommend that merchants have been more and more positioning for additional draw back danger.

The general decline within the volume-weighted funding charge from 0.0050% on Aug. 31 to -0.0017% on Sep. 2 exhibits how sharp this shift in sentiment was, as merchants more and more took brief positions or decreased their publicity to lengthy positions.

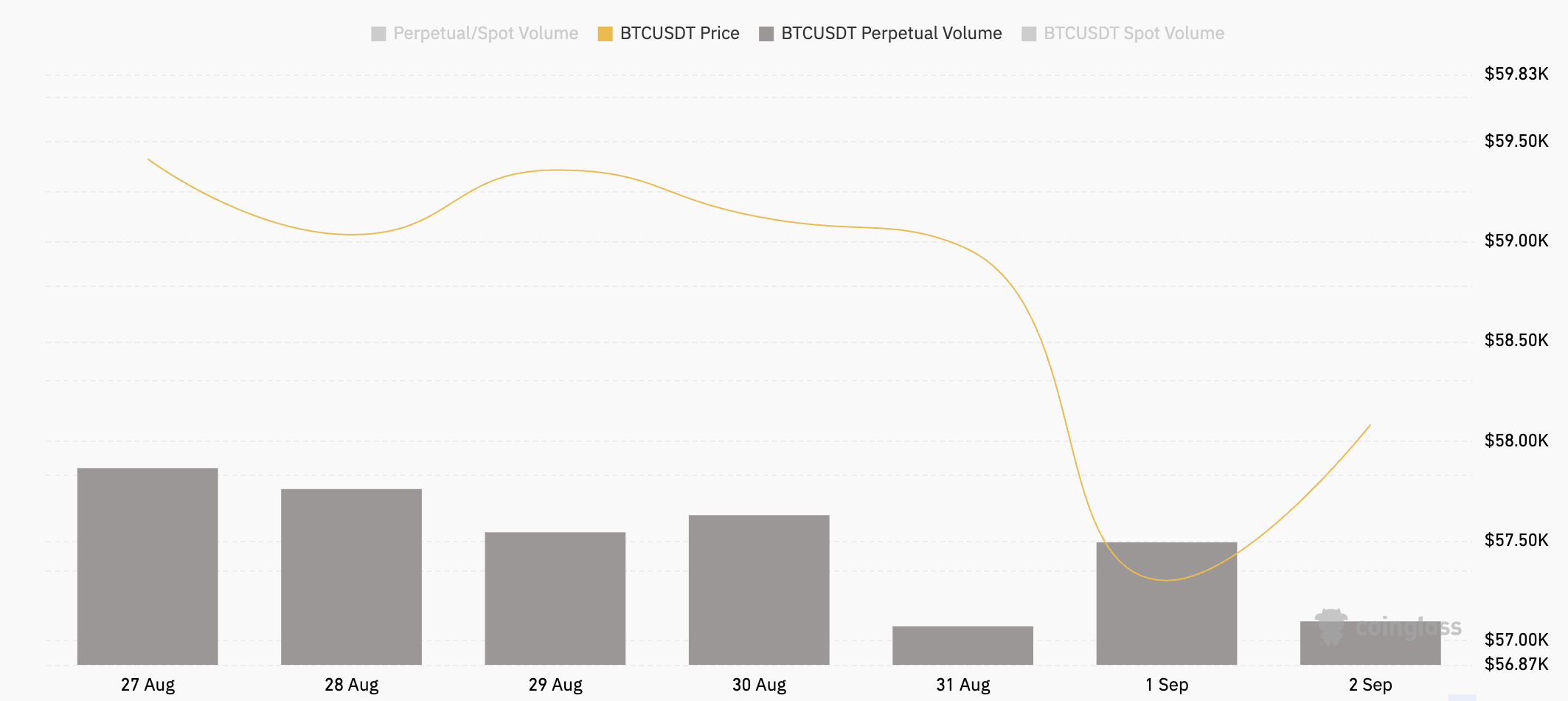

Perpetual futures buying and selling quantity additionally fluctuated considerably all through the weekend, seeing a pointy drop on Aug. 31 and Sep. 2, contrasted with larger volumes on Sep. 1. This implies that merchants have been both taking income or chopping losses amid market uncertainty, resulting in a decline in OI and buying and selling exercise because the funding charges started to shift.

The publish Bitcoin funding charge volatility exhibits market-wide warning appeared first on StarCrypto.