- Sei’s buying and selling knowledge reveals an increase in quantity however declining open curiosity, indicating conflicting market alerts.

- Pyth Community’s latest lengthy positions counsel a possible bullish shift, although combined alerts warn of sudden reversals.

- Sui’s market reveals bullish dealer preferences, however heavy lengthy liquidations point out ongoing volatility and market stress.

Sei, Pyth Community, Sui, Starknet, and JasmyCoin have all seen their costs fall, mirroring the broader market’s turbulence. Nevertheless, derivatives buying and selling knowledge paints a extra intricate image, with every token showcasing its personal market conduct.

Sei is presently priced at $0.284697, with a 24-hour buying and selling quantity of $115,018,784. It has declined 11.81% within the final 24 hours, with a market cap of $939,500,407. The circulating provide stands at 3.3 billion SEI cash.

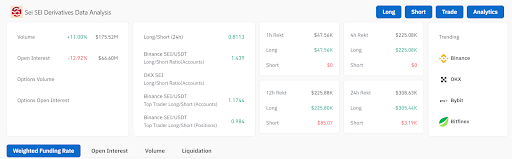

Derivatives knowledge reveals buying and selling quantity has climbed 11% to $175.52M, however open curiosity has fallen 12.92% to $66.60M. An extended/brief ratio of 0.8113 suggests extra brief positions are open. Nevertheless, latest buying and selling knowledge reveals sturdy lengthy positions, with $305.44K lengthy versus $3.19K brief within the final 24 hours.

High merchants on Binance …

The submit Worth Motion and Derivatives Insights for SEI, PYTH, SUI, STRK, JASMY appeared first on Coin Version.