- The Chang onerous fork might see Cardano’s worth beneath neighborhood management rise from $600 million to $10 billion.

- Cardano’s onerous fork represents a paradigm shift, probably attracting new builders and buyers to its ecosystem.

- Market tendencies for ADA present cautious optimism, with blended sentiment and a latest 2.25% worth enhance.

Cardano’s (ADA) Chang onerous fork, arriving on September 1st, guarantees a shift of their blockchain governance, as per Dan Gambardello’s latest put up on X platform. This improve has the potential to redefine Cardano’s place inside the crypto area. Right here’s the important thing takeaway: over $600 million price of ADA (based mostly on at the moment’s worth) will probably be positioned totally beneath neighborhood management.

This determine might balloon to $5 billion and even $10 billion as ADA’s worth will increase, signaling a brand new period of decentralization. Cardano, usually seen as a darkish horse within the crypto world, has constantly held its floor among the many prime ten cryptocurrencies.

The Chang onerous fork isn’t just a technical improve; it represents a shift in Cardano’s governance. This improvement might entice extra builders, customers, and buyers to the Cardano ecosystem, positioning it as a number one community-driven blockchain.

Trying past the onerous fork’s implications, Cardano’s present market efficiency reveals constructive tendencies. The value of ADA is $0.358232, with a 24-hour buying and selling quantity of $246,618,162. It has risen by 2.25% within the final 24 hours and a market cap of $12.88 billion. The circulating provide stands at 35,960,643,044 ADA cash, with a most provide of 45 billion ADA cash.

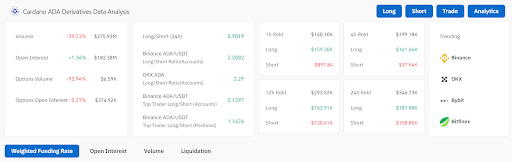

The derivatives market paints a blended image for Cardano. The buying and selling quantity dropped by 39.23%, reaching $275.93 million, reflecting cautious buying and selling exercise. In the meantime, open curiosity rose barely by 1.34% to $182.38 million, suggesting that extra positions are being held regardless of decrease buying and selling exercise.

Choices buying and selling has witnessed a big decline of 92.94%, pointing in direction of a lower in speculative curiosity. Nonetheless, lengthy/quick ratios on main exchanges like Binance and OKX reveal a bullish bias, with extra lengthy positions held by accounts and prime merchants. Nonetheless, greater lengthy liquidations in several time frames point out cautious conduct.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.