In line with CoinShares’ newest weekly fund movement report, crypto funding merchandise noticed their largest inflows in 5 weeks, with $533 million pouring into the sector.

James Butterfill, head of analysis at CoinShares, defined that these inflows adopted remarks by US Federal Reserve Chair Jerome Powell on the Jackson Gap Symposium final week.

On the occasion, Powell hinted that the market would possibly anticipate rate of interest cuts in September, which many market observers recommended had been bullish for Bitcoin and different crypto.

This assertion additionally appeared to have boosted buying and selling volumes, with final week’s quantity reaching $9 billion, considerably greater than in earlier weeks.

Bitcoin, US lead

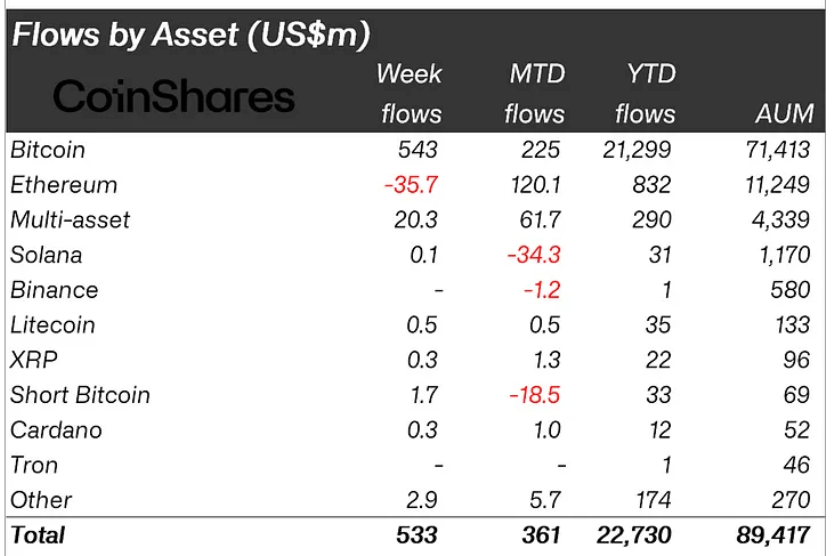

Bitcoin dominated the inflows, with $543 million, most of which occurred on Friday after Powell’s dovish feedback. Butterfill said that this additional indicated Bitcoin’s sensitivity to rate of interest expectations.

Curiously, the bullish sentiment additionally attracted quick trades, with $1.7 million flowing into Quick BTC merchandise.

Conversely, Ethereum confronted outflows totaling $36 million final week. This can be as a result of continued buyers’ exit from Grayscale’s Ethereum Belief. Butterfill wrote:

“Though new issuers proceed to see inflows with the Grayscale Ethereum belief offsetting this with $118 million outflows.”

Regardless of this, the newly launched Ethereum ETFs within the US have collected $3.1 billion in inflows, which partially offsets the $2.5 billion outflow from the Grayscale Belief.

In the meantime, blockchain equities recorded inflows for the third consecutive week, totaling $4.8 million. Different digital property like Solana, XRP, and Litecoin noticed mixed inflows of round $1 million.

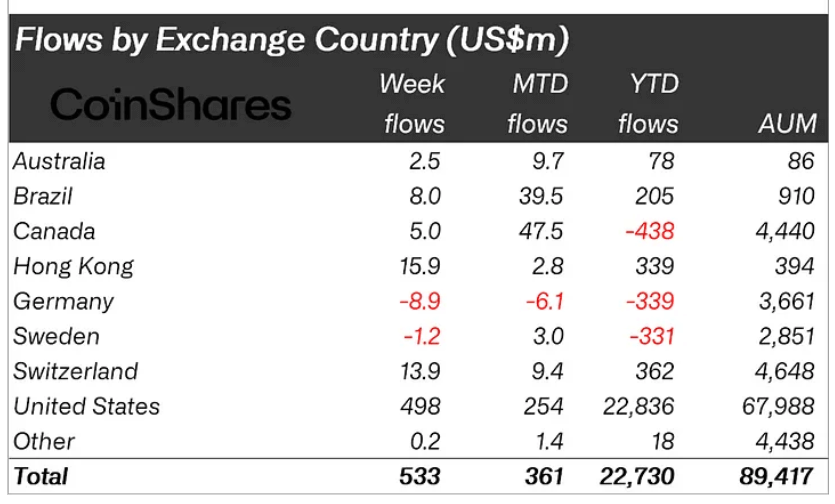

Throughout areas, america unsurprisingly accounted for almost all of the entire inflows, with $498 million. Hong Kong and Switzerland additionally noticed important inflows, reaching $16 million and $14 million, respectively.

In distinction, Germany skilled minor outflows totaling $9 million, making it one of many few international locations with a year-to-date web outflow.