- XRP’s current value improve displays robust market confidence and vital investor curiosity.

- The XRPL Testnet reset goals to spice up effectivity and decrease operational prices for working Testnet nodes.

- Elevated buying and selling quantity and bullish technical indicators counsel potential for additional XRP value progress.

Ripple has efficiently reset the XRPL Testnet to reinforce community efficiency and cut back operational prices. Concurrently, XRP’s value has jumped over 5% up to now 24 hours, signaling elevated investor confidence.

The Testnet reset cleared all DEX content material, accounts, balances, and settings. This transfer goals to streamline the testing surroundings and make it more cost effective to run a Testnet node. XRP’s value surge, in the meantime, Concurrently, XRP exhibited a noteworthy improve in its value over the previous 24 hours, reflecting a broader development of rising investor confidence and heightened market exercise.

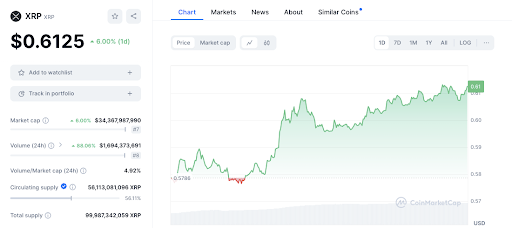

At press time, the value of XRP is $0.6109 indicating a outstanding 5.60% improve from the day past. This upward motion began from a low of $0.5785. Despite the fact that the cryptocurrency dipped briefly, it shortly recovered and continued its climb to the present stage. This volatility highlights XRP’s resilience and the market’s constructive outlook on it.

The current value motion has highlighted essential help and resistance ranges that merchants ought to watch intently. The $0.5785 stage emerged as a major help base early within the buying and selling session, providing stability earlier than the value moved greater. Moreover, the $0.6000 mark acted as a psychological help stage, the place the value consolidated earlier than breaking by means of to new highs.

On the resistance entrance, the $0.6200 stage has confirmed to be a key barrier. XRP briefly approached this resistance stage, which held agency earlier than the value tried to rise additional. A breakthrough above this stage might sign sustained upward momentum. Moreover, the $0.6150 to $0.6200 vary represents one other resistance zone, marking the higher bounds of the current buying and selling vary.

Together with the value rise there’s the buying and selling quantity which has gone up even greater by 92.43% over the previous 24 hours. The rise in buying and selling quantity signifies a powerful patrons’ sentiment and lively market participation, which if sustained ought to maybe contribute to the continuation of the upward trajectory within the XRP’s value.

Technical indicators supply further insights into XRP’s potential future actions. The 1-week Relative Power Index (RSI) at the moment reads 56.94, suggesting a impartial place when it comes to relative power.

Which means that XRP is neither overbought nor oversold, however quite is prepared for potential motion relying on market dynamics. Additionally, the 1-week Shifting Common Convergence Divergence (MACD) buying and selling above the sign line suggests potential short-term upward momentum.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not liable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.