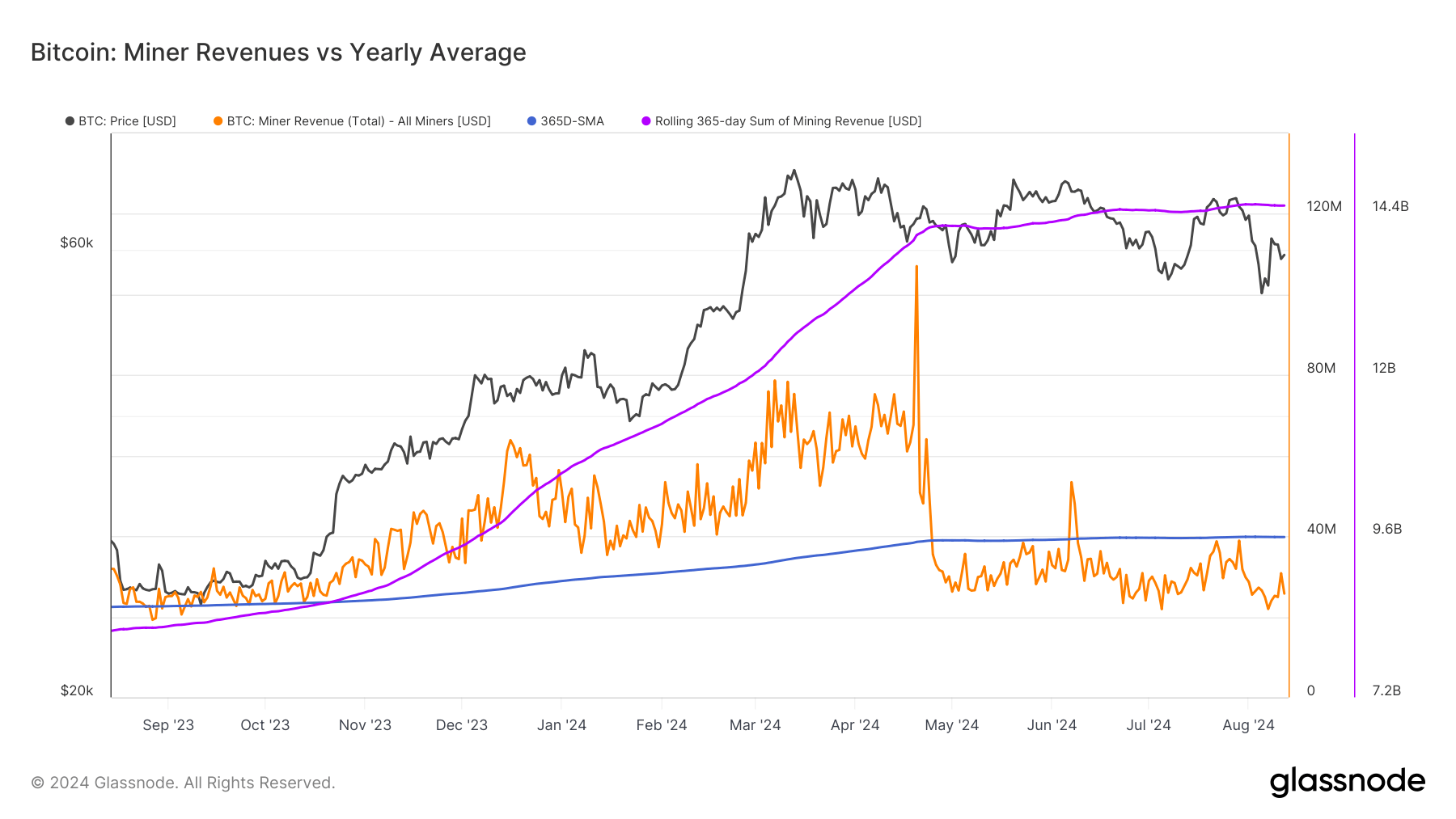

Miner revenues function a barometer for the general state of the Bitcoin ecosystem, reflecting the fragile steadiness between mining prices, Bitcoin value, and community issue. Since Apr. 24, miner income has persistently been under its 365-day easy shifting common (SMA), with solely two transient exceptions in early June.

This extended interval of below-average income culminated on Aug. 7, when miner income plummeted to its lowest degree since September 2023. Whereas this sustained downturn might be attributed to a number of elements, final week’s drop resulted from a major drop in Bitcoin’s value.

Bitcoin noticed important volatility in August, dropping from $65,360 at the start of the month to under $50,000 on Aug. 5 earlier than partially recovering to $54,000 inside 24 hours. Important value fluctuations like this immediately impression miner income, because the USD worth of every mined Bitcoin decreases with the worth.

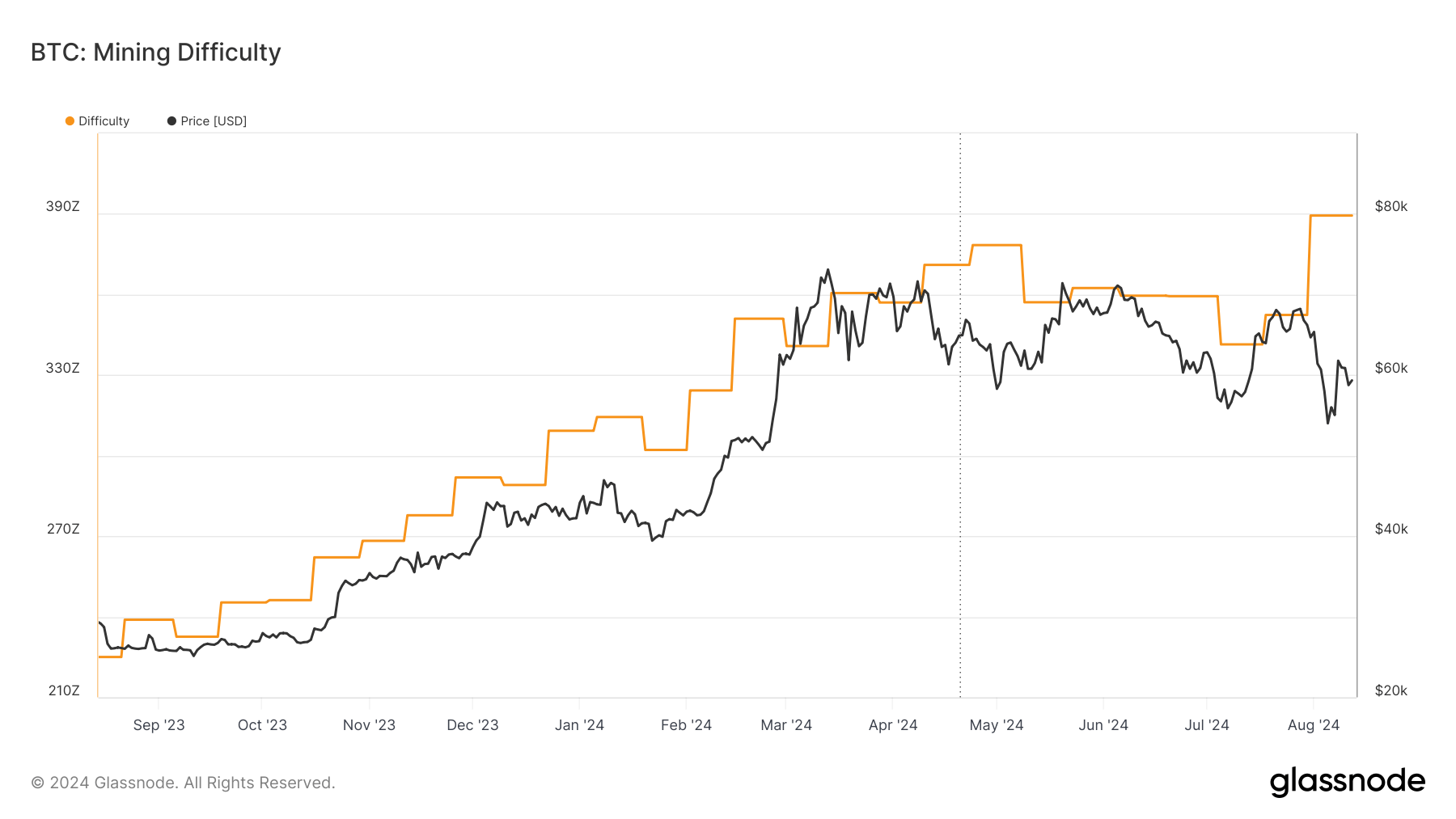

Bitcoin mining issue has additionally been growing this month, requiring extra computational energy to mine every Bitcoin and additional squeezing revenue margins.

This short-term volatility is a part of a long-term development that started with Bitcoin’s halving in April. The halving decreased the block reward from 6.25 BTC to three.125 BTC, halving the variety of new Bitcoins getting into circulation. This structural change has impacted miner revenues and profitability, forcing the trade to adapt to a brand new financial actuality whereas juggling short-term volatility.

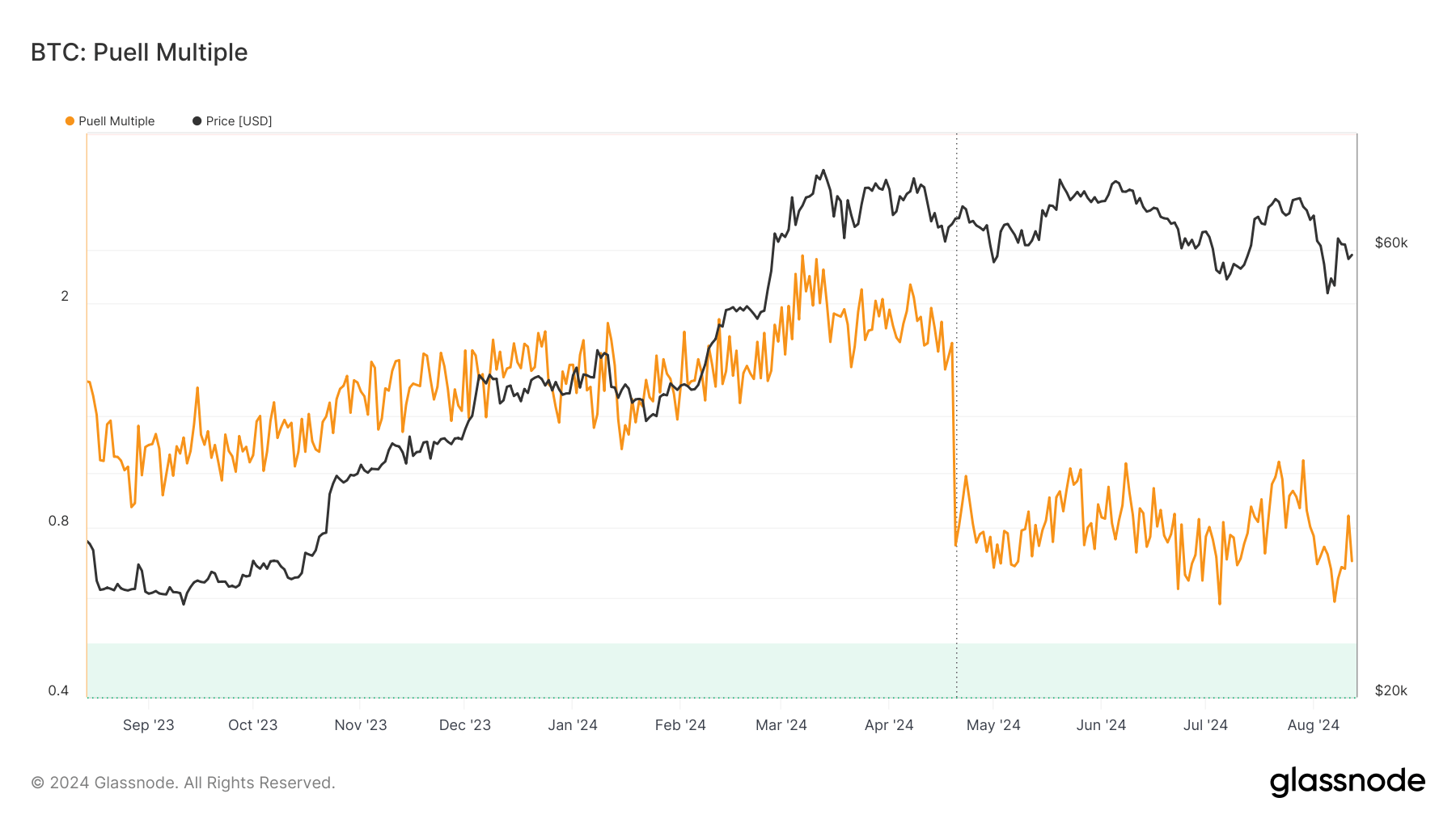

To raised perceive the implications of those adjustments, we will flip to the Puell A number of, a useful metric for assessing miner profitability and market situations. The Puell A number of is calculated by dividing the day by day issuance worth of bitcoins (in USD) by the 365-day shifting common of day by day issuance worth. This metric helps establish durations of miner stress and potential market turning factors.

On Aug. 5, the Puell A number of dropped to 0.5910, its lowest degree since Jan. 3, 2023. This sharp decline from 1.0525 on Jul. 29 signifies that the day by day issuance worth fell considerably under the yearly common. An much more dramatic drop occurred instantly after the halving, with the a number of plummeting from 1.6999 on Apr. 19 to 0.7441 on Apr. 20.

Traditionally, a Puell A number of under 0.5 has signaled market bottoms and introduced engaging shopping for alternatives for traders. The present worth of 0.7, whereas not but under this threshold, means that miners are beneath appreciable strain and that the market may need approached a backside. Nevertheless, it’s essential to notice that the latest halving occasion has essentially altered the issuance, doubtlessly affecting how we interpret the Puell A number of within the close to time period.

The mix of below-average income and a low Puell A number of reveals important stress within the Bitcoin mining trade. Miners are presently incomes much less USD per Bitcoin mined, pushing much less environment friendly operations in the direction of the brink of unprofitability. The decreased rewards post-halving have intensified competitors amongst miners for the accessible Bitcoin, resulting in elevated hash charges and mining issue.

If these situations persist, the market might even see one other capitulation occasion, the place miners are pressured to promote a big a part of their reserves or shut down operations altogether. This situation may improve market volatility as miners liquidate holdings to cowl operational prices. Nevertheless, it might additionally drive effectivity enhancements throughout the trade as miners search cheaper power sources and improve to extra environment friendly {hardware}.

From a market perspective, the present state of miner revenues and the Puell A number of carries a number of implications. as famous, durations of miner stress and low Puell Multiples have usually signaled a superb shopping for alternative for long-term traders. Moreover, miners working at or close to breakeven ranges could also be much less inclined to promote their Bitcoin holdings, doubtlessly decreasing general market provide and supporting costs.

The stress on the mining ecosystem may result in a extra environment friendly and resilient trade in the long run, a development we’ve already begun seeing amongst giant, public miners. As much less environment friendly operations are pressured out of the market, those who stay will probably be higher outfitted to climate future market fluctuations.

The submit Puell A number of drops as miner revenues hit 10-month low appeared first on StarCrypto.