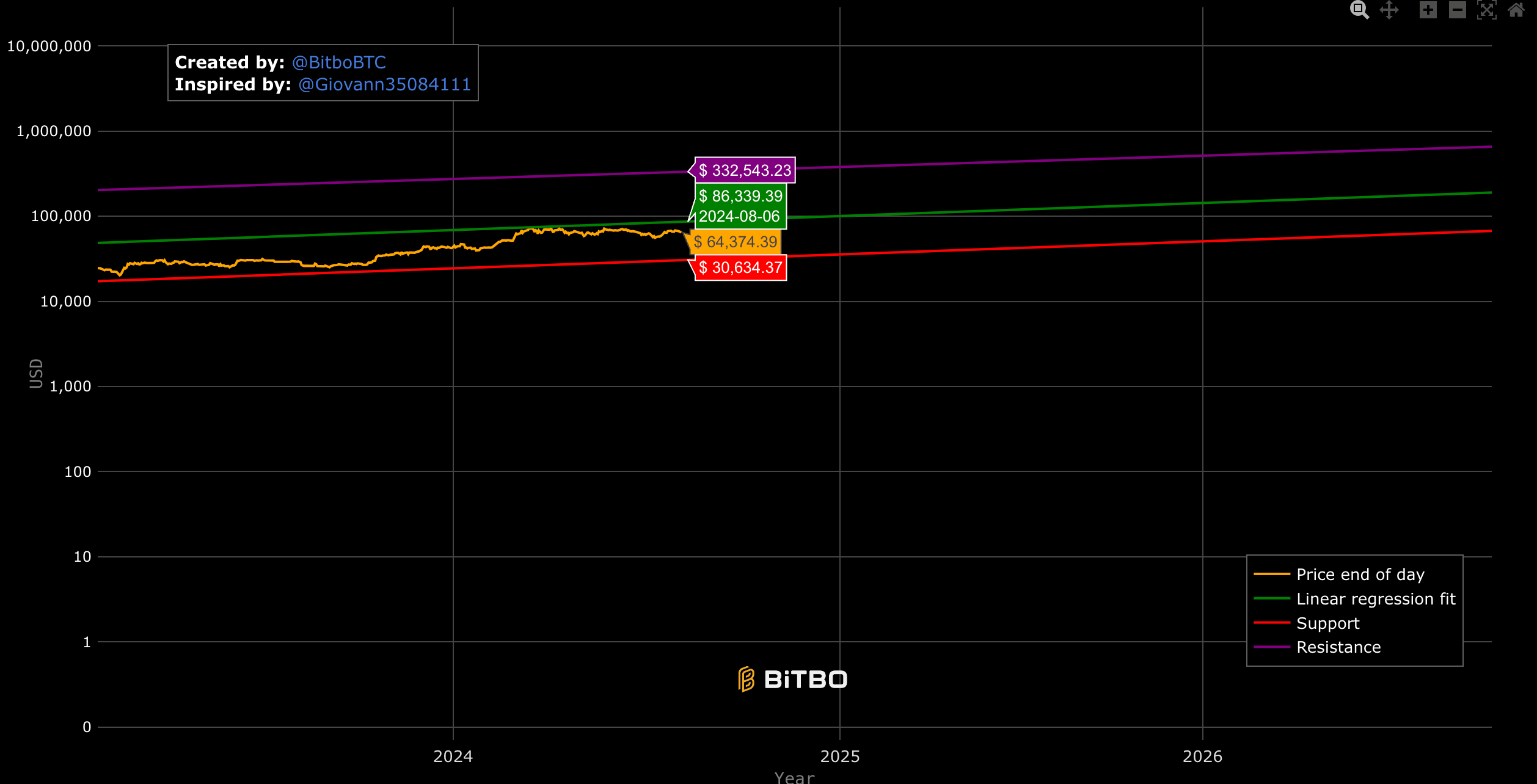

Giovanni Santostasi’s Bitcoin Energy Legislation mannequin suggests Bitcoin’s worth won’t fall beneath $30,000 once more, indicating a flooring for future valuations. The mannequin exhibits Bitcoin’s worth trajectory will proceed to rise, with its present ‘truthful worth’ at $86,339 and potential ceiling at $332,543.

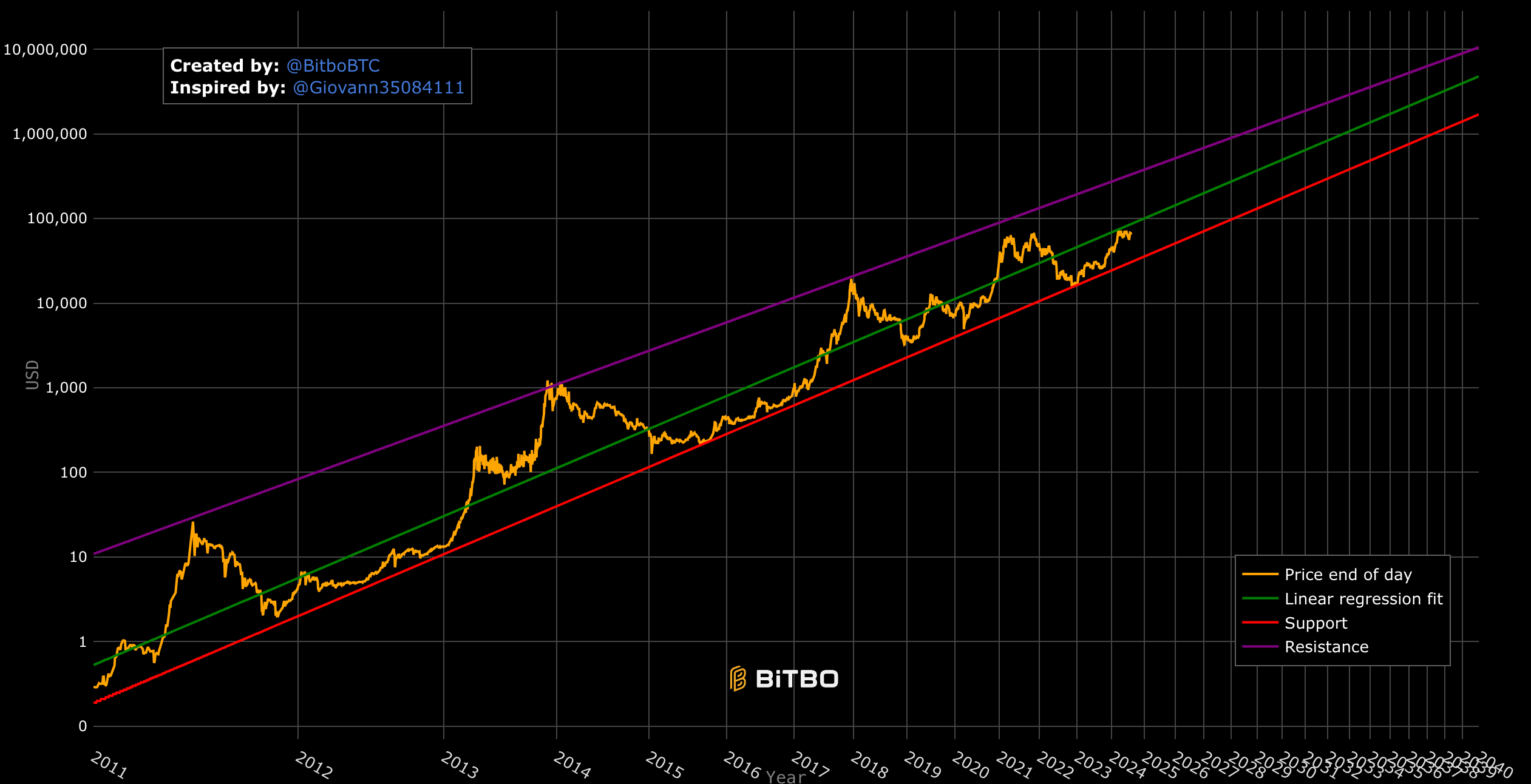

As depicted within the charts from Bitbo, the mannequin makes use of linear regression to ascertain assist and resistance bands, which have traditionally contained Bitcoin’s worth actions. The assist band, derived from previous worth knowledge, suggests a decrease boundary that Bitcoin’s worth shouldn’t breach, whereas the resistance band signifies an higher boundary.

The mannequin predicts that Bitcoin ought to attain $100,000 per coin earlier than 2028 and won’t drop beneath this worth after 2028. Moreover, it forecasts that Bitcoin may hit $1,000,000 between 2028 and 2037 and keep this degree thereafter.

The mannequin’s basis lies within the energy regulation distribution, a statistical relationship the place one amount varies as the ability of one other. This distribution has been noticed in numerous pure phenomena and monetary markets, offering a sturdy framework for long-term worth predictions. The facility-law mannequin’s utility to Bitcoin suggests a constant upward development, aligning with the asset’s historic efficiency regardless of its volatility.

Critics of the mannequin argue that it depends closely on historic knowledge, which can not account for future market forces or unexpected occasions. They warning that whereas the mannequin gives a structured strategy to understanding Bitcoin’s worth actions, it shouldn’t be taken as an absolute predictor of future costs. Nonetheless, the Energy Legislation mannequin affords a compelling perspective on Bitcoin’s potential development, reinforcing the assumption amongst some analysts that Bitcoin’s worth will proceed to rise over the long run.

In contrast to the Inventory-to-Stream mannequin, the Energy Legislation has by no means been invalidated. If this continues, the truthful worth on the subsequent halving needs to be round $290,000 in 2028.