Crypto funding merchandise noticed their third straight week of inflows final week, reaching $1.35 billion. This has pushed the entire inflows for July to surpass $3 billion, in line with CoinShares’ newest weekly report.

Notably, ETP buying and selling volumes additionally rose considerably final week, rising by 45% week-on-week to $12.9 billion. Nonetheless, this important quantity solely accounts for 22% of the general crypto market quantity.

Optimistic sentiments

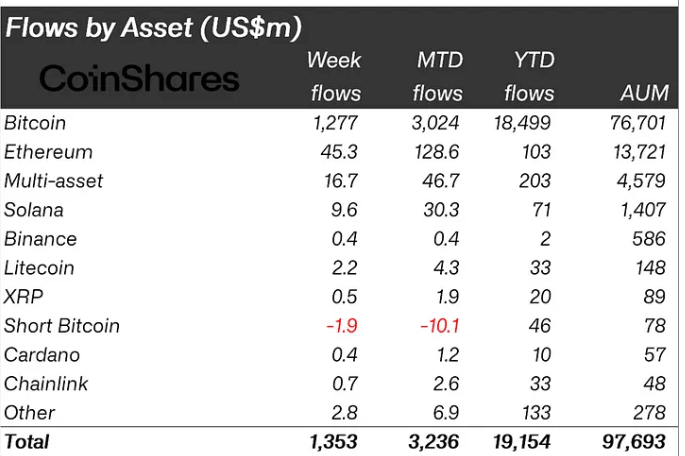

Bitcoin-related merchandise led the inflows, contributing 95% of the entire with $1.27 billion. The flows have been dominated by BlackRock’s IBIT and Constancy’s FBTC, whose BTC ETFs noticed practically $1 billion in inflows final week.

Conversely, short-bitcoin ETPs noticed outflows of $1.9 million, bringing complete outflows since March to $44 million, representing 56% of property underneath administration (AuM).

James Butterfill, head of analysis at CoinShares, defined that this pattern signifies the enduring optimistic investor sentiment since Bitcoin accomplished its halving occasion in April.

Ethereum-related merchandise additionally noticed optimistic motion, with $45 million in inflows final week. This introduced its year-to-date (YTD) inflows to $103 million, overtaking Solana.

The rise in Ethereum inflows is linked to the anticipated launch of its spot exchange-traded funds (ETFs). Final week, the Chicago Board Choices Alternate (Cboe) introduced that 5 merchandise—21Shares’ CETH, Constancy’s FETH, Franklin Templeton’s EZET, Invesco’s QETH, and VanEck’s ETHV—will begin buying and selling on July 23, pending regulatory approval.

Solana noticed $9.6 million in inflows final week however lags behind Ethereum with $71 million YTD. Litecoin was the one different altcoin with over $1 million in inflows, recording $2.2 million final week. Chainlink, Cardano, and Binance collectively noticed $1.5 million in inflows.

Butterfill added that blockchain equities confronted outflows of $8.5 million final week regardless of most ETFs outperforming world fairness indices.

Regionally, the US and Switzerland had important inflows of $1.3 billion and $66 million, respectively. In distinction, Brazil and Hong Kong skilled minor outflows of $5.2 million and $1.9 million, respectively.