The next is a visitor publish from Shane Neagle, Editor In Chief from The Tokenist.

Half a 12 months after Bitcoin ETFs launched, it’s secure to say that they’ve been probably the most profitable ETF launch in historical past, having generated a $309.53 billion quantity. Simply throughout the first day of buying and selling, spot-traded Bitcoin ETFs pulled in $4 billion, crushing the earlier report holder, Gold ETF (GLD), which took 3 days to prime $1 billion in inflows.

That is all of the extra spectacular as Bitcoin is a novel asset in comparison with historic gold. The pattern clearly factors to Bitcoin being more healthy for objective within the digital age. However what’s that objective?

BlackRock’s Head of Thematic & Lively ETFs, Jay Jacobs, just lately famous that Bitcoin is a “potential hedge in opposition to geopolitical and financial dangers”. By now, most individuals are conscious that central banks’ means to tamper with the cash provide brings many ethical hazards, from record-breaking budgetary deficits to inflation as an additional layer of taxation to cowl these wild spending sprees.

Gold is much less suited to counter that means as a result of it’s bodily, confiscatable, and never actually restricted. As a result of Bitcoin is one-tenth the scale of the gold market, its value is extra risky, however it is usually a extra enticing beneficial properties machine.

Now that Bitcoin ETFs have simplified and institutionalized entry to extra thrilling digital gold, which steps are wanted to make sure that pattern continues?

Guaranteeing Community Reliability

Owing to its proof-of-work (PoW) consensus mechanism, Bitcoin is dual-natured. It’s a digital asset anchored into the bodily actuality of vitality and {hardware}. This underlying basis offers Bitcoin its worth as a decentralized counter to central banking.

In flip, the elements of that basis, the Bitcoin community, must scale as much as proceed the institutional consumption. Presently, the Bitcoin community handles round 412k transactions per day, almost double from two years in the past. Though the median transaction charge oscillates relying on community load, it not often exceeds $5 per transaction.

In parallel, their networks must scale to make sure the Bitcoin community handles orders of magnitude higher load coming from establishments. To extend their stability and robustness, they must deal with a number of community elements, from software program and servers to {hardware} and web connection.

Scalable Blockchain Options

Simply as IBM made important contributions to growing present massive language fashions (LLM), the legacy laptop firm additionally made a robust case for blockchain scaling with IBM Blockchain. This immutable ledger is predicated on an open-source Hyperledger Material framework with a whole set of instruments for constructing blockchain platforms.

Such a framework might interface with the Bitcoin ecosystem by way of atomic swaps, similar to digital vaults with timed sensible contracts. Equally, Visa proposed an experimental Common Fee Channel (UPC) framework as a hub for blockchain community interoperability. Worldwide banking community SWIFT had already accomplished the second take a look at section for atomic settlement functionality.

Zooming out, an image emerges of enterprise-grade blockchain options for establishments, interlinking with worldwide hubs and intermediating with establishments that deal with publicity to Bitcoin, similar to Coinbase.

Reliable Servers

Powering scalable blockchain options comes within the type of {hardware}. These can both be inner servers, by way of custom-made options supplied by Broadcom, or offloaded to exterior choices just like the Canton Community.

As a decentralized infrastructure, the Canton Community is a community of networks, constructing on Daml sensible contract language and micro-services structure. The latter permits for every service plugged in to to have its personal server, expandable with extra CPUs and storage.

Utilizing atomic settlements, the Canton Community makes real-time settlement attainable throughout totally different blockchain apps. By outsourcing companies to such networks, companies and establishments can concentrate on core options moderately than IT infrastructure administration, together with the upkeep of CPUs, devoted GPU internet hosting to diversify into AI assist, and different important {hardware}.

Web Connectivity

Nodes in any blockchain community have to speak constantly to validate transactions and execute settlements by including them as the subsequent block on the blockchain ledger. In different phrases, web connectivity essentially entails redundancy and failover methods.

For instance, when Solana skilled community downtime issues, co-founder Anatoly Yakovenko employed Soar Crypto to develop Firedancer as a secondary community validator shopper to fortify community throughput and stability.

With broader options just like the Canton Community, having fun with assist from the Huge Tech and Huge Financial institution, redundancies, multi-channels, backup programs, and cargo balancing are already baked into the DLT cake.

Enhancing Community Efficiency

It’s inherent in all sorts of laptop networks to undergo from some stage of packet loss and jitter. Packet losses can occur attributable to overwhelming demand, inflicting congestion, community interference, defective software program or {hardware}, and knowledge corruption on laborious drives.

Transmission Management Protocols (TCP) cope with packet losses by retransmitting knowledge, which causes delays, or by Ahead Error Correction (FEC), which provides redundant knowledge to packets, eradicating the necessity for retransmission. The Bitcoin Relay Community makes use of FEC to this impact, as does the Blockstream Satellite tv for pc community, in its place avenue to obtain Bitcoin blockchain knowledge.

As for jitter, sure knowledge packets can arrive at totally different intervals. When this jitter occurs, packets land in several orders, disrupting knowledge stream. The jitter downside is often dealt with with buffers that briefly retailer streamed packets to make sure their appropriate order arrival.

One other technique to deal with jitter is to introduce high quality of service (QoS) community configurations that prioritize crucial site visitors. This can be utilized to scale back packet loss. Community design itself is a giant think about lowering jitter by ensuring the community has as few hops as attainable.

The Bitcoin community advantages from its decentralized design as a result of every transaction requires a number of confirmations. If jitter happens, later confirmations offset the delays. Most significantly, the Bitcoin mainnet has an auto-adjusting issue mechanism that maintains the common block time at 10 minutes.

In observe, the administration of the community’s knowledge packet loss and jitter lands on on-site vs. ISP options.

On-site vs. ISP Options

On-site options require organizations to deal with their IT infrastructure. Whereas this provides establishments whole management, together with regulatory knowledge compliance and sooner personnel response, the upfront prices for {hardware} and storage are considerably greater.

Alternatively, ISP-hosted options are simpler to scale as specialised corporations are prone to be well-oiled machines, dealing with each upkeep and community uptime. On the shoppers’ finish, this requires a dependable web connection and the choice of the most effective packet loss and jitter metrics.

Working example, Amazon Net Companies (AWS) offers shoppers a World Accelerator device to reinforce and steadiness community efficiency. Alongside Amazon Managed Blockchain and Quantum Ledger Database (QLDB), such companies propelled AWS to change into one of many infrastructure pillars of the blockchain area.

As for ISPs themselves, they’re sometimes much less forthcoming on their jitter/packet loss metrics, as they depend on a number of elements. To that finish, there are various instruments to trace community latency, packet loss and jitter, similar to PingPlotter.

Jack Dorsey’s Block (former Sq.) opted to construct its personal Bitcoin mining community, using its 3 nm chip design, possible constructed by TSMC foundries. With an in-house, open-source mining hashboard, which is suitable with Raspberry Pi controllers, Block is heading to arrange new requirements for the Bitcoin ecosystem.

The opposite piece of the Bitcoin scalability puzzle revolves round vitality.

Sustainable Power Options

It’s typically mentioned that Bitcoin is digital vitality, or higher but, tokenized vitality. Finally, Bitcoin’s proof-of-work units it aside from 1000’s of copypasta cryptocurrencies, making it nearly unassailable from a community safety standpoint. And that consensus algorithm exerts vitality, as anticipated from any work.

However how a lot and what sort of vitality? Bitcoin’s vitality expenditure is commonly in comparison with a nation’s footprint, such because the Netherlands or Argentina. It’s sufficiently excessive for Greenpeace to name for a marketing campaign to vary Bitcoin from proof-of-work to proof-of-stake.

BRÆKING: @greenpeaceusa continues its SEXIST anti-#Bitcoin marketing campaign, releasing new video about “Bitcoin BROS.”

NEWSFLASH to Greenpeace misogynists: there are WOMEN in Bitcoin, & Bitcoiners is not going to stand by when you ERASE them.

Please retweet when you suppose Greenpeace is sexist. pic.twitter.com/qX3emR8TaL

— Walker⚡️ (@WalkerAmerica) June 22, 2024

But Greenpeace itself might launch such a shift, on condition that Bitcoin’s open-source code is offered to all. The issue is that and not using a community and market curiosity, such a tweak can be meaningless.

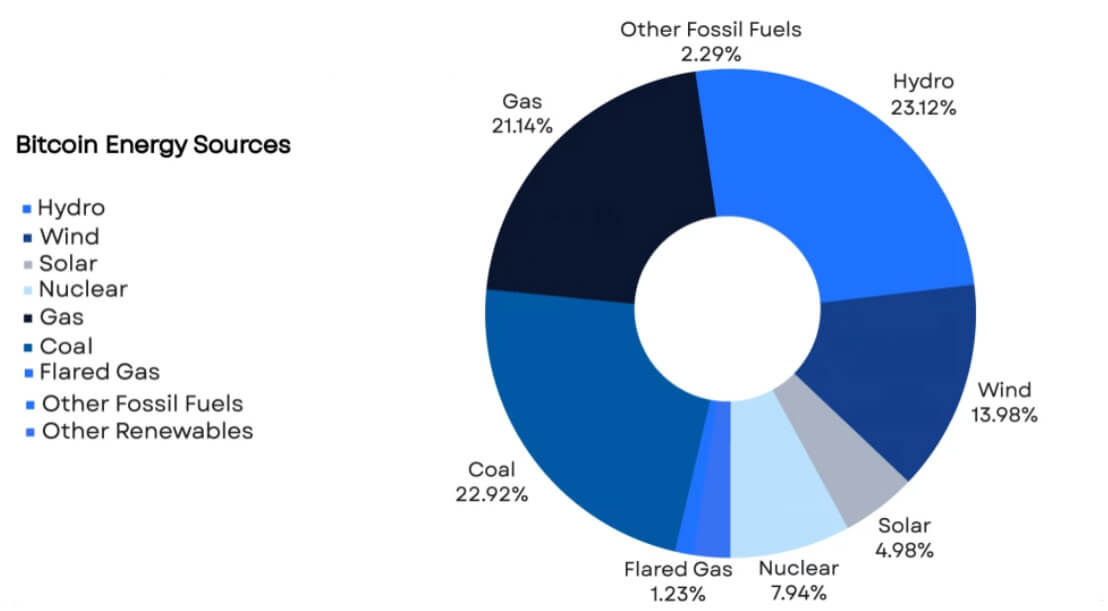

Within the meantime, over 50% of the Bitcoin community attracts energy from renewable sources. In line with Daniel Batten’s analysis by way of Batcoinz, most of it comes from hydro, wind, photo voltaic, and nuclear.

Not solely did Bitcoin step onto the majority-green territory, nevertheless it has been acknowledged as a key ingredient in balancing energy networks. Specifically, the Electrical Reliability Council of Texas (ERCOT) pays massive Bitcoin mining corporations, similar to Bitdeer and Riot Platforms, to stabilize the grid throughout anomalous situations similar to warmth waves.

As just lately as June thirteenth, ERCOT beneficial that Bitcoin mining be immediately built-in as a Controllable Load Useful resource (CLR) to spice up energy grid balancing. Moreover, there’s an rising pattern for Bitcoin miners to make use of flared fuel from oil drilling operations. In any other case wasted and burned off, this byproduct will be captured to energy Bitcoin mining rigs.

Now that BlackRock, the principle driver of the ESG framework, is pushing Bitcoin, this can be a clear sign to institutional traders that the “soiled Bitcoin” narrative is a bygone concern.

Block has but to disclose its 100% solar-powered mining facility in West Texas. Nonetheless, a number of Bitcoin mining corporations, similar to Bitfarms, Iris Power, TeraWulf, and CleanSpark, have already transitioned to near-zero carbon footprints.

With nuclear energy on the horizon attributable to AI knowledge middle calls for, traders ought to count on even higher greening of Bitcoin operations. And within the probability of Donald Trump’s victory within the subsequent presidential elections, Bitcoin sustainability issues will additional fade away.

Conclusion

In 2022, Messari famous that gold mining produces thrice as many carbon emissions as Bitcoin. Since then, Bitcoin has outperformed gold ETF capital inflows by a good higher magnitude.

It seems that there’s nice worth to be present in an asset that can’t be tampered with on a sensible stage and isn’t managed by anybody. Moderately, Bitcoin is enforced by ingenious cryptography, tethering code to {hardware} property and vitality.

With capital rattling damaged, and entry to Bitcoin publicity placed on the identical stage as some other inventory, it’s a race to new highs and new lows to purchase the dip. Constructing from the expertise of different blockchain networks and mining corporations, the tech is available to faucet into this rising ecosystem.