Monitoring and analyzing switch volumes is essential for understanding the underlying financial exercise inside the Bitcoin community. Spikes in switch volumes present heightened market participation, both from new entrants and institutional traders — often throughout bull runs — or vital transactions by current contributors — often throughout downturns.

Whereas spikes in switch volumes often come after main worth actions and aren’t good predictive instruments for worth motion, they will nonetheless be used to deduce the degrees of liquidity and potential future volatility available in the market.

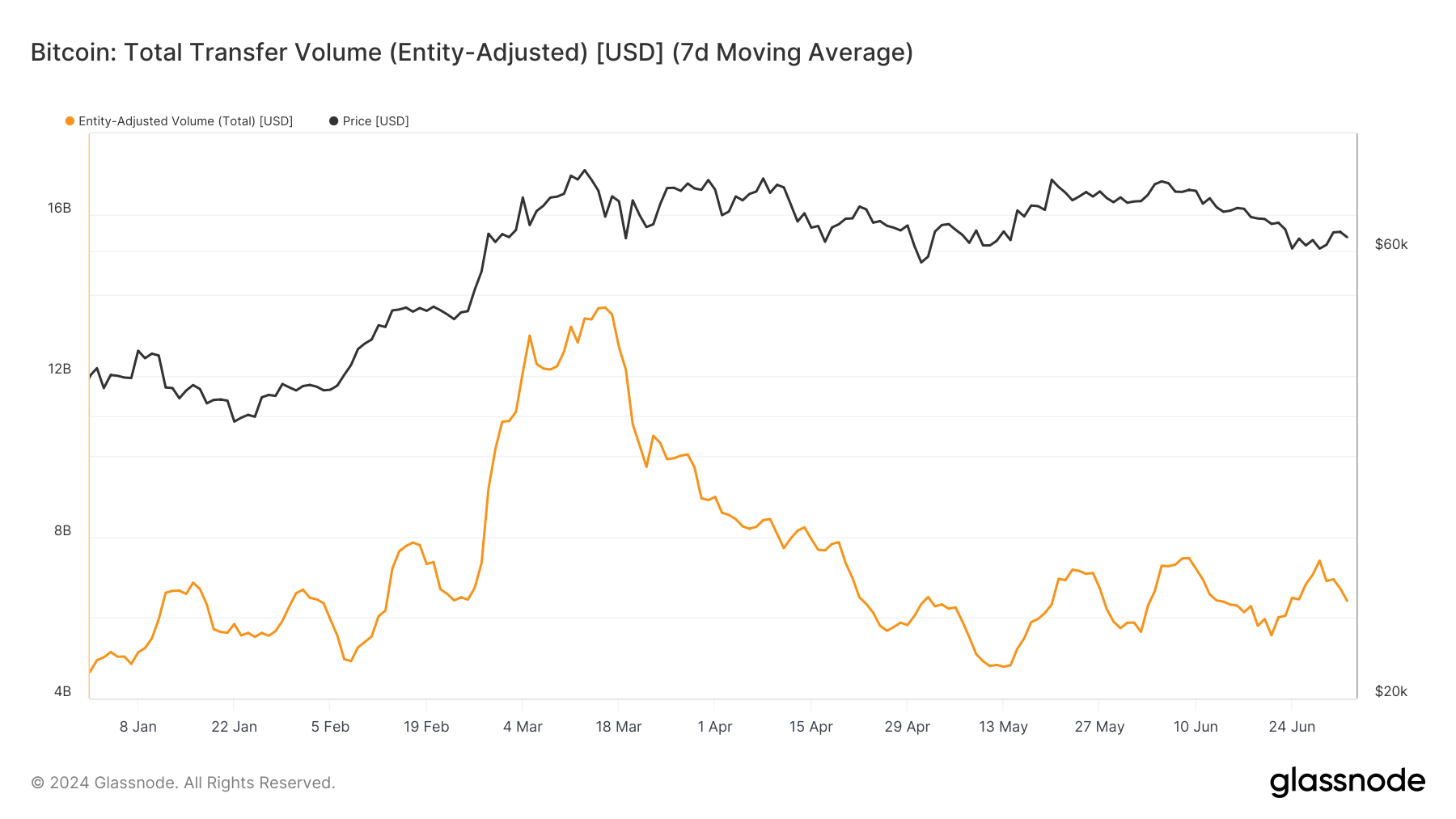

Glassnode’s entity-adjusted switch quantity reveals the precise financial exercise on the Bitcoin community by measuring the USD worth of cash moved between entities. This metric is especially helpful because it filters out inner transactions inside entities like exchanges, offering a clearer image of real market actions.

The full switch quantity on the Bitcoin community reached its all-time excessive of $13.67 billion on March 15. The ATH was reached simply two days after Bitcoin established its personal excessive of $73,104 on March 13. This reveals {that a} vital quantity of BTC was transferred between entities on the peak of market euphoria.

Nevertheless, the market failed to succeed in anyplace close to that prime since mid-March, struggling to surpass $7.5 billion since April 20. The discount in quantity reveals a cooling off from the height market exercise, which comes as Bitcoin’s worth consolidates and it struggles to interrupt away from its sideways buying and selling sample.

The comparatively secure switch quantity we’ve seen over the previous month or so reveals a market in a wait-and-see mode, the place neither robust bullish nor bearish currents dominate the amount. Bitcoin has remained sure in a variety, fluctuating between $60,000 and $65,000, seeing upward actions solely on massive regulatory or broader market actions.

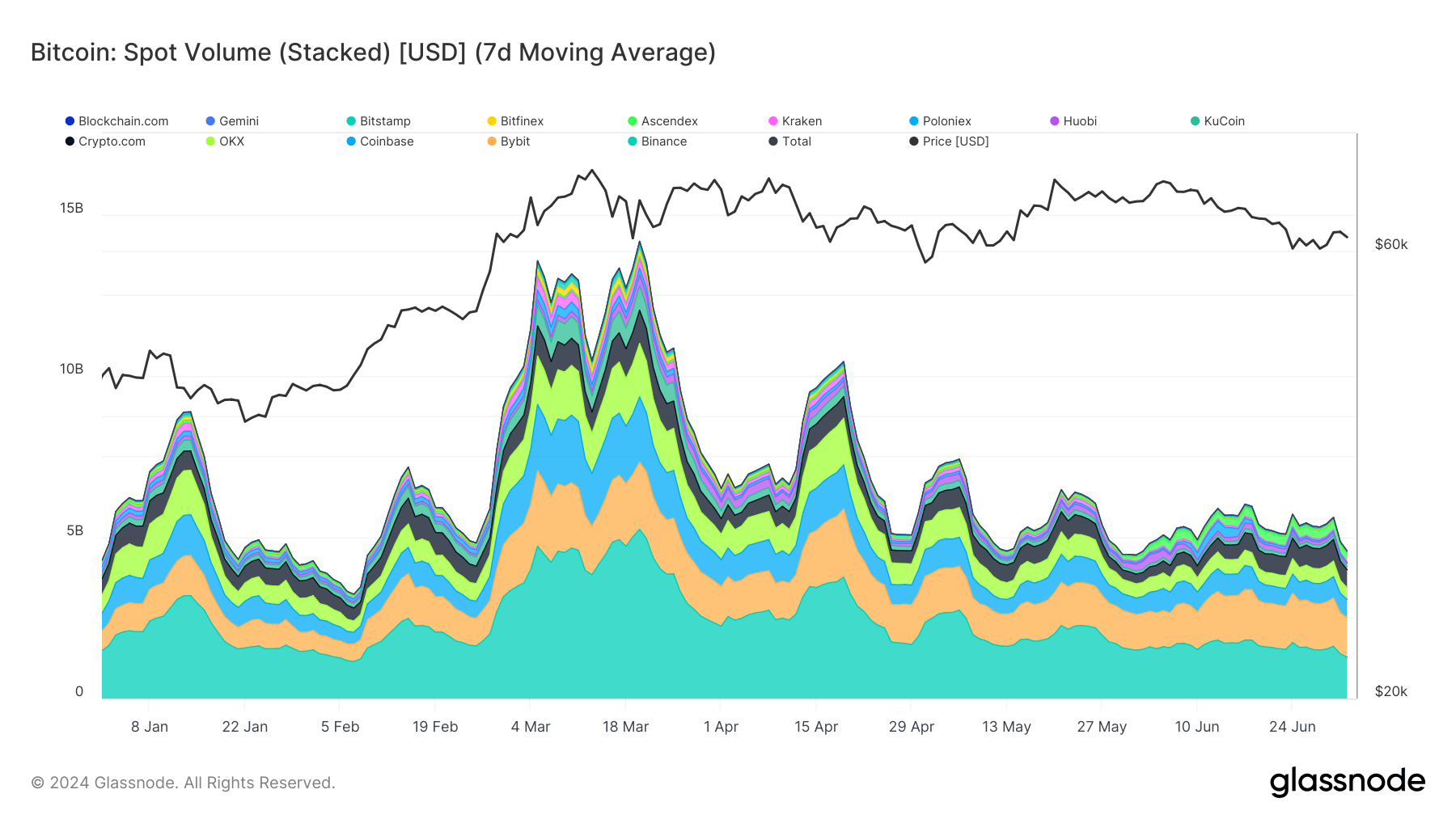

The stagnation in market exercise may also be seen by way of Bitcoin’s spot buying and selling quantity. Whereas each are important, the whole switch and spot volumes present barely totally different insights into the market. Spot quantity represents the cumulative buying and selling quantity on exchanges, reflecting the buying and selling exercise in opposition to USD-backed currencies, together with each fiat and stablecoins.

This is the reason spot quantity is extra indicative of the rapid buying and selling conduct and market liquidity on centralized exchanges moderately than the broader market. Whereas switch volumes give a way of the general motion of worth throughout the community, spot volumes present buying and selling patterns and investor sentiment within the shorter time period.

Traditionally, spot volumes are likely to peak barely later than switch volumes, as evidenced by the information exhibiting a dip in spot quantity to $10.465 on March 13 regardless of Bitcoin hitting its ATH. The yearly excessive for spot quantity was reached on March 20 at $14.156 billion, demonstrating the lag between worth and buying and selling quantity peaks.

Not like switch volumes, spot volumes are likely to peak in response to sharp worth drops, not simply upward motion, as merchants react to mitigate losses. In periods of worth stability, spot volumes have a tendency to say no. This phenomenon has been notably evident over the previous two months, the place spot volumes have remained beneath $6 billion, mirroring the shortage of considerable exercise in switch volumes.

The information reveals a definite development: market contributors develop into much less energetic as Bitcoin’s worth stabilizes inside a sure vary. This sample has develop into extra obvious previously few weeks, the place Bitcoin has traded between $60,000 and $65,000, resulting in diminished buying and selling volumes. Regardless of secure costs, the drop in spot volumes by over $1 billion because the starting of July reveals the market remains to be reluctant to interact closely with out clear directional actions.

The market is presently in consolidation, the place contributors are ready for brand spanking new elementary drivers or exterior elements to make their subsequent transfer. Earlier StarCrypto evaluation recognized related developments by way of different metrics — all pointing to a tense market that refuses to maneuver with out vital outdoors elements.

If Bitcoin stays inside its present vary, we are able to anticipate low buying and selling volumes. Nevertheless, any regulatory, political, or macroeconomic developments may flip right into a spark that ignites the market and breaks this sample.

The submit Market in wait-and-see mode as Bitcoin volumes stagnate appeared first on StarCrypto.