CoinShares’ newest weekly report highlighted a notable shift in crypto funding merchandise, with the sector experiencing its most vital outflows in three months.

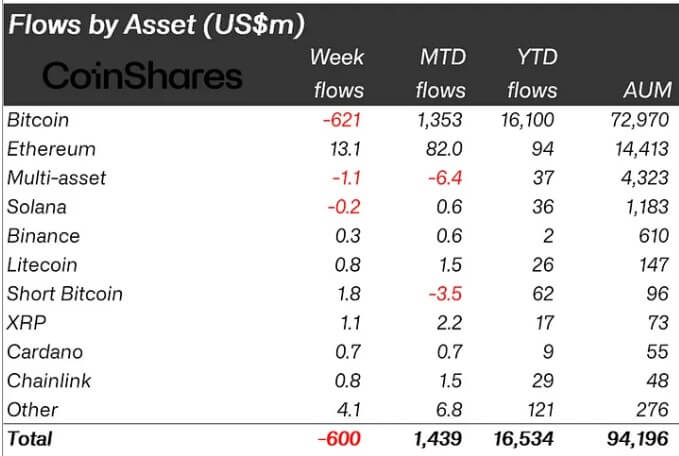

Final week, traders pulled $600 million from the market, with Bitcoin merchandise bearing the brunt, going through $621 million in outflows.

In the meantime, short-Bitcoin merchandise noticed almost $2 million in inflows, reflecting the bearish sentiment.

James Butterfill, CoinShares’ head of analysis, attributed these shifting sentiments to a “extra hawkish-than-expected FOMC assembly.” Final week, the Federal Open Market Committee of the US Federal Reserve determined to take care of the present rate of interest, which many specialists steered meant there could be just one potential charge lower this 12 months.

Butterfill defined that this transfer has pressured traders to scale back their publicity to fixed-supply property like Bitcoin. He added:

“These outflows and up to date worth sell-off noticed complete property beneath administration (AuM) fall from above $100 billion to $94 billion over the week.”

In the meantime, the bearish pattern within the US appeared to have impacted different nations. Canada, Switzerland, and Sweden noticed outflows of $15 million, $24 million, and $15 million, respectively. However, Australia, Brazil, and Germany noticed modest inflows of $1.7 million, $700,000, and $17.4 million, respectively.

Furthermore, the buying and selling quantity for crypto ETPs was $11 billion final week, considerably decrease than the $22 billion weekly common. Regardless of this, these merchandise accounted for 31% of all buying and selling volumes on main exchanges.

Inflows proceed in altcoin.

Regardless of the bearish pattern for Bitcoin, most altcoins had a constructive week, attracting important funds.

Ethereum continued its upward trajectory with an extra $13.1 million in inflows, bringing its month-to-date complete to $82 million. Its turnaround could be attributed to the extremely anticipated launch of spot Ethereum exchange-traded fund (ETF) merchandise within the US, which specialists consider would improve market accessibility for the rising trade.

In the meantime, different altcoins like Cardano and Lido attracted greater than $1 million, whereas different property like Litecoin, Chainlink, and others noticed modest flows.