Inflows into the New child 9 ETFs fell by greater than 50% throughout the previous week to $126 million from $254 million, in line with CoinShares weekly report.

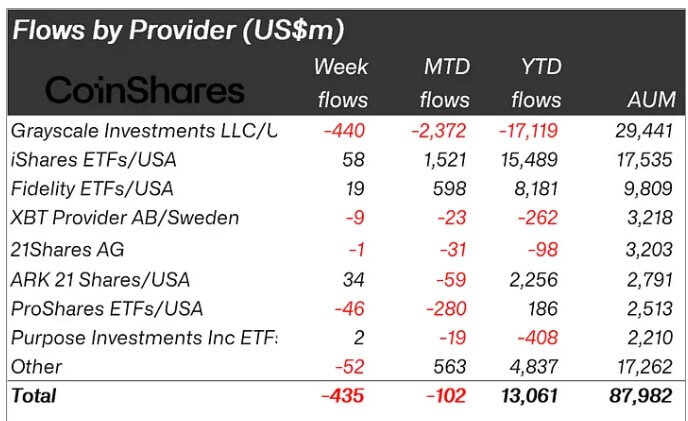

Per the report, these diminished inflows contributed to the third consecutive week’s outflow of $435 million—the most important outflow since March—that main crypto-related funding merchandise recorded throughout the week.

Grayscale lead regardless of ‘decelerating outflows’

A breakdown of the flows confirmed that Grayscale’s GBTC stays accountable for most outflows, with $440 million exiting the product final week.

Nonetheless, this marks GBTC’s lowest weekly outflow in 9 weeks and an indication that outflows have been decelerating. Nonetheless, the overall outflows from GBTC on the year-to-date metric have surpassed $17 billion.

James Butterfill, CoinShares head of analysis, added:

“Whereas Grayscale’s outflows proceed to decelerate, we’ve additionally seen a deceleration in inflows from new issuers, which noticed solely $126 million in inflows final week, in comparison with $254 million the week prior.”

The weakening inflows additionally resulted in a decline in buying and selling quantity, which fell to $11.8 billion from $18 billion.

Final week, main ETF issuers like BlackRock and Constancy recorded a number of days of zero flows. Market observers interpreted this pattern as indicative of a waning buyers’ curiosity within the asset class.

Altcoins draw curiosity

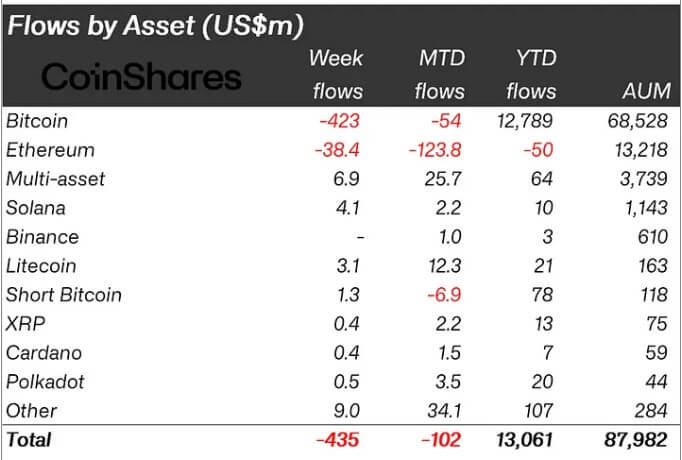

Funding merchandise associated to digital belongings like Solana, XRP, Cardano, Polkadot, and Chainlink noticed inflows final week. The CoinShares report pegged the cumulative inflows into these belongings at greater than $25 million.

However, Ethereum continued its outflow pattern, experiencing a further $38.4 million in outflows, bringing the overall for the month to $123.8 million. The year-to-date circulate is a destructive $50 million.

Remarkably, the prevailing bearish sentiments out there have attracted the bears who added $1.3 million to brief Bitcoin funding merchandise.