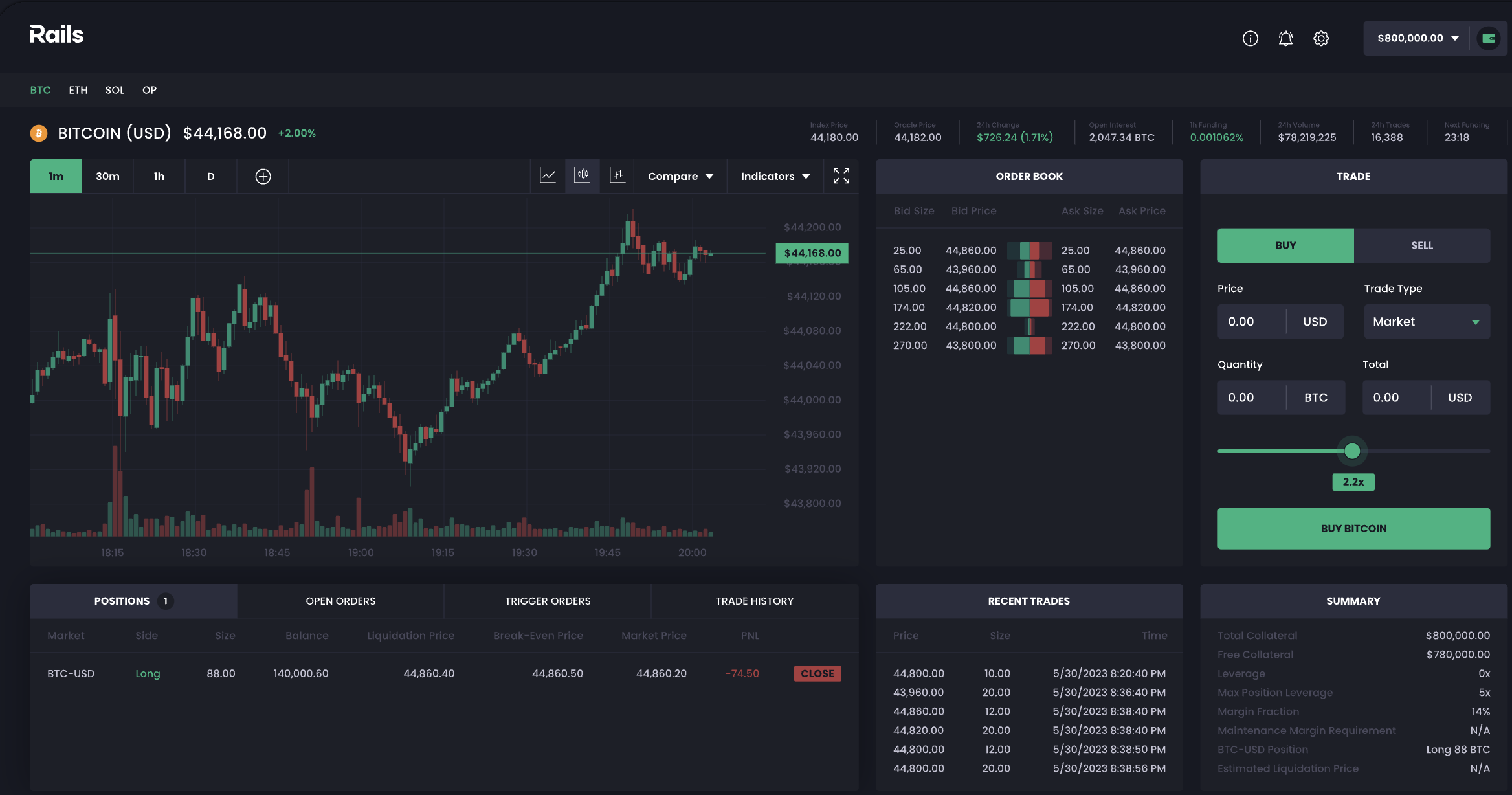

Rails, a decentralized crypto trade, has raised $6.2 million in makes an attempt to fill the void FTX left behind after crashing in 2022, the startup’s co-founder and CEO Satraj Bambra solely advised starcrypto. It’s at present within the early phases of launching an offshore service in choose crypto-friendly nations, which doesn’t embody the U.S.

The crypto neighborhood is watching Rails as a result of it’s trying to straddle the divide in crypto exchanges by constructing out each centralized and decentralized underlying expertise.

The spherical was led by Gradual Ventures with funding additionally from CMCC World, Round13 Capital and Quantstamp. The capital is earmarked for engineering group hiring and increasing its licensing and regulatory technique to make the trade “absolutely compliant,” Bambra mentioned.

Whereas FTX had a plethora of issues, particularly misusing buyer deposits, Rails highlights its buyer deposit security in addition to the crypto derivatives, or perpetual futures aspect of buying and selling; one thing that establishments have been lacking since Sam Bankman-Fried’s trade went defunct.

“There’s an enormous hole, particularly on the perpetual [futures] aspect with how establishments prefer to have publicity,” Bambra mentioned. He co-founded the corporate together with his spouse Megha Bambra and the previous COO of Grindr, Rick Marini. The husband and spouse group beforehand co-founded a startup, crypto pockets BlockEQ, that offered to crypto buying and selling platform Coinsquare for about $12 million CAD, or $8.8 million, in 2018.

Bambra shared that he’s heard from edge funds saying they need to commerce crypto, however don’t have a route to take action; Rails hopes to be that opening. Its principal clientele shall be market makers on the provision aspect and primarily institutional shoppers and high-net-worth traders on the demand aspect.

For context, perpetual futures contracts commerce relative to the spot worth. So, for instance, individuals aren’t shopping for the precise bitcoin itself however are shopping for contracts that mirror the worth by way of one other asset like stablecoin USDC. “It helps you play the course of the market in a way more risk-managed method and that’s why we’re centered on that,” Bambra mentioned.

And sometimes traders and customers alike belief banks, monetary establishments and exchanges to carry their funds, however Rails goes the self-custody route, which suggests the proprietor of the belongings has whole management over them.

Rails has already onboarded north of $10 million in capital early in a “non-public method,” earlier than it opens as much as the general public in September or This fall of this 12 months, Bambra mentioned. In Might, it should open its trade to pick beta testing recipients to start buying and selling and guarantee it’s working correctly.

Picture Credit: Rails (opens in a brand new window)

The startup’s trade isn’t obtainable within the U.S. and Bambra mentioned it’s “nonetheless zoning by way of the place it’ll be,” and could have a solution nearer to September. “Onboarding capital shall be from pleasant jurisdictions.” When requested which of them, he mentioned there have been “none he can share at the moment.”

“We simply need individuals to make use of their cash and that’s why we’ve decentralized custody,” Bambra mentioned. “It’s a wedding between central computing and decentralized custody.”

Central computing helps management threat administration, so commerce orders can have a dependable and nicely managed setting, making executions fast and quick, he added. However decentralized custody permits individuals to be the house owners of their funds, not the trade.

“It’s all centered on person expertise. Utilizing Rails, you’ll check in and enroll, however we’ll educate individuals on having funds on [crypto] wallets and learn how to withdraw,” amongst different goals.

To repair FTX’s drawback, there must be an on-chain answer, Bambra thinks. That centralized computing was one thing Rails noticed with FTX as “being actually, actually good,” however when it got here to decentralized exchanges like dYdX that exist right this moment it wasn’t as stable, Bambra thinks.

However being a hybrid of decentralized and centralized is healthier than being absolutely one aspect or one other, he added. “For individuals who haven’t traded crypto earlier than that need to, it’s tough and cumbersome. For individuals who commerce it day in and day trip, they aren’t comfy placing the scale they used to placed on decentralized exchanges.”

And customers will really feel a “centralized” expertise, with out realizing that “every part besides your cash is decentralized,” Bambra mentioned. All of the executions shall be centralized, however cash is stored in good contracts, a self-executing motion on the blockchain that requires no intermediaries, that shall be audited.

So the group goals to bridge the hole between central computing and decentralized custodying of belongings, by way of cryptography and blockchain expertise, to supply computerized visuals into what’s really being executed on the trade and with funds.

After the anticipated public launch later this 12 months, Rails desires to concentrate on increasing its social capabilities, leaderboard capabilities and create partnerships with trade gamers to increase the product. “We’re very product centered,” Bambra mentioned. “We’re not an opportunistic startup.”