There’s a misguided perception that memecoins are serving to folks out of poverty that I imagine is de facto damaging to the house. Extra so, I believe chains like Solana and Avalanche, that are seeing elevated consideration attributable to memecoin fervor, are extremely overheated. Primarily, memecoin volumes are self-importance metrics akin to likes and followers on social media platforms with no actual substance.

Anybody who works on web2 will know that the true KPIs of social media engagement lie in engagement, user-generated content material, hyperlink clicks, and gross sales conversions. Likes and followers are primarily good for little greater than self-serving egotism. In Web3, the on-chain metrics that networks must be involved with are being augmented with ‘pretend’ memecoin visitors, which can fall off the second the novelty of the shitcoin on line casino fades away.

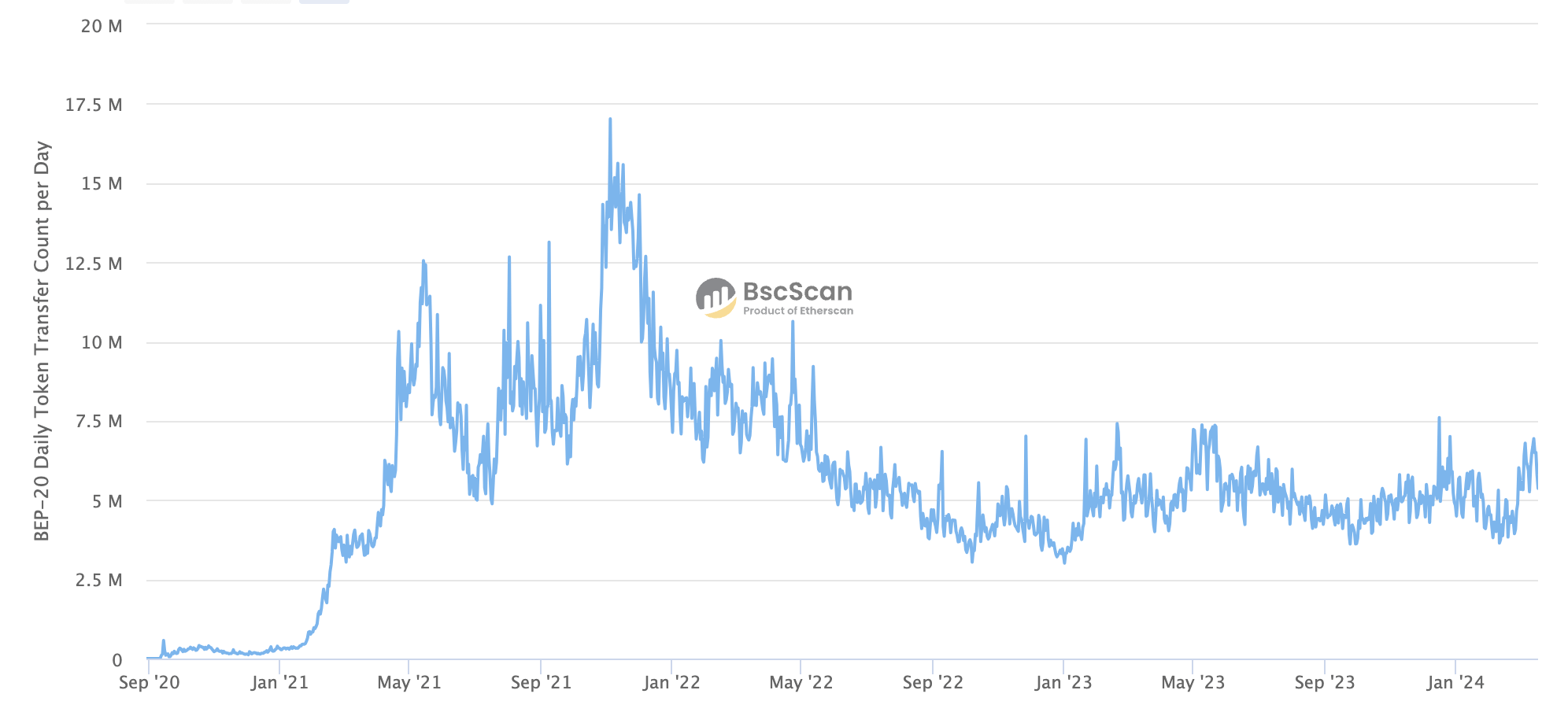

Take a look at the OG memecoin community, BNB Chain, which noticed an enormous surge in utilization in 2021 attributable to memecoin buying and selling on PancakeSwap. It reached round 17 million token transactions per day in 2021 however has since referred to as to round 5 million. Nonetheless, 5 million token transfers a day appears like a wholesome metric, proper?

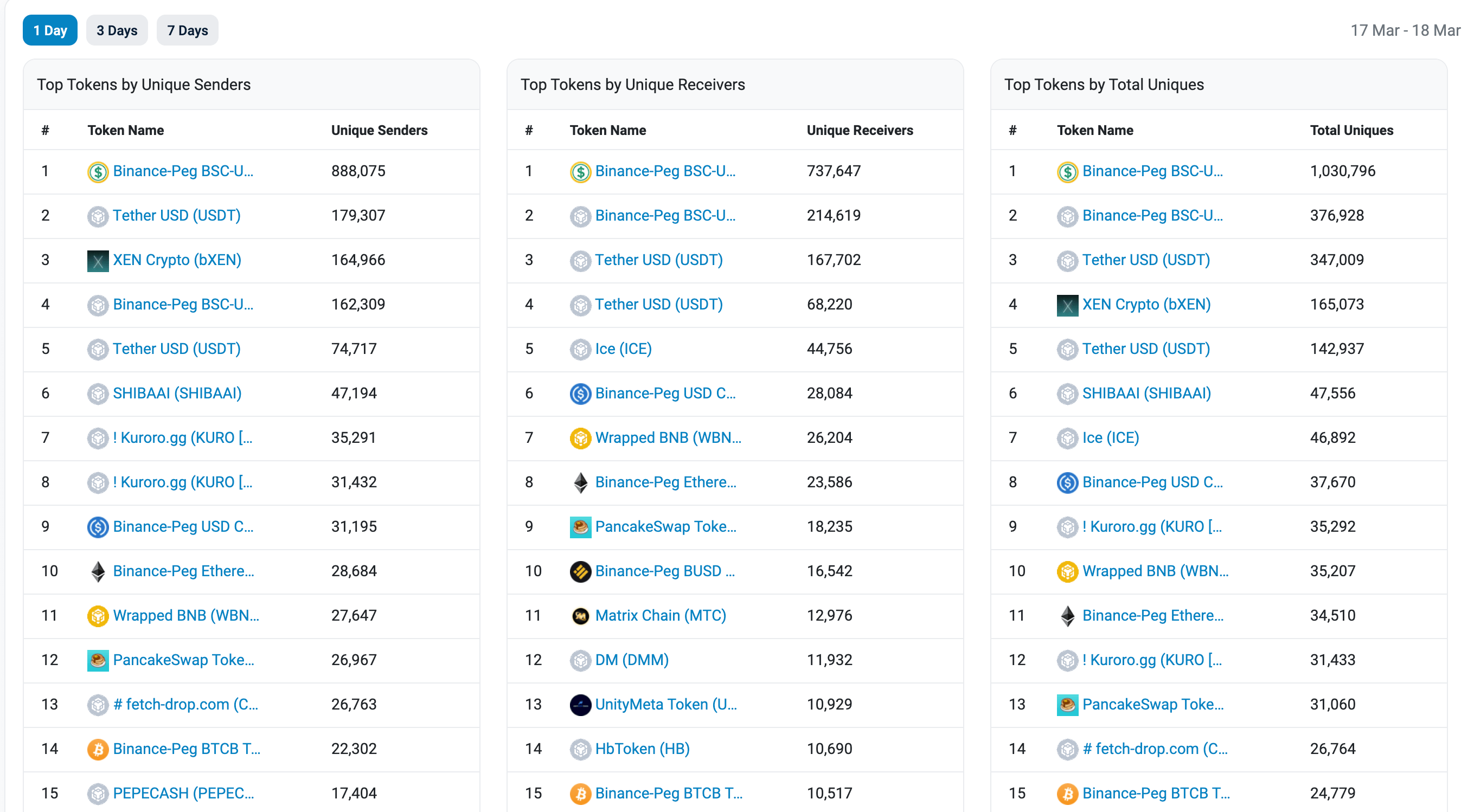

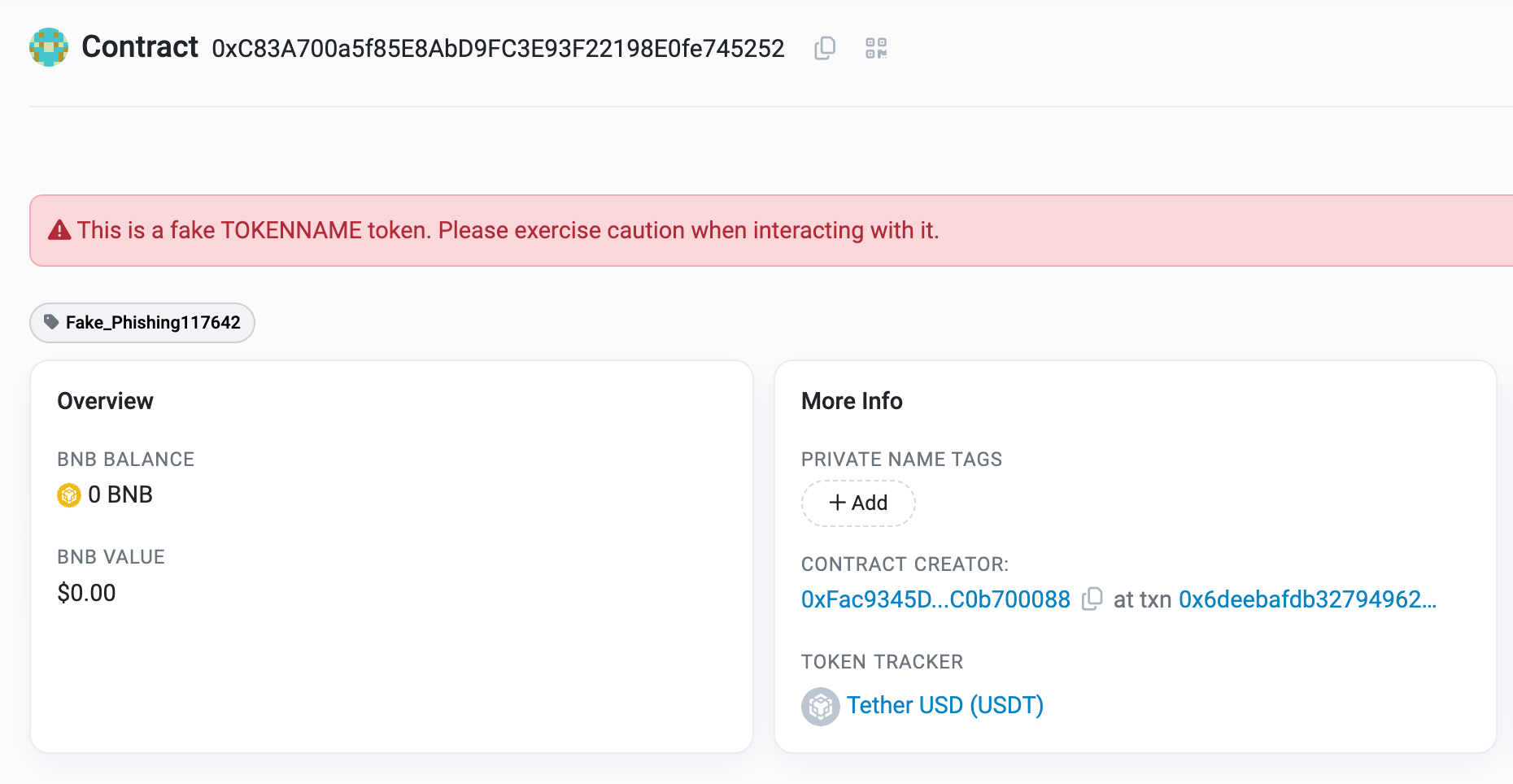

Nonetheless, once we have a look at the highest tokens being transferred on-chain, we discover that almost all are both memecoins or pretend rip-off tokens, in response to BSC Scan.

The vast majority of tokens within the picture above with no brand are rip-off tokens designed to trick customers into buying and selling them to steal funds. For instance, the USDT token with 1.2 million distinctive transfers over the previous seven days will not be an precise token issued by Tether.

Solana, with its pre-sale memecoin circus saving its failed cellphone launch and Avalanche pumping its ‘group token’ financial system by shopping for tokens for its treasury, could properly find yourself like BNB Chain with the route they’re going.

I’m not in opposition to memecoins as an idea, however I do imagine they should be handled just like the playing exercise they’re. As well as, it’s probably that Solana and Avalanche will now be a part of BNB Chain as playing networks crammed with a mixture of rip-off tokens and memes of no materials worth.

Bear in mind, memecoin buying and selling is basically Russian roulette, and the objective is to not be the whales’ exit liquidity.

I used to be an early adopter of Dogecoin again in 2014 after I mined cash utilizing graphics playing cards from my video manufacturing firm. On the time, the time period ‘memecoin’ wasn’t even a factor, as Doge was the one one in existence. I turned an enormous fan of the idea as a method to make ‘magic web cash’ that aligned with the net tradition of the time. Doge memes had been all the trend, and thus, Dogecoin was a enjoyable method to study crypto and probably be part of a digital medium of alternate for a world nonetheless studying easy methods to ‘web.’

For whole transparency, I offered all my Doge for Bitcoin in late 2015 and at present maintain a minimal quantity for nostalgia’s sake.

Nonetheless, the present marketplace for memecoins has nothing to do with providing a enjoyable digital forex that may very well be used to commerce on-line freely. There is no such thing as a utility to any memecoin aside from hoping that the ‘quantity go up.’ Not too long ago, Bitcoin content material creator Layah Heilpern stated,

“Meme cash and shitcoins are actually out right here altering peoples lives. There’s no different {industry} that allows you to go from broke to millionaire over a span of some weeks or perhaps a few days.”

These are harmful narratives as they make folks assume they’ll change their lives with memecoins. The truth is that almost all both purchase in too late or maintain too lengthy. They might be paper millionaires for a second, however they not often materialize income in Bitcoin or fiat phrases. Both their conviction in additional income stops them from promoting earlier than the market inevitably collapses, or a scarcity of liquidity hinders their capability to promote.

Cryptoquant founder Ki Younger Ju seemingly shares a few of my views right here commenting immediately,

“Meme cash hurt the crypto {industry}.

It’s irritating to see billion-dollar-cap memecoins overshadow hardworking groups constructing legit merchandise to advance this {industry}.

Simple cash can’t drive industry-wide progress, as proven by the 2018 ICO burst.”

For context, E book of Meme (BOME) reportedly has achieved a $1b market cap, resulting in an inflow of latest merchants. Nonetheless, DEX knowledge confirmed liquidity of round $64 million when it first reached the milestone. Since then, CEX listings have helped push the buying and selling quantity to over $2 billion over the previous 24 hours.

Slerf, one other Solana pre-sale token, reported that the founder had ‘by chance’ burned all the pre-sale tokens together with the LP earlier than it was listed on CEXs and has now had $700 billion in quantity immediately alone and a market cap of $200 million.

Essentially the most talked about memecoin of the previous month, Dogwifhat (WIF) categorically states,

“WIF isn’t only a cryptocurrency; it’s an emblem of progress, for futuristic transactions, a beacon for individuals who assume forward. It’s clear that the long run belongs to those that embrace improvements like WIF, transcending boundaries & paving a brand new period in finance and expertise.”

Nonetheless, don’t be fooled; not like Dogecoin 10 years in the past, these “symbols” of progress are designed for one factor solely, to make somebody wealthy by dumping on retail buyers enjoying the shitcoin on line casino lottery.

Chains that alter their focus to advertise the group side of digital belongings to foster innovation and engagement bla bla could as properly say what they imply, which is

“Web3 has turn out to be so noisy that the one method we are able to get consideration is by changing into a on line casino, however we don’t need to say that so we’ll faux that is about ‘group.’”

Within the phrases of many a millennial mom, “I’m not mad, I’m simply upset.” I maintain Solana, BNB Chain, and Avalanche in my portfolio; this isn’t a brief vendor report. I merely need to increase consciousness about memecoins and peel again the bs about “group.” The one meme group, for my part, was Dogecoin, however even the unique builders gave up on that.

So let’s simply name a spade a spade and admit memecoins are playing. Then, add the suitable warnings as a substitute of pretending they signify innovation.