Uniswap has outpaced Bitcoin in charges paid by crypto merchants for over every week, with the DEX surpassing Bitcoin on Feb. 14

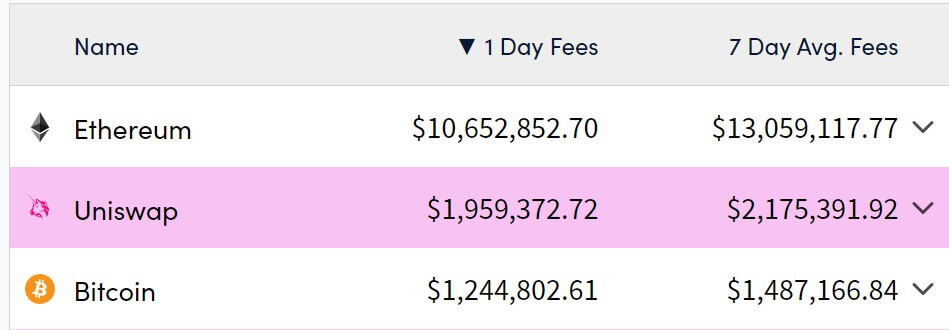

In response to knowledge from Cryptofees, Uniswap raked in round $1.9 million in charges on Feb. 25, surpassing Bitcoin’s $1.2 million on the identical day. This pattern has continued since mid-month, with Uniswap pulling in a median of $2.1 million in charges during the last week, in comparison with BTC’s $1.4 million.

In the meantime, Ethereum is the general chief by way of transaction charges. The blockchain community generated $10.6 million in charges through the previous day and a median of $13 million per day over the previous week. Notably, Bitcoin held this enviable place early within the 12 months and a few intervals final 12 months as group curiosity in Ordinals Inscriptions propelled its community charges greater.

Uniswap charges

Uniswap’s profitable charges have come throughout an fascinating time, with the DEX Basis lately proposing a charge reward mechanism for its UNI token holders.

As the most important DeFi DEX platform, Uniswap handles roughly 30% of whole trades within the decentralized finance sector, in line with DeFillama knowledge. Notably, all charges generated by Uniswap belong to liquidity suppliers (LPs) who provide belongings to the platform. These charges accrue when customers conduct asset swaps on the change, indicating heightened exercise inside the decentralized ecosystem.

Nonetheless, with the brand new proposal, the DEX will allocate protocol charges amongst staked and delegated UNI token holders to revitalize governance participation. Erin Koen, Uniswap Basis’s governance lead, highlighted the potential of this transfer to bolster the protocol’s resilience and decentralization.

The Basis’s govt director, Devin Walsh, additional emphasised how the improve will fortify Uniswap’s governance. Walsh added:

“If each firm constructing on Uniswap disappeared tomorrow, it might be as much as its delegates to leverage their powers to make sure the Uniswap Protocol + ecosystem proceed to outlive and thrive into the long run. In that approach, incentivizing energetic, engaged delegation is integral to long run protocol sustainability.”

The proposal nonetheless awaits preliminary and closing on-chain votes earlier than implementation.

In response to those developments, the UNI token has seen a notable uptick, surging roughly 40% over the previous week to $10.59, primarily based on StarCrypto’s knowledge.