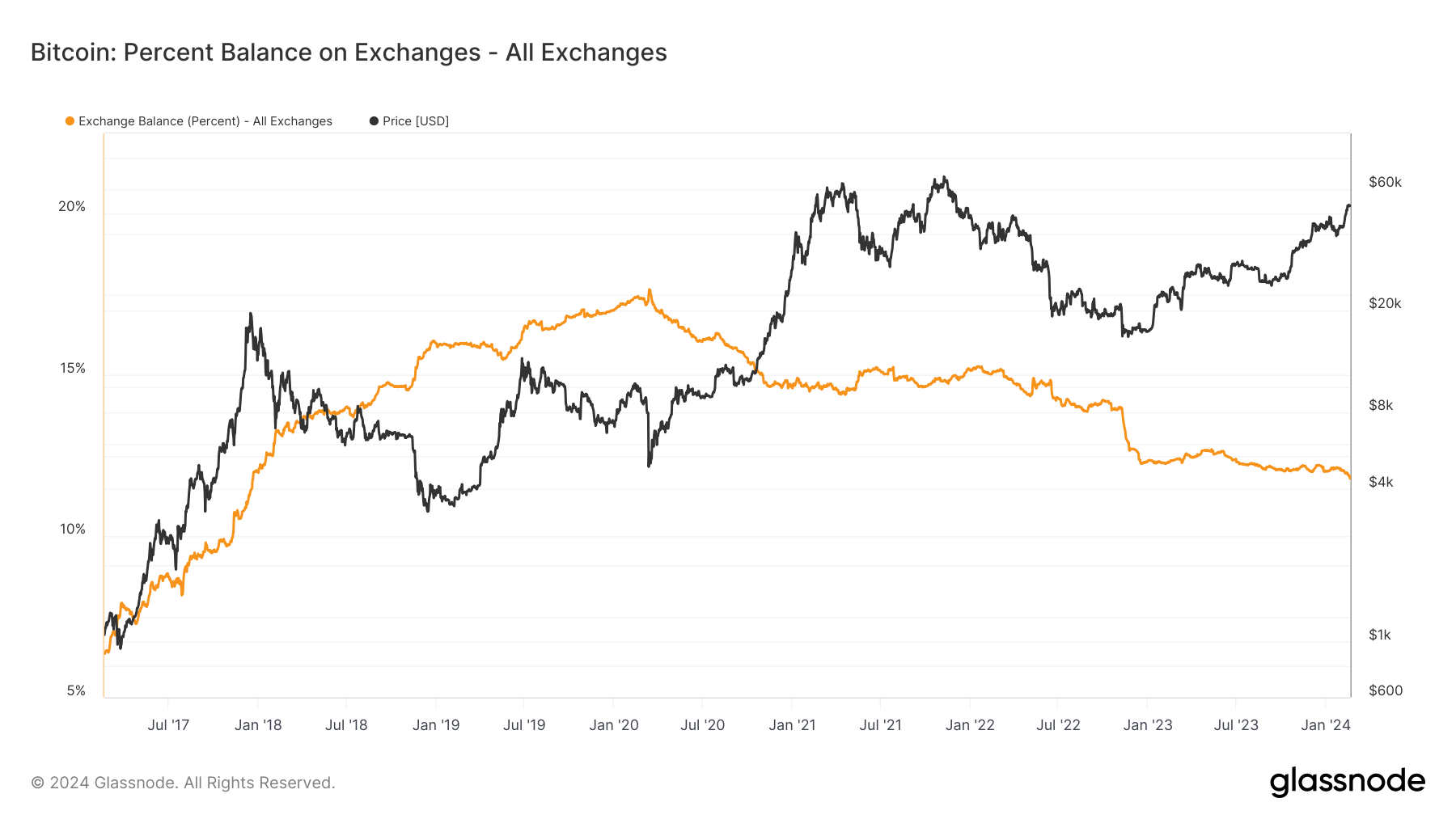

Since mid-March 2020, there was a notable decline within the quantity of Bitcoin saved in trade wallets, marking a big shift in investor conduct.

On the time, over 17% of Bitcoin’s whole provide was housed on exchanges, a document excessive. This development of declining trade balances has continued unabated, even via Bitcoin’s 2021 bull run, which noticed its value peak at $69,000 in November of that yr.

This trajectory has prolonged into 2024, with StarCrypto’s evaluation of Glassnode information revealing a persistent lower in Bitcoin holdings on exchanges.

From Jan. 1 to Feb. 19, the quantity of Bitcoin in trade wallets fell from 2.356 million BTC to 2.314 million, the bottom since April 2018. In the meantime, the proportion of Bitcoin’s provide in trade wallets decreased from 12.03% to 11.79%.

The diminishing presence of Bitcoin on exchanges suggests a rising choice amongst holders to switch their property away from these platforms. This motion might point out a broader technique shift in the direction of long-term holding or a response to prevailing market circumstances.

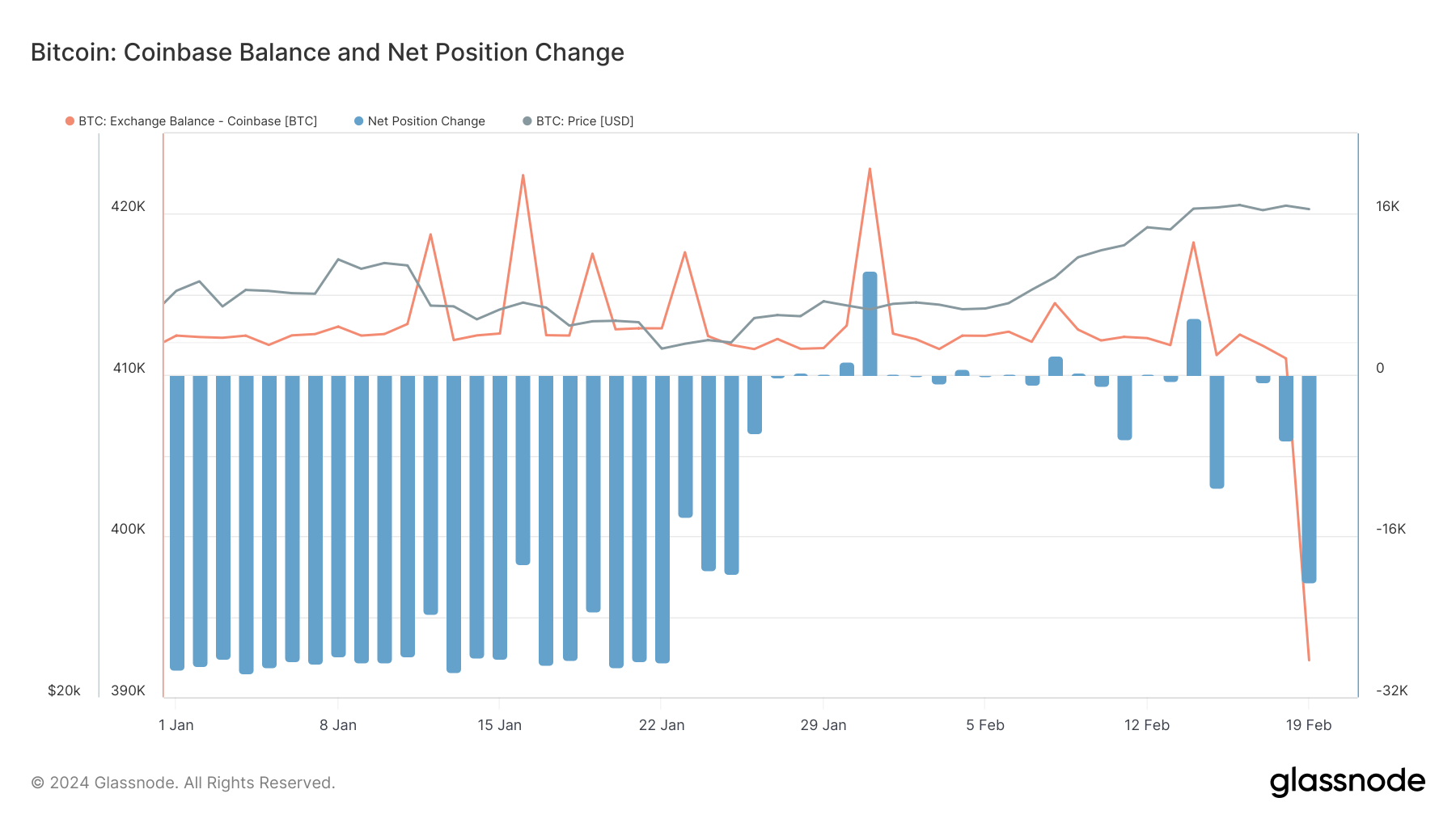

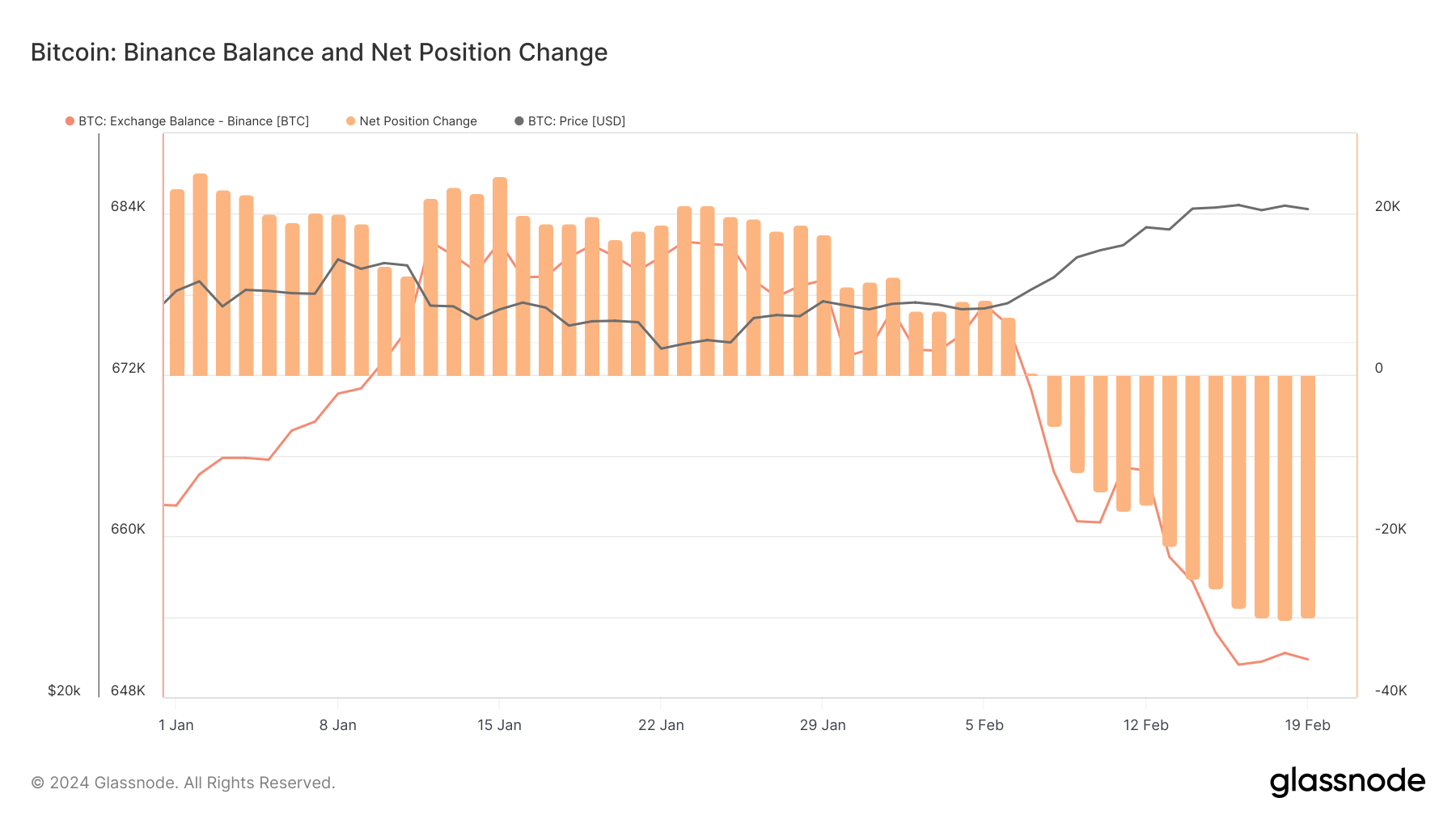

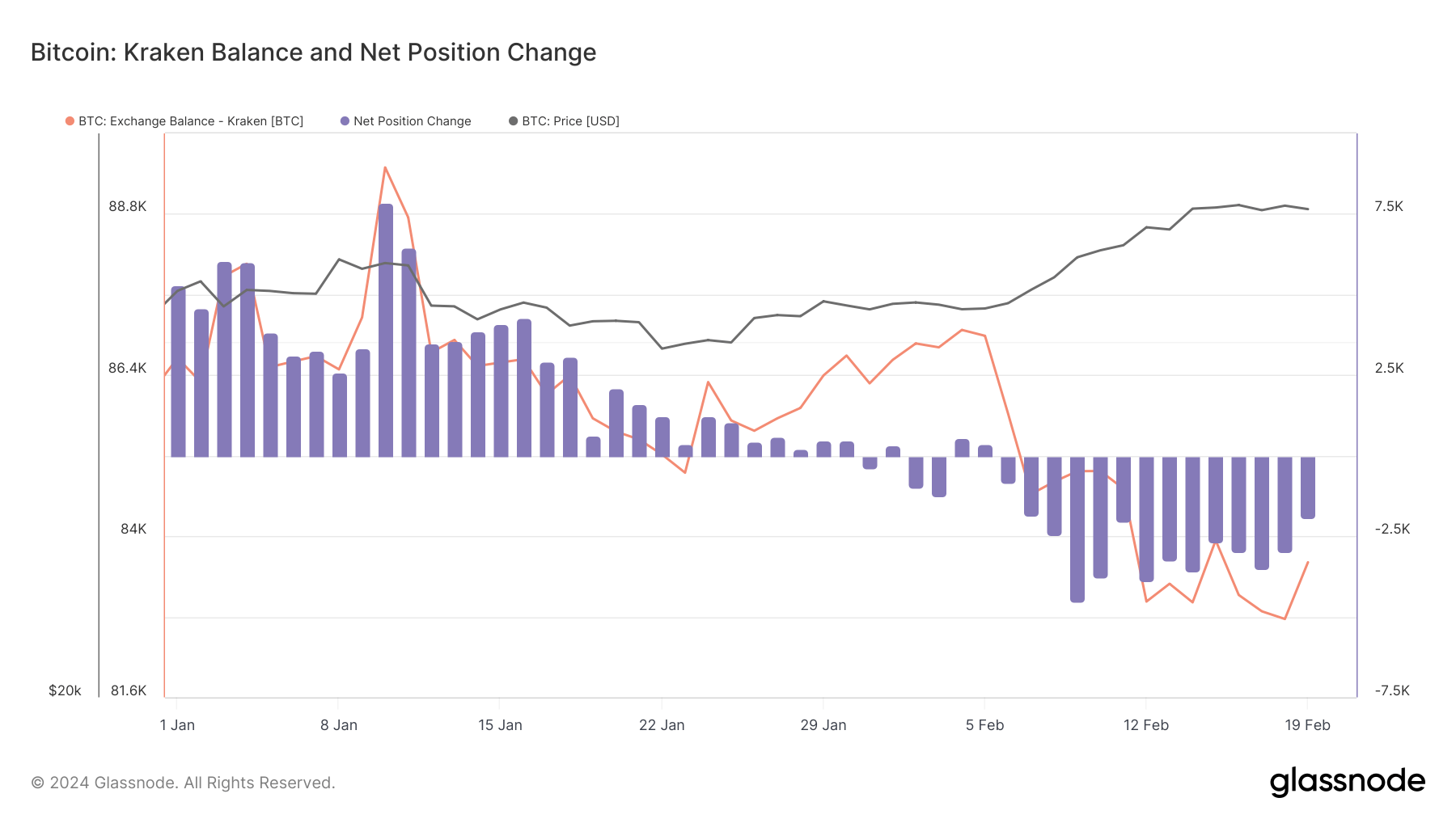

Inspecting particular exchanges reveals nuanced traits and exceptions inside this broader sample.

Coinbase skilled a marked discount in its Bitcoin stability, shedding over 20,000 BTC from Jan.1 to Feb. 19, with constant internet outflows because the finish of January.

Binance additionally noticed a notable discount in its Bitcoin stability this yr. The trade’s stability initially elevated till Jan. 26, when it started declining, with internet outflows beginning on Feb. 8.

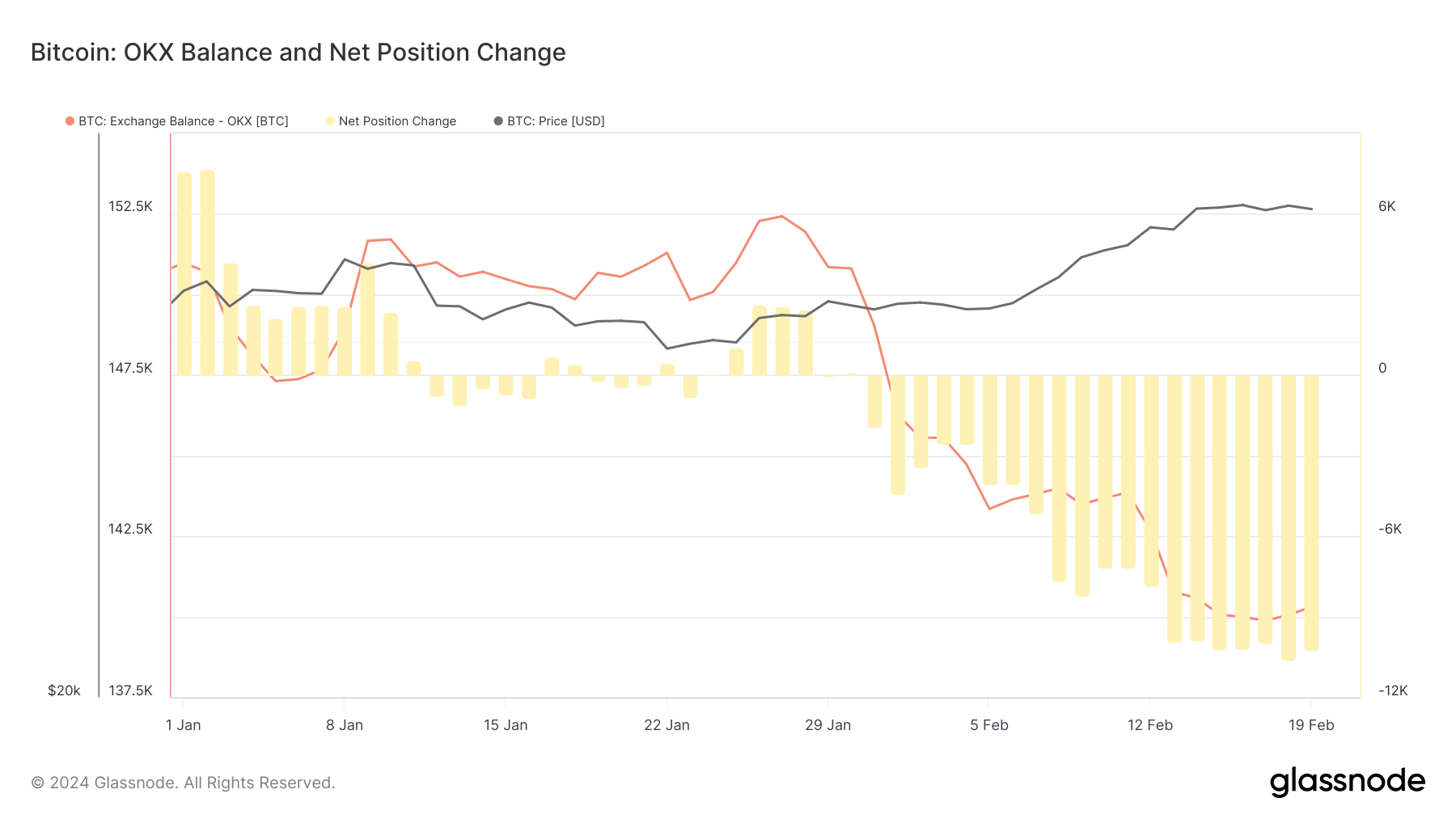

Kraken and OKX aligned with this development, recording internet outflows and a big lower of their Bitcoin balances.

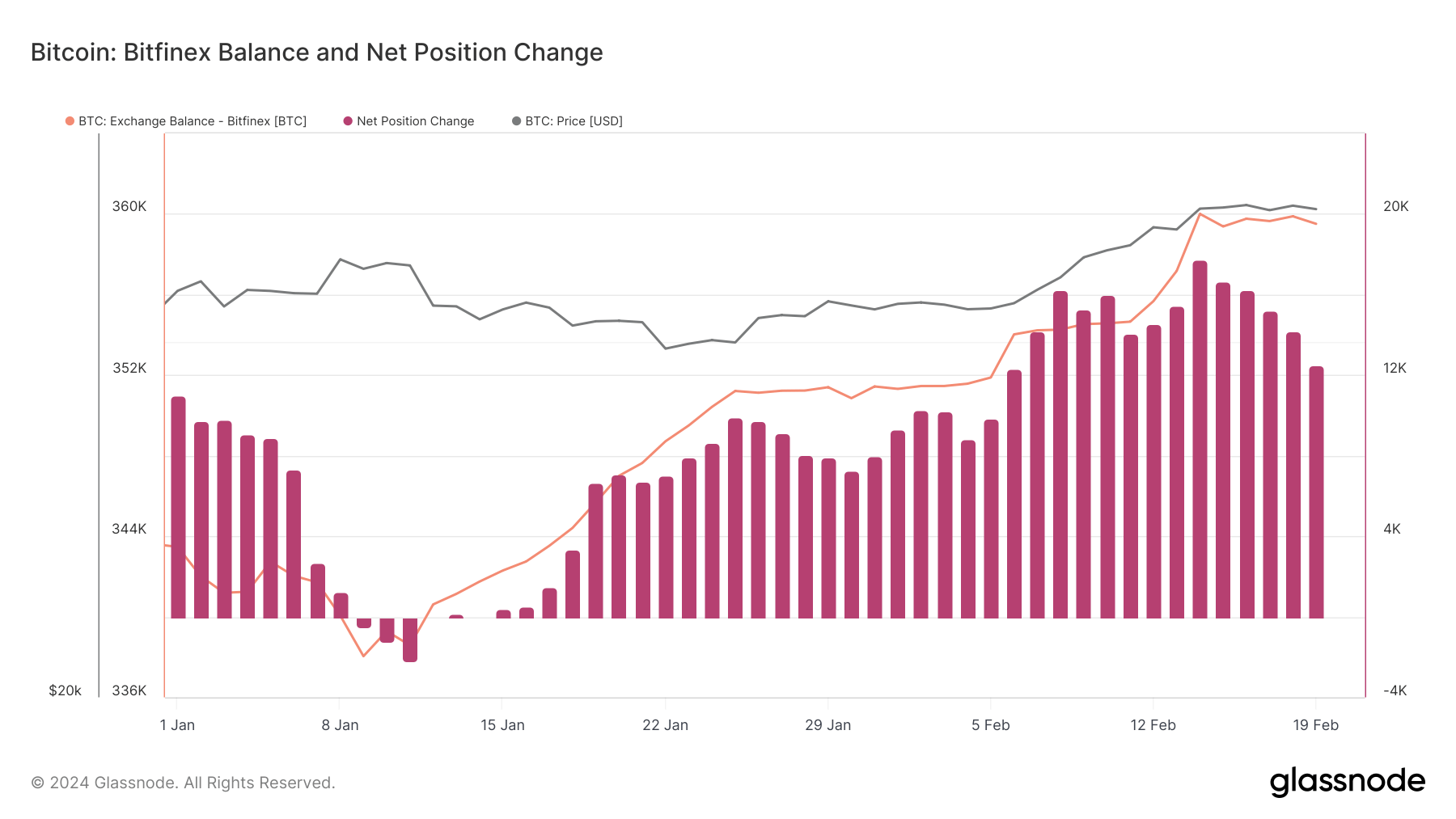

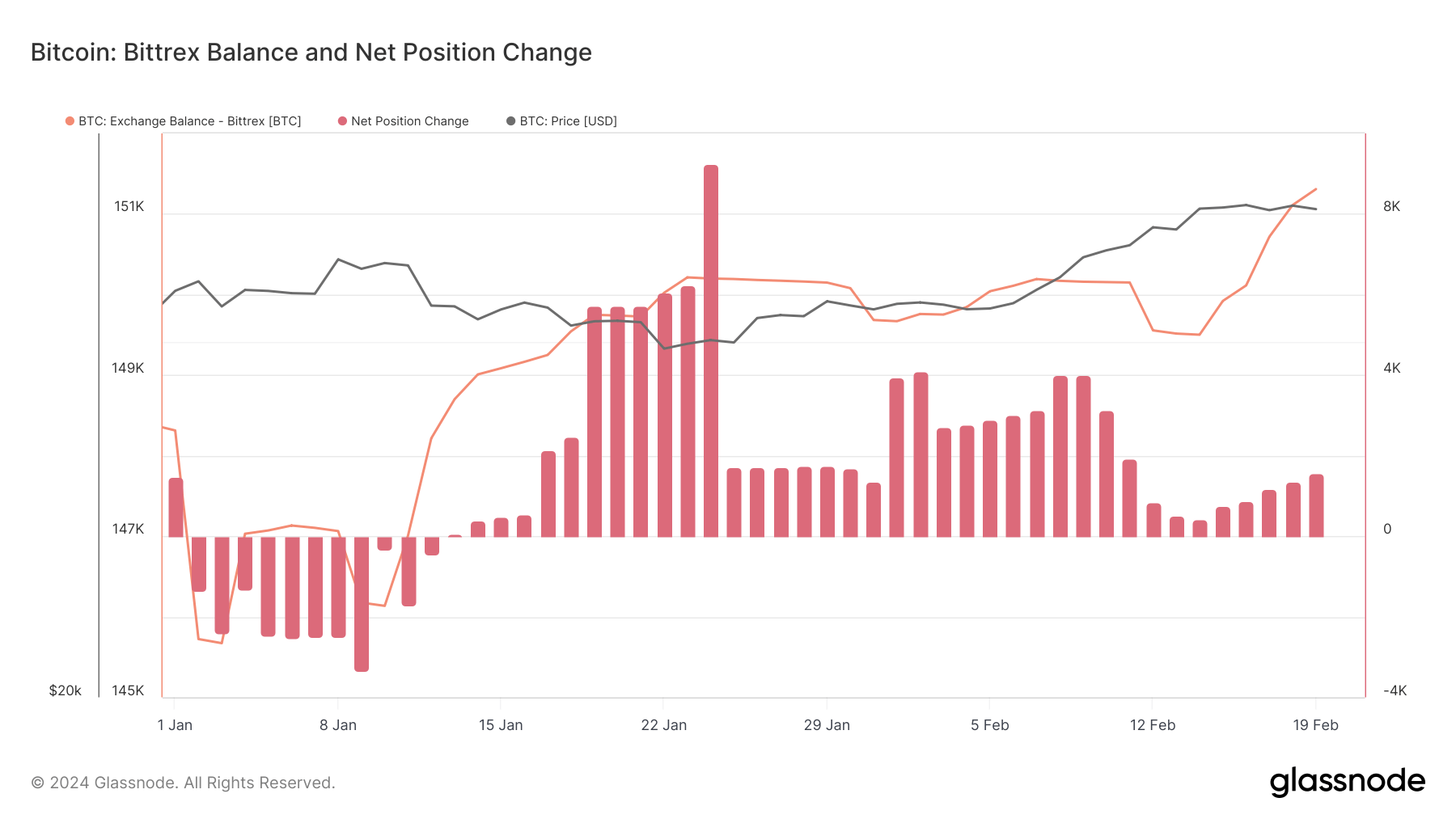

Opposite to the final development, Bitfinex and Bittrex have seen internet inflows since mid-January.

Bitfinex noticed over 16,000 BTC added to its Bitcoin stability because the starting of the yr, helped by constant internet inflows since Jan. 15.

Bittrex additionally noticed a spike in its stability, however this time by a modest 3,000 BTC since Jan. 1. The trade additionally witnessed constant internet inflows since Jan. 14.

The overall lower in Bitcoin balances on exchanges correlates with a bullish sentiment out there. Traders withdrawing Bitcoin to private wallets for long-term holding reduces the promoting stress on exchanges. This technique is underscored by Bitcoin’s value surge from $44,152 on Jan. 1 to $52,000 by Feb. 19, regardless of experiencing a dip in mid-January.

The launch of Spot Bitcoin ETFs within the US has seemingly influenced these traits, however different important elements have additionally performed pivotal roles. The anticipation and introduction of those ETFs may need bolstered market sentiment, contributing to Bitcoin’s value rebound and additional rise in February.

Moreover, the migration of Bitcoin away from exchanges may very well be attributed to rising optimism amongst traders, who foresee additional value beneficial properties pushed by broader acceptance and funding in Bitcoin.

Nevertheless, the collapse of FTX and Celsius and Binance’s authorized challenges have been important catalysts, prompting customers to withdraw funds from exchanges as a consequence of safety and regulatory compliance issues.

These occasions have heightened consciousness across the dangers related to protecting property on exchanges, resulting in a shift in the direction of private wallets for enhanced management and security.

As Bitcoin is faraway from exchanges, the ensuing liquidity discount might improve value volatility. But, this motion additionally exhibits a agency conviction in holding amongst traders, setting the stage for doubtlessly extra sustained value progress because the out there provide turns into more and more constrained.