Ethereum’s value soared to a noteworthy milestone previously day, briefly crossing the $3,000 mark for the primary time in 22 months.

Throughout this era, ETH’s value peaked at roughly $3,025, marking a outstanding 27% surge during the last 30 days. Nonetheless, its worth has retraced barely to round $2,920 as of press time, experiencing a 3.5% dip, in line with starcrypto’s knowledge.

Why did ETH rise?

ETH’s current value surge is extensively attributed to hypothesis surrounding the potential approval of a spot Ethereum exchange-traded fund (ETF) by the US Securities and Change Fee (SEC) in Could.

Customary Chartered, a British multinational financial institution, predicted a good final result for a spot ETH ETF approval. Key figures at crypto asset administration corporations, similar to Bitwise, Grayscale, and Galaxy Digital, estimated a 50% probability of approval for these pending spot Ethereum ETF purposes.

In the meantime, candidates like VanEck, Ark Make investments, and 21Shares are adjusting their purposes to align with the SEC’s standards for approving a Bitcoin ETF.

Moreover, market sentiment has been buoyed by the upcoming Dencun improve. This improve will introduce options like proto-danksharding and price reductions. As well as, the improve will assist improve Ethereum’s community efficiency, scale back transaction prices, and enhance ecosystem interoperability.

The broader market sees pink.

The broader crypto market skilled a decline through the reporting interval, with the worldwide crypto market capitalization dropping by 0.32% to $1.96 trillion.

Bitcoin surged to a brand new yearly peak slightly below $53,000 however swiftly dropped to $51,268 as of press time, in line with starcrypto’s knowledge.

Massive-cap digital belongings like Solana, Avalanche, Cardano, and Ripple’s XRP noticed losses exceeding 3%. Nonetheless, Binance-backed BNB coin and Tron’s TRX token bucked the development, registering positive factors of beneath 3%.

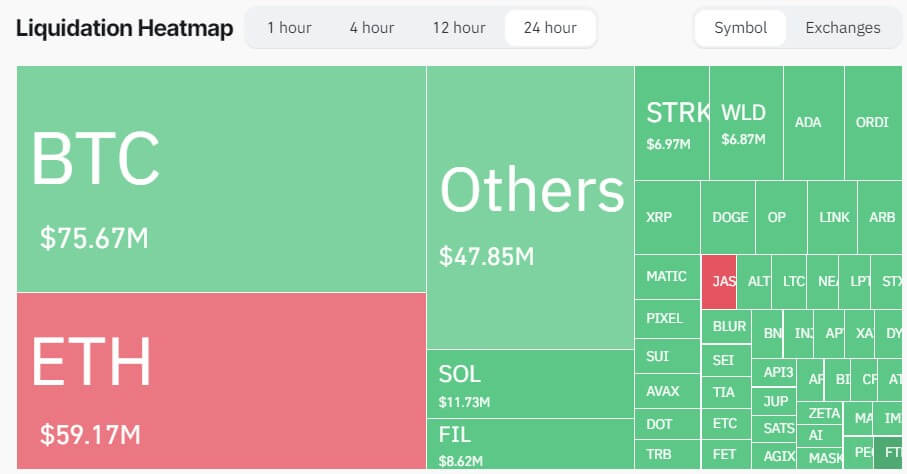

These value actions triggered vital liquidations, totaling over $291 million from greater than 92,000 merchants, per Coinglass knowledge.

Bitcoin led the liquidation figures with a complete lack of $75 million. Lengthy Bitcoin merchants accounted for $42 million in losses, whereas quick merchants misplaced $28.46 million. Ethereum adopted intently, contributing $59.1 million to the general liquidation, with quick merchants bearing the brunt of the losses.