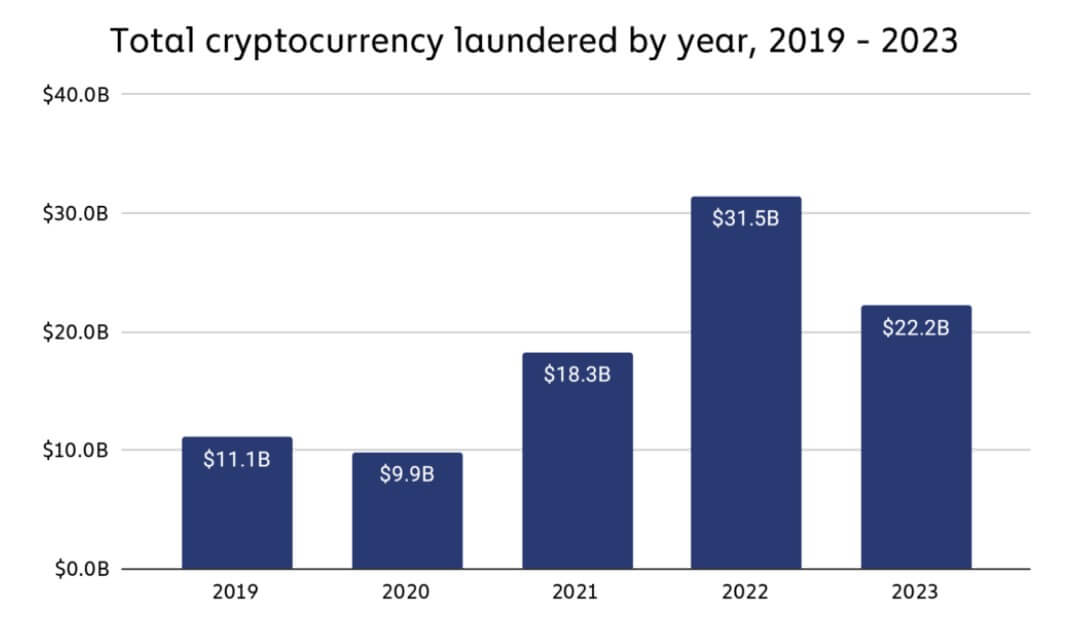

Crypto cash laundering skilled a major decline of 29.5% in 2023 in comparison with the earlier yr, primarily because of a lower in total crypto transaction quantity.

In keeping with a Chainalysis report, illicit addresses moved roughly $22.2 billion in digital property to numerous crypto companies in 2023, marking a notable drop from the $31.5 billion transferred in 2022. This decline aligns with a 14.9% lower in respectable and unlawful crypto transaction volumes.

Centralized exchanges remained the first vacation spot for funds from illicit addresses, though there was a noticeable improve in prison fund actions towards playing companies and bridge protocols.

Intimately, 109 change addresses acquired over $10 million every from illicit sources, totaling $3.4 billion in 2023, a major rise from the $2 billion acquired by 40 addresses in 2022. Equally, 1,425 change addresses acquired over $1 million every, amounting to roughly $6.7 billion in 2023, in comparison with $6.3 billion throughout 542 addresses in 2022.

In the meantime, funds from illicit addresses to bridge protocols surged from $312.2 million in 2022 to $743.8 million in 2023.

‘Altering techniques’

Chainalysis famous that subtle crypto criminals with on-chain laundering expertise, just like the notorious North Korean-backed hackers Lazarus Group, are adapting their cash laundering methods and exploiting new companies like crypto mixers and cross-chain bridges.

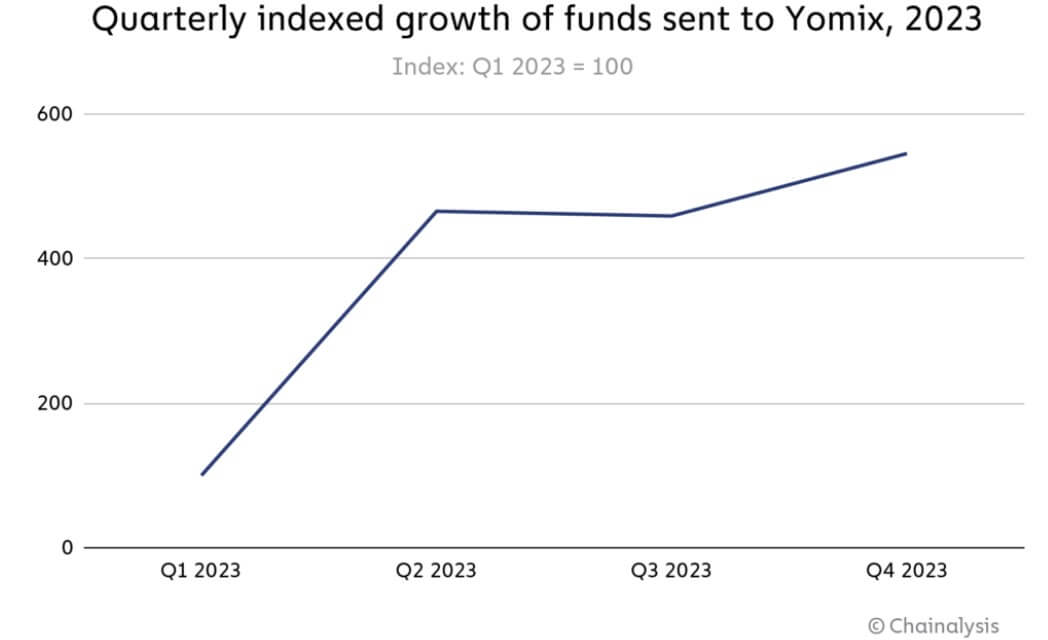

For context, the regulatory strain on crypto mixing companies like Sinbad and Twister Money, pressured Lazarus Group to shift its cash laundering technique to YoMix, a new mixing service supplier.

In keeping with Chainalysis, this transition led to a notable improve in YoMix’s exercise for final yr, with its inflows rising greater than fivefold. Moreover, practically one-third of YoMix’s inflows could be traced again to wallets related to crypto hacks.

“The expansion of YoMix and its embrace by Lazarus Group is a chief instance of subtle actors’ capability to adapt and discover alternative obfuscation companies when beforehand widespread ones are shut down,” Chainalysis concluded.

As well as, North Korean-backed hacker teams had been noticed to be among the many commonest crypto criminals that utilized cross-chain bridges for cash laundering actions.