- Bitcoin re-enters the $50K degree for the primary time after shedding it in 2021.

- Analysts have noticed bearish indicators amid the market’s bullish frenzy.

- BTC’s present worth is reportedly not a great entry, concentrating on $45,500.

Within the final 24 hours, Bitcoin (BTC) hit a major milestone for the crypto market, reclaiming the $50,000 mark. This return to the $50K degree marks the primary occasion of BTC re-entering the vary after shedding it in 2021.

Furthermore, the surge represents a noteworthy restoration from its latest low level of roughly $38,700 recorded final month. Expectedly, Bitcoin’s trajectory has bolstered the broader crypto market, with different outstanding initiatives like Solana (SOL) and Ethereum (ETH) registering notable 9.4% and seven.62% weekly good points at press time, respectively.

In the meantime, analysts have noticed bearish indicators amid the Bitcoin-led bullish frenzy rocking the market. Woominkyu, a verified creator and group supervisor on the on-chain analytics platform CryptoQuant, not too long ago highlighted the potential course of the market.

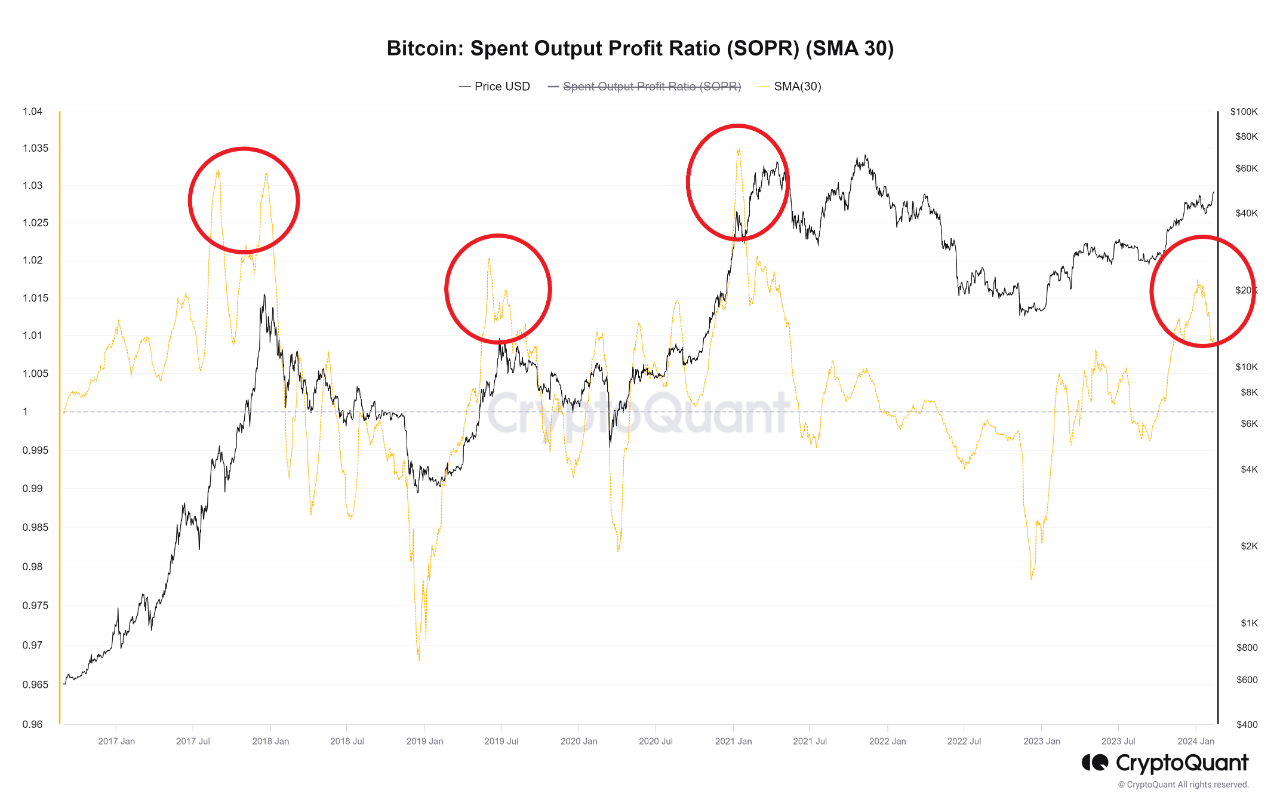

Woominkyu identified that the Spend Output Revenue Ratio (SOPR) on the 30-day transferring common for Bitcoin is above one. Per the disclosure, the metric signifies that BTC holders are predominantly worthwhile.

In keeping with the analyst, these holders, dubbed “Good Cash,” will not be overlooking latest good points. Particularly, Woominkyu argued that the SOPR metric suggests these BTC holders are opting to appreciate their good points by promoting, basically taking earnings.

Moreover, the analyst argued that, based mostly on historic knowledge, the present place of Bitcoin shouldn’t be an optimum entry level. Woominkyu said that suspicion exists regarding an impending worth correction “any second” from BTC’s present worth level, given the excessive chance indicated by the SOPR ratio.

In consequence, the analyst urged monitoring for a decline within the SOPR ratio. He advised a decline beneath one would sign a transition to FOMO-driven purchases, adopted by subsequent gross sales at a loss. Woominkyu believes a chance to enter the market would emerge at that time.

Whereas Woominkyu failed to say how low Bitcoin may attain ought to a correction happen, one other analyst has issued a goal of $45,500. At press time, Bitcoin trades at $49,981, with a 16.65% acquire over the previous week.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.