The value of bitcoin hit $50,000 at this time, a month after the U.S. Securities and Change Fee accepted 11 functions for spot bitcoin ETFs.

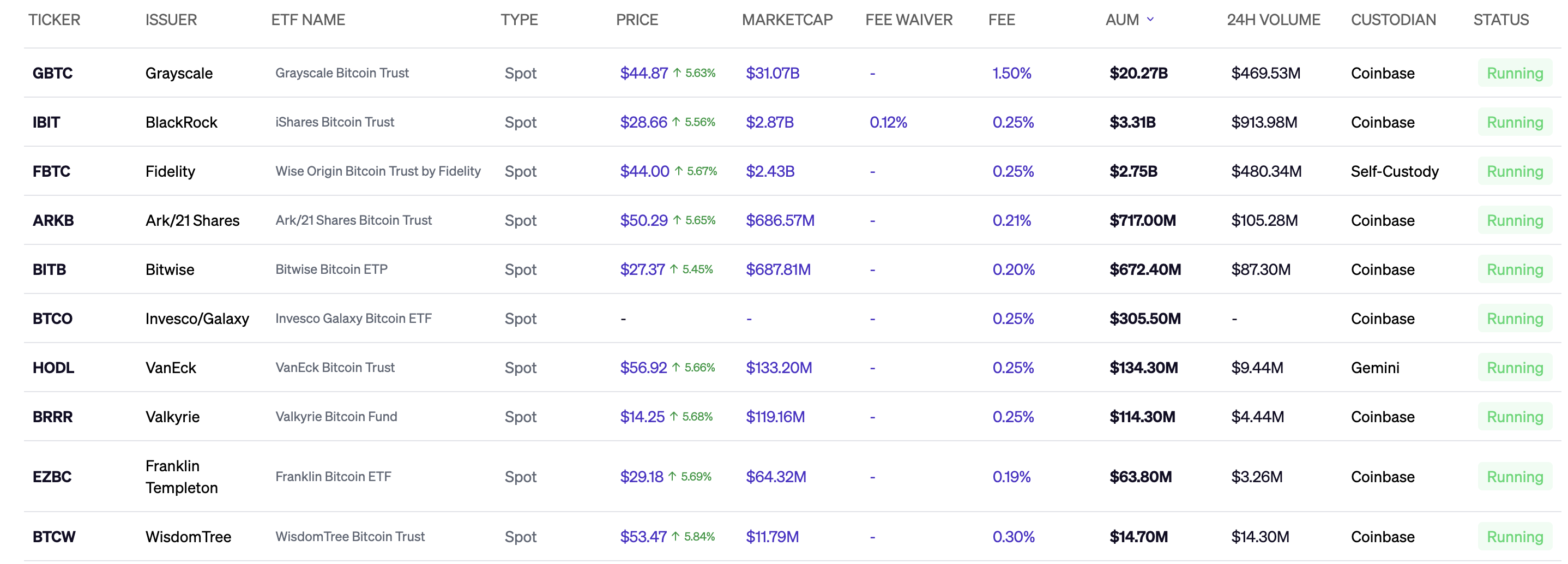

The issuers of these ETFs have seen demand skyrocket past preliminary predictions of some billion. Belongings below administration at these issuers complete round $28.35 billion, making for a market cap of $39.8 billion, in accordance with Blockworks information. Buying and selling quantity throughout 24 hours was $1.38 billion.

Main the spot bitcoin ETF pack is Grayscale Bitcoin Belief at $20.27 billion, adopted by BlackRock’s iShares Bitcoin Belief at $3.31 billion and Constancy’s Clever Origin Bitcoin Belief at $2.75 billion.

Picture Credit: Blockworks Bitcoin Spot ETF tracker (opens in a brand new window)

“The sustained inflows and volumes are greater than I anticipated,” mentioned Matt Hougan, chief funding officer at Bitwise Asset Administration. “The truth that there haven’t been simply day-one flows, however sturdy optimistic inflows in 18 of the primary 19 days is admittedly gratifying. It makes me extraordinarily optimistic on the place bitcoin’s value goes, and its significance on the planet.”

Bitwise runs the Bitwise Bitcoin ETP, at present the fourth-largest spot bitcoin ETF by market cap. However the highway so far wasn’t simple. The truth is, Bitwise took over 20,000 conferences final yr with monetary advisors in preparation for the anticipated approval, Hougan mentioned.

“It was nerve-wracking to launch, whereas we’re not BlackRock, we’re not new to this house. [But] we offer crypto asset funds so we wanted to be related,” Hougan mentioned. Now, he believes ETFs have reached escape velocity and are “sufficiently big to be sustainable from an financial perspective.”

Bitwise’s payment, 0.20%, is the second-lowest of the lot, and Hougan believes it’s a “fairly whole lot” in an effort to be aggressive. But when its fund turns into extraordinarily massive, he mentioned he didn’t know if that fee will stick.

“Proper now, we like our place.”

Hougan additionally believes that demand will proceed to rise as extra nationwide account platforms come on-line and inbound curiosity from massive establishments will increase. “It’s not like they’re shopping for $100 million of bitcoin at this time, however there’s vital inbound and conferences with platforms which have billions of {dollars} in belongings.”

A month after the approvals have been handed down, Hougan thinks spot bitcoin ETFs will maintain the title for the “greatest ETF launch of all time.”

“Even after being within the ETF trade for 15 years, it’s in contrast to something I’ve ever seen…it’s not just a bit greater; it’s a lot greater.”

Within the subsequent 11 months, Hougan is optimistic that volumes will proceed to extend as a result of passage of time and bitcoin’s value spurring demand. The pure viewers for this product takes time to study and make choices and nationwide accounts take time to enhance them, he added.

“I believe it’ll be up, plateau, re-acceleration,” Hougan mentioned. “I don’t suppose demand is slowing down for the subsequent 18 months. I anticipate these ETFs to set information.”

As for what’s subsequent, Bitwise is leaving the door open for different merchandise.

“We don’t have a submitting, however actually desirous about Ethereum [spot ETFs] and you may think about we’re pondering of different issues you are able to do with bitcoin and ethereum,” Hougan mentioned. “We’ve entered the ETF period of crypto and we’ve confirmed traders wish to entry crypto via ETFs. We’re going to offer these merchandise to the extent attainable below regulation.”