Bitcoin choices knowledge, notably open curiosity and strike costs, is essential for understanding the market’s expectations for future worth actions.

Choices are monetary derivatives that give the client the appropriate, however not the duty, to purchase (name possibility) or promote (put possibility) an underlying asset at a predetermined worth (strike worth) on or earlier than a selected date. They’re a vital element of economic markets, offering insights into future worth expectations and market sentiment.

Open curiosity represents the entire variety of excellent choices contracts that haven’t been settled. For Bitcoin choices, a rising open curiosity signifies elevated market participation and curiosity, exhibiting that traders are positioning themselves for future worth actions. Analyzing the distribution of strike costs can reveal the place traders anticipate these costs to maneuver.

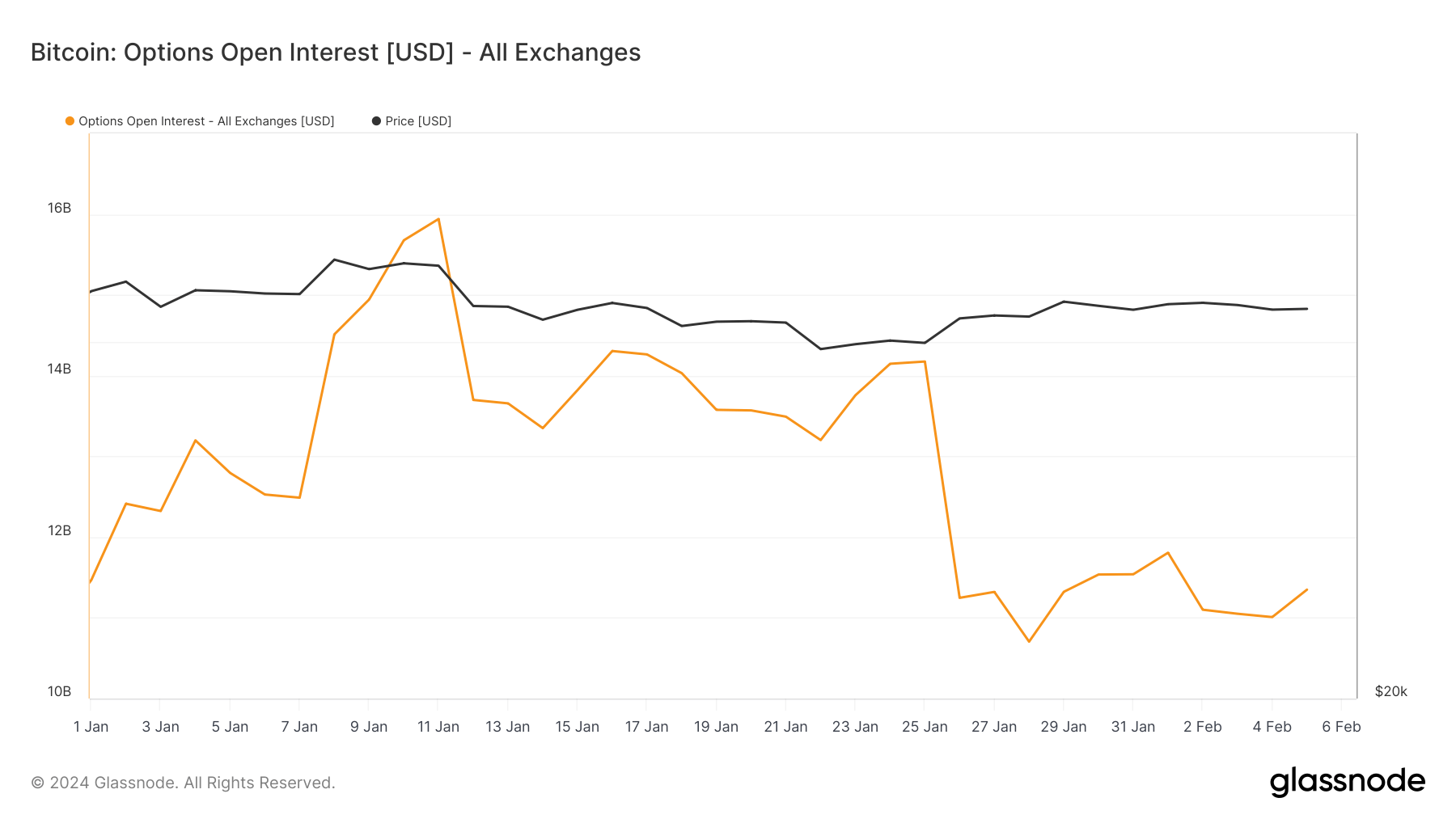

StarCrypto’s evaluation of Glassnode knowledge confirmed a notable improve in open curiosity and buying and selling volumes main as much as the approval of spot Bitcoin ETFs within the U.S. Open curiosity spiked to $15.94 billion on Jan. 11, the day ETFs started buying and selling, up from $11.46 billion on Jan. 1.

This surge suggests elevated market participation and probably a bullish sentiment as traders may need sought to hedge new positions or speculate on the worth route post-ETF approval. Nevertheless, the following decline to $10.704 billion by Jan. 28 and a slight restoration to $11.348 billion by Feb. 5 signifies volatility and probably a reevaluation of market positions as preliminary enthusiasm tempered.

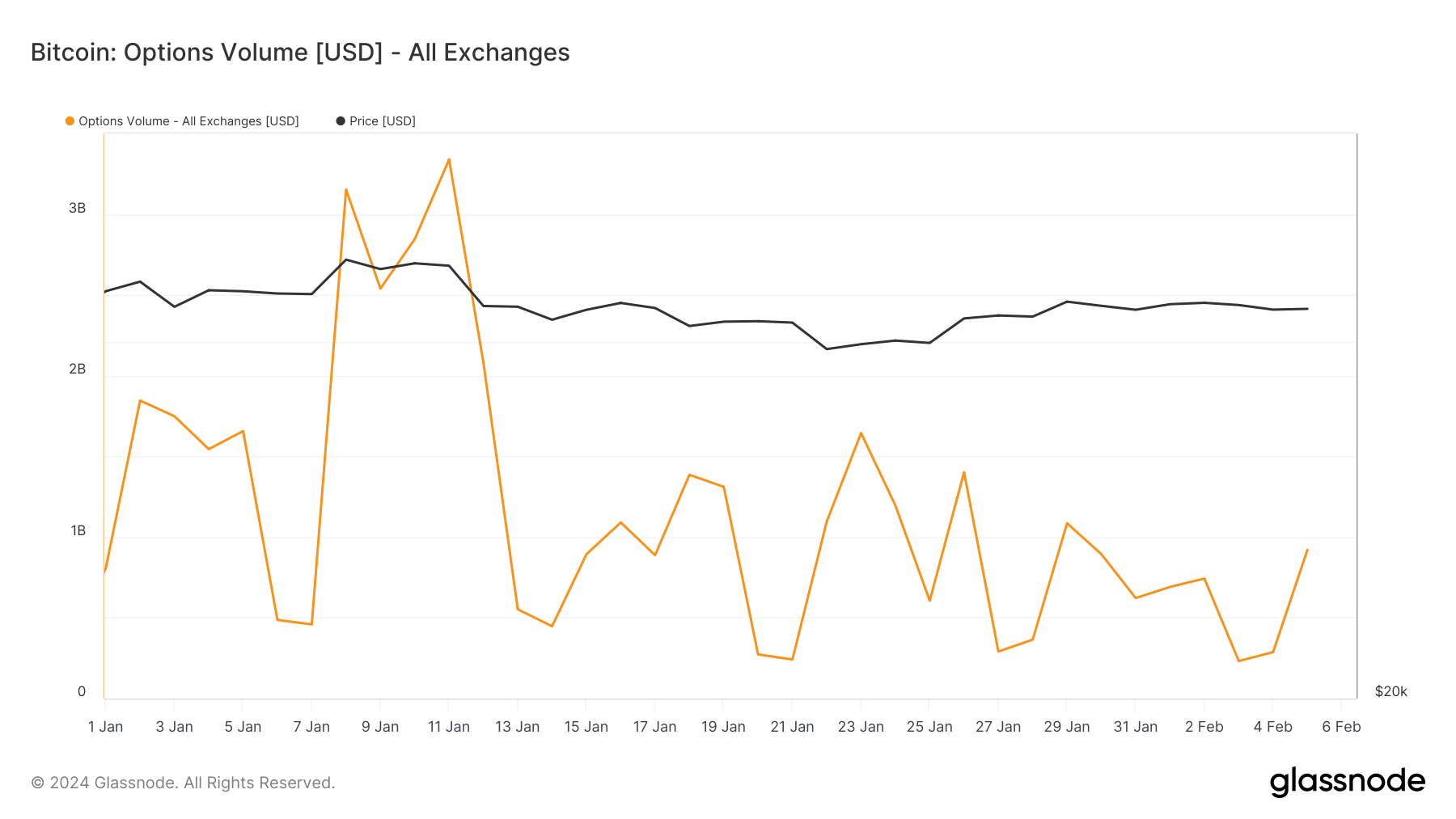

Buying and selling quantity peaked across the ETF launch, with a notable excessive of $3.338 billion on Jan. 11, which aligns with the spike in open curiosity. The fluctuation in volumes, notably the drop to $364.900 million by Jan. 28, additional underscores the market’s uncertainty and reassessment of methods because the preliminary reactions to the ETF buying and selling normalize.

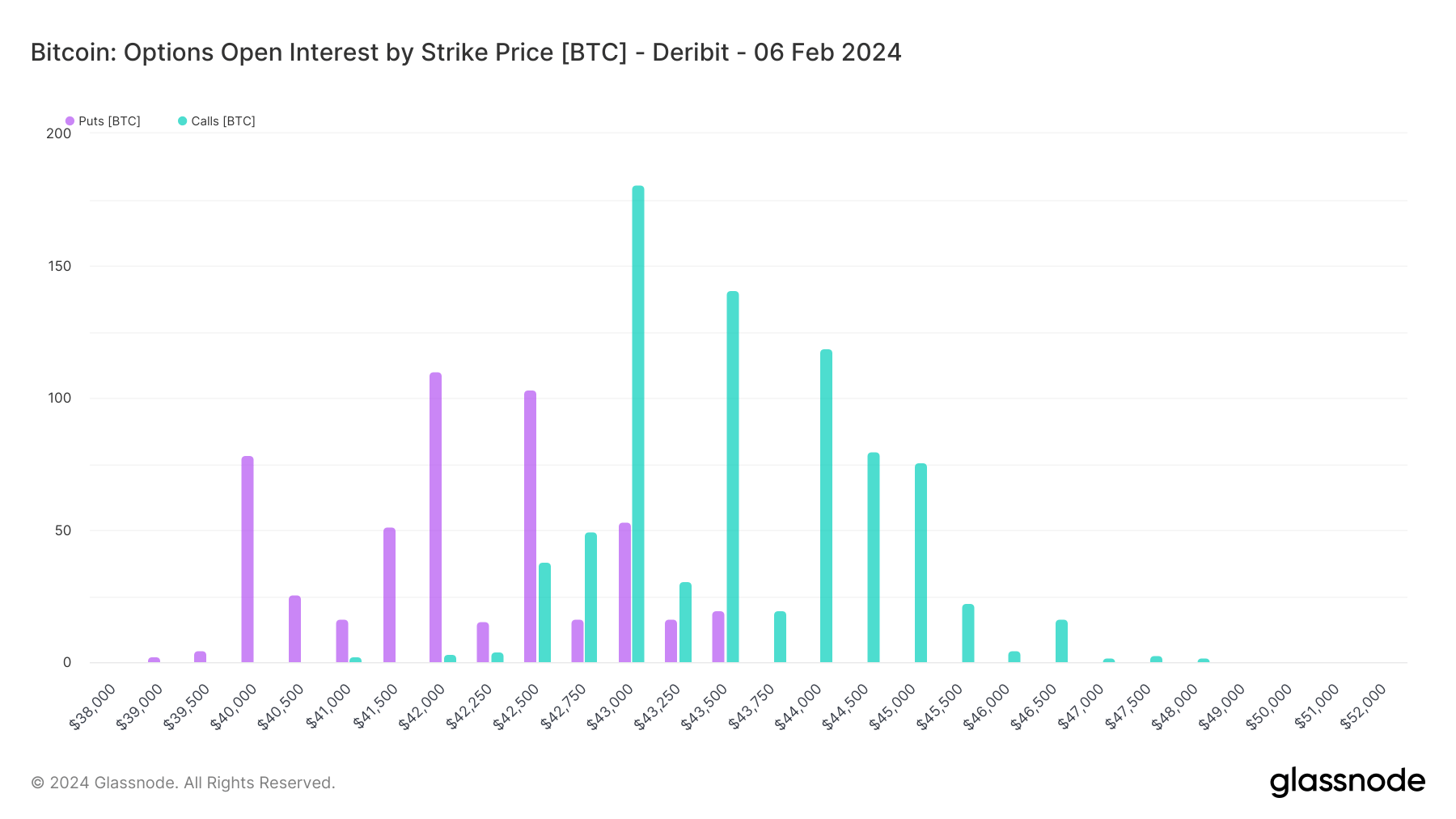

The distribution of open curiosity throughout strike costs on Deribit exhibits a various vary of market expectations: near-term pessimism and long-term optimism. Particularly, for contracts expiring on Feb. 6, we observe a focus of open curiosity in places at decrease strike costs and calls at barely greater however not overly formidable strike costs.

This sample signifies a near-term bearish sentiment or a protecting stance amongst choices holders. They is perhaps hedging towards potential short-term draw back dangers or speculating on rapid worth corrections.

The strike costs for Feb. 6, comparable to $43,000 and $43,500 for calls and notably decrease volumes for places, exhibit a cautious optimism for a modest upward motion or stability within the close to time period.

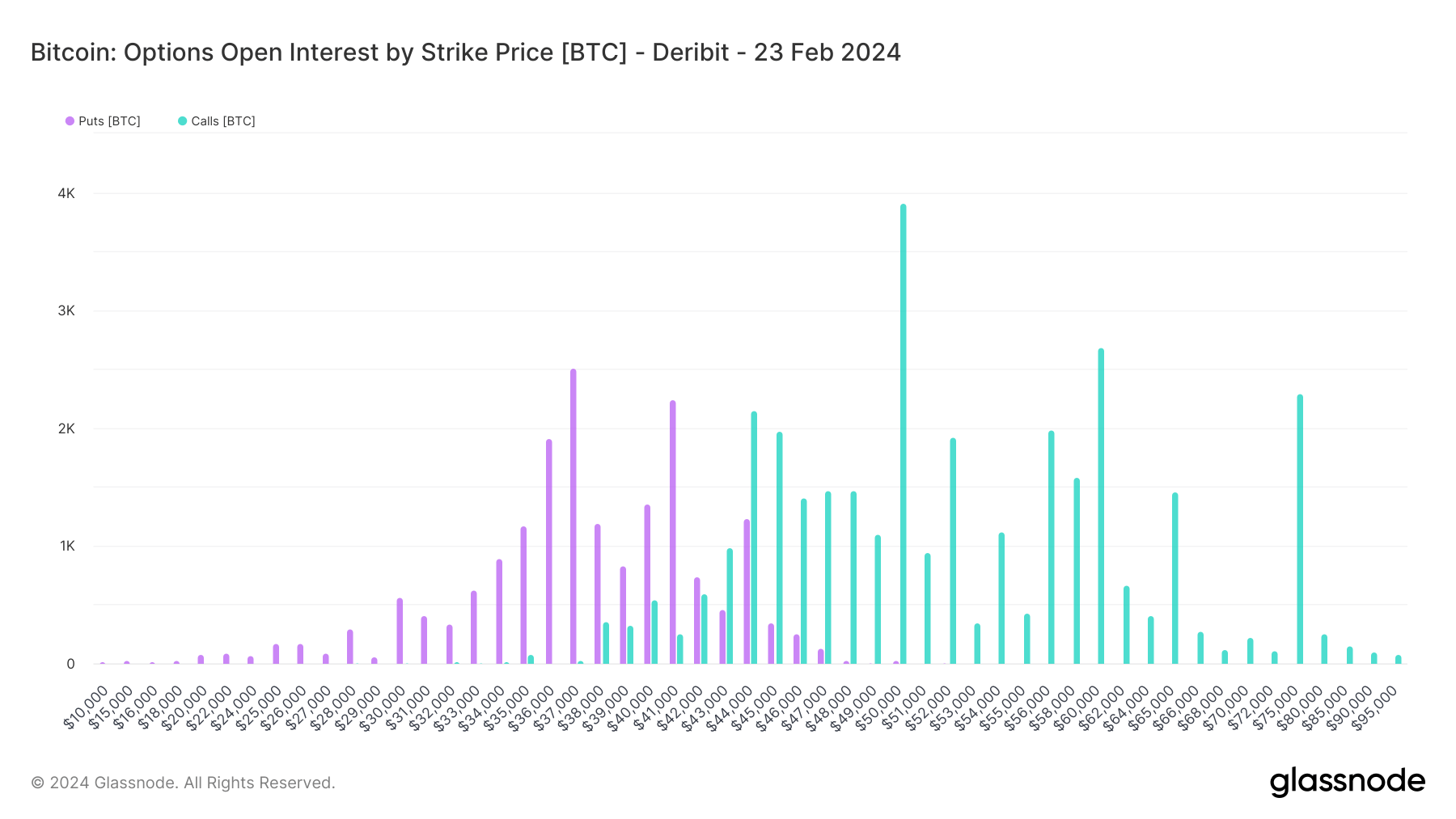

For contracts expiring on Feb. 23, the market sentiment shifts extra dramatically in direction of optimism. The upper open curiosity in places at decrease strike costs ($37,000 and $41,000) aligns with a protecting stance towards important worth drops.

Nevertheless, the substantial curiosity in calls at a lot greater strike costs ($50,000, $52,000, $60,000, and $75,000) underscores a long-term bullish outlook amongst traders. This means that regardless of near-term uncertainties or volatility, there’s a sturdy perception in Bitcoin’s potential for a big worth improve by the tip of the month.

The submit Bitcoin choices present long-term bullishness and near-term pessimism appeared first on StarCrypto.