A novel side of the brand new spot Bitcoin ETFs, as authorised by the SEC, is the cash-creation mechanism for issuing and redeeming shares. The ETFs are thought-about commodity-shares ETFs, but, as BlackRock factors out in its iShares Bitcoin ETF (IBIT) prospectus, “all spot-market commodities apart from bitcoin, similar to gold and silver, make use of in-kind creations and redemptions with the underlying asset.”

In its filings, BlackRock strongly advocated for in-kind orders for shares, however the SEC guided candidates towards a cash-creation mannequin as a result of nature of particular regulatory processes. Individuals allowed to purchase and promote shares of the belief (Approved Members) need to be registered broker-dealers, which implies they’re formally acknowledged and should comply with sure monetary guidelines. Proper now, it’s not clear how these broker-dealers can comply with these guidelines in the event that they’re coping with Bitcoin instantly.

Because of this uncertainty, it’s dangerous for these broker-dealers to make use of Bitcoin to purchase or promote shares of the belief. The SEC in all probability wouldn’t have allowed a product like this on the inventory trade if it’s unclear how the principles apply. Subsequently, all of the ETF purposes had been up to date from in-kind to cash-creates in December earlier than approval.

If the “NASDAQ receives the in-kind regulatory approval” to permit shopping for and promoting shares with Bitcoin instantly sooner or later, the ETFs will probably request a change to allow in-kind orders. Nevertheless, we don’t know when this can occur or if it is going to occur in any respect.

BlackRock’s view on the money creation mannequin for Bitcoin ETFs

This data has been accessible to buyers for the reason that Dec. 19 replace to BlackRock’s S1 submitting. Nevertheless, following the profitable launch of the New child 9 ETFs and billions of {dollars} in quantity, revisiting the world’s largest asset supervisor’s warning to the SEC regarding cash-creates appears worthwhile. It’s essential to notice that BlackRock is required to state any materials dangers in its prospectus, so the inclusion of a possible situation means it’s doable, not possible.

That stated, BlackRock doesn’t consider the cash-creation methodology is environment friendly, stating that the belief’s present follow of shopping for and promoting shares with money as a substitute of utilizing Bitcoin instantly might trigger issues in holding share costs aligned with Bitcoin’s precise worth.

It cautions that this mismatch may occur as a result of money transactions are extra complicated and take longer than direct Bitcoin transactions. It continues to establish that delays in these transactions might imply that the costs used to calculate the worth of the belief’s shares (NAV) could not precisely mirror the real-time worth of Bitcoin.

Additional, underneath a bit entitled ‘Threat Elements Associated to the Belief and the Shares,’ BlackRock additionally warns of decreased arbitrage alternatives for Approved Members,

“Using money creations and redemptions, versus in-kind creations and redemptions, could adversely have an effect on the arbitrage transactions by Approved Members meant to maintain the worth of the Shares carefully linked to the worth of bitcoin and, in consequence, the worth of the Shares could fall or in any other case diverge from NAV.”

Lastly, BlackRock warned that there’s a risk that Approved Members won’t wish to proceed facilitating the belief in the event that they suppose these delays and additional steps have develop into too dangerous or expensive. This reluctance may additionally make it tougher to maintain the belief’s share costs near the precise worth of Bitcoin. If this technique doesn’t work nicely, buyers may purchase shares for greater than they’re price or promote them for much less. This might trigger losses for the shareholders.

BlackRock is a extra distinguished advocate for in-kind orders than the mannequin authorised by the SEC. The prospectus says in-kind share creation and redemption is “usually extra environment friendly, and subsequently less expensive, for spot commodity exchange-traded merchandise.”

Bitcoin ETF NAV correlation with money creation mannequin.

Most apparently, BlackRock identifies cash-creation commodity-shares ETFs as “a novel product that has not been examined and may very well be impacted by any ensuing operational inefficiencies.” Particularly, BlackRock highlights instances of “market volatility or turmoil” the place cash-creates might materially have an effect on the ETF’s capacity to commerce.

“As well as, the Belief’s incapacity to facilitate in-kind creations and redemptions, and ensuing reliance on money creations and redemptions, might trigger the Sponsor to halt or droop the creation or redemption of Shares throughout instances of market volatility or turmoil, amongst different penalties.”

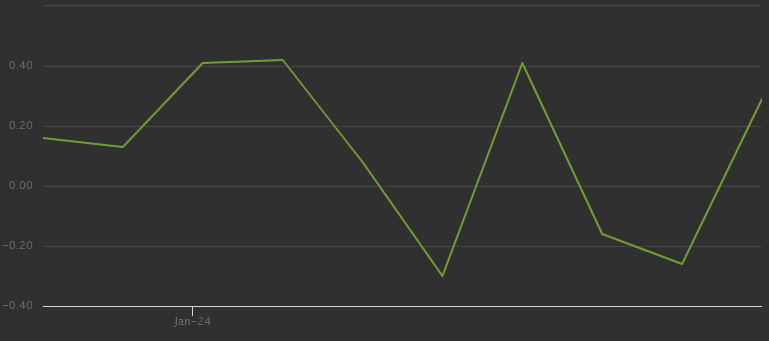

Since launch, the NAV premium to low cost unfold has been lower than 100bps, starting from +40bps to -30bps over ten buying and selling days. By comparability, BlackRock’s iShares Core S&P 500 ETF (IVV) has not deviated extra past +5bps and -11bps over the previous twelve months.

In a extra direct comparability, nonetheless, the iShares Gold Belief (IAUM) has seen a selection of round +300bps over the previous twelve months. Its highest premium to gold was over +200bps, and the bottom low cost was round -140bps.

Provided that IAUM can use in-kind orders for gold and BlackRock believes cash-creates might create a extra unstable low cost or premium for IBIT, buyers could surprise if we must always anticipate it to see deviations from the NAV past 3% sooner or later. Alternatively, maybe BlackRock’s resolve for in-kind orders was a foretelling of the exodus from Grayscale, which, if dealt with in-kind, could have merely seen Bitcoin leaving one ETF and flowing instantly into one other as a substitute of being resold a number of instances.

The following submitting to look out for concerning potential in-kind Bitcoin ETF orders is whether or not the Nasdaq requests that Bitcoin be thought-about a viable asset for purchasing and promoting shares. Till then, the money creation of shares will proceed.