Introduction

Crypto choices buying and selling is poised for accelerated development, marking a pivotal second in its trajectory, in accordance with knowledge. Presently, crypto choices buying and selling constitutes a mere 1% of the whole buying and selling quantity, a stark distinction to the 53% contribution noticed within the conventional finance market.

The newest centralized trade available in the market, Coincall, has launched into a mission to develop probably the most user-friendly crypto choices trade, catering to each retail {and professional} merchants. With the lively world crypto dealer neighborhood surpassing 50 million, the trade anticipates a staggering tenfold development inside three years for its choices buying and selling platform.

The principle aim of Coincall is to streamline the buying and selling expertise for people within the area. The trade envisions a monetary panorama the place comprehending and taking part within the buying and selling world is now not the unique area of monetary consultants.

To attain this imaginative and prescient, Coincall locations a powerful emphasis on offering user-friendly funding merchandise to simplify the onboarding course of for brand spanking new traders. The trade prides itself on fashionable interfaces and a complete academy designed to empower novice merchants with information, enabling them to make knowledgeable choices and commerce extra successfully.

| Web site | https://www.coincall.com/ |

| Obtainable on cell | Sure, Android and IOS |

| Variety of supported cash/tokens | +70 |

| Variety of supported spot buying and selling pairs | 4 |

| Based yr | 2023 |

| Buying and selling varieties | Spot buying and selling, choices buying and selling, futures buying and selling, altcoin choices buying and selling, and non-liquidation futures buying and selling. |

Historical past Overview

The group behind Coincall boasts over 9 years of collective expertise within the crypto trade, with key members hailing from outstanding monetary establishments corresponding to JP Morgan, Binance, OKX, and Bybit. Notably, the founding group possesses intensive experience in crypto choices buying and selling, having established one of many high proprietary buying and selling groups and managed property exceeding $300 million

Coincall proudly declared itself the fastest-growing choices trade in 2023, garnering consideration from 104,330 merchants inside a mere 181 days of its launch. Impressively, the choices buying and selling quantity exceeded 100 million in simply 86 days, underscoring the platform’s fast and substantial impression in the marketplace.

Key Options

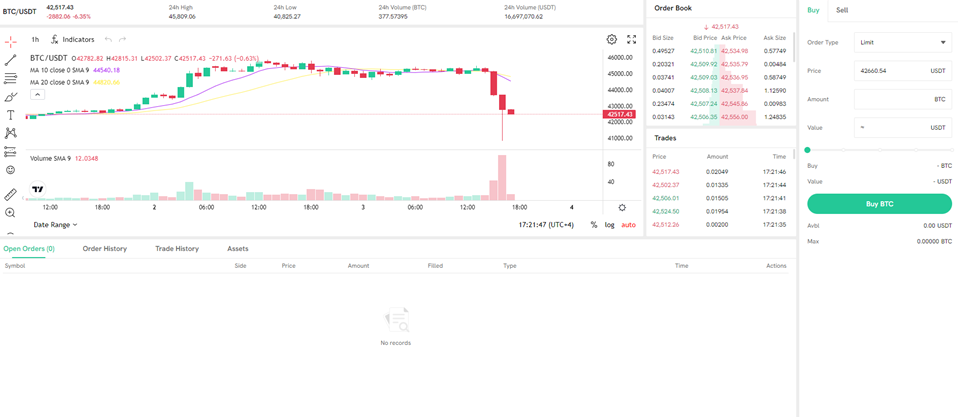

Spot Buying and selling

On Coincall’s Spot Buying and selling interface, customers can see real-time candlestick charts, an order guide, open orders, and order historical past, with the choice to purchase or promote the property. The supported cryptocurrency pairs are BTC/USDT, ETH/USDT, XRP/USDT, and TRX/USDT.

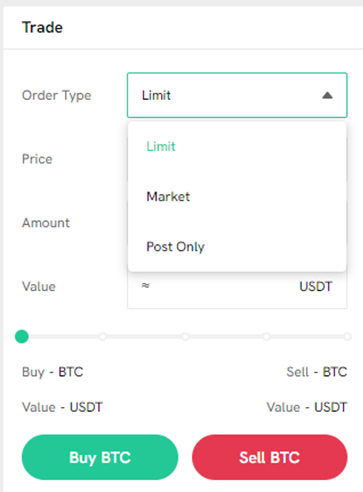

From the interface, merchants can select to purchase or promote with three totally different order varieties, restrict, market, or publish solely.

Merchants utilizing the platform could make buying and selling choices primarily based on their preferences and methods, as Coincall helps three distinct order varieties:

Restrict Orders: Customers can set particular worth ranges at which they’re keen to purchase or promote a selected asset. This order kind permits for exact management over the execution worth.

Market Orders: Merchants can execute orders on the present market worth. Any such order ensures swift execution, as it’s fulfilled at one of the best out there worth available in the market.

Publish Solely Orders: This order kind allows merchants to publish restrict orders to the order guide with out instantly executing them. It ensures that the order will solely be added to the order guide and never match with current orders. This may be helpful for customers wanting so as to add liquidity to the market.

Coincall’s spot buying and selling interface gives customers with a user-friendly expertise and a variety of choices to tailor their buying and selling methods to their particular wants.

Choices Buying and selling

Coincall’s choices function below the European-style choices framework, whereby they’re routinely exercised on the time of expiration. This fashion contrasts with American-style choices, as European choices can solely be exercised on the expiration date and never earlier than.

Merchants on the Coincall trade benefit from the comfort of not having to manually train choices. The system handles the train course of routinely on the expiration day.

Notably, Coincall’s choices contracts are cash-settled, that means that there isn’t a bodily supply of the underlying asset upon settlement. As a substitute, the settlement happens in money.

Each consumers and sellers have the pliability to shut out their positions earlier than the choice contract reaches expiration. By choosing an early closure, they will capitalize on the premium unfold, which represents the distinction between the shopping for and promoting costs of the choice.

Coincall’s choices platform helps 4 transaction varieties: shopping for name choices, shopping for put choices, promoting name choices, and promoting put choices. The supported cryptocurrencies for these choices are Bitcoin (BTC) and Ethereum (ETH).

| BTC Choices (Calls and Places) | ETH Choices (Calls and Places) | |

| Contract underlying | BTC/USD Index | ETH/USD Index |

| Settlement foreign money | USD | USD |

| Contract export | Present day, subsequent day, third day, present week, subsequent week, third week, present month, subsequent month, third month, quarter, subsequent quarter, third quarter, and fourth quarter | Present day, subsequent day, third day, present week, subsequent week, third week, present month, subsequent month, third month, quarter, subsequent quarter, third quarter, and fourth quarter |

| Minimal buying and selling unit | 0.01 BTC | 0.1 ETH |

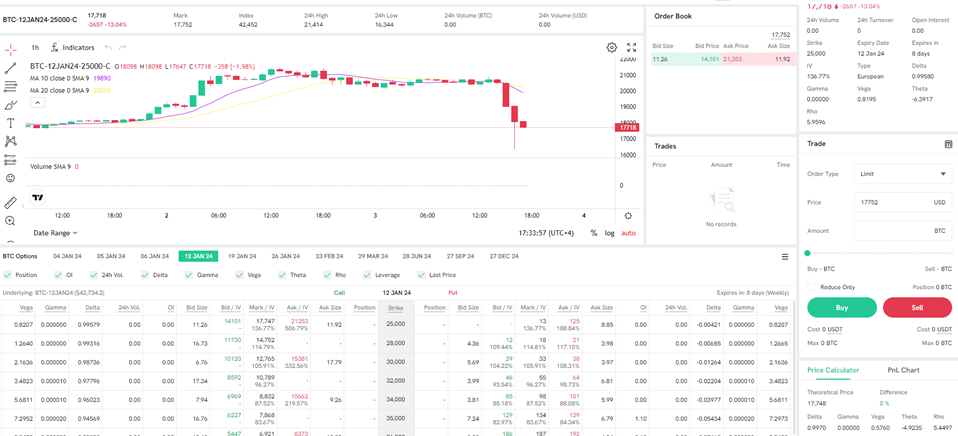

There are two variations of Coincall’s choices buying and selling interface. There’s a Professional model for skilled choices merchants and a Lite model that provides a simplified interface and course of for choices rookies.

The choices buying and selling web page covers an account overview, the place customers can see their account knowledge, complete property, out there steadiness, and unrealized revenue and loss. The interface additionally includes a real-time candlestick chart that revolves across the 4 knowledge factors—the opening worth, the best worth, the bottom worth, and the closing worth.

The choices chain is without doubt one of the most essential sections of choices, because it shows market info of choices contracts, together with underlying worth, strike worth, mark worth, greeks, buying and selling quantity, leverage, ask/bid dimension, ask/bid worth, and many others.

Perpetual Futures

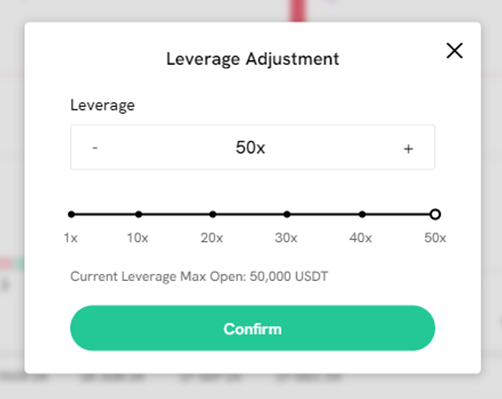

Perpetual futures, generally known as perpetuals, symbolize a by-product contract permitting merchants to invest on the long run worth of an asset with out the constraints of an expiration date. This units them other than conventional futures contracts, which include predetermined expiration dates. Perpetual futures, in distinction, could be held indefinitely.

One notable benefit of participating in perpetual futures buying and selling is the elevated flexibility they provide, together with greater leverage and enhanced liquidity. Merchants can keep positions for an prolonged interval with out being sure by a set expiration date.

The Coincall platform facilitates perpetual futures buying and selling by means of two distinct interfaces tailor-made to skilled and novice merchants. This dual-interface method ensures that merchants, no matter their expertise stage, can seamlessly and successfully take part in perpetual futures buying and selling.

Non-Liquidation Futures

Merchants typically concern the danger of liquidation when buying and selling futures contracts. Crypto futures contain agreements the place merchants should buy or promote a cryptocurrency at a predetermined worth on a future date. Nonetheless, in instances of heightened market volatility, if a dealer lacks enough funds of their buying and selling account to cowl potential losses, their positions might face liquidation.

In response to this frequent concern, Coincall has launched an modern answer often known as “Non-Liquidation Futures.” This product addresses the excessive dangers related to liquidation, the place even when the cryptocurrency’s worth rebounds to its authentic stage, the losses incurred throughout liquidation are irreversible.

The non-liquidation futures are a cryptocurrency contract settled in Tether (USDT). The trade clarified that the underlying asset of the non-liquidation futures is the corresponding crypto’s choices.

The first goal of this product is to allow traders to capitalize on each upward and downward actions in cryptocurrency costs by both shopping for lengthy or promoting quick non-liquidation futures. It’s essential to notice that, as of now, the trade helps solely shopping for lengthy, and efforts are underway to develop futures for promoting quick.

Altcoin Choices Buying and selling

Coincall has made an modern transfer available in the market by introducing choices buying and selling for 10 altcoins, positioning itself because the world’s first trade to supply this characteristic. Merchants can now interact in choices buying and selling for a various vary of altcoins, together with Solana (SOL), Bitcoin Money (BCH), Litecoin (LTC), Chainlink (LINK), Kaspa (KAS), Polygon (MATIC), Filecoin (FIL), Ripple (XRP), Tron (TRX), and Dogecoin (DOGE).

This enlargement in Coincall’s choices not solely broadens the vary of cryptocurrencies out there for choices buying and selling but additionally gives merchants with extra alternatives to diversify their portfolios and capitalize on market actions throughout numerous altcoins.

Take Revenue (TP) and Cease Loss (SL) Orders

Implementing Take Revenue (TP) and Cease Loss (SL) orders is well known as an efficient danger administration technique in buying and selling. A Take Revenue order permits merchants to safe earnings when their market predictions align with precise actions, whereas a Cease Loss order serves as a protecting mechanism, enabling merchants to attenuate losses when the market strikes unfavorably.

The automated orders assist merchants handle danger and reward by planning and letting the system execute the orders routinely, eliminating the necessity for fixed monitoring.

Coincall’s TP and SL orders assist merchants interact in momentum buying and selling and restrict their losses in a unstable market. As soon as the mark worth reaches the predefined set off worth to “take revenue” or “cease loss,” the orders shall be positioned routinely on the predefined order worth.

Safety

First CEX With 100% Third-Occasion Fund Custody

Coincall is the primary centralized trade to retailer all buyer property with third-party custodians. The trade itself by no means shops any funds, growing the property’ safety. The third-party custodians are Copper, Cobo[1] [2] , and Clearloop.

Copper is without doubt one of the main crypto custodians, offering crypto asset custody to greater than 500 establishments, together with Deribit, Bybit, and OKX. Copper operates a cryptocurrency custody and prime broking platform for digital property.

Copper makes use of Multi-Occasion-Computation (MPC) know-how to ship safe custody to institutional shoppers. The MPC know-how permits a number of events to share knowledge for computing duties with out revealing one another’s knowledge. This know-how allows Copper’s shoppers to accumulate, retailer, and commerce digital property with out sacrificing privateness.

Furthermore, main crypto custodian Cobo[1] [2] is one among Coincall’s trusted custodians, a widely known custodian who has been available in the market for six years now. With multiple million registered customers and greater than 100 billion transactions, Cobo is the proper protected to retailer crypto property.

Thirdly, Clearloop, Copper’s off-exchange collateral administration and settlement answer, helps institutional shoppers mitigate dangers and enhance capital effectivity by settling trades whereas merchants’ property stay safe in Copper’s segregated custodian account.

Coincall Bug Bounty Program

To enhance the trade’s safety, Coincall launched the Bug Bounty Program. This system bolsters the safety and reliability of the platform by inviting all moral hackers, safety researchers, and neighborhood members to strengthen the trade’s safety and assist uncover potential vulnerabilities within the system.

The Coincall Bug Bounty Program got here to be as a result of the trade believes that by means of collaborative efforts with the neighborhood, they will guarantee a safer buying and selling atmosphere. The trade gives rewards for figuring out and responsibly disclosing safety points.

KYC

Know your buyer (KYC) is the primary stage of anti-money laundering due diligence. KYC procedures intention to determine and confirm a buyer’s id so as to cut back id theft and fraud.

Coincall trade requires KYC to be accomplished to make sure that the trade complies with authorized and regulatory necessities, enhances the safety stage of customers’ accounts, and higher combats cash laundering and terrorist financing.

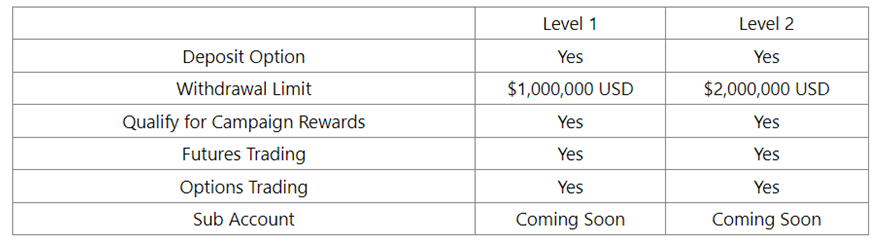

Getting KYC verified on the Coincall trade proves to be helpful for merchants, as there are a number of benefits to getting verified. After getting KYC verified, customers achieve a deposit choice, a better withdrawal restrict, qualify for marketing campaign rewards, and could have futures and choices buying and selling.

Relying on the person, there are two forms of KYC verification on the Coincall trade, particular person and institutional. The non-public/particular person KYC verification process consists of three ranges, primary, stage one, and stage two. The paperwork required for verification are a private ID card and a passport or driving license.

Any non-individual accounts on Coincall must be verified with an institutional KYC. The important thing necessities for the verification differ from the person KYC, and Coincall explains the entire course of in an in depth information, serving to institutional traders commerce with ease.

Deposit/Withdrawal/Buying and selling Charges

Coincall’s choices and futures buying and selling have totally different charges that adjust by product and are calculated as a proportion of the underlying asset of the contract.

Buying and selling Charges

A buying and selling price shall be charged after opening or closing a place. Every transaction’s buying and selling price is calculated primarily based on the underlying asset’s spot index worth on the time of order completion.

| Maker Payment Price | Taker Payment Price | |

| Futures | 0.02% | 0.06% |

| Bitcoin and Ethereum Choices | -0.02% | 0.10% |

| Altcoins Choices | 0.02% | 0.06% |

| Spot | 0% | |

Supply Charges

The trade expenses supply charges each time the choices are exercised, and so they’re calculated primarily based on the settlement worth on the time of order completion.

| Merchandise | Varieties | Payment Price |

| Choices | Each day | |

| Choices | Weekly/Month-to-month/Quarterly | 0.015% |

Deposit and Withdrawal Charges

Coincall doesn’t cost any charges for deposits. Nonetheless, the trade does have a minimal deposit requirement and a few withdrawal charges.

| Coin | Community | Minimal Deposit | Withdrawal Charges |

| USDT | Ethereum | 0.01 | 7.5 |

| USDT | Tron | 0.01 | 2 |

| TRX | Tron | 0.01 | 21 |

| XRP | XRP Native | 0.01 | 0.4 |

Coincall Academy

Coincall Academy gives free schooling for merchants, with lecturers out there in the neighborhood to assist rookies and superior merchants with all their buying and selling inquiries. Furthermore, Coincall hosts weekly classes and stay streams on the Coincall Academy web site. The web site is offered in English, Spanish, Korean, Japanese, and Chinese language.

The academy gives guides for rookies and superior merchants. For rookies, the Coincall Academy has a separate information for every little thing merchants must learn about choice buying and selling, masking all info from what choices buying and selling is, when to commerce choices, the benefits of choices buying and selling, and the forms of choices buying and selling.

The superior merchants information part covers extra superior guides corresponding to implied and realized volatility and some different technical terminologies. Furthermore, the academy covers a “Sensible Methods” part, serving to merchants profit from the Coincall trade to the utmost and commerce with revenue. Methods corresponding to promoting name choices, promoting put choices, bull unfold, bear unfold, shopping for put choices, and shopping for name choices are all lined within the Coincall Free Academy.

Professionals and Cons

| Professionals | Cons |

| Non-liquidation futures buying and selling | No fiat foreign money deposits or withdrawals |

| Newbie and superior buying and selling instruments | |

| Number of buying and selling varieties | |

| Free academy and guides for newbie and superior merchants | |

| Zero spot buying and selling charges |

Ultimate Rating

| Providers supplied | 5/5 |

| Cryptocurrency assist | 4/5 |

| Charges | 4/5 |

| Safety | 3/5 |

| Evaluation rating | 4/5 |

Abstract

As one of many newest crypto exchanges available in the market, Coincall gives modern buying and selling instruments for rookies and superior merchants, serving to them commerce simply and securely. The trade boasts of getting 100% third-party fund custody, making it the primary centralized trade to not maintain any customers’ funds.

The group behind the Coincall trade is a gifted and skilled group with greater than 9 years of expertise within the crypto trade. A group that beforehand based one of many high proprietary buying and selling groups that ranked primary globally on Binance’s complete PnL leaderboard in 2020 and 2021.

Spot buying and selling, choices buying and selling, futures buying and selling, and non-liquidation futures buying and selling are all buying and selling choices on the Coincall trade. Every buying and selling kind on the trade includes a lite and a professional model, making the trade user-friendly for each rookies and superior merchants.

One of many key companies of the trade that distinguishes it from the remaining is altcoin choices buying and selling. Customers can commerce as much as 70 altcoins on the Coincall trade.

Incessantly Requested Questions (FAQs)

Merchants can make the most of Coincall’s number of cryptocurrency choices, because the platform gives BTC, ETH, XRP, and TRX for spot buying and selling and BTC and ETH for non-liquidation futures. Moreover, there are virtually 70 cryptocurrencies for futures buying and selling, corresponding to BTC, ETH, SOL, DOGE, XRP, LTC, ADA, LINK, MATIC, TRX, ALGO, PEPE, BNB, UNI, SEI, and AAVE.

As for choices buying and selling, there are 12 cryptocurrencies, corresponding to BTC, ETH, SOL, DOGE, XRP, MATIC, LINK, and TRX.

The charges range relying on the buying and selling market kind. For makers, the charges are as follows: futures: 0.02%, BTC and ETH choices: -0.06%, altcoin choices: 0.02%, and 0 buying and selling charges for spot buying and selling. As for takers, futures charges are 0.06%, BTC and ETH choices are 0.015%, altcoin choices are 0.06%, and 0 buying and selling charges for spot.

Coincall boasts of getting many forms of buying and selling markets on its platform. Choices buying and selling, altcoin choices buying and selling, futures buying and selling, spot buying and selling, and non-liquidation futures buying and selling.

Sure, apart from the desktop model, Coincall is offered for Android and iOS customers.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.