The interval main as much as the ETF launch was marked by a rise in Bitcoin’s worth. And whereas the launch of the primary spot ETFs within the U.S. did not create the bombastic bull rally many had been hoping for; it confirmed simply how important native markets are in driving world costs.

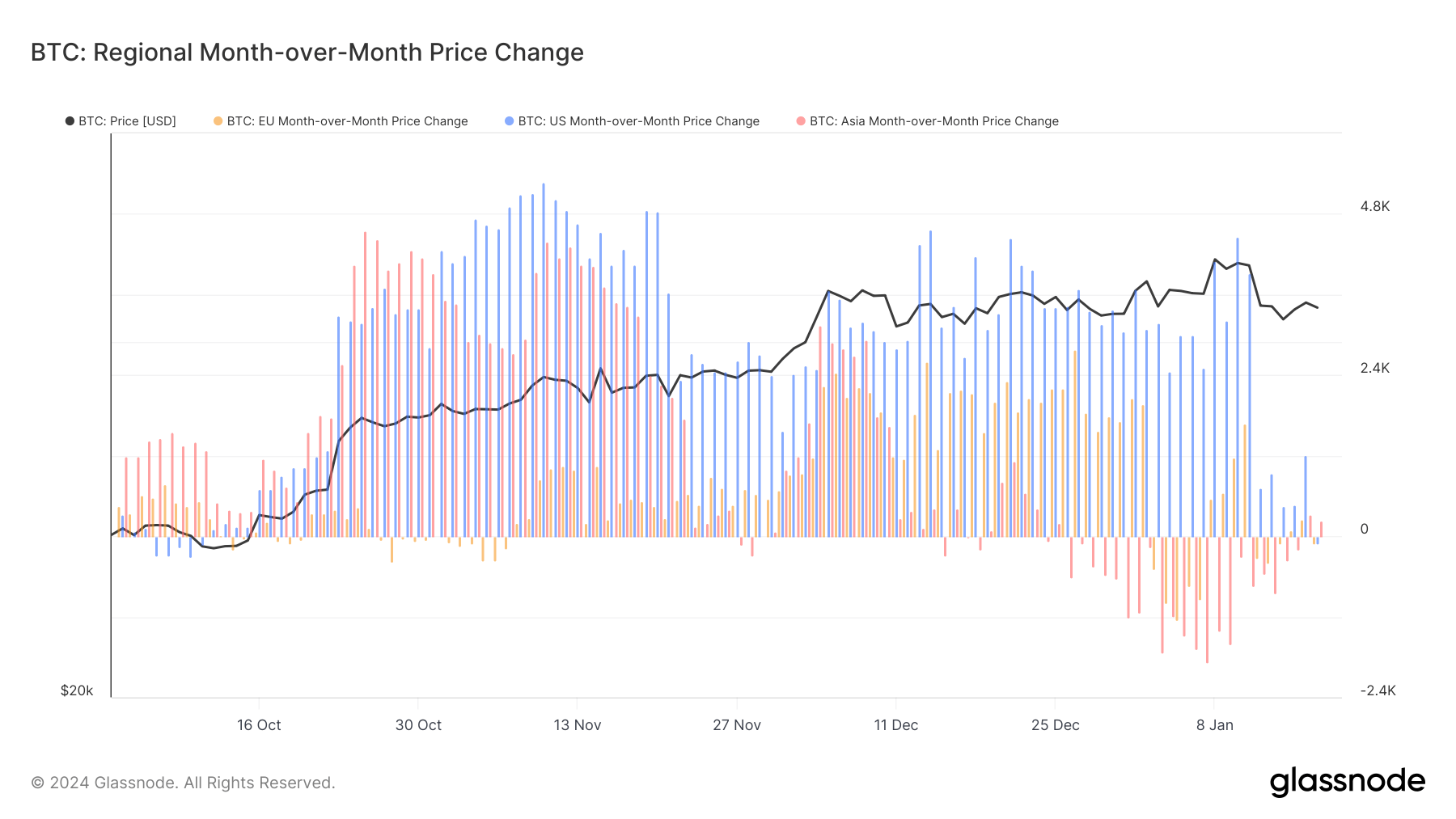

Particularly, Glassnode’s information on regional month-over-month worth modifications signifies that the U.S. market skilled the best fee of worth improve in comparison with Asia and the E.U. This means a rising curiosity in Bitcoin amongst U.S. buyers, possible fueled by the anticipation of the ETFs’ introduction.

Such a regional surge in curiosity is critical, because it highlights how localized components, equivalent to regulatory modifications or the launch of recent monetary merchandise, can considerably affect the market.

The U.S. market considerably influences world Bitcoin costs because of its key position within the world monetary system. As dwelling to numerous influential buyers and a serious hub for technological and monetary innovation, traits within the U.S. usually form world market sentiments. Moreover, the U.S. greenback’s standing as the first world reserve forex implies that monetary actions within the U.S., together with within the cryptocurrency sector, have wider world repercussions.

Traditionally, launching new funding automobiles like ETFs can create bullish sentiment, particularly within the area the place they’re launched, as they supply a extra regulated and doubtlessly safer strategy to spend money on cryptocurrencies.

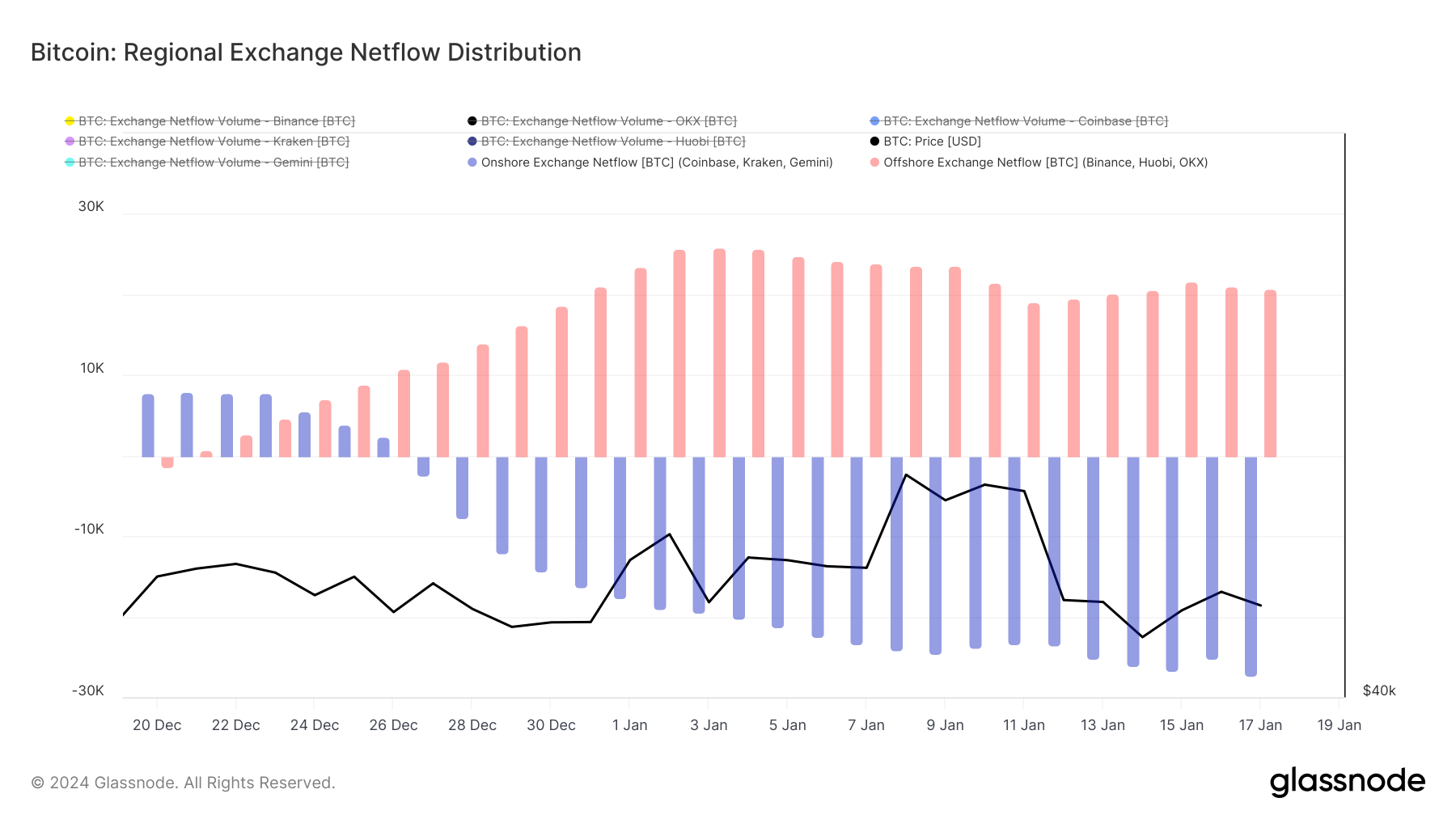

Additional supporting this speculation is the evaluation of trade netflow distribution, a measure of how a lot Bitcoin is getting into or leaving exchanges, which exhibits a constant sample of Bitcoin outflows from U.S.-based exchanges like Coinbase, Kraken, and Gemini. Ranging from late December 2023, these outflows elevated, culminating in a peak on Jan. 17, 2024.

This motion of Bitcoin away from exchanges and certain into personal wallets or longer-term holdings suggests a strategic shift by U.S. buyers in the direction of holding Bitcoin in anticipation of the ETFs’ launch. Such a shift would naturally lower the liquid provide on exchanges, creating upward strain on costs.

The value drop post-ETF launch, from $46,944 to $42,730, illustrates the market’s response to the materialization of a much-anticipated occasion. This type of worth correction will not be unusual in monetary markets following the build-up to main occasions, reflecting the adage “purchase the rumor, promote the information.”

The information from Glassnode demonstrated the numerous affect of the U.S. market on Bitcoin’s worth improve within the months main as much as the launch of the U.S. spot Bitcoin ETFs. Contemplating these findings, it is going to be fascinating to watch how the American market continues to form world cryptocurrency traits sooner or later. This additional confirms that optimistic native market sentiments, influenced both by favorable regulatory information or broader monetary market traits, can have a spillover impact on the worldwide markets.

The submit How rising U.S. curiosity formed Bitcoin’s worth forward of the ETF appeared first on StarCrypto.